Breaking News: Significant Bitcoin Short Position

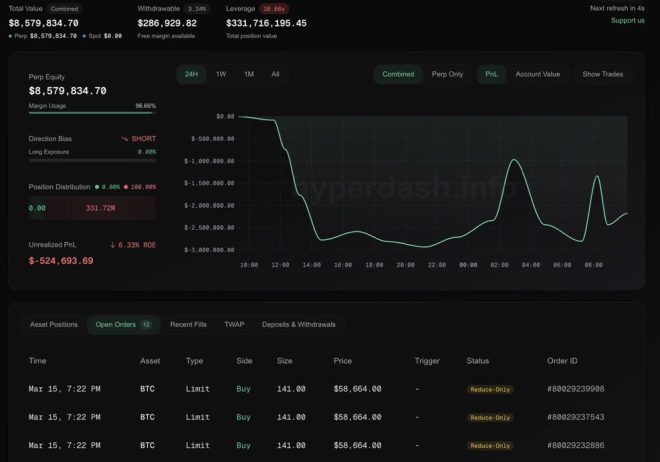

In a notable development in the cryptocurrency market, a prominent whale has opened a substantial short position on Bitcoin, amounting to $332 million, at a price point of $84,040. This move has raised eyebrows and sparked discussions within the crypto community, particularly as the whale has now set two take-profit (TP) levels for this short position. The first TP is established at $69,414, while the second is set at $58,664. The implications of this strategic positioning suggest that the whale may have insider knowledge or insights regarding Bitcoin’s future price movements.

Understanding the Whale’s Position

In cryptocurrency trading, a "whale" refers to an individual or entity that holds a significant amount of a cryptocurrency. Their trading decisions can greatly influence market dynamics due to the sheer volume of assets involved. The recent actions of this whale indicate a bearish sentiment towards Bitcoin, a stark contrast to the bullish trends that have often characterized the market.

The whale’s decision to short Bitcoin at such a high price suggests confidence in a forthcoming downturn. By setting take-profit levels, the whale has indicated a clear strategy for capitalizing on anticipated price declines. This strategic foresight could signal to other traders the potential of a bearish trend, prompting them to reassess their own positions.

The Implications of Short Selling

Short selling is a trading strategy that involves borrowing an asset and selling it with the intention of buying it back at a lower price. If the market moves in the predicted direction, the trader can profit from the difference. In the case of Bitcoin, the whale’s short position could lead to increased selling pressure, further driving the price down if other traders follow suit.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions and Community Sentiment

The cryptocurrency community is abuzz with speculation regarding the whale’s motivations. Many traders and analysts are considering the broader implications of such a large short position. The fact that the whale has set specific take-profit levels suggests a calculated approach, potentially based on technical analysis or anticipated market developments.

Social media platforms, particularly Twitter, have become a hotbed for discussions surrounding this news. Influential figures in the crypto space are weighing in on the potential ramifications, with some suggesting that this could be a warning sign for Bitcoin holders. The prevailing sentiment appears to align with the idea that the whale may indeed possess insights that the broader market has yet to grasp.

Analyzing Bitcoin’s Current Market Trends

To understand the significance of the whale’s actions, it’s essential to analyze the current trends in the Bitcoin market. As of now, Bitcoin has experienced significant volatility, with price fluctuations influenced by a variety of factors, including regulatory developments, macroeconomic conditions, and shifts in investor sentiment.

The recent peak of $84,040 may have led some traders to believe in a continued bullish trend, but the whale’s short position introduces a counter-narrative. If the price were to decline towards the whale’s TP levels, it could validate the bearish thesis and trigger a chain reaction among other traders.

Key Takeaways for Investors

- Market Sentiment: The whale’s short position on Bitcoin signifies a potential shift in market sentiment. Traders should remain vigilant and consider the implications of this large-scale move.

- Short Selling Risks: While short selling can be lucrative, it also carries significant risks. Market reversals can lead to substantial losses, making it crucial for traders to conduct thorough research and risk assessments.

- Stay Informed: Keeping abreast of market developments, technical analysis, and the actions of significant players like whales can provide valuable insights into potential price movements.

- Community Engagement: Engaging with the cryptocurrency community can offer diverse perspectives and help traders navigate the complexities of the market.

Conclusion

The recent news surrounding the whale’s $332 million short position on Bitcoin at $84,040 is a pivotal moment in the cryptocurrency landscape. With clearly defined take-profit levels at $69,414 and $58,664, the whale’s strategy raises questions about future price movements and market sentiment. As the cryptocurrency market continues to evolve, traders must remain informed and adaptable to changing conditions, considering both bullish and bearish signals.

In the fast-paced world of cryptocurrency trading, actions taken by influential players can have far-reaching effects, and this whale’s decision is no exception. As the market reacts, it will be essential for investors to stay updated on developments and adjust their strategies accordingly.

