El Salvador’s Strategic Purchase of Bitcoin: A Bold Move in Cryptocurrency

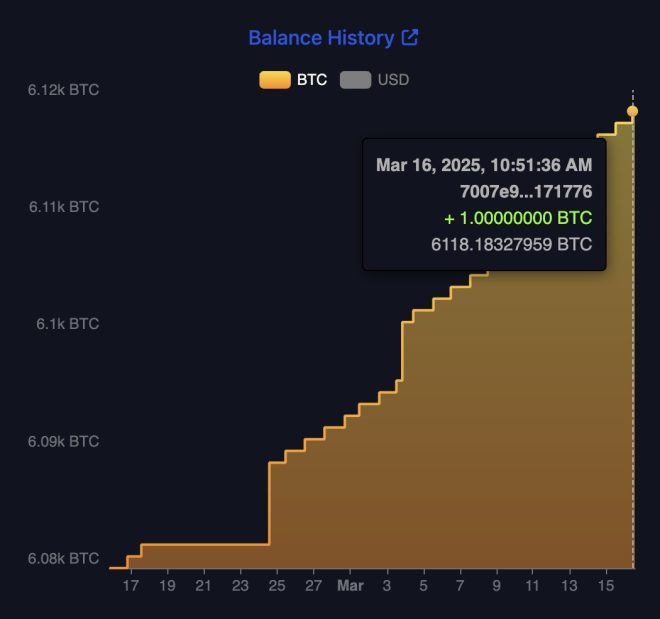

On March 16, 2025, Bitcoin Magazine reported that El Salvador made headlines once again by purchasing Bitcoin during a market dip, further enhancing its strategic reserves. This decision highlights El Salvador’s commitment to Bitcoin as a pivotal part of its economic strategy and underscores the nation’s innovative approach to cryptocurrency adoption.

The Context of El Salvador’s Bitcoin Strategy

El Salvador gained international attention in September 2021 when it became the first country to officially adopt Bitcoin as legal tender. This groundbreaking decision aimed to boost financial inclusion, attract foreign investment, and reduce remittance costs for the 70% of the population without access to traditional banking services. Since then, the government has actively engaged in Bitcoin purchases, positioning itself as a leader in the cryptocurrency space.

The Importance of Buying the Dip

The phrase "buying the dip" is a common strategy among investors, referring to the practice of purchasing assets when their prices have fallen. By acquiring Bitcoin during market dips, El Salvador aims to capitalize on lower prices while increasing its reserves. This strategic move not only demonstrates confidence in Bitcoin’s long-term value but also serves to stabilize the nation’s cryptocurrency holdings.

Economic Implications for El Salvador

El Salvador’s ongoing investment in Bitcoin could have several economic implications:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Financial Inclusion: With a significant portion of the population unbanked, Bitcoin can provide a viable alternative to traditional financial systems. By purchasing Bitcoin, the government signals its commitment to leveraging cryptocurrency for greater financial accessibility.

- Attracting Foreign Investment: By establishing itself as a cryptocurrency-friendly nation, El Salvador hopes to attract foreign investment from blockchain and crypto companies. This influx of capital could lead to job creation and economic growth.

- Remittance Reductions: Remittances are a crucial part of El Salvador’s economy, accounting for a significant percentage of GDP. By using Bitcoin for remittances, the government seeks to lower transaction fees and improve the financial well-being of families receiving funds from abroad.

The Risks Involved

Despite the potential benefits, there are inherent risks associated with Bitcoin investments:

- Market Volatility: Bitcoin’s price is notoriously volatile, and significant fluctuations can lead to substantial losses for investors. El Salvador must manage these risks effectively to protect its financial stability.

- Regulatory Challenges: As a pioneer in cryptocurrency adoption, El Salvador faces scrutiny from international financial institutions and regulatory bodies. Navigating this landscape will be crucial for the long-term success of its Bitcoin strategy.

- Public Sentiment: The government’s Bitcoin policies have generated mixed reactions among the populace. Continued education and transparency will be essential to foster public support and trust in cryptocurrency initiatives.

Future Prospects

El Salvador’s recent acquisition of Bitcoin is a significant step in its ongoing journey toward becoming a cryptocurrency hub. As the nation continues to navigate the complexities of the digital currency space, there are several key areas to watch:

- Expansion of Bitcoin Use Cases: The government is likely to explore additional use cases for Bitcoin, including its application in tourism and e-commerce. By integrating Bitcoin into various aspects of daily life, El Salvador can further promote its use and acceptance.

- International Relations: El Salvador’s unique position in the cryptocurrency landscape may influence its relationships with other countries and international financial institutions. The nation’s approach to Bitcoin could serve as a model for other nations considering similar initiatives.

- Technological Advancements: As blockchain technology evolves, El Salvador may leverage advancements to enhance its Bitcoin infrastructure. This could include developing secure payment systems, improving transaction speeds, and increasing overall user experience.

Conclusion

El Salvador’s strategic decision to buy Bitcoin during a market dip underscores its unwavering commitment to cryptocurrency as a means of economic transformation. By embracing Bitcoin, the nation is paving the way for a more inclusive financial system, attracting foreign investment, and reducing remittance costs. While challenges remain, the future prospects for El Salvador’s Bitcoin strategy are promising, positioning the country as a leader in the global cryptocurrency landscape.

