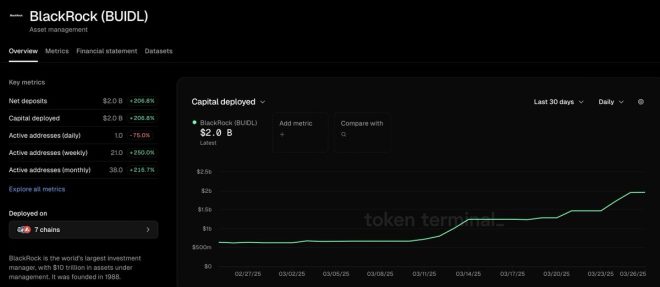

BlackRock’s Ethereum Assets Under Management Exceed $2 Billion

In a significant development for the cryptocurrency market, BlackRock, the world’s largest asset management firm, has announced that its assets under management (AUM) in Ethereum (ETH) have surpassed $2 billion. This milestone, highlighted in a tweet by crypto influencer Crypto Rover, signals a growing institutional interest in Ethereum and may herald a new bullish trend for the cryptocurrency.

The Impact of BlackRock on the Cryptocurrency Market

BlackRock’s foray into the cryptocurrency space has been a topic of keen interest among investors and analysts alike. The firm’s substantial investment in Ethereum underscores a broader acceptance of digital assets among traditional financial institutions. As BlackRock continues to expand its cryptocurrency portfolio, it is helping to legitimize the market and draw in other institutional investors who may have been hesitant to enter the space.

The $2 billion figure is not just a statistic; it represents a significant vote of confidence in Ethereum’s potential as a digital asset. This influx of capital from a reputable institution like BlackRock can have far-reaching implications for Ethereum’s price and overall market dynamics.

What Does This Mean for Ethereum?

The surpassing of $2 billion in AUM by BlackRock can be seen as a precursor to an impending rally in Ethereum’s price. Historically, when large financial institutions make significant investments in cryptocurrencies, it often leads to increased market activity. As more investors become aware of BlackRock’s involvement, it could trigger a wave of buying interest, pushing Ethereum’s price upward.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Ethereum has already established itself as a leading platform for decentralized applications (dApps) and smart contracts. With the backing of a major player like BlackRock, Ethereum’s position in the market is likely to strengthen further. This could also enhance Ethereum’s reputation as a viable investment option, particularly for those looking to diversify their portfolios with digital assets.

The Future of Ethereum and Institutional Investments

The growing trend of institutional investment in Ethereum and other cryptocurrencies cannot be overlooked. As traditional financial institutions recognize the potential of blockchain technology and digital currencies, they are increasingly looking to allocate funds to these assets. BlackRock’s significant investment in Ethereum is a clear indication that the cryptocurrency market is evolving and gaining traction in the mainstream financial landscape.

Investors should watch for potential catalysts that could drive Ethereum’s price higher in the coming months. Factors such as increased adoption of Ethereum-based applications, improvements in scalability and transaction speeds, and further institutional investments could all contribute to a bullish outlook for the cryptocurrency.

Conclusion

In summary, BlackRock’s announcement that its Ethereum assets under management have exceeded $2 billion marks a pivotal moment for both the firm and the cryptocurrency market. This development may signal the beginning of a new bullish trend for Ethereum, as institutional interest continues to grow. With BlackRock leading the charge, Ethereum is poised to attract more investors and potentially rally in price.

As the cryptocurrency landscape continues to evolve, staying informed about such developments will be crucial for investors looking to capitalize on the opportunities presented by digital assets. The future looks promising for Ethereum, especially with the backing of institutional giants like BlackRock.

