Iran’s Currency Crisis: Rial Hits Record Low Against the Dollar

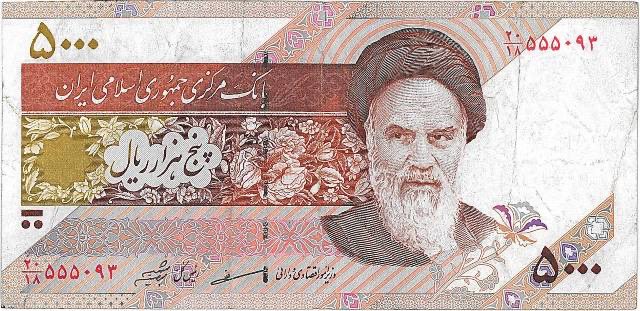

The economic landscape in Iran has taken a significant downturn, as the country’s currency, the rial, has reached an unprecedented low of 1,039,000 rials per U.S. dollar. This alarming decline is highlighted by recent data released by Bonbast, a platform that tracks currency exchange rates in Iran. The news, initially shared by Open Source Intel on Twitter, underscores the escalating financial challenges facing the Iranian economy.

Understanding the Currency Drop

The depreciation of the rial is not an isolated incident; rather, it is a culmination of various factors that have plagued the Iranian economy for years. Economic mismanagement, stringent international sanctions, and domestic political instability have all contributed to the currency’s rapid decline. The record low exchange rate reflects a broader trend of economic instability, which has left many Iranians struggling to cope with rising prices and dwindling purchasing power.

Factors Contributing to the Rial’s Decline

- International Sanctions: The Iranian economy has faced severe sanctions imposed by the United States and other nations, particularly after the U.S. withdrawal from the Joint Comprehensive Plan of Action (JCPOA) in 2018. These sanctions have severely restricted Iran’s ability to engage in international trade, leading to a scarcity of foreign currency.

- Inflation: Iran has been grappling with hyperinflation, which has significantly eroded the value of the rial. The Iranian government has struggled to control inflation, leading to soaring prices for basic goods and services. This economic instability has led many citizens to lose faith in their currency, prompting a shift towards more stable foreign currencies.

- Political Instability: Domestic political turmoil and social unrest have further exacerbated the economic crisis. Protests against the government, fueled by discontent over economic conditions, have created an environment of uncertainty that deters foreign investment and destabilizes the economy.

- Oil Dependency: Iran’s economy is heavily reliant on oil exports, which have been hampered by sanctions and falling global oil prices. The reduced income from oil sales has limited the government’s ability to support the currency and stabilize the economy.

Implications of the Currency Collapse

The record low value of the rial has far-reaching implications for the Iranian population and the economy as a whole. As the currency weakens, the cost of imports skyrockets, leading to increased prices for essential goods. This situation disproportionately affects low-income families, who struggle to afford basic necessities.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The depreciation of the rial also erodes savings, as the value of money diminishes over time. Many Iranians have turned to foreign currencies or gold as a means of preserving their wealth. This trend reflects a loss of confidence in the rial and highlights the urgent need for economic reform.

The Government’s Response

In response to the currency crisis, the Iranian government has implemented various measures aimed at stabilizing the economy. Efforts have included attempts to control inflation, increase foreign currency reserves, and negotiate with international partners to alleviate sanctions. However, these measures have met with limited success, and many Iranians remain skeptical of the government’s ability to address the economic challenges effectively.

The Path Forward

For Iran to recover from this economic crisis, it will need to undertake significant reforms. These reforms may include diversifying the economy away from oil dependency, improving governance, and fostering a more favorable environment for foreign investment. Additionally, engaging in constructive dialogue with the international community could open avenues for economic relief and support.

Conclusion

The recent plunge of the Iranian rial to a record low against the U.S. dollar serves as a stark reminder of the economic challenges facing the country. With a combination of external pressures and internal issues, the Iranian economy is at a critical juncture. Addressing the root causes of the currency crisis will require a concerted effort from the government, the private sector, and the Iranian people. As the situation continues to unfold, the world will be watching closely to see how Iran navigates this turbulent economic landscape.

