Tesla’s Strong Performance in China: A Recent Update

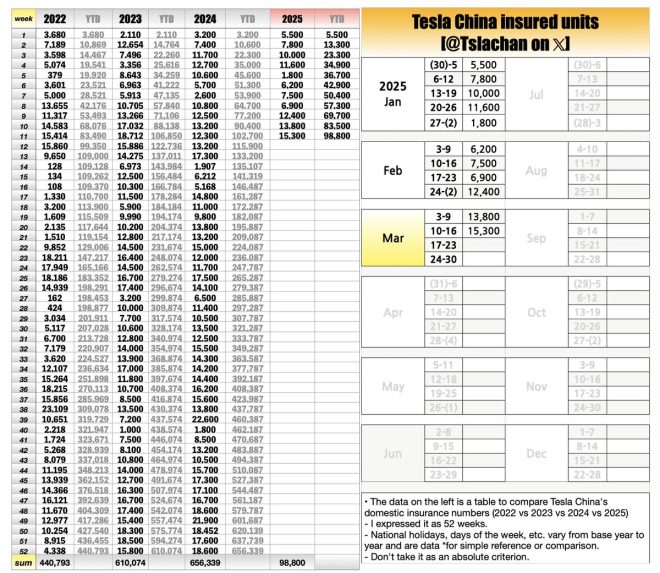

Tesla, Inc. has consistently made headlines with its innovative electric vehicles (EVs), and recent data from China adds to the excitement surrounding this prominent automaker. In a recent tweet from Tsla Chan, a well-known Tesla-focused account, we received crucial insights into Tesla’s insured units in China during specific weeks of March 2025. This information is key for investors and enthusiasts alike, reflecting Tesla’s growing footprint in one of the world’s largest automotive markets.

Key Data Points

In the tweet, the figures presented show a notable performance in the Chinese market:

- March 3-9: Tesla reported 13,800 insured units.

- March 10-16: The number increased significantly to 15,300 insured units.

This data suggests a robust demand for Tesla vehicles in China, indicating a healthy upward trajectory in sales and market acceptance.

Understanding Tesla’s Market Dynamics in China

Tesla’s operations in China have been pivotal to its global strategy. As electric vehicles gain traction worldwide, China has emerged as a vital market due to its large population and increasing focus on sustainable energy solutions. Here are a few key factors influencing Tesla’s success in the Chinese market:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

1. Government Support for EVs

China’s government has been actively promoting electric vehicles through various subsidies and incentives. These initiatives lower the overall cost for consumers, making electric vehicles more accessible. Tesla’s alignment with these policies has helped it capture a significant market share.

2. Local Manufacturing

Tesla’s Gigafactory in Shanghai, which began operations in late 2019, has allowed the company to manufacture vehicles locally. This not only reduces shipping costs but also enables Tesla to respond quickly to market demands. Local production further enhances Tesla’s competitive edge over its rivals, who may face longer lead times.

3. Innovative Technology and Features

Tesla vehicles are known for their advanced technology, including Autopilot capabilities, over-the-air software updates, and cutting-edge battery technology. These features appeal to tech-savvy Chinese consumers who are increasingly looking for modern and efficient transportation solutions.

4. Brand Perception and Market Positioning

Tesla has successfully positioned itself as a premium brand in the EV sector. Its reputation for quality and innovation resonates with Chinese consumers, leading to a loyal customer base. Marketing campaigns and strategic partnerships have also bolstered Tesla’s brand image in the region.

Implications of the Recent Data

The increase in insured units from 13,800 to 15,300 within just one week is a testament to Tesla’s ability to ramp up production and meet consumer demand. Here are some implications of this data:

A. Investor Confidence

Investors closely monitor sales data, as it often serves as an indicator of a company’s health and future performance. The uptick in insured units could boost investor confidence in Tesla’s stock, particularly within the context of the rapidly evolving EV market.

B. Competitive Landscape

As Tesla solidifies its position in the Chinese market, competitors will need to ramp up their efforts to keep pace. The growing sales figures may prompt other automakers to enhance their offerings, improve technology, and possibly re-evaluate pricing strategies to attract consumers.

C. Future Growth Projections

The positive sales trend suggests that Tesla may continue to see growth in China, particularly as the country moves towards stricter emissions standards and a greater emphasis on renewable energy sources. Analysts may revise their growth projections upward based on this data, which could have broader implications for the stock market.

Conclusion

Tesla’s recent insurance data from China highlights the company’s strong performance in a crucial market. With insured units increasing from 13,800 to 15,300 in just a week, it’s clear that consumer demand for Tesla vehicles is on the rise. As the company continues to leverage local manufacturing, government support, and its innovative technology, it is well-positioned to maintain its competitive advantage in the rapidly growing EV sector.

Investors and industry analysts should keep a close eye on these developments, as they will undoubtedly shape the future landscape of the automotive market, particularly in the realm of electric vehicles. With ongoing advancements and a commitment to sustainability, Tesla is not just a car manufacturer but a leader in the transition towards a greener future.

