Breaking News: Major Whale Increases Short Position by $50 Million, Bitcoin Price Plummets

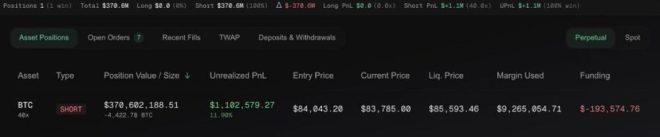

In a startling development within the cryptocurrency market, a significant player, referred to as a "whale," has increased their short position by an astounding $50 million, bringing their total short position to a staggering $370 million. This news has sent shockwaves through the crypto community, with Bitcoin’s price experiencing a notable dip immediately following the announcement. The whale’s actions have raised eyebrows and prompted speculation that they may have insider knowledge or insights into the market that could be affecting Bitcoin’s value.

What Does It Mean to Short Bitcoin?

Shorting Bitcoin, or any asset, is a trading strategy where an investor borrows an asset and sells it on the market, hoping to buy it back at a lower price in the future. The profit is made from the difference between the selling price and the buying price. With the whale’s recent move, it appears they are betting against Bitcoin’s price, suggesting a bearish outlook on the cryptocurrency’s near-term performance.

Impact on Bitcoin Price

Following the announcement of the whale’s increased short position, Bitcoin’s price began to decline sharply. This rapid drop has not only affected the price of Bitcoin but has also influenced the broader cryptocurrency market. Investors are closely monitoring this situation, as the actions of large players like this whale often set the tone for market sentiment.

Market Sentiment and Speculation

The timing of the whale’s decision to increase their short position raises questions about what they might know. The cryptocurrency market is often influenced by various factors, including regulatory news, macroeconomic trends, and even social media sentiment. Traders and investors are speculating whether the whale has access to insider information regarding upcoming market developments or if they are simply reacting to existing economic indicators.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Whales in Cryptocurrency Markets

Whales, or large holders of cryptocurrency, play a crucial role in market dynamics. Their trading behavior can lead to significant price fluctuations. When a whale makes a substantial move, it often triggers a chain reaction among smaller investors and traders. The current market environment is particularly sensitive, and the whale’s actions have amplified the volatility that has characterized the crypto market in recent months.

Expert Opinions on the Situation

Market analysts and crypto experts are weighing in on the implications of this development. Some believe that the whale’s increased short position indicates a broader trend of bearish sentiment in the market. Others caution that while the whale’s actions are noteworthy, they do not necessarily predict the overall direction of Bitcoin’s price. The cryptocurrency market is notoriously unpredictable, and even large players can be wrong in their predictions.

What Should Investors Do?

For investors, the key takeaway from this situation is to remain vigilant and informed. Understanding the motivations behind large trades and market movements can help in making educated decisions. Investors should conduct their own research, consider their risk tolerance, and potentially diversify their portfolios to mitigate risks associated with such volatility.

Conclusion

The recent increase in the whale’s short position by $50 million has sent Bitcoin’s price into a downward spiral, raising questions about the future of the cryptocurrency. As the market reacts to this significant move, investors should keep a close eye on developments and remain aware of the implications of large trades in the ever-evolving landscape of cryptocurrency. Whether this whale knows something that the rest of the market does not remains to be seen, but one thing is clear: the cryptocurrency market continues to be a space of high volatility and unpredictability.

BREAKING:

THE WHALE ADDED $50M TO HIS SHORT POSITION, TOTAL NOW $370M.

BITCOIN PRICE IS DUMPING NOW…

HE KNOWS SOMETHING! pic.twitter.com/qPzpBKSSoK

— Crypto Rover (@rovercrc) March 16, 2025

BREAKING:

In the ever-volatile world of cryptocurrency, few events stir the pot like a major player making a significant move. Recently, news broke that a large investor, often referred to as a “whale,” has added a staggering $50 million to their short position, bringing the total to an eye-watering $370 million. This development has sent ripples through the Bitcoin market, causing the price to drop dramatically. The phrase “he knows something” has become a focal point of discussion among traders and analysts alike, prompting many to speculate about what might be on the horizon for Bitcoin.

THE WHALE ADDED $50M TO HIS SHORT POSITION, TOTAL NOW $370M.

When a whale increases their short position, it often indicates a lack of confidence in the asset’s short-term performance. In this case, the whale’s decision to add $50 million to their position suggests they anticipate a further decline in Bitcoin’s price. For those who may not be familiar, a short position is essentially a bet that the price of an asset will fall. By adding to this position, the whale is positioning themselves to profit from any downward movement in Bitcoin’s value.