BREAKING:

BLACKROCK’S $ETH ASSETS UNDER MANAGEMENT SURPASS $2,000,000,000. $ETH WILL RALLY SOON pic.twitter.com/IxMYmnDo8e

— Crypto Rover (@rovercrc) March 28, 2025

BREAKING: BLACKROCK’S $ETH ASSETS UNDER MANAGEMENT SURPASS $2,000,000,000

The crypto world is buzzing, and if you haven’t heard yet, you’re in for a treat! Recent reports indicate that BlackRock, the world’s largest asset manager, has surpassed a whopping $2 billion in assets under management (AUM) for Ethereum ($ETH). This news is not just a number; it represents a significant shift in institutional interest and confidence in the cryptocurrency space. Let’s dive into what this means for Ethereum and the broader market.

$ETH WILL RALLY SOON

With BlackRock’s impressive stake in Ethereum, many traders and investors are speculating on a potential rally for $ETH. The timing couldn’t be better, as the cryptocurrency market has been experiencing fluctuations, and this kind of institutional backing is often a precursor to upward momentum. But what’s driving this interest?

BlackRock’s decision to invest heavily in Ethereum stems from its growing acceptance as a viable asset class. As more traditional financial institutions recognize the value and utility of cryptocurrencies, we can expect a more significant influx of capital into this space. The prospect of a $ETH rally is exciting for both seasoned investors and newcomers alike.

Understanding the Impact of Institutional Investment

Institutional investment in cryptocurrencies is a game-changer. When firms like BlackRock enter the arena, it sets a precedent that can influence other institutions to follow suit. This can lead to increased liquidity and stability in the market. For Ethereum, having a powerhouse like BlackRock on its side can enhance its legitimacy and long-term prospects.

Investors often see institutional involvement as a vote of confidence. When big players put their money into $ETH, it signals to the market that they believe in its potential for growth. This can create a positive feedback loop, attracting even more investors and pushing prices higher.

Ethereum’s Unique Value Proposition

So, why is Ethereum such a hot commodity right now? Unlike Bitcoin, which primarily serves as a store of value, Ethereum is a platform for decentralized applications (dApps) and smart contracts. This unique functionality allows developers to build and deploy a wide range of applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs).

As the world continues to embrace technology and digital solutions, Ethereum’s versatility positions it well for future growth. The ongoing upgrades to the Ethereum network, including the transition to Ethereum 2.0, aim to improve scalability and reduce transaction costs, making it even more attractive for developers and users.

What This Means for Investors

For those invested in $ETH, this news from BlackRock is a cause for celebration. An influx of institutional money often leads to price appreciation, which is something every investor loves to hear. However, it’s essential to remember that the crypto market is volatile. While the potential for a rally exists, it’s crucial to approach investing with caution and a well-thought-out strategy.

If you’re considering investing in Ethereum, it’s a good idea to do your research. Look into the fundamentals of the project, understand the technology behind it, and keep an eye on market trends. It’s also beneficial to stay updated with news and developments, as the crypto landscape can change rapidly.

The Bigger Picture: What’s Next for $ETH?

As we look ahead, the question on everyone’s mind is: what’s next for $ETH? With BlackRock’s substantial investment, we could see a wave of new interest in Ethereum from both retail and institutional investors. This could create exciting opportunities for growth and innovation within the ecosystem.

Moreover, as more companies explore blockchain technology and the benefits of decentralized finance, Ethereum is likely to be at the forefront of this movement. Its established position as a leading smart contract platform makes it a crucial player in the ongoing evolution of the financial landscape.

In addition, keep an eye on regulatory developments. As governments around the world begin to formulate their approach to cryptocurrencies, these regulations could have a significant impact on market dynamics. A clear regulatory framework may encourage even more institutional investment, further solidifying Ethereum’s place as a key asset in diversified portfolios.

Final Thoughts

The news about BlackRock surpassing $2 billion in $ETH assets under management is monumental. It reflects growing confidence in Ethereum and the cryptocurrency market as a whole. As we anticipate a potential rally, it’s crucial to stay informed and be prepared for the opportunities and challenges that lie ahead.

Whether you’re a seasoned investor or just starting, now is the time to pay attention to what’s happening in the crypto space. With institutional players like BlackRock leading the charge, the future of $ETH looks brighter than ever. Buckle up; it’s going to be an exciting ride!