Death- Obituary News

Breaking News: A Major Cryptocurrency Whale Faces Liquidation

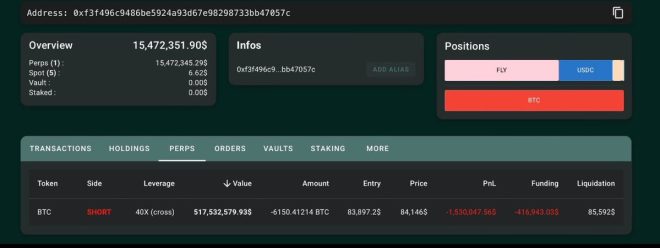

In the ever-evolving landscape of cryptocurrency trading, significant movements by prominent traders—often referred to as "whales"—can have dramatic implications for the market. Recently, a notable incident has captured the attention of crypto enthusiasts and market analysts alike: a whale is facing a staggering unrealized loss of $1.5 million on a $400 million Bitcoin short position. This situation raises critical questions about market dynamics, trading strategies, and the volatility inherent to the cryptocurrency sector.

Understanding the Situation

The whale in question has entered a short position on Bitcoin, betting that the price of the cryptocurrency would decline. As of the latest reports, this trader’s position is deeply underwater, with an unrealized loss indicating that the market price of Bitcoin has moved against their expectations. The short position, which is essentially a strategy to profit from declining prices, can lead to significant risks when the market behaves unpredictably.

In this case, the whale’s short position has put them at the brink of liquidation—a situation where a trader’s losses exceed their margin, prompting the brokerage or trading platform to close their position to prevent further losses. Liquidation in cryptocurrency trading is particularly impactful as it can trigger significant market movements, often exacerbating volatility as more positions are liquidated in response to falling prices.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of Liquidation

Liquidation events can have a cascading effect on the market. When a large position is liquidated, it can lead to a sharp increase in selling pressure, causing a rapid decline in prices. This phenomenon can create a ripple effect, where other traders also face liquidation, further driving down the price of Bitcoin and potentially other cryptocurrencies.

Moreover, the psychological impact of such events can lead to panic selling among retail investors. The fear of further losses may prompt more traders to exit their positions, intensifying the downward pressure on prices. It is essential for traders to remain informed and cautious, especially during periods of heightened volatility.

What This Means for Bitcoin and the Market

The news of this whale’s impending liquidation could serve as a critical turning point for Bitcoin and the broader cryptocurrency market. If the liquidation occurs, it may not only impact Bitcoin prices but also influence market sentiment. Traders and investors may reassess their positions, and the subsequent reactions could lead to increased volatility.

Bitcoin, often seen as a barometer for the overall health of the cryptocurrency market, may experience sharp fluctuations in price as traders react to this news. Additionally, the behavior of large market players can influence smaller traders, creating a feedback loop that exacerbates market movements.

Strategies for Traders

In light of this situation, it is crucial for traders to adopt sound risk management strategies. Here are several key considerations:

- Understand Liquidation Risks: Traders should have a clear understanding of how liquidation works and the risks associated with margin trading. This knowledge can help in making informed decisions and avoiding situations where they could be forced out of their positions.

- Diversification: Rather than concentrating investments in a single asset or position, diversifying across various cryptocurrencies can mitigate the risk of significant losses stemming from any one investment.

- Stay Informed: Keeping abreast of market news, such as large liquidations or significant movements by whales, can provide valuable insights into potential market shifts. This information can be critical for making timely trading decisions.

- Use Stop-Loss Orders: Implementing stop-loss orders can help protect investments by automatically closing positions at predetermined price levels, thereby limiting potential losses.

- Emotional Discipline: The cryptocurrency market is characterized by rapid price movements and emotional reactions. Maintaining a disciplined approach and avoiding impulsive trading decisions can help mitigate risks.

Conclusion

The current situation surrounding the whale’s $1.5 million unrealized loss on a $400 million Bitcoin short position serves as a stark reminder of the inherent risks in cryptocurrency trading. The potential for liquidation and its subsequent impact on market prices underscores the importance of informed trading strategies and risk management practices.

As the cryptocurrency market continues to evolve, traders must remain vigilant and adaptable to changing conditions. Understanding the dynamics of large positions and their potential effects on the market can empower traders to navigate this volatile landscape more effectively. In this environment, knowledge is power, and staying informed can make all the difference in achieving trading success.

Final Thoughts

The cryptocurrency market is not for the faint of heart, and the recent developments involving major traders highlight the necessity for caution and strategic planning. Whether you are a seasoned investor or a newcomer to the crypto world, understanding the implications of large market movements can be crucial in making sound investment choices. As the situation unfolds, all eyes will be on the Bitcoin market to see how it reacts to this significant news, and traders must be prepared for the potential consequences.

BREAKING: THE WHALE IS NOW IN A $1.5M UNREALIZED LOSS ON HIS $400M BITCOIN SHORT!

HE’S ABOUT TO GET LIQUIDATED!!! pic.twitter.com/mIBaAWFZ8i

— Ripple Van Winkle | Crypto Researcher (@RipBullWinkle) March 17, 2025

BREAKING: THE WHALE IS NOW IN A $1.5M UNREALIZED LOSS ON HIS $400M BITCOIN SHORT!

