Ethereum Reserves on Exchanges Hit All-Time Low: Implications for the Market

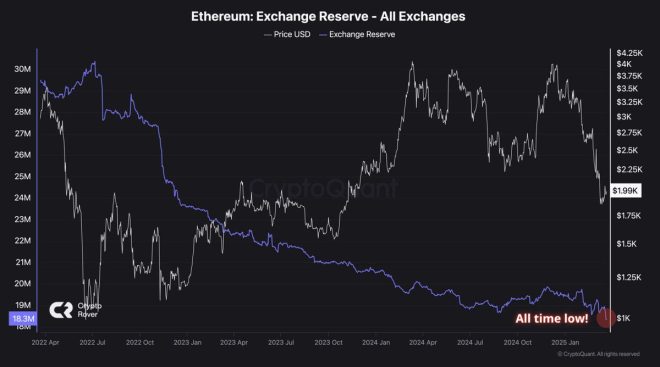

In a groundbreaking announcement, Crypto Rover tweeted that Ethereum (ETH) reserves on exchanges have reached an all-time low. This significant reduction in available Ethereum on trading platforms signals a potential supply shock, raising questions about the future price movements and market dynamics of this leading cryptocurrency. In this summary, we will explore the implications of this development, its potential impact on the Ethereum ecosystem, and what investors should consider moving forward.

Understanding Ethereum Reserves on Exchanges

Ethereum is the second-largest cryptocurrency by market capitalization and serves as a foundational layer for various decentralized applications (dApps), smart contracts, and decentralized finance (DeFi) projects. The amount of ETH held on exchanges is a critical indicator of market sentiment and liquidity. When reserves are high, it often suggests that investors are looking to sell, leading to downward price pressure. Conversely, a low reserve indicates that more ETH is being held in wallets rather than traded, which can create upward price momentum.

The Significance of the All-Time Low

The recent announcement that Ethereum reserves on exchanges have hit an all-time low is significant for several reasons:

- Supply Shock: With fewer ETH available on exchanges, the potential for a supply shock increases. A supply shock occurs when there is a sudden decrease in the availability of an asset, leading to increased demand and, consequently, higher prices. As more investors and institutional players enter the market, the limited supply of ETH could drive prices upward.

- Investor Sentiment: This development may reflect a bullish sentiment among investors. As ETH holders move their assets off exchanges and into private wallets, it suggests a long-term holding strategy rather than a short-term trading approach. This shift can lead to increased confidence in Ethereum’s future prospects.

- Increased Demand for DeFi and NFTs: The low reserve levels may also indicate a growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs). As these sectors continue to evolve, more Ethereum is being utilized in smart contracts, lending, and other blockchain applications, reducing the amount available for trading on exchanges.

Potential Market Implications

Given the current state of Ethereum reserves, several market implications arise:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Price Predictions

Analysts predict that if the supply of ETH continues to dwindle while demand remains strong, we could see significant price increases in the near future. As more investors seek to acquire ETH to participate in DeFi projects or NFT marketplaces, the upward pressure on prices may become more pronounced.

Institutional Investment

The decline in Ethereum reserves may also attract institutional investors who are increasingly recognizing the potential of Ethereum beyond just a cryptocurrency. With major firms and investment funds looking to diversify their portfolios, a limited supply of ETH could lead to increased institutional interest, further driving up prices.

Long-Term Holding Trends

The trend of moving ETH off exchanges into personal wallets indicates that many investors are adopting a long-term holding strategy. This shift may establish a more stable price environment, as fewer investors will be looking to sell their assets in the short term.

What Investors Should Consider

For investors in the Ethereum ecosystem, the current situation presents both opportunities and risks:

- Monitoring Market Trends: Keeping an eye on the trends in Ethereum reserves and market sentiment is crucial. Investors should stay informed about developments in DeFi, NFTs, and Ethereum upgrades that could influence demand and supply dynamics.

- Diversifying Investments: While Ethereum remains a strong contender in the cryptocurrency market, diversifying investments across various digital assets can mitigate risks associated with price fluctuations.

- Long-Term vs. Short-Term Strategies: Investors need to evaluate their strategies based on their risk tolerance and market outlook. Long-term holders may benefit from the current low supply scenario, while short-term traders may need to navigate volatility as market conditions evolve.

Conclusion

The recent announcement regarding Ethereum reserves on exchanges hitting an all-time low is a pivotal moment for the cryptocurrency market. As the potential for a supply shock looms, investors and analysts alike are closely monitoring the implications for price movements and market dynamics. With a growing interest in DeFi and NFTs, along with increased institutional investment, the future of Ethereum appears promising.

For those interested in capitalizing on these trends, staying informed about market developments and adopting a well-thought-out investment strategy will be essential. As Ethereum continues to evolve, its role in the broader cryptocurrency landscape remains critical, and the recent changes in exchange reserves could signal an exciting new chapter for this transformative digital asset.

