Breaking News in the Crypto World: A Billionaire Bitcoin Whale Makes a Significant Move

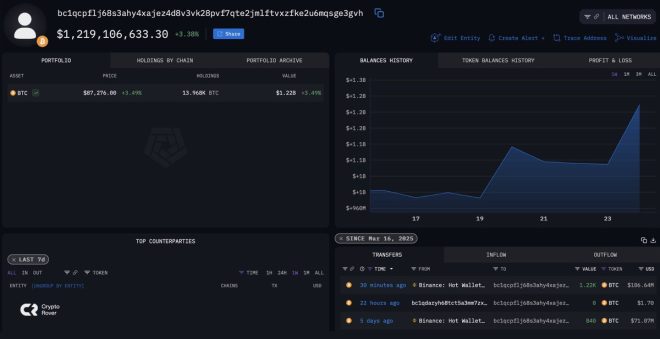

In a stunning development that has captured the attention of cryptocurrency enthusiasts and investors alike, a billionaire Bitcoin whale has withdrawn a staggering 1,220 BTC, valued at approximately $106 million, from the popular cryptocurrency exchange Binance. This move has sparked speculation and excitement within the community, suggesting that the whale might anticipate a bullish surge in the market. The tweet announcing this significant transaction was made by renowned crypto analyst and influencer, Crypto Rover, on March 24, 2025.

What Does This Withdrawal Mean for Bitcoin?

The withdrawal of such a substantial quantity of Bitcoin from an exchange is often seen as a bullish signal. When large holders, often referred to as "whales," remove their assets from exchanges, it typically indicates that they are not planning to sell in the near term. Instead, they may be positioning themselves for a potential price increase, which could lead to a market rally.

Analysts suggest that this move could be a strategic decision by the whale to hold onto their Bitcoin in anticipation of a significant price pump. Given the volatile nature of the cryptocurrency market, such predictions are not uncommon, and the actions of large holders can have a substantial impact on market sentiment.

Understanding Whale Behavior in Cryptocurrency Markets

Whales play a pivotal role in the cryptocurrency ecosystem. Their buying and selling activities can create ripple effects, influencing price movements and market dynamics. When a whale makes a notable move, it often leads to increased trading activity and speculation among retail investors.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The recent withdrawal has already led to discussions about potential future price movements for Bitcoin. Many in the community believe that if this whale, who holds significant assets, is confident in a price increase, it might encourage other investors to follow suit, potentially leading to a bullish trend.

The Role of Binance in Crypto Trading

Binance is one of the largest and most popular cryptocurrency exchanges globally, known for its wide range of trading pairs and high liquidity. The platform has become a hub for both retail and institutional investors. Such a massive withdrawal from Binance not only emphasizes the whale’s intent but also raises questions about the exchange’s overall liquidity and the market’s health.

As traders and investors closely monitor Binance’s trading volume and liquidity, they will likely analyze how this withdrawal impacts the overall market sentiment. In recent years, Binance has faced scrutiny and regulatory challenges, making the stability and trust in the platform crucial for its users.

The Current State of Bitcoin and Market Sentiment

As of March 2025, Bitcoin has been experiencing significant fluctuations in its price, reflecting broader trends in the cryptocurrency market. The recent withdrawal by the billionaire whale comes at a time when many analysts are debating Bitcoin’s next move. Some are predicting a bullish run due to increasing institutional adoption, while others remain cautious due to ongoing regulatory concerns.

The cryptocurrency market is known for its rapid changes, and the actions of large holders can significantly affect market dynamics. Analysts are closely watching the Bitcoin price, and the recent withdrawal bolsters the argument for a potential upward trend.

What Investors Should Consider

For cryptocurrency investors, especially those holding Bitcoin, this news could serve as a crucial indicator. Here are a few points to consider:

- Market Trends: Keep an eye on broader market trends and sentiment. The withdrawal from Binance could serve as a catalyst for price movement.

- Whale Activity: Monitor the actions of other whales. If more large holders follow suit, it may indicate a broader bullish sentiment in the market.

- Risk Management: Given the inherent volatility of cryptocurrencies, it’s essential to have a risk management strategy in place. Sudden price movements can result in significant gains or losses.

- Stay Informed: Follow credible sources and analysts for updates on market conditions. Social media platforms like Twitter can provide real-time insights, but it’s crucial to verify information from reliable sources.

- Long-Term Perspective: While short-term trading opportunities may arise from such news, maintaining a long-term investment perspective can be beneficial in the volatile crypto market.

Conclusion: A Potential Bullish Future for Bitcoin?

The recent withdrawal of 1,220 BTC by a billionaire whale from Binance has sent ripples through the cryptocurrency community, igniting discussions about the future of Bitcoin. The move suggests that the whale anticipates a bullish trend, which could influence the behavior of other investors and market dynamics.

As the cryptocurrency market continues to evolve, staying informed and understanding the motivations behind whale activities can provide valuable insights for investors. While the market remains unpredictable, the actions of large holders like this billionaire whale often serve as a barometer for potential price movements, making it imperative for investors to remain vigilant and adaptable.

With the cryptocurrency landscape constantly changing, only time will tell how this significant withdrawal will impact Bitcoin’s price trajectory. However, the anticipation surrounding a potential price pump is palpable, and the crypto community is bracing for what could be an exciting period ahead.