In summary, the recent data shared by Tsla Chan underscores Tesla’s significant role in the Chinese automotive market. As the company continues to grow and innovate, its impact on the global EV landscape will be profound, making it a key player to watch in the coming years. If you’re interested in the performance of Tesla or the electric vehicle market as a whole, following updates like these is crucial for staying informed and making educated decisions.

$TSLA

BREAKING: Tesla China insured units3-9 : 13,800

10-16 : 15,300 pic.twitter.com/KaJa0BOvO3— Tsla Chan (@Tslachan) March 18, 2025

$TSLA BREAKING: Tesla China Insured Units

In the fast-paced world of electric vehicles, Tesla continues to be a major player, especially in China. Recently, a tweet from Tsla Chan revealed some exciting news for Tesla enthusiasts and investors alike. The tweet highlighted the number of insured units for Tesla vehicles in China during a specific period. According to the tweet, from March 3 to March 9, there were 13,800 insured units, while from March 10 to March 16, that number increased to 15,300. This surge showcases the growing demand for Tesla vehicles in one of the largest automotive markets in the world.

Understanding the Impact of Tesla’s Growth in China

When we talk about Tesla’s success in China, it’s essential to recognize the significance of the Chinese market. With a population exceeding 1.4 billion, China is a hotbed for electric vehicle adoption. The government’s push for greener alternatives and the development of extensive charging infrastructure have made it an attractive ground for Tesla. The numbers shared in the tweet from Tsla Chan are not just figures; they represent a trend that could have long-term implications for the company and its investors.

Breaking Down the Numbers: March 2025 Insured Units

The figures released indicate a solid uptick in Tesla’s insured units in just a week’s time. The comparison of 13,800 insured units from March 3-9 to 15,300 insured units from March 10-16 highlights a significant increase of about 10.9%. This growth could be attributed to several factors, including new model releases, enhanced marketing strategies, and perhaps even competitive pricing that Tesla has implemented to attract more consumers.

Why the Increase in Insured Units Matters

So, why should this information matter to you? Well, the increase in insured units typically translates to higher sales figures in the coming weeks and months. Insurance is usually one of the final steps before a customer officially takes ownership of their vehicle, making these numbers a reliable indicator of demand. Investors keeping an eye on $TSLA will find these insights valuable as they assess the company’s market performance and growth potential.

The Competitive Landscape of Electric Vehicles in China

While Tesla has established itself as a leader in the electric vehicle sector, it faces stiff competition from local manufacturers like NIO, Xpeng, and BYD. Each of these companies is also working hard to capture the attention and wallets of Chinese consumers. With the rapid advancements in technology and battery efficiency, the competition is fierce.

The recent uptick in Tesla’s insured units could indicate that the company is not only maintaining its market share but potentially gaining ground against its rivals. Strategies like localized manufacturing and tailored marketing campaigns are crucial in appealing to the Chinese consumer base, which values both innovation and quality.

What’s Next for Tesla in the Chinese Market?

As Tesla continues to grow its footprint in China, one can only wonder what lies ahead. The company has plans to expand its production capabilities and introduce more models that cater to local tastes. Additionally, Tesla’s focus on sustainability resonates well with the Chinese government’s goals to reduce carbon emissions, which could bolster its reputation and sales.

Moreover, Tesla’s commitment to innovation—whether through self-driving technology or battery technology—positions it favorably against competitors. The anticipation surrounding upcoming models and technological advancements can further drive interest and, consequently, insured units.

Investor Sentiment and Future Outlook

For investors, the news of increased insured units is a positive indicator, suggesting that Tesla is on the right track to meeting, or even exceeding, its sales targets in China. Keeping an eye on such metrics can provide critical insights into the company’s performance and future market strategies. As the electric vehicle market continues to evolve, staying informed about these developments can help investors make better decisions.

The Role of Social Media in Real-Time Updates

The role of social media in the dissemination of information is undeniable. Platforms like Twitter enable real-time updates that can influence market sentiment significantly. The tweet from Tsla Chan, which broke down Tesla’s insured units, is a perfect example of how quickly information can spread and impact investor behavior. Following reliable sources on social media can be an effective way for investors to stay updated on critical developments.

In Conclusion: The Future Looks Bright for $TSLA

The recent announcement regarding Tesla’s insured units in China is a testament to the company’s ongoing success and growth in a competitive market. With increasing numbers reflecting consumer interest, Tesla is poised for continued expansion. Investors and fans alike should keep a close eye on these developments, as they may signal exciting times ahead for $TSLA and the electric vehicle industry at large.

As we look to the future, the electric vehicle market is bound to become even more competitive. However, with Tesla’s innovative spirit and commitment to sustainability, it remains a frontrunner in paving the way for the future of transportation. Whether you’re considering investing in Tesla or simply watching the market trends, the numbers released are a noteworthy snapshot of a thriving industry.

“`

This article is structured to keep readers engaged while providing valuable insights into Tesla’s performance in China, utilizing the specified keywords effectively throughout the content.