RBI Confirms IndusInd Bank’s Stability: An Overview

In a recent announcement that has garnered significant attention, the Reserve Bank of India (RBI) confirmed the financial stability of IndusInd Bank. The news comes as a relief to stakeholders, investors, and customers alike, as it highlights the bank’s robust financial health amidst a rapidly changing economic landscape. This summary delves into the key financial metrics that reinforce IndusInd Bank’s strong standing and what it means for customers and investors.

Key Financial Metrics

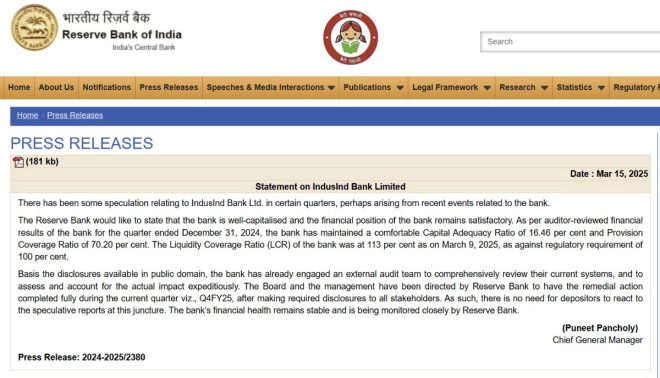

According to the RBI, IndusInd Bank is operating with a Capital Adequacy Ratio (CAR) of 16.46%. This figure is particularly noteworthy as it exceeds the regulatory requirement set by the RBI, showcasing the bank’s strong capital base. The CAR is a critical indicator of a bank’s financial strength, as it measures a bank’s available capital expressed as a percentage of its risk-weighted assets. A higher CAR means that the bank is well-capitalized and can absorb potential losses, providing a safety net for depositors and investors.

In addition to the CAR, the bank’s Liquidity Coverage Ratio (LCR) stands at an impressive 113%. This ratio indicates that IndusInd Bank has sufficient liquid assets to meet its short-term obligations, ensuring that it can withstand financial stress or unexpected withdrawals. A healthy LCR is vital for maintaining confidence among customers and investors, especially in uncertain economic conditions.

Moreover, the Provision Coverage Ratio (PCR) is reported at 70.20%. This metric reflects the bank’s preparedness to address potential loan defaults. A higher PCR indicates that the bank has set aside adequate provisions to cover bad debts, thus mitigating risks associated with non-performing assets (NPAs). This proactive approach to risk management is essential in maintaining the bank’s overall health and stability.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Customers and Investors

The RBI’s confirmation of IndusInd Bank’s stability is a positive signal for existing and potential customers. Individuals and businesses can feel more secure in their dealings with the bank, knowing that it is financially sound and capable of meeting its obligations. This assurance can lead to increased customer trust and loyalty, which is essential for the bank’s ongoing growth.

For investors, the bank’s solid financial metrics suggest a lower risk profile, making it an attractive option in the banking sector. With a strong CAR, LCR, and PCR, IndusInd Bank demonstrates its commitment to financial discipline and transparency. Investors often seek banks that exhibit robust financial health, as this can lead to sustained profitability and potential appreciation in stock value.

The Role of RBI in Ensuring Financial Stability

The RBI plays a crucial role in monitoring the financial health of banks in India. Through rigorous assessments and periodic evaluations, the central bank ensures that financial institutions adhere to the stipulated regulatory norms. The confirmation of IndusInd Bank’s stability is a testament to the RBI’s effective regulatory framework and its commitment to maintaining a stable banking environment.

Conclusion

The recent announcement by the RBI regarding IndusInd Bank’s financial stability is indeed a reassuring development in the banking sector. With a Capital Adequacy Ratio of 16.46%, Liquidity Coverage Ratio of 113%, and Provision Coverage Ratio of 70.20%, IndusInd Bank stands firm against economic challenges. This news not only bolsters customer confidence but also enhances the bank’s attractiveness to investors.

As the banking landscape continues to evolve, the focus on financial stability and regulatory compliance will remain paramount. IndusInd Bank’s strong performance metrics position it well for future growth, making it a bank to watch in the coming years. The RBI’s endorsement further solidifies its status as a reliable financial institution, reassuring all stakeholders of its enduring stability.

BREAKING: RBI Confirms IndusInd Bank’s Stability https://t.co/iwrZqCuT9d

No risk, no worries – IndusInd Bank remains strong with solid financials.-Capital Adequacy Ratio: 16.46% (Above requirement)

-Liquidity Coverage Ratio: 113% (Well-buffered)

-Provision Coverage: 70.20%… pic.twitter.com/jC3Wz6e56V— Times Algebra (@TimesAlgebraIND) March 15, 2025

BREAKING: RBI Confirms IndusInd Bank’s Stability

If you’ve been keeping an eye on the banking sector, you might have come across some recent news that has sent waves of optimism through the financial community. The Reserve Bank of India (RBI) has confirmed the stability of IndusInd Bank, which is fantastic news for investors, customers, and stakeholders alike. The bank has demonstrated robust financial health, easing fears of instability that sometimes grip the banking world. As we dive deeper into this topic, let’s explore what this means for the bank and its customers.

