Metaplanet’s Bold Move: Issuing ¥2 Billion in Bonds for Bitcoin Acquisition

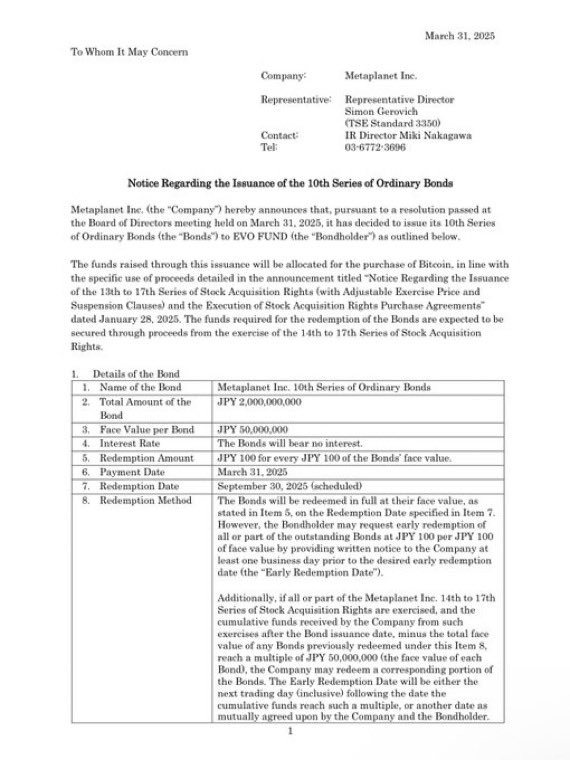

In a groundbreaking announcement on March 31, 2025, Metaplanet, a prominent player in the cryptocurrency market, revealed its strategic decision to issue ¥2 billion in bonds aimed at acquiring more Bitcoin. This move signifies a substantial shift in the organization’s investment strategy and reflects the growing confidence in Bitcoin as a valuable asset. The news was shared by renowned crypto analyst Crypto Rover via Twitter, generating significant buzz within the cryptocurrency community.

Understanding the Bond Issuance

Metaplanet’s decision to issue bonds worth ¥2 billion is a clear indication of its intent to deepen its involvement in the Bitcoin market. Bonds are typically used by companies to raise capital for various purposes, and in this case, Metaplanet is channeling the raised funds specifically towards Bitcoin acquisitions. This approach could provide the company with a competitive edge, as it positions itself strategically within the ever-evolving landscape of digital currencies.

Why Bitcoin?

Bitcoin has long been regarded as a leading cryptocurrency and a store of value, often referred to as "digital gold." Its decentralized nature, limited supply, and increasing adoption by institutional investors make it an attractive investment option. Metaplanet’s commitment to acquiring more Bitcoin underscores its belief in the cryptocurrency’s long-term potential. By investing in Bitcoin, Metaplanet aims to enhance its asset portfolio and benefit from the anticipated appreciation of Bitcoin’s value.

Implications for the Cryptocurrency Market

Metaplanet’s bond issuance and subsequent Bitcoin acquisition could have far-reaching implications for the cryptocurrency market. As more companies embrace Bitcoin as a legitimate asset class, it could lead to increased institutional interest and investment in the cryptocurrency sector. This, in turn, could drive up demand for Bitcoin, potentially leading to a surge in its price.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Furthermore, the successful issuance of bonds specifically for Bitcoin acquisition may inspire other companies to explore similar strategies. This trend could normalize the practice of utilizing traditional financial instruments to invest in cryptocurrencies, bridging the gap between conventional finance and the digital asset world.

The Growing Trend of Institutional Investment

Metaplanet’s strategy aligns with the broader trend of institutional investment in Bitcoin. Over the past few years, several high-profile institutions have entered the cryptocurrency market, recognizing Bitcoin’s potential as a hedge against inflation and economic uncertainty. From hedge funds to publicly traded companies, the influx of institutional capital has played a pivotal role in propelling Bitcoin’s price to new heights.

As institutions continue to diversify their portfolios by including Bitcoin, the demand for the cryptocurrency is likely to grow. Metaplanet’s proactive approach to acquiring Bitcoin through bond issuance positions it as a forward-thinking entity within the space, potentially attracting further attention from investors and analysts alike.

The Future of Bitcoin and Metaplanet

Looking ahead, the future of Bitcoin remains promising, with numerous factors contributing to its potential growth. As more people and institutions recognize the value of Bitcoin, its adoption is expected to increase, leading to greater liquidity and market stability. Additionally, ongoing developments in blockchain technology and the overall cryptocurrency ecosystem will likely influence Bitcoin’s trajectory.

For Metaplanet, the successful execution of its bond issuance and Bitcoin acquisition strategy could lead to significant benefits. By increasing its Bitcoin holdings, the company may enhance its overall value and establish itself as a key player in the cryptocurrency landscape. The potential for capital appreciation in Bitcoin could yield substantial returns for Metaplanet, further solidifying its position in the market.

Conclusion

Metaplanet’s decision to issue ¥2 billion in bonds for the purpose of acquiring Bitcoin marks a significant moment in the cryptocurrency world. This bold move reflects a growing confidence in Bitcoin as an asset class and highlights the increasing trend of institutional investment in digital currencies. As Metaplanet takes strategic steps to enhance its Bitcoin holdings, the implications for the cryptocurrency market are likely to be profound.

