North Carolina’s Bold Move: Investing Public Funds into Bitcoin

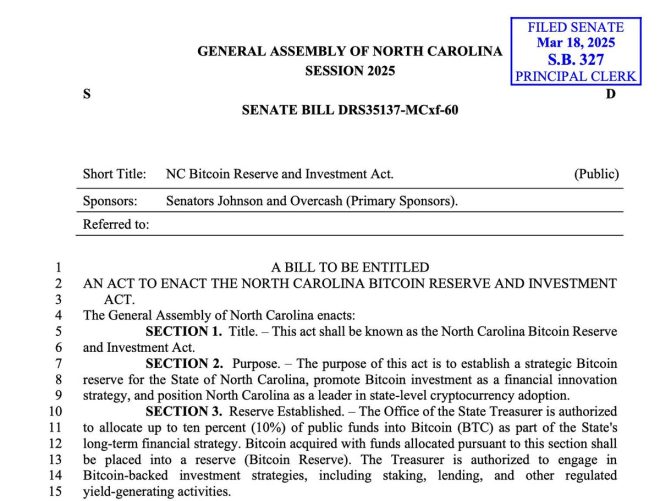

A significant development in the realm of cryptocurrency has emerged from North Carolina, as the state has introduced a groundbreaking bill that proposes investing up to 10% of its public funds into Bitcoin. This initiative marks a pivotal moment not only for the state but also for the broader financial landscape, as it reflects an increasing acceptance of digital currencies by governmental entities.

Understanding the Bill

The bill, which was announced via a tweet from Ash Crypto on March 19, 2025, signifies North Carolina’s willingness to embrace innovative financial solutions. By allocating a portion of public funds to Bitcoin, the state aims to enhance its investment portfolio and capitalize on the potential growth of digital assets. This bold move is indicative of a growing trend among states and institutions considering cryptocurrency as a viable investment option.

The Implications of the Investment

Investing public funds into Bitcoin could have several significant implications for North Carolina:

- Diversification of Investment Portfolio: By venturing into Bitcoin, North Carolina can diversify its investment portfolio. Cryptocurrency has demonstrated high volatility but has also shown the potential for substantial returns. Diversifying into this asset class may provide further financial security for the state’s public funds.

- Encouraging Technological Innovation: This initiative could spur technological advancements and innovation within the state. As Bitcoin and other cryptocurrencies become more mainstream, there is a potential for North Carolina to position itself as a leader in blockchain technology and digital finance.

- Attracting New Businesses: By adopting a forward-thinking approach to cryptocurrency, North Carolina could attract businesses and startups that operate within the blockchain ecosystem. This influx of companies could lead to job creation and economic growth in the region.

- Public Sentiment and Trust: The decision to invest in Bitcoin may also affect public sentiment towards the state government. Demonstrating a commitment to modern financial practices could enhance trust and confidence among residents and investors alike.

The Growing Acceptance of Bitcoin

The move by North Carolina is part of a broader trend towards the acceptance of Bitcoin and other cryptocurrencies by governments and institutions. Over the past few years, various states in the U.S. and countries worldwide have begun exploring the integration of digital currencies into their financial systems. This shift underscores the growing recognition of cryptocurrencies as legitimate financial assets.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Why Bitcoin?

Bitcoin, the first and most widely recognized cryptocurrency, has gained significant traction since its inception in 2009. Its decentralized nature, limited supply, and potential for high returns make it an appealing investment for many. Here are some reasons why Bitcoin is becoming a popular choice for public investment:

- Store of Value: Many view Bitcoin as a digital gold. Its limited supply of 21 million coins presents a deflationary aspect that appeals to investors seeking to preserve wealth over time.

- Increased Institutional Adoption: The surge in institutional investment into Bitcoin from companies and financial institutions has bolstered its credibility. High-profile endorsements and large-scale purchases have contributed to its rising status as a legitimate asset class.

- Hedge Against Inflation: With rising inflation rates, many investors are looking for assets that can act as a hedge. Bitcoin’s scarcity and decentralized nature provide an attractive alternative to traditional fiat currencies, which can be devalued through inflationary policies.

- Technological Advancements: The underlying blockchain technology of Bitcoin offers a secure and transparent method of conducting transactions. As more people become aware of its benefits, the demand for Bitcoin is likely to increase.

Challenges Ahead

Despite the potential benefits, investing public funds into Bitcoin also presents challenges that must be addressed:

- Volatility: Bitcoin is known for its price volatility. The value of Bitcoin can fluctuate dramatically over short periods, which poses risks for public funds that require stability.

- Regulatory Concerns: The regulatory landscape surrounding cryptocurrencies is constantly evolving. North Carolina will need to navigate these regulations carefully to ensure compliance and protect its investments.

- Public Perception: The decision to invest public funds in a volatile asset like Bitcoin may not sit well with all constituents. Transparency and communication will be essential to gain public support and trust.

- Security Risks: The security of digital assets is paramount. North Carolina will need to implement robust security measures to protect its Bitcoin holdings from potential hacking or theft.

Conclusion

North Carolina’s decision to explore investing public funds into Bitcoin is a significant development that could reshape the state’s financial landscape. As cryptocurrency continues to gain acceptance, this initiative may serve as a catalyst for economic growth, technological innovation, and increased public trust in government financial practices.

While there are challenges to consider, the potential benefits of diversifying into Bitcoin could outweigh the risks if managed wisely. As North Carolina takes this bold step, it may encourage other states and institutions to follow suit, marking a new era of public investment in the digital age. The future of finance is evolving rapidly, and North Carolina is positioning itself at the forefront of this transformation.