As the cryptocurrency world continues to evolve, El Salvador’s actions will serve as a case study for other nations contemplating similar paths. The bold moves made by the Salvadoran government may not only change the country’s economic landscape but could also redefine the role of cryptocurrencies in global finance.

JUST IN: El Salvador bought the bitcoin dip again today and added to their strategic reserve. pic.twitter.com/vSnEuEeuKo

— Bitcoin Magazine (@BitcoinMagazine) March 16, 2025

JUST IN: El Salvador bought the bitcoin dip again today and added to their strategic reserve.

If you’ve been following the cryptocurrency space, you probably heard the buzz around El Salvador’s most recent move in the Bitcoin market. Just like a savvy investor, El Salvador has once again decided to buy the Bitcoin dip, adding to its strategic reserve. This isn’t just a random investment decision; it’s a bold statement about the nation’s commitment to Bitcoin as a legitimate currency. Let’s dive into what this means for El Salvador, Bitcoin, and the broader crypto landscape.

Why is El Salvador Investing in Bitcoin?

El Salvador made history in 2021 by becoming the first country to adopt Bitcoin as legal tender. This groundbreaking move was met with a mix of excitement and skepticism. For the government, it was a way to boost financial inclusion, attract investment, and create jobs. They believe that by integrating Bitcoin into their economy, they can reduce reliance on traditional banking systems and empower citizens who often lack access to basic financial services.

The latest purchase during the dip shows that El Salvador is doubling down on this strategy. President Nayib Bukele has been vocal about his belief in Bitcoin’s long-term potential. By accumulating more Bitcoin, the country aims to bolster its reserves and, in turn, its economic stability.

What Does “Buying the Dip” Mean?

In the world of investing, “buying the dip” refers to the strategy of purchasing an asset after its price has dropped, with the expectation that it will recover in value over time. This tactic is particularly popular among cryptocurrency enthusiasts, who often see price fluctuations as opportunities. For El Salvador, this strategy seems to be part of a broader plan to leverage Bitcoin’s volatility for economic gain.

When the price of Bitcoin drops, it can create a perfect buying opportunity for those confident in its future potential. El Salvador’s decision to buy the dip signals that they are not just reacting to market conditions but are actively participating in shaping their economic future.

El Salvador’s Strategic Reserve: What’s at Stake?

By adding to their strategic reserve, El Salvador is essentially stockpiling Bitcoin as a financial asset. This reserve can be used in various ways, such as stabilizing the economy during downturns or funding public projects. The strategic reserve acts like a safety net for the country, helping to cushion against economic shocks.

Moreover, the more Bitcoin El Salvador holds, the stronger its position becomes on the global stage. This move can attract international investors who are looking for opportunities in the burgeoning crypto market. As more countries explore the idea of adopting cryptocurrencies, El Salvador is positioning itself as a leader in the space.

The Reaction from the Crypto Community

The news of El Salvador’s latest Bitcoin purchase has sparked conversations across the crypto community. Many supporters view this as a positive sign, reinforcing their belief in Bitcoin’s potential as a global currency. On social media, reactions range from excitement to cautious optimism.

Critics, however, warn that this could be a risky move for the nation. They point out the volatility associated with cryptocurrencies, which can lead to significant financial losses. Yet, El Salvador seems undeterred, maintaining a forward-thinking approach to its economic strategy.

How Does This Impact Bitcoin’s Value?

Each time El Salvador buys Bitcoin, it adds to the overall demand for the cryptocurrency. In a market where supply is limited, increased demand can lead to price appreciation. This buying behavior has the potential to stabilize Bitcoin’s price, especially during turbulent market conditions.

However, it’s essential to note that while El Salvador’s actions can influence Bitcoin’s price, the cryptocurrency market is still highly speculative. Factors such as regulatory news, technological advancements, and macroeconomic conditions play significant roles in determining Bitcoin’s value.

The Future of Bitcoin in El Salvador

Looking ahead, El Salvador’s commitment to Bitcoin raises intriguing questions about the future of cryptocurrency in the nation. Will other countries follow suit? Can Bitcoin become a stable option for everyday transactions? These are questions that the global community is watching closely.

El Salvador’s journey may serve as a case study for other nations considering a similar path. The outcome of this experiment could either bolster the adoption of cryptocurrencies or serve as a cautionary tale about the risks involved.

The Broader Implications for Cryptocurrency Adoption

What El Salvador is doing is more than just a national experiment; it’s a potential catalyst for change in how we view money. As more countries explore the incorporation of digital currencies into their economies, the conversation around cryptocurrency adoption will evolve.

A successful Bitcoin strategy in El Salvador could pave the way for other nations to consider similar moves. Conversely, if things go awry, it might deter countries from exploring cryptocurrencies as a viable option for their economies.

Conclusion

El Salvador’s decision to buy the Bitcoin dip again is a bold move that underscores its commitment to becoming a leader in the cryptocurrency space. By adding to its strategic reserve, the country aims to stabilize its economy and attract international investment.

As the crypto world watches closely, El Salvador’s journey could shape the future of Bitcoin and its acceptance worldwide. Whether you’re a seasoned crypto enthusiast or just curious about the space, it’s fascinating to see how this small nation is making waves in the global economy.

With Bitcoin’s price constantly fluctuating, it will be interesting to see how El Salvador’s investment strategy unfolds in the coming months. Keep an eye on this story; it’s one that’s likely to develop further as the world continues to grapple with the implications of cryptocurrencies.