GameStop Completes $1.5 Billion Stock Offering: A New Era for the Gaming Retailer

In a significant development for investors and the gaming industry, GameStop has successfully completed a $1.5 billion stock offering. This bold move positions the company strategically to leverage the funds for potential investments in various sectors, including cryptocurrency, with a particular focus on Bitcoin (BTC). This summary will explore the implications of this stock offering, the potential investment in Bitcoin, and what this means for GameStop moving forward.

Understanding GameStop’s Stock Offering

GameStop’s recent stock offering represents a critical step for the company, which has been undergoing a transformation in response to changing market dynamics. The gaming retailer, once primarily known for its physical game sales, has been pivoting towards an online and digital future. The $1.5 billion raised from this stock offering is expected to enhance GameStop’s financial stability and provide the necessary capital for strategic initiatives.

The decision to conduct a stock offering may reflect the company’s desire to capitalize on its increased stock price, which has seen considerable volatility in recent years due to the influence of retail investors and the broader market trends. By issuing new shares, GameStop can bolster its balance sheet and invest in high-potential areas that can drive growth.

The Cryptocurrency Investment Angle

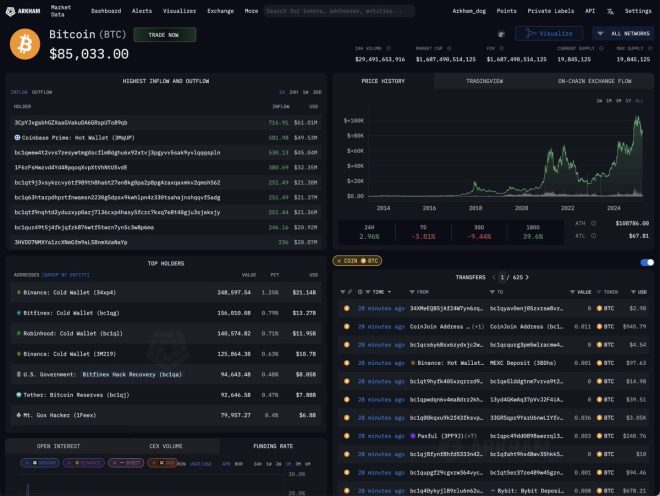

One of the most intriguing aspects of GameStop’s stock offering is the potential allocation of funds towards Bitcoin (BTC). As indicated in the announcement, GameStop may utilize a portion of the $1.5 billion to purchase Bitcoin, a move that aligns with the growing trend of traditional companies investing in cryptocurrency. This strategy is not just about diversification; it’s also about positioning GameStop as a forward-thinking organization that embraces digital currencies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The interest in Bitcoin and cryptocurrencies has surged in recent years, with many investors viewing these assets as a hedge against inflation and a new form of digital gold. By investing in Bitcoin, GameStop could potentially tap into this burgeoning market, appealing to a younger, tech-savvy demographic that is increasingly interested in cryptocurrencies.

Implications for GameStop’s Future

The completion of the $1.5 billion stock offering and the potential investment in Bitcoin could have several implications for GameStop’s future:

- Financial Strength: By increasing its capital reserves, GameStop can improve its financial health, allowing for more flexibility in its operations and strategic initiatives.

- Market Positioning: Investing in Bitcoin could enhance GameStop’s brand image, positioning it as an innovative player in both the gaming and financial sectors. This could attract new customers and investors who are interested in both gaming and cryptocurrency.

- Attracting Investors: The stock offering may appeal to investors who are looking for growth opportunities in both traditional retail and the rapidly evolving cryptocurrency market. This dual focus could attract a diverse range of investors.

- Future Growth Opportunities: With additional capital, GameStop may explore new business ventures, such as expanding its online gaming offerings, developing new products, or enhancing its e-commerce platform. The funds could also support research and development in gaming technology.

The Market Reaction

In response to this announcement, market analysts and investors will be keenly observing GameStop’s stock performance. The initial reaction to the stock offering and the news of potential Bitcoin investments could lead to fluctuations in stock prices, as traders react to the implications of these developments.

Historically, GameStop has experienced significant volatility, particularly during the well-publicized short squeeze that captivated the financial world. As the company continues to navigate its transformation, investor sentiment will play a crucial role in shaping its trajectory.

Conclusion

GameStop’s completion of a $1.5 billion stock offering marks a pivotal moment in the company’s ongoing evolution. By potentially investing in Bitcoin, GameStop is not only diversifying its portfolio but also aligning itself with the growing trend of digital assets. This strategic move may bolster the company’s financial stability and enhance its market position, appealing to a new generation of investors and customers.

As GameStop charts its course forward, the gaming retailer is poised to embrace new opportunities while navigating the challenges of a rapidly changing market. The combination of traditional retail and digital innovation may well define GameStop’s future, making it a company to watch in the coming years. Whether the investments made with the newly acquired capital will yield significant returns remains to be seen, but the potential is undoubtedly intriguing.

In the broader context of the gaming industry and the financial markets, GameStop’s actions reflect a larger trend of convergence between traditional businesses and the digital economy. As companies increasingly recognize the importance of adapting to technological advancements and changing consumer preferences, GameStop’s journey will serve as a case study in resilience and innovation.

