World Liberty Financial’s Strategic Acquisition of $MNT

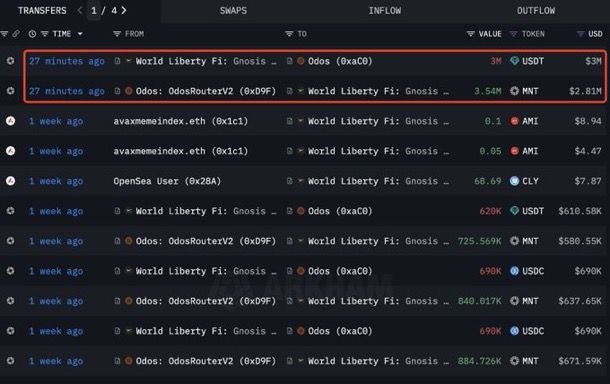

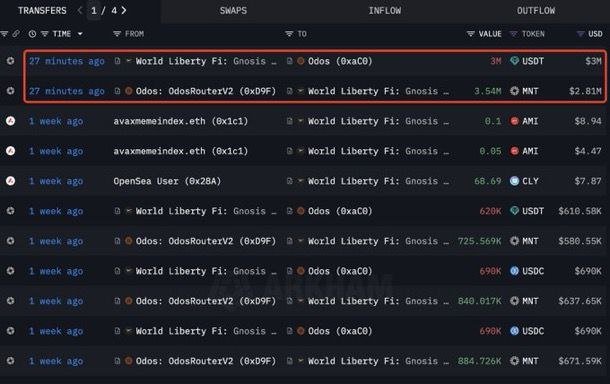

In a significant move within the financial sector, World Liberty Financial has recently acquired 3.54 million shares of the cryptocurrency $MNT for a substantial investment of $3 million. This acquisition has raised eyebrows across the industry, especially considering that World Liberty Financial is currently facing a total loss of $109 million. The strategic decision to continue purchasing despite these losses begs the question: does World Liberty Financial know something that the rest of the market does not?

Understanding the Context of the Acquisition

World Liberty Financial’s bold investment is noteworthy for several reasons. Firstly, the sheer volume of shares purchased indicates a strong belief in the future potential of $MNT. The decision to invest heavily in a time of financial loss suggests that the company has confidence in the long-term growth trajectory of this cryptocurrency.

Moreover, $MNT is gaining traction in the market, and investors are increasingly recognizing its potential for value appreciation. Cryptocurrencies have been known for their volatility, but they can also offer significant returns for those willing to navigate the risks involved.

The Importance of Cryptocurrency Investments

Cryptocurrency investments have become a focal point for many financial institutions and individual investors over the past decade. With the rise of blockchain technology, digital currencies have disrupted traditional financial systems and created new investment opportunities. Companies like World Liberty Financial are keenly aware of this landscape and are positioning themselves to capitalize on emerging trends.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Investors often look for signals from major players in the market, and World Liberty Financial’s latest acquisition may serve as a crucial indicator for future movements in the cryptocurrency sector. The decision to double down on $MNT amid losses suggests that the company may have insights into upcoming developments or market shifts.

Analyzing World Liberty Financial’s Financial State

While the acquisition of $MNT is significant, it is essential to consider World Liberty Financial’s current financial position. With a reported loss of $109 million, the company is navigating a challenging financial landscape. This situation raises questions about the sustainability of their investment strategy and whether this bold move will pay off in the long run.

Investors are likely to scrutinize the company’s financial health closely. Transparency regarding their overall investment strategy and risk management will be critical in maintaining investor confidence. If World Liberty Financial can provide a clear rationale for their investment in $MNT, it may help to mitigate concerns about their financial losses.

The Market’s Reaction to the Acquisition

As news of World Liberty Financial’s acquisition spreads, market reaction will be closely monitored. Traders and investors often react to significant moves by established firms, and this acquisition could lead to increased interest in $MNT. If the market perceives this investment as a positive signal, it could generate upward momentum for $MNT and attract more investors to the cryptocurrency space.

Additionally, the acquisition may prompt other financial institutions to reevaluate their positions on cryptocurrencies. A successful investment by World Liberty Financial could encourage a shift in sentiment, leading to broader adoption of digital currencies across the financial sector.

Potential Implications for the Cryptocurrency Market

World Liberty Financial’s investment in $MNT could have several implications for the broader cryptocurrency market. If the company successfully navigates its current financial challenges and sees a return on its investment in $MNT, it may inspire confidence in other investors and encourage increased participation in the cryptocurrency sector.

Furthermore, the acquisition highlights the ongoing trend of institutional investment in cryptocurrencies. As more established financial institutions enter the market, it may lead to greater legitimacy for digital currencies and contribute to their long-term growth.

Conclusion: A Bold Move with Uncertain Outcomes

World Liberty Financial’s acquisition of 3.54 million shares of $MNT for $3 million is a bold move that has captured the attention of industry observers. The company’s current financial losses raise questions about the sustainability of this strategy, but their continued investment suggests a strong belief in the potential of $MNT.

As the cryptocurrency market continues to evolve, the implications of this acquisition will be closely watched. If World Liberty Financial can turn its losses around and capitalize on its investment in $MNT, it could mark a turning point for both the company and the broader cryptocurrency market.