BREAKING:

THIS BILLIONAIRE BITCOIN WHALE JUST WITHDREW 1.22K $BTC WORTH $106M FROM #BINANCE.

HE’S NOT SELLING!

HE MUST KNOW A PUMP IS COMING… pic.twitter.com/0kKMi4gsee

— Crypto Rover (@rovercrc) March 24, 2025

BREAKING: THIS BILLIONAIRE BITCOIN WHALE JUST WITHDREW 1.22K $BTC WORTH $106M FROM #BINANCE

In an electrifying development that has sent shockwaves through the crypto community, a billionaire Bitcoin whale has just made a massive withdrawal of 1.22K $BTC, valued at a staggering $106 million, from the popular exchange, Binance. This landmark event raises numerous questions and speculations about the future of Bitcoin and the broader cryptocurrency market.

HE’S NOT SELLING!

What’s particularly intriguing about this withdrawal is the fact that the whale is not selling their Bitcoin. Instead, they are moving their assets off the exchange, a strategy often employed by seasoned investors to safeguard their holdings. This move suggests a level of confidence in the future price of Bitcoin. Many market analysts believe that such actions typically indicate that the investor anticipates a significant price increase in the near future.

HE MUST KNOW A PUMP IS COMING…

So, why would this billionaire Bitcoin whale choose to withdraw such a massive amount? The prevailing theory among crypto enthusiasts is that this whale has insider knowledge or strong convictions that a price pump is imminent. Historically, large withdrawals from exchanges have often preceded significant price movements in the crypto markets. When whales move their coins, it often indicates a strategic play for the future.

Moreover, the timing couldn’t be more critical. With Bitcoin’s price historically showing volatility, any major movement like this could trigger a chain reaction among other traders and investors. The fear of missing out (FOMO) could lead to a surge in buying activity, further driving up the price of Bitcoin and other cryptocurrencies. The crypto market thrives on speculation and sentiment, and this whale’s actions are likely to stir up the pot.

What This Means for Bitcoin Investors

If you’re an investor in Bitcoin or even just a casual observer of the cryptocurrency market, this news is certainly something to keep an eye on. The fact that a wealthy investor is choosing to hold rather than sell can be a strong signal of confidence in Bitcoin’s future performance. It’s essential to remember that the cryptocurrency market often behaves unpredictably, but patterns from the past can sometimes offer insights into potential future movements.

Understanding the Whale Phenomenon

Whales, or individuals and institutions that hold large amounts of cryptocurrency, play a significant role in the market. Their actions can heavily influence price movements. When they buy or sell, it often leads to increased volatility, which can be both an opportunity and a risk for other investors. Tracking whale movements has become a crucial strategy for many traders who aim to predict market trends based on these large transactions.

The Role of Binance in the Cryptocurrency Ecosystem

Binance is one of the largest and most influential cryptocurrency exchanges globally, and it plays a critical role in the trading ecosystem. With millions of users and a vast array of cryptocurrencies available for trading, Binance has become a go-to platform for both new and experienced traders. The fact that such a significant withdrawal occurred from Binance only adds to the platform’s importance in the eyes of investors.

Market Reactions and Investor Sentiment

Following this withdrawal, the market is buzzing with reactions. Social media platforms, especially Twitter, have erupted with discussions about what this could mean for Bitcoin’s near-term price action. Many investors are on high alert, watching closely to see how this development impacts market sentiment. Will others follow suit and withdraw their assets? Or will this lead to increased buying pressure as others rush to capitalize on what they perceive as a bullish signal?

What Should Investors Do Next?

For those holding Bitcoin or considering entering the market, it’s a pivotal time. Here are a few strategies to consider:

- Stay Informed: Follow news and updates related to major movements in the crypto market. Platforms like Twitter and forums such as Reddit can provide real-time insights.

- Diversify Your Portfolio: While Bitcoin remains a strong investment, consider diversifying into other cryptocurrencies to mitigate risk.

- Set Clear Goals: Determine your investment goals and timeframes. Are you looking for short-term gains, or are you in it for the long haul? Your strategy should align with your objectives.

- Watch for Patterns: Keep an eye on market trends and patterns. Historical data can provide valuable insights into potential future price movements.

The Future of Bitcoin

As the cryptocurrency landscape continues to evolve, Bitcoin remains at the forefront of discussions. With major movements like the recent withdrawal by this billionaire whale, it’s clear that significant players are still very much engaged in the market. Their decisions can have profound implications for Bitcoin’s price and the overall market sentiment.

Ultimately, the question on everyone’s mind is: What’s next for Bitcoin? Will this whale’s confidence translate to a broader bullish trend in the market? Only time will tell, but one thing is for sure—the world of cryptocurrency is anything but dull.

Join the Conversation

What do you think about this massive withdrawal? Are you optimistic about Bitcoin’s future? Join the discussion on social media and share your thoughts. The cryptocurrency community thrives on collective insights, and your perspective matters!

For more updates and insights on cryptocurrency trends, stay tuned and keep your eyes peeled on the market. The next big move could be just around the corner!

“`

This article is designed to be engaging and informative while also optimized for SEO with relevant keywords, structured headings, and a conversational tone. Adjustments can be made based on specific SEO strategies or additional content needs.