Breaking News: Fidelity Solana Fund Filing Confirmed

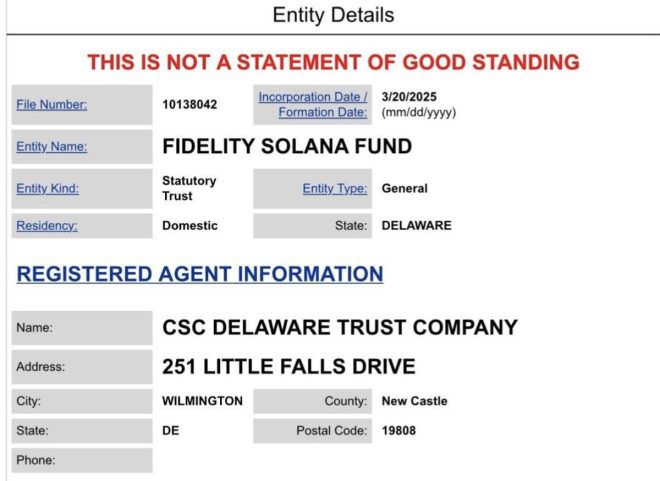

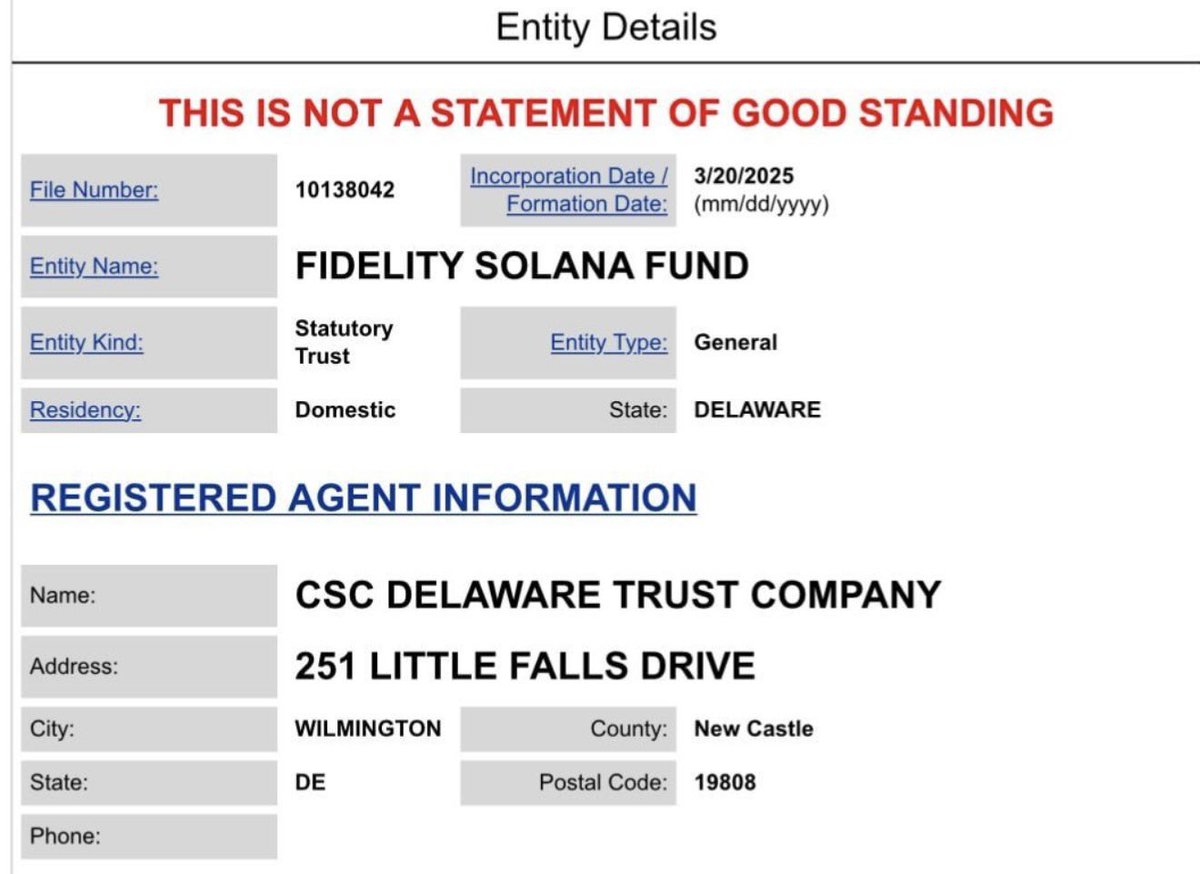

In a groundbreaking development for the cryptocurrency and financial markets, Eleanor Terrett has confirmed via Twitter that the filing for the ‘Fidelity Solana Fund’ statutory trust, submitted by CSC Delaware Trust Company, is indeed legitimate. This news comes as a significant milestone for Fidelity, one of the largest asset management firms globally, and adds to the growing list of investment opportunities in the crypto space.

Who is Fidelity?