In the ever-changing landscape of digital currencies, World Liberty Financial’s decision to invest in $MNT serves as a reminder of the risks and rewards associated with cryptocurrency investments. Investors and financial institutions alike will be keen to see how this story unfolds and what it means for the future of digital currencies in the financial ecosystem.

By staying informed about developments in the cryptocurrency market and analyzing the strategies of major players like World Liberty Financial, investors can better navigate this volatile yet potentially lucrative landscape. As always, due diligence and careful consideration of market trends will be essential for anyone looking to invest in cryptocurrencies.

Breaking:

World Liberty Financial has bought 3.54 million $MNT for $3 million.

As of now, World Liberty Financial has a total loss of $109 million but they’re buying continuously.

Do they know something? pic.twitter.com/ClTdj7mQzL

— Cas Abbé (@cas_abbe) March 24, 2025

Breaking: World Liberty Financial has bought 3.54 million $MNT for $3 million.

In a surprising move that has caught the attention of investors and analysts alike, World Liberty Financial has recently purchased a staggering 3.54 million shares of $MNT for a total amount of $3 million. This bold acquisition raises numerous questions and speculations about the company’s future and the potential implications for the stock market, particularly for $MNT. Let’s dig deeper into what this purchase means and why it has generated such buzz in financial circles.

Understanding the Context of the Acquisition

Before we dive into the specifics, it’s essential to understand the backdrop against which this acquisition took place. World Liberty Financial, despite now facing a total loss of $109 million, is showing an aggressive purchasing strategy. This is not just a random investment; it comes in the wake of significant financial fluctuations and market uncertainties that have affected numerous companies in the past year.

But why would a company with such substantial losses continue to buy shares? It leads us to ponder: Do they know something? This question looms large over the financial community as they analyze the potential motivations behind this bold move.

The Implications of Buying $MNT Shares

Acquiring 3.54 million shares of $MNT is no small feat. It indicates a strong belief in the stock’s potential for recovery or growth. Investors often look at such acquisitions as signals. When a firm invests heavily in a specific stock, it can be interpreted as a sign of confidence in that company’s future performance.

$MNT has seen its ups and downs, and the recent activities by World Liberty Financial might suggest that they foresee a turnaround. This acquisition could be a strategic move to position themselves advantageously for potential gains when the market rebounds.

What Does This Mean for Other Investors?

For other investors, this news can be quite telling. If World Liberty Financial, a company with a substantial financial background, is willing to invest significantly in $MNT despite its losses, it might be wise for other investors to take note. The fact that they are buying continuously indicates a long-term strategy rather than a quick flip. It may also mean that they have insights or access to information that the average investor does not.

Investors should consider doing their own research on $MNT, analyzing market trends, and evaluating the company’s fundamentals. Engaging with financial advisors or following credible financial news sources can provide valuable insights into whether this investment could be worthwhile.

The Risks Involved

While the acquisition by World Liberty Financial might seem like a golden opportunity, it’s crucial to remember that investing in the stock market comes with risks. The company is currently facing significant losses, and the volatility of stocks can lead to unpredictable outcomes.

Investors should be cautious and weigh the risks against potential rewards. It’s wise to diversify portfolios and not put all eggs in one basket, especially in uncertain market conditions.

Analyzing World Liberty Financial’s Strategy

So, what could be the strategic reasoning behind World Liberty Financial’s decision to continue buying shares? One possibility is that they are banking on the potential for $MNT to rebound in value. Historically, many companies have seen their stocks recover after a downturn, and perhaps World Liberty Financial is betting on a similar scenario.

Additionally, companies often look for undervalued stocks that have the potential for growth. If World Liberty Financial believes that $MNT is currently undervalued, their continued purchases could be a strategy to capitalize on this perceived opportunity.

The Market’s Reaction

As news of this acquisition spreads, it will be interesting to observe how the market reacts. Stock prices often experience fluctuations based on investor sentiment. If other investors start to believe in the potential of $MNT following World Liberty Financial’s actions, we could see an uptick in the stock’s performance.

On the other hand, if skepticism prevails and investors remain wary of the underlying issues leading to World Liberty Financial’s losses, $MNT may not see the desired growth.

Monitoring Future Developments

It’s essential to keep an eye on future developments related to both World Liberty Financial and $MNT. Companies often release reports, earnings calls, or other communications that can shed light on their financial health and strategies. Staying informed will allow investors to make educated decisions moving forward.

Conclusion: The Bigger Picture

World Liberty Financial’s recent acquisition of 3.54 million shares of $MNT for $3 million is a significant move that merits attention. Despite facing a loss of $109 million, their continuous buying raises questions about their insight into the market and the future of $MNT. While this could be an opportunity for savvy investors, it also reminds us of the inherent risks in the stock market.

Investors should approach this situation with a balanced mindset, conducting thorough research and considering both the potential rewards and risks involved. As the financial landscape continues to evolve, staying informed and adaptable will be key to navigating these interesting times in the market.

For more updates on this story, keep an eye on financial news platforms and social media channels, as developments are likely to unfold in the coming weeks.