Bitcoin Futures Show Strong Rebound Amidst Flat Performance of Ethereum and Solana

In a recent update from Cointelegraph, it has been reported that Bitcoin (BTC) futures have experienced a notable rebound, while the prices of Ethereum (ETH) and Solana (SOL) remain relatively flat. The surge in Bitcoin futures volume highlights the ongoing interest and activity in the cryptocurrency market, indicating a potential shift in investor sentiment.

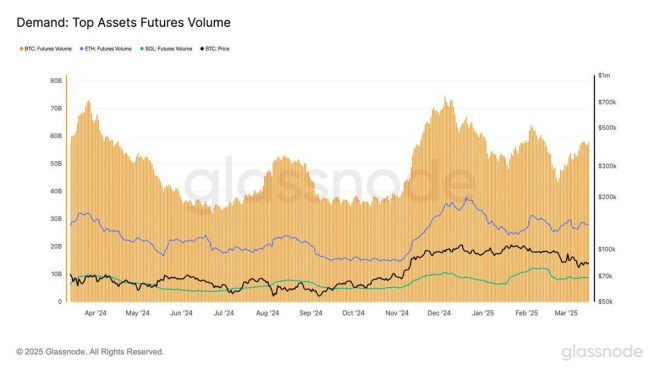

The data revealed that Bitcoin futures volume has increased by an impressive 32% since February 23, reaching a total of $57 billion. However, it is essential to note that this figure is still below the peak of $74 billion recorded in December. This resurgence in trading volume suggests that traders are becoming more active in the Bitcoin market, possibly in anticipation of price movements or changes in market dynamics.

The Current State of Bitcoin Futures

Bitcoin futures are financial contracts that allow investors to speculate on the future price of Bitcoin. They enable traders to buy or sell Bitcoin at a predetermined price at a specified future date. This type of trading has become increasingly popular as it provides a way for investors to hedge their positions or gain exposure to Bitcoin without having to own the actual cryptocurrency.

The recent rise in Bitcoin futures volume indicates a growing confidence among traders in the potential for price movements. The 32% increase in volume since late February suggests that more market participants are willing to engage with Bitcoin futures, possibly driven by recent market developments or sentiment shifts.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Ethereum and Solana Remain Steady

In contrast to the active Bitcoin futures market, Ethereum and Solana have maintained a relatively flat performance. Both cryptocurrencies have seen limited movement in their prices, which may suggest a period of consolidation after previous volatility. While Bitcoin is often viewed as the market leader, the performance of Ethereum and Solana is also crucial as they represent significant segments of the broader cryptocurrency ecosystem.

Ethereum, known for its smart contract capabilities and decentralized applications, has been a key player in the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs). Meanwhile, Solana has gained attention for its high throughput and low transaction fees, positioning itself as a strong contender in the blockchain space. Despite their current flat performance, both cryptocurrencies have the potential for significant price movements based on market trends and developments.

Market Implications

The rebound in Bitcoin futures and the stable performance of Ethereum and Solana could have several implications for the cryptocurrency market. A rise in Bitcoin futures volume may indicate an influx of institutional investors and traders looking to capitalize on price movements. This increased participation could lead to greater volatility in Bitcoin prices, influencing the broader market.

Moreover, the performance of Ethereum and Solana in the context of a rebounding Bitcoin could reflect varying investor strategies. Traders may be focusing their efforts on Bitcoin as a more established asset, while Ethereum and Solana could be viewed as long-term investments with growth potential. The divergence in price performance among these major cryptocurrencies may also highlight shifting market dynamics and investor preferences.

The Role of Sentiment in Cryptocurrency Trading

Investor sentiment plays a crucial role in the cryptocurrency market. Factors such as news events, regulatory developments, and macroeconomic trends can significantly influence market behavior. The recent increase in Bitcoin futures volume may be indicative of a positive shift in sentiment, potentially driven by favorable news or developments within the cryptocurrency space.

Traders often monitor sentiment indicators to gauge market trends and make informed decisions. The current state of Bitcoin futures, alongside the stable performances of Ethereum and Solana, may suggest a cautious optimism among investors. As the market evolves, it will be essential to keep an eye on sentiment shifts, as they can lead to rapid changes in price dynamics.

Conclusion

In summary, the cryptocurrency market is witnessing a rebound in Bitcoin futures volume, with a 32% increase since late February, signaling heightened interest among traders. Meanwhile, Ethereum and Solana are experiencing flat price movements, prompting investors to assess their strategies carefully. The divergence in performance among these cryptocurrencies reflects varying levels of investor sentiment and market dynamics.

As the market continues to evolve, understanding the implications of trading volume, price movements, and investor sentiment will be crucial for making informed decisions. The crypto landscape is known for its volatility, and developments in Bitcoin futures could set the stage for future price movements across the entire market. Traders and investors alike should stay informed and vigilant as they navigate this exciting and ever-changing environment.