No Risk, No Worries – IndusInd Bank Remains Strong with Solid Financials

What does it mean when we say a bank is solid? It boils down to a few key financial metrics that give us a clearer picture of its health. IndusInd Bank has been holding its ground firmly, showcasing impressive ratios that indicate it is well-prepared to weather any financial storm.

According to the RBI’s report, IndusInd Bank has a **Capital Adequacy Ratio (CAR)** of **16.46%**, which is above the regulatory requirement. This ratio measures a bank’s capital in relation to its risk-weighted assets, essentially telling us how well-equipped the bank is to absorb potential losses. A higher CAR indicates a well-capitalized institution, providing a safety net for depositors and investors alike.

Capital Adequacy Ratio: 16.46% (Above Requirement)

So why is a Capital Adequacy Ratio of **16.46%** significant? Well, it’s a clear indicator that IndusInd Bank is not just surviving but thriving. A CAR above the required threshold suggests that the bank is in a strong position to support its obligations and can handle unexpected financial hiccups. When it comes to finances, having a buffer is crucial, and IndusInd Bank is clearly ahead of the game.

This solid ratio instills confidence among customers. If you’re considering banking with IndusInd, knowing that they have a sturdy capital foundation means that your money is in capable hands. The RBI’s endorsement certainly adds an extra layer of credibility, making it a favorable choice for both existing and potential customers.

Liquidity Coverage Ratio: 113% (Well-Buffered)

Next up is the **Liquidity Coverage Ratio (LCR)**, which stands at a robust **113%**. This metric is crucial because it measures a bank’s ability to meet its short-term obligations. In simpler terms, it tells us how well the bank can endure financial stress over a 30-day period without the need to sell assets at a loss.

An LCR of **113%** not only meets regulatory standards but also indicates that IndusInd Bank has more than enough liquid assets to cover potential withdrawals. This is particularly reassuring for customers who might worry about accessing their funds during uncertain times. The confidence that comes from knowing that the bank can meet its immediate obligations can’t be overstated.

This liquidity buffer reflects the bank’s prudent management and commitment to maintaining a healthy balance between its assets and liabilities. It’s a sign that IndusInd Bank is not just focused on growth but is also taking the necessary steps to ensure its sustainability.

Provision Coverage: 70.20%

Another metric that highlights the strength of IndusInd Bank is its **Provision Coverage Ratio (PCR)**, which currently stands at **70.20%**. This ratio indicates how much of the bank’s non-performing assets (NPAs) are covered by provisions. A higher PCR means that the bank is better prepared to handle potential losses from loans that may default.

A **PCR** of **70.20%** is quite impressive and shows that IndusInd Bank is proactively managing its risks. This assurance means that even if some loans go bad, the bank has set aside adequate funds to cover those losses, ensuring stability for its operations and, by extension, its customers.

Understanding the Importance of Stability in Banking

Why does this stability matter? In a world where economic uncertainties can lead to panic, having a stable bank gives customers peace of mind. It encourages individuals and businesses to trust the institution with their money. When customers feel secure, they are more likely to invest, borrow, and save, which ultimately benefits the economy.

IndusInd Bank’s strong financials are not just numbers on a balance sheet; they represent a promise of security for its customers. This trust is vital, especially in today’s fast-paced financial landscape, where changes can happen overnight.

What This Means for Customers and Investors

When a bank like IndusInd is backed by solid financials, it opens up a world of opportunities for its customers. Whether you’re a small business owner looking for a loan, an individual considering a savings account, or an investor eyeing stock options, knowing that the bank is stable is crucial.

For investors, the confirmation of IndusInd Bank’s stability by the RBI is a green light. It’s an indication that the bank is on a sound footing, making it an attractive investment option. As more people gain confidence in the bank’s stability, it can lead to increased stock prices and better returns.

Final Thoughts on IndusInd Bank’s Financial Health

In the ever-changing world of finance, it’s refreshing to see a bank like IndusInd standing tall amidst the chaos. The RBI’s confirmation of its stability, coupled with impressive financial metrics such as a **Capital Adequacy Ratio** of **16.46%**, a **Liquidity Coverage Ratio** of **113%**, and a **Provision Coverage Ratio** of **70.20%**, paints a promising picture.

For those considering their banking options, look no further than IndusInd Bank. The strong financial health showcased by these metrics reflects a commitment to customer security and institutional integrity. As they continue to build on this foundation, both customers and investors can rest easy, knowing they are in good hands.

Whether you’re looking to open a new account, apply for a loan, or just want to feel secure in your banking choice, the assurance of IndusInd Bank’s stability is a compelling reason to take the leap. After all, in banking, stability isn’t just a luxury; it’s a necessity.