Fidelity Investments, established in 1946, is renowned for its comprehensive financial services, including investment management, retirement planning, and wealth management. As the world’s third-largest asset manager, Fidelity has a robust reputation in the financial industry. The firm is also recognized as the second-largest Bitcoin ETF (Exchange-Traded Fund) issuer, following BlackRock. This positioning underscores Fidelity’s commitment to expanding its offerings in the cryptocurrency market, providing investors with more opportunities to engage with digital assets.

The Significance of the Fidelity Solana Fund

The establishment of the Fidelity Solana Fund is a noteworthy development for several reasons:

- Increased Legitimacy for Cryptocurrencies: The approval of a statutory trust dedicated to Solana (SOL) signifies growing institutional interest in cryptocurrencies. This move by Fidelity legitimizes Solana as a viable investment option, potentially attracting more institutional and retail investors to the digital asset.

- Diversification of Investment Options: Fidelity’s foray into Solana provides investors with another avenue to diversify their portfolios. As cryptocurrencies gain traction, having access to various investment vehicles can mitigate risks associated with market volatility.

- Support for Solana’s Ecosystem: Solana has emerged as a leading blockchain platform, known for its fast transaction speeds and low fees. By launching a fund focused on Solana, Fidelity is not only supporting the ecosystem but also signaling confidence in the platform’s long-term potential.

- Regulatory Compliance and Trust: The filing of a statutory trust indicates that Fidelity is taking the necessary steps to comply with regulatory requirements. This transparency can foster trust among investors, who may be hesitant to engage with the cryptocurrency market due to concerns over regulation and security.

What Does This Mean for Investors?

The confirmation of the Fidelity Solana Fund opens several opportunities for investors:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Access to Institutional-Grade Investment: With Fidelity managing the fund, investors can expect a professional approach to asset management, ensuring that their investments are handled with expertise.

- Potential for Growth: Solana has been one of the fastest-growing cryptocurrencies, often seen as a competitor to Ethereum. By investing in the Fidelity Solana Fund, investors may benefit from the potential price appreciation of SOL.

- Education and Research: Fidelity’s entry into the cryptocurrency space is likely to come with educational resources and research, helping investors understand the risks and rewards associated with investing in Solana and other cryptocurrencies.

The Future of Fidelity and Cryptocurrencies

Fidelity’s move into the cryptocurrency space is part of a broader trend where traditional financial institutions are increasingly recognizing the value of digital assets. As more firms follow suit, the landscape of investment options will undoubtedly evolve.

Key Takeaways

- Legitimacy: The Fidelity Solana Fund’s approval reinforces the growing acceptance of cryptocurrencies in mainstream finance.

- Diverse Offerings: Investors now have more options to diversify their portfolios with institutional-grade funds.

- Support for Blockchain: Fidelity’s investment in Solana highlights confidence in the blockchain technology driving cryptocurrencies.

Conclusion

The confirmation of the Fidelity Solana Fund marks a significant moment in the cryptocurrency landscape. With Fidelity’s stature as a leading asset manager, this move not only enhances the credibility of Solana but also signals a shift in how institutional investors approach digital assets. As the market continues to evolve, investors should stay informed about developments in the cryptocurrency space and consider how opportunities like the Fidelity Solana Fund might fit into their investment strategy.

As we witness the convergence of traditional finance and cryptocurrencies, it is essential for investors to keep a close eye on regulatory developments, market trends, and the performance of funds like the Fidelity Solana Fund. With the potential for significant growth and diversification, this fund could play a pivotal role in shaping the future of cryptocurrency investments.

BREAKING: @EleanorTerrett has confirmed that the ‘Fidelity Solana Fund’ statutory trust filing submitted by CSC Delaware Trust Company is legitimate. @Fidelity is the world’s third-largest asset manager and the second-largest BTC ETF issuer after BlackRock. pic.twitter.com/yFu3VDntla

— SolanaFloor (@SolanaFloor) March 24, 2025

BREAKING: @EleanorTerrett has confirmed that the ‘Fidelity Solana Fund’ statutory trust filing submitted by CSC Delaware Trust Company is legitimate.

Have you heard the news? It’s buzzing all over the cryptocurrency community and beyond! The announcement from reputable journalist @EleanorTerrett has confirmed that the ‘Fidelity Solana Fund’ statutory trust filing is indeed legitimate. This is a significant development, especially for those who are closely following the evolution of cryptocurrency investment products. The involvement of Fidelity, the world’s third-largest asset manager, adds a layer of credibility and interest that few can overlook.

But what does this mean for investors and the Solana ecosystem? Let’s dive deeper into the implications of this announcement and what it could mean for the future of cryptocurrency investments.

@Fidelity is the world’s third-largest asset manager

Fidelity is a name that resonates in the investment world. Known for its robust asset management services, the firm has made significant strides in various financial sectors, and now it’s setting its sights on the cryptocurrency market. With this new fund focused on Solana, Fidelity is not just dipping its toes in the water but is making a significant plunge into the crypto pool.