For anyone looking to keep track of developments in the cryptocurrency market, staying updated on trends in Bitcoin futures and the performance of major cryptocurrencies like Ethereum and Solana will be essential. The current landscape presents both opportunities and challenges, and informed decision-making will be key to navigating this dynamic market effectively.

JUST IN: Bitcoin futures rebound while Ethereum and Solana stay flat.

BTC futures volume has climbed 32% since Feb 23 to $57B but remains below December’s $74B peak. pic.twitter.com/tUI7frUmds

— Cointelegraph (@Cointelegraph) March 18, 2025

JUST IN: Bitcoin futures rebound while Ethereum and Solana stay flat

In the ever-evolving landscape of cryptocurrency, the latest developments have caught the attention of traders and investors alike. Bitcoin futures are experiencing a notable rebound, while Ethereum and Solana are holding steady. As of March 18, 2025, Bitcoin futures volume has surged by an impressive 32% since February 23, hitting a staggering $57 billion. However, it’s essential to note that this figure still falls short of December’s peak of $74 billion.

Understanding Bitcoin Futures

For those new to the crypto scene, Bitcoin futures might sound a bit complex, but they’re quite straightforward once you get the hang of it. Essentially, Bitcoin futures are contracts that allow investors to speculate on the future price of Bitcoin. This means that traders can buy or sell Bitcoin at a predetermined price on a specified date. The idea is to hedge against potential price fluctuations or to take advantage of these movements for profit. When the futures market shows signs of a rebound, like what we’re seeing now, it often indicates renewed interest and confidence in Bitcoin.

The Rise in BTC Futures Volume

The recent uptick in Bitcoin futures volume can be attributed to various factors, including increased institutional interest and overall market sentiment. As cryptocurrency becomes more mainstream, larger players are entering the market, contributing to the surge in trading volumes. According to Cointelegraph, this spike in volume signifies a critical moment for Bitcoin, as it attempts to regain its stance in the volatile crypto arena.

Ethereum and Solana’s Performance

While Bitcoin is making waves, Ethereum and Solana are holding their ground without significant fluctuations. This stability can be fascinating to analyze. Ethereum, with its smart contract capabilities, continues to be a favorite among developers and investors alike. Despite the lack of movement in its futures volume, Ethereum remains a strong contender in the crypto space.

Solana, on the other hand, has captured attention for its fast transaction speeds and low fees. However, its current flatline in the market indicates a period of consolidation. Investors are keen on watching how these two major players will respond to Bitcoin’s volatility in the coming weeks.

The Market Dynamics at Play

The cryptocurrency market is notorious for its volatility, and this week is no exception. With Bitcoin futures bouncing back, many are speculating how this might affect the broader market. A rising tide often lifts all boats, and as Bitcoin regains momentum, it could trigger renewed interest in altcoins like Ethereum and Solana. This interconnectedness of cryptocurrencies means that shifts in one can impact the entire market ecosystem.

Institutional Interest in Bitcoin

One of the driving forces behind the recent surge in BTC futures volume is the growing interest from institutional investors. Large financial institutions and hedge funds are beginning to dive into cryptocurrencies, and their involvement adds a layer of legitimacy to the market. This interest often leads to increased trading volumes and can contribute to price stabilization.

Moreover, as more institutions adopt Bitcoin as a part of their investment portfolios, the confidence in Bitcoin’s future value rises. The shift from retail to institutional trading can be a game-changer, reshaping the landscape of cryptocurrency trading.

What’s Next for Bitcoin, Ethereum, and Solana?

Looking ahead, many are wondering what the future holds for Bitcoin, Ethereum, and Solana. With Bitcoin’s recent rally in futures volume, it’s plausible that we may see a ripple effect across the market. Investors are closely monitoring these trends, and any significant changes could lead to more active trading in Ethereum and Solana.

For Bitcoin, the goal remains to surpass the December peak of $74 billion in futures volume. If it can maintain this upward trajectory, it might signal a broader recovery in the cryptocurrency market. Meanwhile, Ethereum and Solana traders will be looking for indicators that could suggest when they might experience their own breakout moments.

Conclusion: Keeping an Eye on the Market

In summary, the cryptocurrency market is buzzing with activity, particularly with Bitcoin futures rebounding and Ethereum and Solana maintaining a steady pace. The 32% increase in Bitcoin futures volume since February 23 is a significant development, showcasing the dynamic nature of crypto trading. As we continue to monitor these trends, it’s clear that the interplay between these cryptocurrencies will remain crucial in shaping the future of the market. Stay tuned for more updates as we dive deeper into the world of cryptocurrency!

“`