BlackRock’s Bitcoin Holdings Show Signs of Recovery: A Bullish Outlook

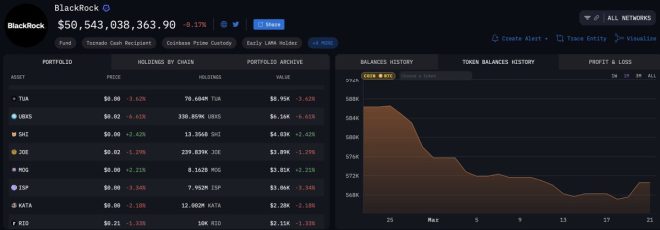

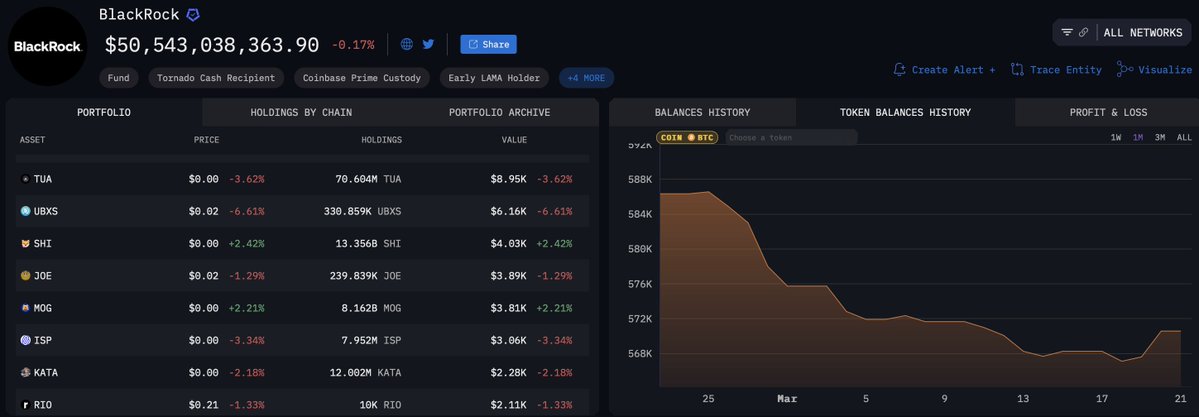

In recent news that has caught the attention of investors and crypto enthusiasts alike, BlackRock’s Bitcoin holdings have shown a significant uptick after a prolonged month-long downtrend. This development has sparked optimism in the market, leading to a bullish sentiment surrounding Bitcoin and its potential trajectory.

BlackRock’s Investment Strategy

BlackRock, as one of the world’s largest asset management firms, has a substantial influence on global financial markets. The firm’s approach to Bitcoin has been closely monitored by investors, as it often serves as a barometer for institutional interest in cryptocurrency. Over the past several years, BlackRock has gradually integrated cryptocurrency into its investment portfolio, recognizing the growing demand and potential for digital assets.

The Recent Downtrend

For a significant period, Bitcoin experienced a downturn, leading to concerns among investors about its stability and future growth. This period of decline was marked by various factors, including regulatory uncertainty, market volatility, and investor sentiment shifting towards traditional assets. During this time, BlackRock’s Bitcoin holdings saw a decrease, which further fueled speculation about the future of the cryptocurrency market.

The Bullish Turnaround

However, as of March 22, 2025, reports indicate that BlackRock has begun increasing its Bitcoin holdings once again. This resurgence is seen as a positive sign, not only for BlackRock but also for the broader cryptocurrency market. Analysts suggest that this increase could signify a renewed confidence in Bitcoin’s potential as an asset class.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Implications

The implications of BlackRock’s increased Bitcoin holdings are significant. As an institutional investor, BlackRock’s actions can influence market trends and investor behavior. An uptick in their holdings may encourage other institutional investors to reconsider their stance on Bitcoin, potentially leading to increased demand and higher prices.

Investor Sentiment

The news of BlackRock’s recovery in Bitcoin holdings has been met with enthusiasm among investors. The market is often influenced by sentiment, and this development has reignited interest in Bitcoin as a viable investment option. Investors are hopeful that this bullish momentum could lead to a more stable and upward-trending market.

The Future of Bitcoin

Looking ahead, the future of Bitcoin appears to be aligned with institutional interest and market dynamics. As more large firms like BlackRock continue to invest in Bitcoin, it could pave the way for broader acceptance and integration of cryptocurrency into mainstream financial systems. Furthermore, regulatory clarity and advancements in blockchain technology may enhance Bitcoin’s appeal as a long-term investment.

Conclusion

In conclusion, BlackRock’s recent increase in Bitcoin holdings marks a pivotal moment in the cryptocurrency market, signaling a potential recovery from a month-long downtrend. The bullish sentiment surrounding this news highlights the importance of institutional interest in shaping the future of Bitcoin. As the market continues to evolve, investors will be keenly watching BlackRock and other major players for indications of Bitcoin’s trajectory in the coming months.

—

This summary highlights the recent developments surrounding BlackRock’s Bitcoin holdings and their implications for the cryptocurrency market. The focus on institutional investment and market sentiment provides crucial context for understanding the current landscape of Bitcoin and its future prospects.

BREAKING:

BLACKROCK’S BITCOIN HOLDINGS ARE FINALLY INCREASING AFTER A MONTH-LONG DOWNTREND.