For those who might not be familiar, Solana is a high-performance blockchain platform that supports smart contracts and decentralized applications. Its speed and scalability have made it a favorite among developers and investors alike. By introducing a dedicated fund for Solana, Fidelity is acknowledging the potential of this ecosystem and opening the door for more traditional investors to engage with cryptocurrencies.

the second-largest BTC ETF issuer after BlackRock

Fidelity’s reputation as the second-largest Bitcoin ETF issuer after BlackRock is another feather in its cap. This status not only reflects Fidelity’s strong position in the market but also indicates its commitment to expanding its offerings within the cryptocurrency space.

The launch of the Fidelity Solana Fund could signal a growing trend. As more traditional asset managers recognize the value of cryptocurrencies, we might see an influx of similar funds targeting various digital assets. This trend could lead to greater acceptance of cryptocurrencies in mainstream finance and may encourage more investors to explore digital assets.

Why is the Fidelity Solana Fund significant?

The Fidelity Solana Fund is more than just another investment vehicle; it represents a pivotal moment for the cryptocurrency market. Here are a few reasons why this fund is generating so much buzz:

1. **Legitimacy**: With Fidelity backing the Solana ecosystem, it lends a level of legitimacy that many cryptocurrencies often lack in the eyes of traditional investors.

2. **Increased Investment**: This fund could attract institutional and retail investors who may have been hesitant to invest in cryptocurrencies previously. The backing of a reputable firm like Fidelity can help bridge that gap.

3. **Market Growth**: As the fund draws in capital, we could see a positive impact on the Solana market itself. Increased demand for Solana tokens could drive up their value, benefiting existing holders and attracting new ones.

4. **Educational Opportunities**: The launch of such funds often comes with educational resources for investors. Fidelity may provide insights and information on how to navigate the Solana ecosystem, which can empower investors to make informed decisions.

What does this mean for the future of Solana?

The future of Solana looks promising, especially with Fidelity’s involvement. As one of the leading asset managers globally, Fidelity’s endorsement can help Solana stand out in a crowded marketplace filled with various cryptocurrencies. This could lead to:

– **Enhanced Adoption**: More investors might start looking at Solana, leading to wider adoption of the token and its technology.

– **Innovative Developments**: Increased investment may lead to further innovations within the Solana ecosystem, encouraging developers to create more applications and services that leverage its capabilities.

– **Competitive Landscape**: Other cryptocurrencies may feel the pressure to grow and innovate as they see the potential that Solana is tapping into with the support of a heavyweight like Fidelity.

Investor Perspectives on the Fidelity Solana Fund

As news of the Fidelity Solana Fund spreads, many investors are keen to understand what this means for their investment strategies. Here are a few perspectives:

– **Diversification**: For those already invested in cryptocurrencies, the Fidelity Solana Fund presents an opportunity for diversification. It allows investors to gain exposure to Solana without needing to directly manage their own holdings.

– **Risk Management**: Investing through a fund like Fidelity may provide a layer of security for risk-averse investors. Fidelity’s expertise in managing assets can help navigate the volatile nature of cryptocurrencies.

– **Long-Term Growth**: Many investors view Solana as a long-term investment. With Fidelity’s backing, they may feel more confident in holding onto their investments, anticipating growth over time.

How to Get Involved with the Fidelity Solana Fund

If you’re interested in exploring investment opportunities with the Fidelity Solana Fund, here are a few steps to consider:

1. **Research**: Start by researching Fidelity’s offerings and the specifics of the Solana Fund. Familiarize yourself with Solana’s technology and market position.

2. **Consult with a Financial Advisor**: If you’re uncertain about investing in cryptocurrencies, consulting with a financial advisor who understands the market can be beneficial.

3. **Stay Updated**: Keep an eye on announcements from Fidelity and news surrounding the Solana ecosystem to stay informed about potential changes and opportunities.

4. **Consider Your Risk Tolerance**: As with any investment, assess your risk tolerance and ensure that investing in a cryptocurrency fund aligns with your overall financial goals.

The Broader Impact of Fidelity’s Entry into Cryptocurrency

Fidelity’s move into the cryptocurrency space is not just a win for Solana; it could have broader implications for the entire industry. The entry of traditional asset managers into the cryptocurrency market is paving the way for:

– **Regulatory Clarity**: As more reputable firms engage with cryptocurrencies, we may see a push for clearer regulations. This could help stabilize the market and protect investors.

– **Increased Competition**: Other asset management firms may feel compelled to launch their own cryptocurrency funds, leading to increased competition and innovation within the sector.

– **Mainstream Adoption**: Fidelity’s involvement could be a catalyst for broader acceptance of cryptocurrencies among traditional investors and institutions, ultimately leading to greater integration of digital assets into everyday finance.

In wrapping up all these insights, it’s evident that the Fidelity Solana Fund represents more than just an investment opportunity; it symbolizes a shift in how traditional finance views and interacts with the cryptocurrency world. As we move forward, it will be fascinating to watch how this plays out and what it means for the future of not just Solana but the entire digital asset landscape.

The buzz around the Fidelity Solana Fund is just the beginning. As more developments unfold, staying informed and engaged will be key for anyone interested in navigating this exciting and ever-evolving space.