Bitcoin Market Update: Whale Closes Major Short Position

In a significant development within the cryptocurrency market, a prominent Bitcoin whale has completely closed a short position valued at an astonishing $540 million, realizing a profit of $7.9 million in the process. This critical move has sparked speculation about potential upward momentum for Bitcoin prices, as market participants anticipate a possible price increase now that this substantial short position has been eliminated. The news, which was shared by the popular crypto analyst Crypto Rover on Twitter, has captured the attention of traders and investors alike, highlighting the ever-volatile nature of the cryptocurrency market.

Understanding the Impact of Whale Movements

Whales, or individuals and entities that hold large amounts of cryptocurrency, play a significant role in the market dynamics of Bitcoin and other digital currencies. Their buying and selling decisions can lead to dramatic price fluctuations. When a whale decides to close a short position, it can signal a shift in market sentiment, potentially leading to increased buying pressure. The closure of a $540 million short position indicates that the whale may anticipate a bullish trend for Bitcoin, paving the way for further price increases.

The Profit Realization

The whale’s decision to close the position for a profit of $7.9 million underscores the strategic maneuvers that can be made in the cryptocurrency trading landscape. Short selling, which involves borrowing and selling an asset with the expectation of buying it back at a lower price, can be a risky endeavor. However, in this case, the whale’s timing paid off, allowing them to capitalize on market movements effectively. The profit gained from this transaction can be seen as a validation of the whale’s trading strategy and market analysis.

What This Means for Bitcoin Prices

With the closure of this substantial short position, many analysts are eagerly watching Bitcoin’s price movements. The phrase "the way is free to pump now" suggests that the market may experience upward momentum, as a reduced number of short positions can lead to a short squeeze. In a short squeeze, traders who have shorted the asset may be forced to buy it back at higher prices to cover their positions, further driving up the price.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Sentiment Shifts

The closure of the whale’s short position has the potential to shift market sentiment. Positive news in the cryptocurrency space often leads to increased retail and institutional interest, which can drive prices higher. Traders and investors may interpret this move as a bullish signal, prompting them to enter the market or increase their current holdings.

The Role of Social Media in Crypto Trading

Platforms like Twitter, where news and updates can spread rapidly, play a crucial role in shaping market sentiment. The tweet from Crypto Rover has not only informed followers about the whale’s actions but has also contributed to a broader narrative surrounding Bitcoin’s potential trajectory. Social media’s impact on trading decisions cannot be underestimated, as traders often look to influencers and analysts for insights into market trends.

Future Considerations for Bitcoin Investors

Investors should remain vigilant about the factors influencing Bitcoin’s price in the wake of this news. While the closure of a major short position may signal a potential upward trend, it is essential to consider other market conditions, including regulatory developments, macroeconomic trends, and technological advancements within the cryptocurrency space.

Conclusion

The recent closure of a $540 million short position by a Bitcoin whale has sent ripples through the cryptocurrency market, generating excitement and speculation about the potential for price increases. With the whale realizing a profit of $7.9 million, market participants are keenly observing how this development may influence Bitcoin’s trajectory. As the cryptocurrency market continues to evolve, traders and investors must remain informed about the implications of whale movements and the overall market sentiment.

In summary, the closure of this significant short position could pave the way for a bullish phase in Bitcoin’s price movements. As the market reacts to this news, staying updated on developments and trends will be crucial for navigating the ever-changing landscape of cryptocurrency trading.

BREAKING:

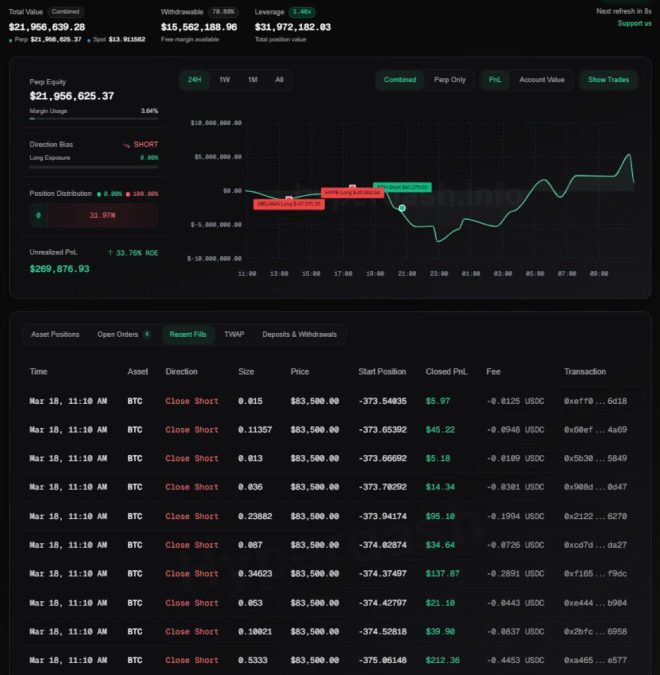

THE BITCOIN SHORT WHALE HAS FULLY CLOSED HIS $540 MILLION SHORT POSITION.

HE MADE $7.9M PROFIT.

