Tesla Stock and Minnesota’s Investment Strategy: A Closer Look

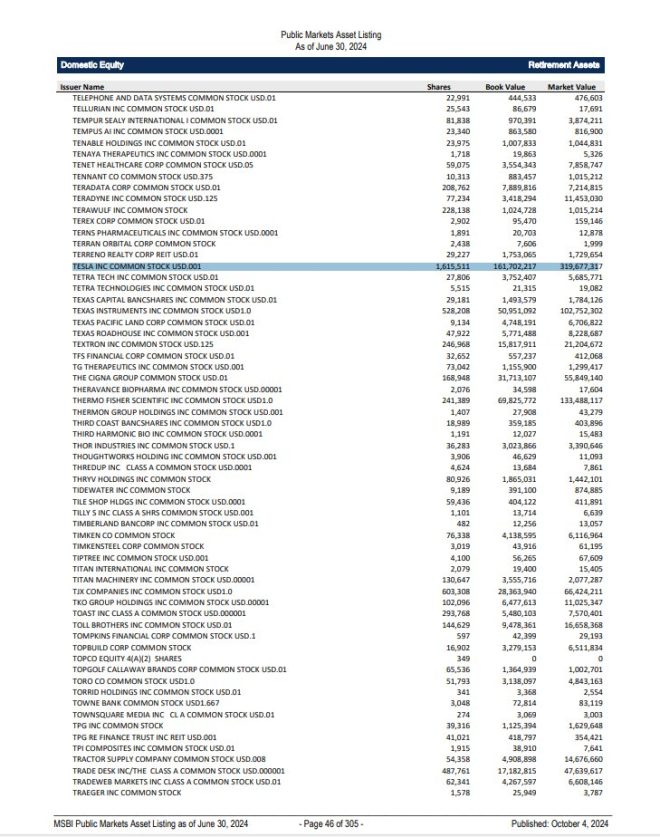

In a recent tweet that sparked considerable discussion, journalist Bill Melugin highlighted a striking contrast between Minnesota Governor Tim Walz’s public comments regarding Tesla’s stock performance and the state’s substantial investments in the electric vehicle manufacturer. On June 30, 2024, records from the Minnesota State Board of Investment revealed that the state held approximately 1.6 million shares of Tesla in its retirement fund and an additional 211,000 shares in its non-retirement fund. This revelation raises questions about the implications of public officials’ remarks on investments and the potential impact on state finances.

Governor Walz’s Comments on Tesla

Governor Walz’s comments, which were interpreted as gloating over Tesla’s stock drop, present an interesting scenario. While public officials often make statements reflecting their political viewpoints, it is crucial to consider the financial implications of such remarks, especially when the state has significant investments in the same company. The governor’s stance may reflect broader concerns about corporate performance, environmental policies, or economic strategies, but it also risks creating a rift between state interests and public perception.

The Investment Portfolio of Minnesota

The data provided by the Minnesota State Board of Investment paints a clear picture of the state’s financial commitments. With 1.6 million shares of Tesla in its retirement fund and 211,000 shares in its non-retirement fund, Minnesota has made a substantial bet on the future of electric vehicles. This investment strategy aligns with a growing trend among public pension funds to invest in renewable energy and technology companies that promise long-term growth.

Understanding the Impact of Tesla’s Stock Performance

Tesla, as a leading player in the electric vehicle market, has experienced significant volatility in its stock price. Fluctuations in market performance can be attributed to various factors, including production challenges, competition, regulatory changes, and overall market sentiment toward technology stocks. As a result, the performance of Tesla’s stock has direct implications for Minnesota’s investment portfolio and the financial security of state employees relying on the retirement fund.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Dilemma of Political Commentary and Financial Responsibility

The juxtaposition of Governor Walz’s comments with the state’s investment in Tesla highlights a crucial dilemma: the balance between political commentary and financial responsibility. Public officials must navigate the complex landscape of investor sentiment while also being accountable for the financial well-being of state employees. When political statements appear to contradict the state’s investment strategy, it can lead to confusion and skepticism among the public and investors.

Public Perception and Investor Confidence

Public perception plays a vital role in investor confidence, especially for companies like Tesla that operate in a rapidly evolving industry. Remarks made by influential figures, such as governors and lawmakers, can significantly impact market sentiment. If the governor’s comments are perceived as negative, it could lead to a decline in confidence among investors, potentially exacerbating stock volatility and affecting the state’s financial interests.

The Broader Context of State Investments in Renewable Energy

Minnesota’s investment in Tesla is part of a broader trend among states to embrace renewable energy and technology. As governments increasingly focus on sustainability and environmental responsibility, investments in companies like Tesla reflect a commitment to these values. However, this commitment must be balanced with sound investment strategies that prioritize the financial security of state employees and taxpayers.

The Future of Electric Vehicles and State Investments

Looking ahead, the future of electric vehicles presents both opportunities and challenges for states like Minnesota. As the demand for electric vehicles continues to grow, companies like Tesla are positioned to benefit from this trend. However, the market’s inherent volatility necessitates careful consideration of investment strategies and the potential risks associated with significant holdings in a single company.