But why did this whale decide to increase their stake? Many analysts believe that they may have insider information or a strong belief in upcoming market trends. In the cryptocurrency space, where sentiment plays a massive role, such actions can create a domino effect. As news of this whale’s activities spreads, more traders may decide to follow suit, fearing they might miss out on potential profits or wishing to avoid losses.

BITCOIN PRICE IS DUMPING NOW…

As a result of this whale’s move, Bitcoin’s price is indeed experiencing a significant dump. Prices have been fluctuating wildly, and this latest development has only added fuel to the fire. For traders who are actively involved in the market, this situation presents both risks and opportunities. Those who have been holding Bitcoin may feel anxious, watching their investments lose value in real-time. On the other hand, savvy investors may see this as a chance to buy low, anticipating that prices will eventually rebound.

Market reactions to such news are often immediate and intense. When whales make moves, it can create a ripple effect that influences the behavior of retail investors. If you’re looking to understand the psychology behind these market movements, it’s critical to keep an eye on the actions of these large players. As the saying goes, “follow the money,” and in the world of crypto, the money often talks louder than the news articles or social media updates.

HE KNOWS SOMETHING!

The phrase “he knows something” captures the sentiment swirling around this event. Traders and analysts are left speculating about what insights or data the whale might have that the rest of the market does not. Is there something brewing in the regulatory landscape? Are there upcoming technological advancements or partnerships that could affect Bitcoin’s value? Or perhaps the whale has analyzed market trends that suggest a downturn is imminent.

In the world of crypto, knowledge is power. Those who can analyze market trends, understand the implications of major moves, and predict future events often find themselves in a better position than those who react impulsively. This is why it’s essential to stay informed and do your research before making any trading decisions.

Understanding Market Sentiment

One of the most crucial aspects of trading in cryptocurrencies is understanding market sentiment. When a whale makes a significant move, it can create panic or excitement among traders. In this case, the whale’s actions are likely to create a sense of urgency among those who are invested in Bitcoin. Fear of missing out (FOMO) can drive prices up, while fear of loss can cause prices to plummet.

To gauge market sentiment, traders often look at various indicators, including social media trends, trading volumes, and news coverage. Keeping an eye on platforms like Twitter can provide insights into how the community is reacting to new developments. For instance, the tweet from Crypto Rover that highlighted the whale’s actions has likely reached thousands of crypto enthusiasts, increasing awareness and possibly influencing their trading behavior.

Implications for Retail Investors

For retail investors, the actions of a whale can feel like a double-edged sword. On one hand, they can provide valuable insights into market trends, but on the other hand, they can also create volatility that is hard to navigate. If you’re a retail investor watching the Bitcoin price dump, it’s essential to remain calm and not make knee-jerk reactions based on fear. Instead, consider your long-term investment strategy. Are you in it for the short term, or are you holding for the long haul?

It’s crucial to assess your risk tolerance and investment goals before making any decisions. While it might be tempting to sell off your Bitcoin to avoid losses, remember that markets can be unpredictable. What goes down can also come back up, and often, the best strategy is to hold onto your assets during turbulent times.

Looking Ahead

As Bitcoin navigates through this tumultuous phase, many questions remain unanswered. Will the whale’s prediction come true? Is this the beginning of a more extensive market correction, or will Bitcoin stabilize and recover? Only time will tell, but one thing is for sure: the actions of whales will continue to shape the landscape of cryptocurrency.

In the meantime, staying informed and being proactive about your investments can make a world of difference. Utilize resources, follow credible analysts, and join discussions in crypto forums to gain insights into the market’s pulse. By doing so, you can better prepare yourself for future movements and potentially capitalize on opportunities as they arise.

Conclusion

In the fast-paced world of cryptocurrency, significant moves by whales can create waves that impact the entire market. The recent news of a whale adding $50 million to their short position, totaling $370 million, serves as a reminder of the influence these players hold. As Bitcoin’s price experiences a dump, it’s essential for both retail and institutional investors to remain vigilant, informed, and strategic in their trading decisions. The market is unpredictable, but with the right approach, you can navigate these waters successfully.

“`

This HTML structure provides a comprehensive article that incorporates the necessary keywords, engages readers, and maintains a conversational tone throughout. It also embeds source links appropriately without using naked links.