BREAKING: North Carolina just

introduced a bill to invest up to 10%

of its public funds into Bitcoin. pic.twitter.com/FdSeWS2kM7— Ash Crypto (@Ashcryptoreal) March 19, 2025

BREAKING: North Carolina just introduced a bill to invest up to 10% of its public funds into Bitcoin.

The world of cryptocurrency has been a rollercoaster ride over the past few years, and it seems like things are heating up once again in North Carolina. Recently, a bill was introduced that could pave the way for the state to invest up to 10% of its public funds into Bitcoin. This is a significant move and has the potential to reshape the financial landscape not only for North Carolina but also for how states approach cryptocurrencies in general.

Understanding the Bill: What’s on the Table?

The bill aims to allocate a portion of North Carolina’s public funds into Bitcoin, a decision that reflects a growing trend among states and institutions to embrace digital assets. By investing in Bitcoin, North Carolina could diversify its investment portfolio, potentially yielding higher returns in a rapidly evolving market. The proposal has sparked discussions across social media, with many expressing both excitement and skepticism.

Investing public funds in Bitcoin is no small feat. It raises questions about security, volatility, and long-term sustainability. However, proponents argue that incorporating Bitcoin could lead to increased financial growth opportunities for the state. As cryptocurrencies mature, their potential to provide substantial returns could outweigh the risks associated with their volatility.

Why Bitcoin? The Case for Cryptocurrency Investments

Bitcoin, the pioneer of cryptocurrencies, has shown remarkable resilience and growth since its inception. Many view it as a hedge against inflation and a store of value, similar to gold. With central banks around the world adopting ultra-loose monetary policies, the appeal of Bitcoin as a safeguard against currency devaluation has grown significantly.

Investing in Bitcoin can also be seen as a forward-thinking strategy. As digital currencies gain acceptance globally, early adopters could reap the benefits. For North Carolina, this investment could mean tapping into a burgeoning market and positioning itself as a leader in the cryptocurrency space.

However, it’s essential to recognize the inherent risks. Bitcoin’s price can fluctuate wildly, influenced by factors ranging from regulatory news to market sentiment. This volatility makes it a double-edged sword for public investments, where stability is often prioritized.

Public Reaction: What Are People Saying?

The response to the proposed bill has been mixed. Some residents are thrilled about the prospect of North Carolina taking such a bold step into the future of finance. They see it as a necessary move to modernize the state’s investment strategies and keep up with technological advancements. Others, however, express concerns about the risks involved in cryptocurrency investments, particularly when it comes to managing public funds.

Social media platforms have been buzzing with opinions. Supporters argue that this move could lead to increased revenue for the state, while critics caution against the volatility and unpredictability of the cryptocurrency market. The debate highlights a broader discussion about the future of money and investment strategies in the digital age.

Potential Impacts on North Carolina’s Economy

If the bill passes, the implications for North Carolina’s economy could be substantial. Investing in Bitcoin could provide a new revenue stream, enhancing the state’s financial position. Increased funds could be funneled into education, infrastructure, and public services, benefiting the entire community.

Moreover, embracing Bitcoin could attract tech-savvy businesses and investors to North Carolina. As more companies seek to capitalize on the cryptocurrency boom, the state could become a hub for innovation and technology. This influx could lead to job creation and economic growth, further solidifying North Carolina’s status as a forward-thinking state.

However, it’s crucial for lawmakers to proceed with caution. Thorough research and risk assessment must guide the investment strategy to ensure that public funds are managed responsibly. A balanced approach that considers both the potential rewards and the risks associated with Bitcoin investments will be essential.

The Future of Cryptocurrency in Government Investments

North Carolina’s decision to consider investing public funds in Bitcoin is part of a broader trend seen across the United States. Several states have already started exploring the possibilities of cryptocurrency investments, either directly or indirectly. This shift signals a growing acceptance of digital currencies in mainstream finance, prompting many to wonder how traditional financial institutions will adapt.

As more states take this leap, it could lead to a domino effect, encouraging other jurisdictions to follow suit. The potential for cryptocurrencies to become a standard component of public investment portfolios could redefine how governments manage their finances.

However, the path is fraught with challenges. Regulatory frameworks are still evolving, and ensuring adequate safeguards against fraud and mismanagement will be critical. As governments explore this new frontier, striking the right balance between innovation and security will be paramount.

Moving Forward: What’s Next for North Carolina?

As North Carolina deliberates on the proposed bill, residents and investors alike will be watching closely. The outcome could set a precedent for how public funds are managed in the age of digital currencies. If the bill passes, it will be essential for state officials to establish clear guidelines for managing the investment and mitigating risks.

Education will also play a crucial role. As Bitcoin and other cryptocurrencies become more integrated into public finance, ensuring that lawmakers and the public understand the intricacies of these digital assets will be vital.

Ultimately, North Carolina’s foray into Bitcoin could serve as a litmus test for other states considering similar measures. The outcome will likely influence the broader conversation around cryptocurrency investments in government finances, shaping the future of public investment strategies across the nation.

In the coming months, as the bill progresses through the legislative process, we can expect more discussions, debates, and perhaps even a few unexpected turns. One thing is for sure: the cryptocurrency landscape is evolving rapidly, and North Carolina is poised to play a pivotal role in this transformation.

As we observe these developments, it’s essential to stay informed and engaged. Whether you’re an investor, a resident of North Carolina, or simply interested in the world of cryptocurrency, this is a space to watch closely. The implications of this bill could resonate far beyond state lines, influencing how we think about money, investment, and the future of finance.

Keeping an eye on this story as it unfolds will be crucial, not just for North Carolinians but for anyone invested in the future of cryptocurrency and finance. The excitement is palpable, and the potential for change is enormous. North Carolina’s decision could very well be a step toward a new era of public investment strategies, one that embraces innovation while navigating the complexities of the digital age.