WHALE INVESTMENT IN BITCOIN: A SIGN OF CONFIDENCE IN THE CRYPTO MARKET

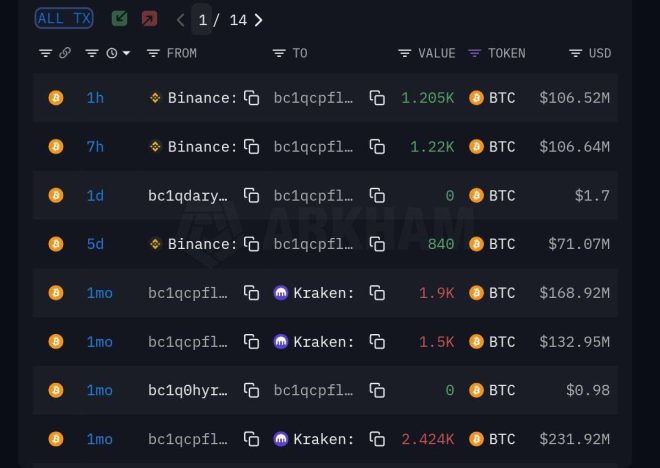

In a recent development that has sent ripples through the cryptocurrency community, a prominent investor, often referred to as a "whale," has made headlines by acquiring an impressive 1,205 Bitcoin (BTC) valued at approximately $106 million on the Binance exchange. This significant investment brings the whale’s total holdings to a staggering 15,173 BTC, now worth around $1.34 billion. This event not only underscores the whale’s confidence in Bitcoin but also highlights the contrasting behaviors of retail investors amidst market fluctuations.

THE WHALE’S STRATEGY

Whales, defined as individuals or entities that hold a large amount of cryptocurrency, often have a significant influence on the market due to their buying and selling power. The recent purchase by this whale indicates a bullish sentiment towards Bitcoin, even as many retail investors are engaging in panic selling. This behavior suggests a divergence in market strategies, where savvy investors see opportunity amidst fear and uncertainty.

MARKET SENTIMENT AND RETAIL INVESTORS

The current market sentiment appears to be fraught with anxiety as many retail investors react to price volatility by selling off their assets. Panic selling can often lead to a downward spiral in prices, creating an environment where fear overshadows rational decision-making. In stark contrast, the whale’s purchase exemplifies a long-term investment strategy that capitalizes on market dips. This approach suggests that experienced investors are looking beyond short-term fluctuations and are instead focusing on the fundamental value of Bitcoin.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

THE SIGNIFICANCE OF WHALE ACTIVITY

Whale activity is closely monitored by traders and analysts as it can serve as an indicator of market trends. When whales accumulate large amounts of Bitcoin, it often signals confidence in the asset’s future potential. This accumulation can lead to increased demand, which may eventually drive prices higher. For retail investors, understanding the actions of whales can provide valuable insights into market movements.

BITCOIN’S RESILIENCE

Bitcoin has faced numerous challenges since its inception, including regulatory scrutiny, technological hurdles, and market volatility. Despite these challenges, Bitcoin has shown remarkable resilience, often bouncing back stronger after significant downturns. The whale’s latest acquisition could be seen as a reaffirmation of Bitcoin’s long-term potential as a store of value and a hedge against inflation.

LONG-TERM INVESTMENT STRATEGIES

For retail investors, the situation presents an important lesson in investment strategy. While it may be tempting to react impulsively to market changes, a more calculated approach can yield better results. Long-term investing, as demonstrated by the whale, involves patience and a focus on the asset’s underlying value rather than short-term market sentiment.

EDUCATION AND AWARENESS

As the cryptocurrency landscape continues to evolve, educating oneself about market dynamics, investment strategies, and the behavior of different market participants is crucial. Retail investors can benefit from staying informed about whale movements and broader market trends, allowing them to make more informed decisions.

CONCLUSION

The recent acquisition of 1,205 Bitcoin by a whale highlights a significant moment in the cryptocurrency market. While panic selling may dominate the actions of some retail investors, the whale’s confidence in Bitcoin showcases a contrasting perspective that emphasizes long-term potential. As the market continues to fluctuate, understanding the behavior of whales and adopting a strategic approach to investing may prove beneficial for those navigating the ever-changing landscape of cryptocurrency.

In a world where fear can often dictate actions, the whale’s purchase serves as a reminder that opportunity can often be found amidst uncertainty. As the cryptocurrency market evolves, the actions of whales will continue to provide insight into potential future trends, guiding investors in their journey through this dynamic financial landscape.