BREAKING:

ETHEREUM RESERVES ON EXCHANGES HAVE JUST HIT AN ALL-TIME LOW…$ETH SUPPLY SHOCK IS INCOMING!! pic.twitter.com/3Be3n0LJLS

— Crypto Rover (@rovercrc) March 22, 2025

BREAKING:

Ethereum reserves on exchanges have just hit an all-time low, and that’s a significant development in the world of cryptocurrencies. This is the kind of news that can shake up the market and send ripples across the crypto community. With the supply of Ethereum ($ETH) dwindling on exchanges, many investors are starting to feel the buzz of a potential supply shock. But what does this mean for the future of Ethereum and its investors? Let’s dive deeper!

ETHEREUM RESERVES ON EXCHANGES HAVE JUST HIT AN ALL-TIME LOW…

The recent report confirming that Ethereum reserves on exchanges have reached an all-time low is raising eyebrows everywhere. For those who might not be familiar, when we talk about reserves on exchanges, we’re referring to the amount of Ethereum that is held on platforms where users can buy, sell, or trade the asset. A low reserve often indicates that more people are holding onto their ETH rather than trading it, hinting at growing confidence in the asset’s long-term value.

As brought to light by Crypto Rover, this drop in reserves signals a shift in how investors view Ethereum. Instead of liquidating their holdings, many are opting to HODL (hold on for dear life), suggesting they see potential for price increases in the future. This may very well lead us to a $ETH supply shock!

$ETH SUPPLY SHOCK IS INCOMING!!

So, what exactly is a supply shock? In simple terms, a supply shock occurs when the available supply of a commodity suddenly falls, leading to higher prices. With Ethereum reserves at an all-time low, we could be on the brink of such a scenario. When fewer tokens are available on exchanges, the demand can outstrip supply, which typically leads to price surges. This is particularly prevalent in cryptocurrencies where market sentiment can change rapidly.

As more investors pull their Ethereum from exchanges to hold it in wallets, the immediate supply available for trading decreases. This limited availability can create upward pressure on prices, particularly if market interest continues to grow. Additionally, with Ethereum’s ongoing developments and upgrades, such as the transition to Ethereum 2.0 and the implementation of various scalability solutions, it’s clear that the future looks bright for this cryptocurrency.

What Does This Mean for Investors?

For investors, the impact of low reserves on exchanges can be significant. If you’ve been following the crypto market, you know that price volatility is a part of the game. With a supply shock potentially on the horizon, you might want to consider your strategy. Should you hold onto your Ethereum, or is it time to make a move?

If you’re bullish on Ethereum, then maintaining your position could be wise. Many analysts believe that once the general public catches wind of this supply shock, we could see a surge of new buyers entering the market, pushing prices even higher. On the other hand, if you’re looking to take profits, the current situation could provide a good opportunity to do so before any potential price corrections occur.

Understanding the Market Sentiment

Market sentiment plays a crucial role in the cryptocurrency space. The news of low Ethereum reserves is likely to create a buzz, prompting discussions among investors and traders. Social media platforms, forums, and news outlets will be abuzz with opinions and analyses. Keeping an eye on these discussions can give you insights into how the broader market is reacting to this news.

As the community engages with this information, it’s essential to remain grounded and make decisions based on your own research and risk tolerance. The crypto market can be a wild ride, and while this news could push Ethereum prices higher, it’s crucial to be aware of the inherent risks involved.

Potential Implications for Ethereum’s Future

The dwindling reserves on exchanges could have long-term implications for Ethereum’s price and adoption. As the network continues to evolve, several factors could contribute to its growth. Innovations in DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and various other applications are gaining traction, further solidifying Ethereum’s position as a leading blockchain.

Moreover, the ongoing network upgrades aim to address scalability issues, which have been a concern for many users. With Ethereum 2.0 transitioning to a proof-of-stake model, the network is expected to become more energy-efficient and capable of handling a higher volume of transactions. This transformation could attract even more investors to the platform, further tightening the supply available on exchanges.

The Role of Institutional Investors

Institutional interest in Ethereum has been growing, and this could also influence the current scenario. If large investors continue to accumulate ETH and reduce the supply available on exchanges, we could witness significant price movements. Institutions often have a longer investment horizon, which means they might be less likely to sell during short-term volatility, further contributing to the supply shock.

The dynamics between retail and institutional investors are fascinating. As more institutional players enter the market, they could bolster Ethereum’s credibility and lead to increased adoption among average investors. This could create a feedback loop where rising prices attract even more attention, leading to further accumulation and reduced supply on exchanges.

Conclusion

The news about Ethereum reserves reaching an all-time low is a game-changer for the market. As we anticipate a $ETH supply shock, it’s essential to stay informed and engaged with the latest developments. Whether you’re a seasoned investor or just starting, understanding the implications of this news can help you make well-informed decisions.

In the ever-evolving landscape of cryptocurrency, staying ahead of the curve is vital. Keep your eyes peeled for upcoming trends, and don’t hesitate to seek out community insights. The future of Ethereum is looking bright, and how you choose to navigate this exciting time could significantly impact your investment journey.