The bond issuance not only positions Metaplanet for potential financial gains but also sets a precedent for other companies considering similar approaches. As the cryptocurrency landscape continues to evolve, Metaplanet’s actions serve as a reminder of the expanding opportunities within the digital asset space.

With the increasing adoption of Bitcoin and the growing interest from institutional investors, the future looks bright for both Bitcoin and Metaplanet. As this story unfolds, it will be interesting to observe how other companies respond to Metaplanet’s initiative and how it influences the broader cryptocurrency market dynamics.

Key Takeaways

- Metaplanet has issued ¥2 billion in bonds to acquire more Bitcoin, reflecting a strategic shift towards cryptocurrency investment.

- The move highlights the growing confidence in Bitcoin as a valuable asset and may inspire other companies to adopt similar strategies.

- Institutional investment in Bitcoin is on the rise, with companies recognizing its potential as a hedge against inflation and economic uncertainty.

- The successful execution of Metaplanet’s strategy could lead to significant benefits and establish it as a key player in the cryptocurrency landscape.

In summary, Metaplanet’s bond issuance for Bitcoin acquisition is a pivotal development in the cryptocurrency sector, signaling the increasing integration of traditional finance with the world of digital assets.

BREAKING:

METAPLANET ISSUES ¥2 BILLION IN BONDS TO PURCHASE MORE BITCOIN

THIS IS MASSIVE! pic.twitter.com/6nfvafu1aF

— Crypto Rover (@rovercrc) March 31, 2025

BREAKING:

In a major move that’s sending ripples across the crypto world, Metaplanet has issued ¥2 billion in bonds to purchase more Bitcoin. This news is not just a typical market update; it’s a game-changer that reflects the growing institutional interest in Bitcoin and cryptocurrencies as a whole. With this bold step, Metaplanet is positioning itself at the forefront of the digital currency revolution. If you’re curious about what this means for the market and for investors, you’re in the right place!

METAPLANET ISSUES ¥2 BILLION IN BONDS TO PURCHASE MORE BITCOIN

So, what exactly does this bond issuance entail? Bonds are essentially loans that investors make to an organization, and in this case, Metaplanet is borrowing ¥2 billion with the intention of using those funds to buy more Bitcoin. This move signals confidence in Bitcoin’s future price appreciation and highlights the growing trend of companies seeking to hold Bitcoin as part of their treasury management strategy. For instance, companies like MicroStrategy and Tesla have also made headlines for their similar moves, showcasing a shift in how corporations view Bitcoin. You can read more about these strategies in detail from sources like Forbes.

THIS IS MASSIVE!

Why is this considered massive? Well, for starters, the amount of money involved is significant. Issuing ¥2 billion in bonds isn’t something that just any company can do. It indicates that Metaplanet has strong backing and the financial stability to attract investors willing to lend them money. Furthermore, using these funds to purchase Bitcoin aligns with the growing trend of companies diversifying their portfolios with digital assets. With Bitcoin’s price showing resilience and potential for long-term growth, this could turn out to be a profitable decision for Metaplanet. Many believe that Bitcoin is becoming a modern store of value, similar to gold, and companies are taking notice.

Understanding the Implications of This Move

When a company like Metaplanet decides to buy Bitcoin, it isn’t just about making a quick profit. It’s about the long-term strategy of protecting and growing their capital. As inflation concerns rise globally, Bitcoin is increasingly viewed as a hedge against currency devaluation. This perspective is echoed in a Wall Street Journal article, which discusses how institutional investors are looking to Bitcoin as a safe haven asset.

What This Means for Investors

If you’re an investor, Metaplanet’s decision could influence your own strategy. It demonstrates a growing acceptance of Bitcoin in mainstream finance. As more companies invest in Bitcoin, it could lead to increased demand, pushing the price higher. This trend could also pave the way for regulatory clarity, which many investors are awaiting. With companies like Metaplanet leading the charge, we might see more institutional players entering the market, which would only enhance Bitcoin’s legitimacy.

The Future of Bitcoin and Cryptocurrency

The future is looking bright for Bitcoin, especially with news like Metaplanet’s bond issuance. As adoption continues to grow, the narrative around Bitcoin will likely shift from being seen as a speculative asset to being recognized as a legitimate form of currency and investment. According to some analysts, Bitcoin could potentially reach new heights, and with institutional backing, the volatility that has plagued the crypto market may begin to stabilize. For more insights on Bitcoin’s potential, check out this article from CoinDesk.

Investing Considerations

If you’re thinking about investing in Bitcoin or cryptocurrencies as a whole, it’s essential to do your research. Understand the risks involved, the market’s volatility, and the potential for both gains and losses. While the current trend is promising, the crypto market can change rapidly. Always consider your financial situation, investment goals, and risk tolerance before diving in.

Conclusion: A New Era for Cryptocurrencies

Metaplanet’s issuance of ¥2 billion in bonds to buy more Bitcoin marks a significant moment in the evolution of cryptocurrencies. It underscores a broader shift toward acceptance and integration of digital currencies in traditional financial systems. For investors, this is not just a headline; it’s an opportunity to reassess their strategies in light of growing institutional interest in Bitcoin. As we move forward, keeping an eye on developments like this will be crucial for anyone involved in the crypto space. So, buckle up—this journey is just beginning!