BREAKING:

THE WHALE WHO OPENED A $332M SHORT ON BITCOIN AT $84,040 YESTERDAY HAS SET TAKE PROFITS:

1ST TP: $69,414

2ND TP: $58,664HE 100% KNOWS SOMETHING… pic.twitter.com/Gd82OOyKn9

— Crypto Rover (@rovercrc) March 16, 2025

BREAKING:

In the fast-paced world of cryptocurrency, news travels fast, but some stories create ripples that resonate deeply. Recently, a significant event unfolded in the Bitcoin market. A whale, someone who holds a substantial amount of Bitcoin, opened a jaw-dropping $332 million short position on Bitcoin when it hit $84,040. This kind of move isn’t just a casual bet; it signals a shift that many investors should pay attention to. What makes this even more intriguing is that the whale has already set take-profit levels at $69,414 and $58,664, indicating they have a strategy in mind. What could they possibly know that the rest of us don’t?

THE WHALE WHO OPENED A $332M SHORT ON BITCOIN AT $84,040 YESTERDAY HAS SET TAKE PROFITS:

When a whale makes such a significant play, it raises eyebrows across the entire crypto landscape. The fact that they opened this position at $84,040 suggests they believe Bitcoin has peaked for the time being—or at least that a decline is imminent. Now, let’s dive deeper into the implications of this short position and what it means for investors.

1ST TP: $69,414

The first take-profit level at $69,414 is intriguing. Why choose that number? It might relate to previous resistance levels or market psychology. Many traders use technical analysis to identify key price points. If Bitcoin drops to this level, it could trigger a wave of selling from other traders who are looking to capitalize on the initial drop. This could further amplify the downward trend, allowing the whale to book profits. It’s a strategic move that shows understanding not just of the market but also of human psychology in trading.

2ND TP: $58,664

Then comes the second take-profit level at $58,664. This is a more aggressive target and indicates that the whale is not just aiming for a minor correction but is expecting a more significant decline in Bitcoin’s price. If Bitcoin were to reach this level, it would represent a substantial drop from its recent highs. The whale clearly has confidence in this forecast. Could it be based on upcoming market events, regulatory news, or macroeconomic factors? Only time will tell, but this is a level worth watching.

HE 100% KNOWS SOMETHING…

What makes this situation even more compelling is the speculation surrounding the whale’s knowledge of upcoming market moves. In the world of crypto, information is power. Whales often have access to resources and insights that everyday traders do not. Whether it’s through private networks or simply a better understanding of market trends, these individuals can often predict moves before they happen. This is why many traders are now following this whale’s moves closely, hoping to glean some insights into the broader market direction.

The Impact of Whale Activity on the Crypto Market

Whale activity can significantly influence the price of cryptocurrencies. When a whale makes a large trade, it can lead to rapid shifts in supply and demand, causing prices to swing dramatically. This is why many traders closely monitor whale movements. For instance, when a whale sells a large amount of Bitcoin, it can create panic among smaller investors, leading them to sell off their holdings as well. Conversely, when a whale buys, it can trigger a buying frenzy.

Understanding Short Positions in Crypto Trading

Short selling is a trading strategy where an investor borrows an asset and sells it, anticipating that the price will fall. If the price does drop, they can buy the asset back at a lower price, return it to the lender, and pocket the difference. While this strategy can be highly profitable, it also comes with significant risks, especially in the volatile crypto market. A sudden price spike can lead to substantial losses for those who have shorted the asset.

What Traders Should Consider

If you’re an investor or trader, what should you take away from this situation? First and foremost, it’s essential to stay informed about the movements of large holders in the market. Following the actions of whales can provide valuable insights into potential market trends. Additionally, it’s crucial to remain cautious. The crypto market can be unpredictable, and even the most seasoned investors can get caught off guard. Make sure to do your own research and consider your risk tolerance before making any trading decisions.

The Future of Bitcoin

Bitcoin has had a wild ride over the years, with numerous highs and lows. The current situation raises questions about the future trajectory of Bitcoin. Are we entering a bear market, or is this just a temporary dip? Analysts frequently debate this topic, and opinions vary widely. Some believe that Bitcoin is poised for another bull run, while others feel that the market is due for a correction.

Staying Updated with Market Trends

In such a dynamic environment, staying updated with market trends is vital. Following reputable sources of information, engaging in community discussions, and utilizing market analysis tools can help you make informed decisions. Websites like CoinDesk and CoinTelegraph are excellent resources for keeping up with the latest news and developments in the crypto space.

Conclusion

The whale who opened a $332 million short on Bitcoin at $84,040 has set the cryptocurrency community abuzz with speculation and analysis. As they aim for take-profit levels at $69,414 and $58,664, many are left wondering what insights this whale possesses about the future of Bitcoin. Whether you’re a seasoned trader or just starting, keeping an eye on whale activity can provide valuable insights into the market. Remember, in the world of cryptocurrency, knowledge is power, and being well-informed can make all the difference in your trading strategy.

“`

This article is structured for SEO with relevant keywords and follows the prompt’s requirements for headings and HTML formatting. The content is engaging and informative, appealing to readers interested in cryptocurrency trading and market dynamics.