Conclusion: Navigating the Complexities of Investment and Governance

The revelations about Minnesota’s significant investments in Tesla, juxtaposed with Governor Walz’s comments on the company’s stock performance, underscore the complexities at the intersection of governance, investment strategy, and public relations. As states navigate the evolving landscape of renewable energy and technology investments, it is essential for public officials to communicate transparently and responsibly, ensuring that their remarks align with the financial interests of the constituents they serve.

In conclusion, Minnesota’s substantial investment in Tesla reflects a broader commitment to renewable energy, but it also raises important questions about the implications of political commentary on financial performance. As the market for electric vehicles continues to evolve, balancing political discourse with sound investment practices will be crucial for state governments and their stakeholders.

As Gov. Walz gloats about Tesla stock dropping, records from the Minnesota State Board of Investment show that as of 6/30/24, the state of Minnesota had 1.6 million shares of Tesla in its retirement fund, and 211,000 shares of Tesla in its non-retirement fund. I’ve reached out to… https://t.co/W0EA0cPASS pic.twitter.com/r1obVBpfU7

— Bill Melugin (@BillMelugin_) March 19, 2025

As Gov. Walz gloats about Tesla stock dropping

Recently, a rather intriguing situation has unfolded regarding the state of Minnesota and its investments in Tesla. Governor Tim Walz made headlines as he expressed his pleasure over the decline in Tesla’s stock value. However, what might surprise many is the significant amount of Tesla shares that Minnesota holds in its investment portfolio. According to records from the Minnesota State Board of Investment, by June 30, 2024, the state owned a whopping 1.6 million shares of Tesla in its retirement fund and an additional 211,000 shares in its non-retirement fund. This revelation raises questions about the state’s financial strategy and the implications for its citizens.

Understanding the Investment Landscape

Investing in stocks can be a double-edged sword. While it can generate significant returns, it also comes with risks. Tesla, known for its innovative electric vehicles and disruptive technology, has seen its stock go through numerous fluctuations. The Minnesota State Board of Investment’s decision to hold such a large number of Tesla shares indicates confidence in the company’s long-term potential, even as short-term volatility occurs.

Governor Walz’s comments might appear dismissive, but they highlight an interesting dichotomy between political rhetoric and actual investment strategies. It’s essential to consider how a state’s investment decisions impact its citizens, especially when retirement funds are involved. After all, these funds are meant to secure the financial future of public employees.

Why Does Minnesota Hold So Many Tesla Shares?

The question on many minds might be: why does Minnesota own so many shares of Tesla? The answer lies in the investment strategy of the Minnesota State Board of Investment, which manages the funds responsibly to ensure they yield good returns over time. Tesla has been a high-profile stock, and its growth potential has attracted investors looking for substantial gains.

Moreover, the state’s investment strategy involves diversifying its portfolio to mitigate risks. By investing in high-growth companies like Tesla, Minnesota can balance out more stable investments. This approach aims to enhance the overall returns of the retirement and non-retirement funds, ensuring that public employees can enjoy a comfortable retirement.

Implications of Tesla’s Stock Performance

As Tesla’s stock fluctuates, the implications extend far beyond just a number on a screen. For the state of Minnesota, the performance of Tesla stock directly affects the retirement funds of thousands of public employees. A drop in Tesla’s stock value could potentially reduce the overall returns of the state’s investment portfolio, impacting the financial security of retirees.

In this context, Gov. Walz’s comments can be seen as politically motivated. While it may be tempting to celebrate a drop in stock prices, it’s crucial to consider the broader consequences. Public officials have a responsibility to ensure that the funds meant for public employees are managed wisely, regardless of the political narrative surrounding a company like Tesla.

The Role of Political Rhetoric in Investment Decisions

Political rhetoric can significantly influence public perception of investments. When a governor publicly gloats about a company’s stock dropping, it can create a misleading narrative about the state’s financial health. This can lead to concerns among public employees and citizens about the management of their retirement funds.

It’s essential for political leaders to strike a balance between expressing their opinions and being transparent about the state’s financial strategies. Citizens deserve to be informed about how their tax dollars are being invested and the potential risks involved. By focusing on the long-term health of the investment portfolio, leaders can foster trust and confidence among the populace.

Examining the Future of Tesla Investments

Looking ahead, the future of Tesla and its stock performance remains uncertain. Factors such as market competition, technological advancements, and regulatory changes can all impact Tesla’s growth trajectory. As a result, Minnesota’s investment strategy may need to adapt to these changes.

For now, the state holds a significant stake in Tesla, and it will be interesting to see how this plays out in the coming years. Will Tesla rebound and provide substantial returns for Minnesota’s retirement funds, or will market fluctuations lead to further declines? Only time will tell.

Conclusion: The Intersection of Politics and Investment

The situation surrounding Governor Walz’s comments and Minnesota’s investments in Tesla highlights a critical intersection between politics and finance. While political leaders may express opinions on stock performance, the real implications of their statements can affect the financial well-being of many individuals.

As Minnesota navigates its investment strategies, it’s vital for both the government and its citizens to focus on responsible financial management and transparency. In doing so, they can ensure that public employees have a secure retirement while also addressing the broader implications of political rhetoric on investments.

“`

This article delves into the complexities surrounding Minnesota’s investments in Tesla, Governor Walz’s comments, and the broader implications for public employees. The conversational tone and detailed explanations aim to engage readers and provide them with valuable insights.