BREAKING:

WHALE JUST BOUGHT ANOTHER

1205 BITCOIN WORTH $106 MILLION

ON BINANCE.HE NOW HOLDS 15,173

BTC WORTH $1.34 BILLION.WHILE YOU ARE PANIC SELLING,

WHALES ARE PANIC BUYING pic.twitter.com/DHpn0pqmGz— Ash Crypto (@Ashcryptoreal) March 24, 2025

BREAKING:

In the world of cryptocurrency, big moves often signal major shifts in market sentiment. Recently, it was reported that a whale just bought another 1205 Bitcoin worth $106 million on Binance. This bold purchase has brought the whale’s total holdings to an impressive 15,173 BTC worth $1.34 billion. While many retail investors are panic selling, it’s clear that the big players are panic buying. This situation raises a lot of interesting questions about market trends and investor psychology.

WHALE JUST BOUGHT ANOTHER

The term “whale” refers to individuals or entities that hold large amounts of cryptocurrency. Their actions can heavily influence market trends. When a whale makes a significant purchase like this, it often creates waves throughout the entire crypto ecosystem. The fact that this particular whale has added 1205 Bitcoin to their holdings suggests a strong belief in the future of Bitcoin, even amidst volatility.

1205 BITCOIN WORTH $106 MILLION

So, what does a purchase of 1205 Bitcoin worth $106 million tell us? For one, it signals confidence from seasoned investors who are not easily swayed by market fluctuations. This whale’s investment highlights a critical point: while some are exiting the market due to fear, others see an opportunity to buy at lower prices. This behavior often leads to discussions about the long-term prognosis of Bitcoin and its potential to recover from downturns.

ON BINANCE.HE NOW HOLDS 15,173

Binance, one of the largest cryptocurrency exchanges in the world, continues to be a popular platform for whales to make large transactions. The fact that this whale now holds a staggering 15,173 BTC indicates not just a significant financial commitment, but also a strong belief in Bitcoin’s underlying technology and its future value. Such large holdings can also provide the whale with significant influence over market dynamics, allowing them to manipulate prices if they choose to sell.

BTC WORTH $1.34 BILLION.

With a current value of $1.34 billion, this whale’s investment is not just a personal statement; it reflects a broader trend in cryptocurrency investing. The rise of institutional investors and high-net-worth individuals in the crypto space is changing how the market operates. They’re not making decisions based on short-term gains but rather on long-term value propositions, which is a valuable perspective for everyday investors to consider.

WHILE YOU ARE PANIC SELLING,

Now, let’s talk about the panic selling that many retail investors are engaging in. It’s natural to feel anxious during market downturns, and many people may feel pressured to sell their assets for fear of losing everything. However, this whale’s recent purchase is a stark reminder that while some are running away from the market, others see it as a golden opportunity. Panic selling can often lead to missed opportunities, especially if the market turns around shortly after.

WHALES ARE PANIC BUYING

The contrasting behavior of whales and retail investors speaks volumes about market psychology. It’s easy to get swept up in fear during a downturn, but the reality is that seasoned investors tend to buy when prices are low. They understand that cryptocurrency markets are volatile and can recover just as quickly as they decline. This divergence in behavior is a crucial lesson for anyone in the crypto space: don’t let fear dictate your investment decisions.

The Importance of HODLing

Amidst all this chaos, the concept of “HODLing” emerges as a powerful strategy. HODL, which originated from a misspelled online post in 2013, stands for “Hold On for Dear Life.” It emphasizes the importance of holding onto your investments rather than selling in response to market dips. The behavior of whales suggests that they are HODLing their assets, believing that in the long run, Bitcoin and other cryptocurrencies will appreciate in value.

Market Trends and Analysis

Understanding market trends is essential for navigating the cryptocurrency landscape. The recent purchase by this whale could indicate an impending market shift. Historical data shows that significant purchases by whales often precede price increases. This could mean that Bitcoin is poised for a rally, making now an ideal time for investors to rethink their strategies.

The Role of Media in Shaping Perception

Media coverage, such as the tweet from Ash Crypto, plays a crucial role in shaping public perception of the cryptocurrency market. When news breaks about significant investments from whales, it tends to create buzz and can influence the behavior of retail investors. The psychological impact of such news can lead to increased confidence among buyers or heightened fear among sellers. As an investor, it’s important to consume news critically and not let headlines dictate your decisions.

Long-term vs. Short-term Investments

One of the key takeaways from the actions of this whale is the difference between long-term and short-term investment strategies. While day traders might be looking to capitalize on short-term price movements, whales generally have a longer time horizon. They understand the cyclical nature of markets and are often willing to weather short-term volatility for long-term gains. This perspective can be incredibly beneficial for retail investors, who might be tempted to make snap decisions based on short-term market fluctuations.

Conclusion: A Call to Educate Yourself

This situation serves as a call to action for anyone involved in cryptocurrency. Rather than allowing panic to dictate actions, take this opportunity to educate yourself about the market. Understand the psychology behind whale investments and how you can utilize this knowledge to make informed decisions. The cryptocurrency market is full of opportunities, but it requires a level-headed approach to navigate successfully.

“`