THE WAY IS FREE TO PUMP NOW!!! pic.twitter.com/n9JNCMRBVk

— Crypto Rover (@rovercrc) March 18, 2025

BREAKING:

In the world of cryptocurrency, few events create as much buzz as the sudden movements of large investors, often referred to as “whales.” Recently, we witnessed a significant development: a Bitcoin short whale has fully closed his massive $540 million short position. This decision has sent ripples through the crypto market, and the implications could be vast. Let’s dive into what this means and why it has become a hot topic among traders and investors alike.

THE BITCOIN SHORT WHALE HAS FULLY CLOSED HIS $540 MILLION SHORT POSITION.

The whale in question made headlines after closing out a short position that was worth a staggering $540 million. For those who might not be familiar, a short position involves borrowing an asset (in this case, Bitcoin) to sell it at the current market price, hoping to buy it back later at a lower price. If done correctly, this strategy can yield significant profits—but it also carries substantial risks. When the market moves against a short position, losses can mount quickly.

What Does Closing a Short Position Mean?

By fully closing this short position, the whale has effectively decided to exit the bet that Bitcoin’s price would decline. This can be seen as a bullish signal, indicating that the whale believes the price of Bitcoin is likely to rise from here. And in the world of crypto, a bullish sentiment can often lead to increased buying pressure, as other traders may follow suit, driving the price even higher.

HE MADE $7.9M PROFIT.

Now, let’s talk about the profits. The whale reportedly made a cool $7.9 million from this maneuver. This kind of profit margin is not something to sneeze at, especially in the volatile world of cryptocurrency trading. But how did he do it? The strategy likely involved carefully timing the entry and exit points, utilizing market analysis, and perhaps even leveraging some advanced trading tools.

Understanding Profits in Short Selling

To put the profit into perspective, it’s crucial to understand how short selling works. When prices drop, the short seller can buy back the asset at a lower price, pocketing the difference. In this case, the whale must have timed the market perfectly, anticipating a downturn and then capitalizing on it just before closing the position. For aspiring traders, this is a classic example of how market timing and strategy can lead to substantial gains.

THE WAY IS FREE TO PUMP NOW!!!

The phrase “the way is free to pump now” suggests that the market may be primed for a rally after this significant short position has been closed. Many traders in the crypto community interpret the closure of such large short positions as a signal that the bearish pressure has been alleviated. With fewer people betting against Bitcoin, it creates an environment where buying pressure can increase, potentially pushing prices upward.

The Psychological Aspect of Trading

The impact of such news on the market goes beyond mere numbers. The psychological aspect of trading plays a huge role. Traders often react to big moves in the market, and when they see whales closing short positions, it can instill a sense of confidence. FOMO (Fear of Missing Out) can kick in, leading more investors to jump in and buy Bitcoin, further driving up the price.

The Broader Market Implications

This significant event doesn’t happen in a vacuum. The broader cryptocurrency market has been experiencing fluctuations, and the actions of one whale can set off a chain reaction. When large players make moves, it often prompts smaller investors to reconsider their positions. The $540 million closure could signal a shift in market sentiment, potentially leading to a more bullish atmosphere across other cryptocurrencies as well.

Market Trends to Watch

As the dust settles from this whale’s actions, traders should keep an eye on a few key indicators. First, monitor Bitcoin’s price movements closely. If the price begins to increase significantly, it could validate the whale’s decision to close the short position. Additionally, watch for changes in trading volume; increased volume often accompanies significant price movements and can indicate strong market interest.

What Can Traders Learn from This?

For those new to trading or looking to refine their strategies, there are several lessons to be gleaned from this event. Firstly, understanding market psychology is crucial. The moves of whales can often dictate the sentiment of the market. Secondly, timing is everything. This whale likely had a well-thought-out strategy and executed it based on market trends and analysis.

Risk Management is Key

Lastly, this incident highlights the importance of risk management. While the whale made a profitable exit, not all trades end in profit. Setting stop-loss orders and understanding your own risk tolerance can help you navigate the often tumultuous waters of cryptocurrency trading. Remember, it’s not just about making profits; it’s about managing losses too.

Looking Ahead

The cryptocurrency market is known for its volatility, and while this whale’s action may signal a positive shift for Bitcoin, it’s essential to remain cautious. The market can change rapidly, and what seems like a sure bet today might not hold tomorrow. Staying informed, continuously learning, and adapting your strategies will be crucial in this fast-paced environment.

Community Insights and Reactions

The reaction from the crypto community has been overwhelmingly positive. Many traders are seeing this as an opportunity to enter the market, while seasoned investors are analyzing the implications of the whale’s actions. Social media platforms are buzzing with discussions, predictions, and strategies, creating an electrifying atmosphere for both new and experienced traders. Keeping an eye on platforms like Twitter can provide valuable insights as the community reacts to ongoing developments.

Final Thoughts

In summary, the recent closure of a $540 million short position by a Bitcoin whale has set off a chain reaction in the cryptocurrency market. With a reported profit of $7.9 million, this action not only impacts the whale’s portfolio but also shapes market sentiment. As traders, it’s essential to understand the implications of such moves and to stay informed about market trends. Whether you’re a seasoned trader or just getting started, keeping a pulse on the market and learning from these big moves will help you navigate the exciting world of cryptocurrency.