When it comes to the world of cryptocurrency, few things capture attention quite like the actions of major players, or as they’re often called, “whales.” These individuals or entities hold significant amounts of cryptocurrency, and their trading decisions can create ripples throughout the market. Recently, a tweet from crypto researcher Ripple Van Winkle highlighted a particularly striking situation: a whale is currently facing a staggering $1.5 million unrealized loss on a $400 million Bitcoin short position. This kind of news sends shockwaves through the crypto community, raising questions about market dynamics, risk management, and the potential for liquidation.

HE’S ABOUT TO GET LIQUIDATED!!!

Liquidation is a term that strikes fear in the hearts of traders. It occurs when an asset’s price moves against a trader’s position to the point that their broker closes the position automatically to prevent further losses. In this case, the whale’s massive short position is on shaky ground. With Bitcoin prices fluctuating wildly, the threat of liquidation looms large. For those unfamiliar with the term, a short position involves borrowing an asset to sell it at the current market price, hoping to buy it back later at a lower price. If the price rises instead, the short seller stands to lose significantly.

The potential liquidation of a whale’s position can lead to cascading effects throughout the market. When a large position is liquidated, it can trigger a wave of selling, causing prices to plummet even further. This is where it gets interesting: the broader market is often impacted not just by the whale’s actions but by the reactions of other traders who may panic in the face of such news.

Understanding the Impact of Whale Activity on the Market

Whales wield immense power in the cryptocurrency market. Their buying or selling decisions can sway prices, making it crucial for regular traders to keep an eye on their activities. The situation with the whale facing a $1.5 million unrealized loss on his $400 million Bitcoin short is a prime example of how one individual’s trading strategy can have broader implications.

Many traders often try to mimic whale behavior, believing that if a whale is making a move, there must be a good reason behind it. However, this can lead to herd mentality, where traders jump into positions based solely on speculation rather than sound analysis. It’s a dangerous game that can lead to significant losses, especially in a volatile market like cryptocurrency.

Why Would a Whale Short Bitcoin?

It’s essential to understand the motivations behind shorting an asset like Bitcoin. Whales, with their vast resources, often have access to advanced market analysis and insights that the average trader may not. They might short Bitcoin for several reasons:

1. **Market Sentiment**: If a whale perceives that the market is overvalued or that negative sentiment is building, they might short Bitcoin to capitalize on an expected downturn.

2. **Hedging**: Sometimes, whales might short Bitcoin as a hedge against other investments. By shorting Bitcoin, they can protect their overall portfolio from adverse price movements.

3. **Profit from Volatility**: The cryptocurrency market is known for its volatility. Whales may short Bitcoin in anticipation of significant price fluctuations, aiming to profit from the swings.

However, this strategy comes with risks, as evidenced by the current predicament of the whale in question.

The Psychology of Trading and Liquidation Fear

The fear of liquidation is palpable among traders, especially those who have experienced it firsthand. It can lead to a psychological spiral where traders panic and make hasty decisions. The situation with the whale’s $1.5 million loss serves as a reminder of the inherent risks in trading, particularly in a market as unpredictable as cryptocurrency.

For many traders, news of a whale’s potential liquidation can be a trigger point. It may cause them to reevaluate their positions and consider whether to exit their trades before a potential market downturn. The psychology of trading plays a significant role in how individuals react to such news.

What Can Traders Learn from This Situation?

The current situation involving the whale in a $1.5 million unrealized loss on a $400 million Bitcoin short provides valuable lessons for traders:

1. **Risk Management is Key**: Always have a strategy in place to manage risk. This includes setting stop-loss orders to limit potential losses and diversifying your portfolio.

2. **Stay Informed**: Keep an eye on market trends and whale activity. Understanding the motivations behind large trades can provide insights into potential market movements.

3. **Avoid Herd Mentality**: Resist the temptation to make hasty decisions based solely on news or market sentiment. Instead, base your trading decisions on thorough analysis and research.

4. **Embrace Volatility**: While volatility can be daunting, it also presents opportunities for profit. Learn to navigate the ups and downs of the market with a level head.

The Future of Bitcoin and Whale Strategies

As we look ahead, the future of Bitcoin remains uncertain. The cryptocurrency market is known for its rapid changes, and the current predicament of the whale serves as a reminder of how quickly fortunes can shift. Traders will be watching closely to see how this situation unfolds and what it means for the broader market.

Whales, too, will likely reassess their strategies in light of this development. The pressure of unrealized losses can lead to changes in trading behavior, as they might seek to rebalance their portfolios or adjust their positions to mitigate risk.

Conclusion

The cryptocurrency market is a fascinating and often unpredictable landscape, where the actions of a single whale can reverberate through the entire ecosystem. The current situation involving a whale facing a $1.5 million unrealized loss on a $400 million Bitcoin short serves as a stark reminder of the risks inherent in trading. By learning from these situations, traders can better navigate the complexities of the market and make informed decisions that align with their risk tolerance and investment goals.

In the end, whether you’re a seasoned trader or a newcomer to the crypto space, staying informed and practicing sound risk management will always be crucial. The world of Bitcoin and cryptocurrency is full of opportunities, but it requires a steady hand and a keen eye for the market’s ever-changing dynamics.