The Blockchain Group Acquires 580 Bitcoins for €47.3 Million: A Significant Milestone in Crypto Investment

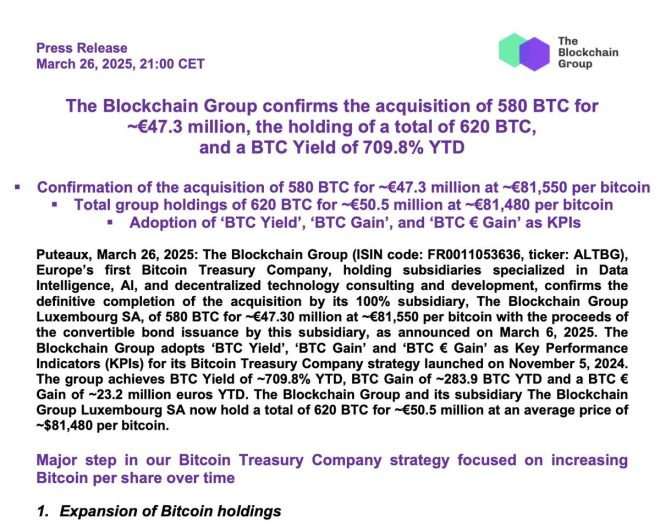

In the ever-evolving landscape of cryptocurrency, significant transactions often signal trends and shifts in market dynamics. A recent announcement from The Blockchain Group, a French company, has made headlines by acquiring 580 Bitcoins for an impressive €47.3 million. This transaction, reported by Bitcoin Magazine on March 26, 2025, underscores the growing institutional interest in Bitcoin and highlights the ongoing adoption of cryptocurrencies across various sectors.

The Significance of the Acquisition

The acquisition of 580 Bitcoins marks a strategic move for The Blockchain Group, positioning the company as a notable player in the cryptocurrency market. With Bitcoin’s increasing legitimacy as a financial asset, this purchase reflects a broader trend where institutional investors are embracing digital currencies. Such investments not only bolster the company’s financial portfolio but also signal confidence in Bitcoin’s long-term value proposition.

Bitcoin: A Brief Overview

Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous entity known as Satoshi Nakamoto. It operates on a decentralized ledger technology called blockchain, which ensures transparency and security in transactions. Over the years, Bitcoin has gained traction as a form of digital gold, particularly as a hedge against inflation and economic uncertainty. The recent surge in institutional investments further supports the notion that Bitcoin is becoming an essential component of modern investment strategies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Growing Institutional Interest in Bitcoin

The acquisition by The Blockchain Group is part of a larger trend where institutional investors are increasingly recognizing the potential of Bitcoin. In recent years, numerous hedge funds, corporations, and investment firms have allocated substantial resources to Bitcoin, often viewing it as a store of value comparable to traditional assets like gold. This shift is fueled by several factors, including:

- Inflation Hedge: With central banks worldwide adopting expansive monetary policies, many investors are turning to Bitcoin as a safeguard against inflation. The fixed supply of Bitcoin—capped at 21 million coins—makes it an attractive alternative to fiat currencies, which can be printed in unlimited quantities.

- Diversification: Institutional investors are actively seeking ways to diversify their portfolios. Bitcoin offers an uncorrelated asset that can provide substantial returns, making it a valuable addition to a balanced investment strategy.

- Mainstream Adoption: As more businesses and financial institutions adopt Bitcoin, its legitimacy as a form of payment and investment continues to grow. High-profile endorsements and investments have further solidified Bitcoin’s position in the financial ecosystem.

The Future of Bitcoin and The Blockchain Group

The Blockchain Group’s strategic acquisition not only enhances its asset base but also positions the company to capitalize on the future appreciation of Bitcoin. As the cryptocurrency market matures, companies like The Blockchain Group are likely to play a pivotal role in shaping its trajectory. Their involvement can lead to increased trust and acceptance of cryptocurrencies among traditional investors and businesses.

Market Implications of the Acquisition

The purchase of 580 Bitcoins for €47.3 million is likely to have several implications for the market:

- Price Impact: Large purchases of Bitcoin can influence market dynamics, potentially driving prices higher. As demand increases, particularly from institutional investors, the price of Bitcoin may experience upward pressure.

- Market Sentiment: Such acquisitions can positively affect market sentiment, encouraging other investors to consider Bitcoin as a viable investment option. As confidence grows, it may lead to increased trading volumes and market activity.

- Regulatory Scrutiny: As institutional investments in Bitcoin rise, regulatory bodies may increase scrutiny of cryptocurrency transactions. This could lead to clearer regulatory frameworks, which may benefit the overall market by providing guidelines for institutional participation.

Conclusion

The Blockchain Group’s acquisition of 580 Bitcoins for €47.3 million is a significant event in the cryptocurrency landscape, highlighting the increasing acceptance of Bitcoin as a legitimate financial asset. As institutional interest continues to grow, Bitcoin’s role in the global financial ecosystem is likely to expand, attracting more investors and businesses to the digital currency space.

This acquisition stands as a testament to the evolving nature of finance and the potential of cryptocurrencies to reshape traditional investment paradigms. As we look to the future, the ongoing developments in the cryptocurrency market will undoubtedly continue to captivate investors and shape the financial landscape.

For those looking to understand the dynamics of Bitcoin and its role in modern finance, the acquisition by The Blockchain Group serves as a critical case study in institutional investment trends and the ongoing evolution of the cryptocurrency market.