BULLISH! pic.twitter.com/oUJJPBPR1k

— Crypto Rover (@rovercrc) March 22, 2025

BREAKING:

In the ever-evolving world of cryptocurrency, news travels fast, and some updates can send shockwaves through the market. A recent tweet by Crypto Rover has caught the attention of many investors and crypto enthusiasts alike. The tweet states that BlackRock’s Bitcoin holdings are finally increasing after a month-long downtrend. This is significant news, especially for those keeping a close eye on the performance of Bitcoin and the larger cryptocurrency market. The excitement is palpable, with the tweet ending on a bullish note, emphasizing the potential for upward momentum in Bitcoin prices.

BLACKROCK’S BITCOIN HOLDINGS ARE FINALLY INCREASING AFTER A MONTH-LONG DOWNTREND.

For those not in the loop, BlackRock is one of the world’s largest investment management firms, and its movements in the cryptocurrency space are closely monitored by analysts and investors. The fact that their holdings in Bitcoin are on the rise again is a promising signal for the market. After experiencing a month-long downtrend, which can be disheartening for many investors, this uptick can suggest a renewed interest from institutional investors in Bitcoin. It’s worth considering how BlackRock’s strategies might influence market trends and the overall sentiment surrounding Bitcoin.

BULLISH!

When we hear the term “bullish,” it usually translates to optimism. In the context of investing, being bullish means that investors expect prices to rise. With BlackRock increasing its Bitcoin holdings, there’s a wave of optimism sweeping through the crypto community. Many believe that this could be a turning point for Bitcoin, suggesting that institutional confidence is returning after a shaky period. This renewed interest could lead to more investments, pushing prices up even further. For everyday investors, this could mean new opportunities to capitalize on Bitcoin’s potential growth.

The Impact of BlackRock’s Holdings on the Crypto Market

BlackRock’s involvement in Bitcoin is nothing new. The firm has been exploring cryptocurrency for some time, and their actions can heavily influence market dynamics. When major players like BlackRock increase their holdings, it often leads to increased investor confidence across the board. This can create a ripple effect, attracting more institutional and retail investors to the market.

The recent increase in BlackRock’s Bitcoin holdings could signal a shift towards a more bullish market sentiment, which is crucial after a month of declining prices. Investors are always on the lookout for signs of recovery, and BlackRock’s actions could be just the catalyst needed to spark renewed interest in Bitcoin and other cryptocurrencies.

Understanding Bitcoin’s Recent Performance

The cryptocurrency market is notorious for its volatility, and Bitcoin is often at the forefront of these fluctuations. After a month of downturn, many investors may have felt uncertain about the future of their investments. Understanding the reasons behind this downturn is just as important as acknowledging the recent uptick in BlackRock’s holdings. Factors such as regulatory changes, market sentiment, and macroeconomic conditions can all contribute to Bitcoin’s performance.

During the recent downturn, many analysts speculated about the impact of tightening monetary policies and increased scrutiny from regulators. These factors can create a cautious atmosphere among investors, leading to sell-offs and a subsequent drop in prices. However, as BlackRock’s holdings begin to increase, it may suggest a stabilization in the market, potentially paving the way for a bullish trend.

What Does This Mean for Retail Investors?

If you’re a retail investor, this news could be particularly exciting. The crypto market is often seen as a high-risk environment, but institutional investments can lend a level of credibility and stability. When firms like BlackRock increase their holdings, it often indicates a vote of confidence in the asset class, which can encourage retail investors to re-enter the market.

For those thinking about investing in Bitcoin, now might be the perfect time to do your research. Consider what this uptick in holdings could mean for the future of Bitcoin prices. It’s essential to stay informed and think critically about your investment strategy in light of these developments. Remember, the crypto market can be unpredictable, so always weigh the potential risks and rewards before making any decisions.

The Future of Bitcoin and Institutional Investment

Looking ahead, the question on everyone’s mind is: what’s next for Bitcoin? As BlackRock and other institutional players continue to show interest in Bitcoin, the potential for price increases becomes more tangible. The increased activity from these firms could lead to greater market stability and an influx of new investors.

Moreover, as more institutions enter the crypto space, we could see the emergence of new financial products and services that cater to both institutional and retail investors. This could create a more robust ecosystem for Bitcoin, enhancing its legitimacy as an asset class. The interplay between institutional investment and retail participation is crucial for the continued growth of Bitcoin and the broader cryptocurrency market.

Keeping an Eye on Market Trends

As always, staying informed is key to navigating the cryptocurrency landscape. Monitoring market trends and institutional activity can provide valuable insights into potential price movements. News like BlackRock’s increasing Bitcoin holdings can serve as a barometer for overall market sentiment.

By keeping tabs on developments in the crypto space, you can better position yourself to make informed investment decisions. Whether you’re a seasoned investor or new to the game, understanding the impact of institutional movements can enhance your approach to investing in Bitcoin and other cryptocurrencies.

In Conclusion

BlackRock’s recent increase in Bitcoin holdings is a noteworthy development in the world of cryptocurrency. As the market shifts from a month-long downtrend to a more bullish outlook, both institutional and retail investors have reason to feel optimistic. Keeping an eye on these trends and understanding their implications can help you navigate the exciting yet unpredictable journey that is investing in Bitcoin.