BREAKING

Iran’s currency drops to a record low of 1,039,000 rials per U.S. dollar, according to data from Bonbast. pic.twitter.com/Os3Abc3e6f

— Open Source Intel (@Osint613) March 25, 2025

BREAKING

In a significant economic development, Iran’s currency has hit a staggering low of 1,039,000 rials per U.S. dollar, as reported by Bonbast. This dramatic drop has sent shockwaves through both domestic and international markets, raising concerns about the country’s economic stability and future prospects.

Understanding the Iranian Rial’s Plummet

So, what does it mean when we say that Iran’s currency has dropped to a record low? The Iranian rial has been on a downward trajectory for some time, reflecting various internal and external pressures. The recent fall to 1,039,000 rials per U.S. dollar isn’t just a statistic; it’s a reflection of the economic struggles facing the nation. Inflation, sanctions, and a lack of foreign investment have all played a role in this crisis.

The Impact of Sanctions on Iran’s Economy

One of the primary culprits behind the rial’s depreciation is the ongoing economic sanctions imposed by the United States and other countries. These sanctions have severely restricted Iran’s ability to trade on the global market, causing a ripple effect that impacts everything from consumer goods to critical infrastructure. With less access to foreign currency, the demand for dollars skyrockets, further devaluing the rial.

Inflation: A Persistent Problem

Inflation in Iran has reached alarming levels, contributing significantly to the currency’s decline. According to various reports, inflation rates have surged, causing prices for everyday goods to rise dramatically. Citizens are feeling the pinch as their purchasing power diminishes, leading to widespread dissatisfaction and protests. The Iranian government has struggled to control this inflation, making it a central issue in economic discussions.

Public Response to the Currency Crisis

The economic crisis is causing anxiety among the Iranian populace. Many are concerned about their savings and the future of their livelihoods. Social media has been abuzz with reactions, echoing sentiments of frustration and hopelessness. The government’s attempts to stabilize the currency have often been met with skepticism. People are looking for solutions, yet many feel the situation is beyond their control.

What Does This Mean for Everyday Iranians?

For the average Iranian, the drop in the rial’s value translates to higher prices for imported goods. Items that were once affordable are now out of reach for many families. Basic necessities such as food, clothing, and healthcare are becoming increasingly expensive. The situation is dire, and the ripple effects are felt across all sectors of society.

Global Repercussions of Iran’s Currency Crisis

This economic turmoil in Iran doesn’t just affect its citizens; it has implications for the global economy as well. As one of the world’s significant oil producers, instability in Iran can impact oil prices and supply chains worldwide. Investors are closely monitoring the situation, as any further deterioration could lead to broader economic ramifications beyond Iran’s borders.

The Role of Domestic Policies

The Iranian government has implemented various domestic policies in an attempt to stabilize the economy. However, many of these measures have had limited success. The lack of transparency and accountability within the government has led to skepticism about its ability to effectively manage the economy. Reform is desperately needed, but the question remains: will the government be willing to make the necessary changes?

Possible Solutions and Future Outlook

Experts suggest that addressing the root causes of the currency crisis is essential for recovery. This includes engaging in diplomatic negotiations to alleviate sanctions, encouraging foreign investment, and implementing sound economic policies. The path to recovery won’t be easy, but it is crucial for the future stability of Iran’s economy and the well-being of its citizens.

Conclusion

Iran’s currency crisis, highlighted by its drop to 1,039,000 rials per U.S. dollar, is a developing story that warrants close attention. The implications of this economic downturn are far-reaching, affecting not only the Iranian people but also the global economy. As the situation unfolds, it is essential to stay informed and understand the broader context of these changes.

For the latest updates on this evolving story, keep an eye on economic news sources, and stay engaged with discussions surrounding Iran’s economic future. The resilience of the Iranian people will be tested, and how this crisis is navigated will shape the nation’s trajectory for years to come.

“`

This article uses the specified keywords and maintains a conversational tone, ensuring engagement while providing comprehensive information about the economic situation in Iran.