JUST IN: French company The Blockchain Group purchases 580 #Bitcoin for €47.3 million. pic.twitter.com/46Dwlj6vV8

— Bitcoin Magazine (@BitcoinMagazine) March 26, 2025

JUST IN: French company The Blockchain Group purchases 580 Bitcoin for €47.3 million.

In an exciting development that underscores the growing acceptance of cryptocurrency in the corporate world, French company The Blockchain Group has made headlines by acquiring 580 Bitcoin for a staggering €47.3 million. This move not only signifies a strategic investment but also reflects the evolving landscape of digital assets and their increasing role in traditional finance.

Understanding The Blockchain Group’s Investment Strategy

The Blockchain Group, a prominent player in the blockchain industry, has been at the forefront of promoting and integrating blockchain technologies into various sectors. Their recent purchase of 580 Bitcoin is a clear indication that they are not just advocates of blockchain technology but are also ready to leverage its financial potential. The acquisition represents a significant investment that aligns with their vision of harnessing the power of decentralized finance.

The Rising Popularity of Bitcoin in Corporate Portfolios

Over the past few years, Bitcoin has transitioned from being a speculative asset to a legitimate investment choice for corporations. Companies like MicroStrategy and Tesla have paved the way, showcasing how Bitcoin can be integrated into corporate balance sheets. The Blockchain Group’s investment is yet another testament to the cryptocurrency’s maturation as an asset class.

What Does This Means for the Crypto Market?

When a reputable company like The Blockchain Group makes such a substantial investment in Bitcoin, it sends a powerful message to the market. It signals confidence in Bitcoin’s future and encourages other companies to consider similar investments. This could potentially lead to increased demand for Bitcoin, driving its price higher and solidifying its position as a valuable asset.

Bitcoin: The Asset of the Future

The allure of Bitcoin lies in its decentralized nature and the potential for significant returns. As traditional markets fluctuate, more investors are looking to Bitcoin as a hedge against inflation and economic uncertainty. The Blockchain Group’s purchase of 580 Bitcoin for €47.3 million reflects this sentiment, as they position themselves at the forefront of a financial revolution.

The Financial Implications of This Acquisition

Investing in Bitcoin can be a risky endeavor, but The Blockchain Group’s decision seems to be a calculated one. By acquiring 580 Bitcoin, they are not only diversifying their portfolio but also potentially setting themselves up for substantial gains as the cryptocurrency market evolves. With Bitcoin’s price surging in recent months, this purchase could yield impressive returns in the long run.

Decentralized Finance: A Growing Trend

The Blockchain Group’s investment aligns with the broader trend towards decentralized finance (DeFi), where traditional financial services are offered on blockchain platforms. This movement is changing how we view finance, making it more accessible and efficient. By embracing Bitcoin, The Blockchain Group is positioning itself as a leader in this transformative space.

Why Invest in Bitcoin?

For many, Bitcoin represents a new era of financial freedom. Its limited supply and decentralized nature make it an appealing option for those looking to protect their wealth. The Blockchain Group’s recent purchase highlights the growing recognition of Bitcoin as a legitimate asset class that can complement traditional investments.

The Future of Bitcoin and Corporate Investments

As more companies follow The Blockchain Group’s lead, we can expect to see a shift in how businesses approach their investment strategies. Bitcoin could become a staple in corporate portfolios, offering a hedge against economic instability and inflation. The implications of this trend are profound, suggesting a future where digital assets play a central role in corporate finance.

The Community’s Reaction to The Blockchain Group’s Purchase

The cryptocurrency community has reacted positively to The Blockchain Group’s investment in Bitcoin. Many enthusiasts see it as a validation of Bitcoin’s value and its potential to reshape the financial landscape. Social media platforms are abuzz with discussions about what this could mean for the future of cryptocurrency, with many expressing excitement about the possibilities.

How This Acquisition Might Influence Future Transactions

The Blockchain Group’s acquisition could pave the way for other companies to consider Bitcoin as part of their financial strategy. As more organizations recognize the benefits of investing in Bitcoin, we may see a surge in corporate transactions involving cryptocurrencies. This could lead to greater liquidity in the market and potentially stabilize prices.

Educational Initiatives on Cryptocurrency

As interest in Bitcoin grows, there is an increasing need for educational initiatives to help individuals and businesses understand how to navigate the cryptocurrency landscape. The Blockchain Group, with its expertise in blockchain technology, could play a pivotal role in developing resources and training programs that educate others about the benefits and risks associated with investing in Bitcoin.

Potential Risks of Investing in Bitcoin

While the prospects of investing in Bitcoin can be enticing, it’s essential to acknowledge the risks involved. The cryptocurrency market is known for its volatility, and prices can fluctuate dramatically within short periods. Companies like The Blockchain Group must be prepared for such fluctuations and have strategies in place to mitigate potential losses.

Final Thoughts on The Blockchain Group’s Investment

The Blockchain Group’s acquisition of 580 Bitcoin for €47.3 million marks a significant milestone in the acceptance of cryptocurrencies by traditional businesses. As they navigate this new territory, they not only stand to benefit financially but also contribute to the broader acceptance of digital currencies in the corporate world. This investment is more than just a financial decision; it’s a statement about the future of finance and the role that Bitcoin will play in it.

With the cryptocurrency market continuing to evolve, it will be fascinating to see how The Blockchain Group and other companies leverage Bitcoin in the years to come. As we witness this shift, one thing is certain: the future of finance is here, and it’s digital.