For investors, the key takeaway is that GameStop’s strategic decisions may have far-reaching implications, not only for the company itself but also for the entire gaming and cryptocurrency landscape. As we move forward, keeping an eye on GameStop’s developments will be essential for understanding the evolving intersection of retail, technology, and finance.

JUST IN: GAMESTOP COMPLETES ITS $1.5B STOCK OFFERING

GAMESTOP NOW HAS $1.5B TO BUY $BTC https://t.co/SM9Nnsv8wE pic.twitter.com/Nf32AwTfaw

— Arkham (@arkham) April 1, 2025

JUST IN: GAMESTOP COMPLETES ITS $1.5B STOCK OFFERING

GameStop has made headlines once again with a significant announcement: the company has successfully completed its $1.5 billion stock offering. This move has sent ripples through both the gaming and financial sectors, capturing the attention of investors and analysts alike. What does this mean for GameStop and its future, especially in the context of the current cryptocurrency landscape? Let’s dive in.

GAMESTOP NOW HAS $1.5B TO BUY $BTC

With the newfound capital, GameStop has the potential to venture into the world of cryptocurrency, specifically Bitcoin. The decision to allocate funds towards buying $BTC (Bitcoin) is particularly intriguing considering the current market dynamics and the growing interest in digital currencies. But why is GameStop choosing this route?

Bitcoin has been a hot topic for quite some time, and many companies are increasingly looking at it as a legitimate asset class. By entering the crypto market, GameStop could diversify its portfolio, potentially boosting its stock price and attracting a new base of investors who are passionate about digital currencies.

Investors might be asking themselves: Is this a smart move? Historically, Bitcoin has shown significant volatility, but it has also provided substantial returns for those who invest wisely. GameStop’s decision to invest in Bitcoin could be an attempt to capitalize on this trend.

The Context of GameStop’s Stock Offering

To fully appreciate the impact of this $1.5 billion stock offering, it’s essential to understand the context behind it. GameStop, famously known for its role in the meme stock phenomenon, has had a tumultuous journey over the past couple of years. From being on the brink of bankruptcy to becoming a darling of retail investors, the company has seen it all.

In the wake of the pandemic, GameStop pivoted towards e-commerce, enhancing its online presence and exploring new business models. This stock offering is a part of that strategy, aiming to raise funds that can be used for future growth initiatives. By successfully completing the offering, GameStop demonstrates its ability to navigate the financial landscape, positioning itself as a more resilient player in the industry.

Understanding the Implications of the Offering

The implications of GameStop’s stock offering are vast. For one, it signals confidence from investors and the market in the company’s ability to rebound and grow. The influx of $1.5 billion not only provides capital but also offers a cushion for future investments and innovations.

Moreover, it highlights a shift in how traditional companies are considering the digital asset space. GameStop’s move to potentially invest in Bitcoin aligns with a broader trend where companies are embracing cryptocurrencies as part of their financial strategy.

This could encourage other traditional retailers to follow suit, creating a ripple effect throughout various industries. The more companies that invest in Bitcoin, the more legitimacy it gains as an asset class, potentially leading to broader acceptance and integration into everyday business practices.

Investors’ Reactions

Investors and analysts have varied reactions to GameStop’s announcement. Some view it as a bold and innovative move that could place GameStop ahead of its competitors, while others remain cautious about the volatility that comes with cryptocurrency investments.

The general sentiment in the investment community is one of optimism. GameStop’s stock price saw an uptick following the announcement, indicating that investors are keen on the potential upside this new strategy could bring. It’s a calculated risk, and like any investment, it comes with its own set of challenges and rewards.

The Future of GameStop and Cryptocurrency

So, what does the future hold for GameStop as it steps into the cryptocurrency arena? If GameStop successfully integrates Bitcoin into its business model, it could set a precedent for other companies, especially in the retail sector, to explore similar opportunities.

GameStop’s leadership will need to tread carefully, ensuring they have the right strategies in place to manage the inherent risks associated with cryptocurrency. This includes understanding market fluctuations, regulatory considerations, and technology infrastructure to support digital transactions.

The company’s approach to Bitcoin will likely be scrutinized closely, not just by investors but also by the media and financial analysts. How GameStop navigates this new venture could either solidify its position as a forward-thinking company or expose it to potential pitfalls if not managed correctly.

Conclusion: A Potential Game Changer?

With the completion of its $1.5 billion stock offering, GameStop finds itself at a crossroads, with the opportunity to reshape its future. The decision to venture into Bitcoin investments could be a game changer, opening new avenues for growth and innovation.

It’s an exciting time for GameStop, and as developments unfold, both investors and fans of the company will be watching closely. The intersection of retail gaming and cryptocurrency could lead to unexpected outcomes, making it a fascinating narrative for the financial and gaming worlds alike.

As always, staying informed and understanding the implications of these developments is crucial for anyone looking to invest or simply follow GameStop’s journey. Whether this bold move pays off remains to be seen, but one thing is for sure: GameStop is not done making waves in the financial waters.

If you’re interested in keeping up with the latest news surrounding GameStop and its foray into Bitcoin, consider following credible sources and financial news outlets for updates. The digital landscape is evolving, and being in the loop can make all the difference.