Gold Reaches Historic $3,000 Mark: What This Means for Investors

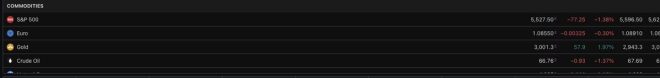

On March 14, 2025, a significant milestone was reached in the world of finance as gold prices soared to an unprecedented $3,000 per ounce. This landmark event, reported by the Twitter account @unusual_whales, marks the first time in history that gold has traded at such a high value. As investors and analysts alike scramble to understand the implications of this surge, it’s essential to explore the factors driving this price increase and what it means for the future of gold investment.

The Factors Behind the Surge in Gold Prices

Economic Uncertainty

One of the primary drivers of gold’s price increase is ongoing economic uncertainty. In recent years, geopolitical tensions, inflation rates, and the impacts of global events such as pandemics have led to a heightened sense of risk among investors. Gold has traditionally been viewed as a safe-haven asset during times of economic turmoil. As uncertainty grows, more investors turn to gold to protect their wealth, driving up demand and, consequently, prices.

Inflation Concerns

With inflation rates reaching historically high levels in many countries, the purchasing power of fiat currencies is diminishing. This erosion of value has prompted investors to hedge against inflation by investing in tangible assets like gold. As more people seek to preserve their wealth against the backdrop of rising prices, the demand for gold increases, pushing its price higher.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Central Bank Policies

Central banks around the world have been adopting aggressive monetary policies, including low interest rates and quantitative easing, to stimulate economic growth. While these measures can be beneficial in the short term, they also lead to concerns about currency devaluation. As a result, many investors are turning to gold as a hedge against potential currency risks, further contributing to the rising gold prices.

The Historical Context of Gold Prices

Gold has always been regarded as a valuable asset, serving as a form of currency and a store of value for centuries. However, the journey to the $3,000 mark has been a long one, with gold prices experiencing significant fluctuations over the decades. Notably, during the financial crisis of 2008, gold prices began a steady ascent as investors sought security. The subsequent years saw gold reach previous highs, but the crossing of the $3,000 threshold is a clear indication of changing market dynamics.

Implications for Investors

Diversification Strategies

For investors, the rise of gold to $3,000 underscores the importance of diversification in investment portfolios. While gold has traditionally been viewed as a hedge against inflation and economic instability, its recent surge may encourage investors to reevaluate their asset allocations. By including gold in a diversified portfolio, investors can mitigate risk and potentially enhance returns, especially during turbulent economic times.

Long-Term Outlook

The long-term outlook for gold remains a topic of debate among analysts. Some experts predict that the price of gold could continue to rise as economic uncertainties persist, while others believe that a correction may be on the horizon. Regardless, the $3,000 milestone serves as a reminder of the asset’s historical resilience and its role in risk management for investors.

The Role of Technology in Gold Trading

Digital Gold and Cryptocurrencies

The rise of digital assets and cryptocurrencies has introduced new dynamics to the gold market. Some investors view cryptocurrencies as a modern alternative to gold, often referring to Bitcoin as “digital gold.” However, the volatility associated with cryptocurrencies has made gold remain a more stable option for many investors seeking refuge during market fluctuations.

Trading Platforms and Accessibility

Advancements in technology have also made gold trading more accessible to retail investors. Online trading platforms have democratized the investment landscape, allowing individuals to buy and sell gold with ease. This increased accessibility may contribute to heightened demand for gold, further driving its price upward.

Conclusion

The recent surge of gold prices to $3,000 per ounce is a landmark event that reflects broader economic trends and investor sentiment. As economic uncertainty looms and inflation concerns grow, gold’s appeal as a safe-haven asset becomes more pronounced. Investors should carefully consider the implications of this historic milestone, as it could signal a shift in market dynamics and investment strategies.

With the right approach, gold can play a vital role in a diversified portfolio, helping investors navigate the challenges of an unpredictable economic landscape. Whether viewed as a hedge against inflation, a store of value, or a strategic investment, gold remains a critical asset in the financial world. As we move forward, monitoring gold’s performance will be essential for investors looking to capitalize on its potential and secure their financial futures.

In summary, the $3,000 mark not only underscores the enduring value of gold but also highlights the need for strategic investment planning amidst economic volatility. As always, investors should conduct thorough research and consider their risk tolerance before making investment decisions in this ever-evolving market.

BREAKING: Gold is now trading at $3,000 for first time ever pic.twitter.com/9gbt70tjpu

— unusual_whales (@unusual_whales) March 14, 2025

BREAKING: Gold is now trading at $3,000 for first time ever

Gold has always been a symbol of wealth, power, and investment stability. It’s a precious metal that has drawn human attention for centuries, serving as currency, jewelry, and a safe haven during turbulent economic times. So it’s no surprise that when news broke that gold is now trading at $3,000 for the first time ever, it sent shockwaves through the financial world. This milestone is not just a number; it represents a significant shift in the global economy and the value of currency. Let’s dive deeper into what this means for investors, traders, and the general public.

The Significance of Gold Reaching $3,000

When you hear that gold is trading at $3,000, you might wonder why this matters. Gold has historically been a hedge against inflation and economic uncertainty. As inflation rises and currencies fluctuate, many investors flock to gold as a safe haven. The fact that gold has now hit this unprecedented level is a clear indicator of the current economic climate.

In recent years, we’ve witnessed various factors contributing to the rise of gold prices. From geopolitical tensions to economic instability caused by the pandemic, all these elements have played their part. As the world continues to grapple with these issues, gold’s value has surged, and reaching the $3,000 mark is a testament to its enduring allure as a stable investment.

What Factors Contributed to Gold’s Rise?

Understanding why gold has skyrocketed to $3,000 requires a look at several key factors. First, we have to consider inflation. With central banks around the globe pumping money into the economy to stimulate growth, inflation has become a pressing concern. Higher inflation often leads to a decrease in purchasing power, making gold a more attractive option for investors looking to protect their assets.

Additionally, geopolitical tensions have also played a significant role. From trade wars to conflicts in various regions, uncertainty can drive investors toward gold as a means of safeguarding their investments. The Reuters reported that such uncertainties have historically resulted in increased demand for gold, contributing to its price surge.

Investor Sentiment and Market Reactions

So, how are investors reacting to this historic milestone? Many are excited, as this price point could signal a new era for gold investments. For those who have been holding onto their gold, this is a moment of triumph. Even those who have just started investing in gold are likely feeling optimistic about their choices. As news spreads about gold hitting $3,000, the market is buzzing with discussions about potential future gains and what this could mean for investors.

Traders are also paying close attention to market trends. Many are wondering if gold will maintain this high price or if it will fluctuate. Some analysts predict that as more investors turn to gold, we may see even further increases. Others caution that volatility is always a risk in the market, so it’s essential for investors to stay informed and make choices based on research and analysis.

How This Affects Other Investment Avenues

The surge in gold prices doesn’t just impact gold investors; it has ripple effects across various markets. For instance, stocks and bonds may experience fluctuations as investors look to diversify their portfolios. If gold continues to rise, we might see a shift in where people choose to invest their capital.

Moreover, industries that rely on gold, such as jewelry and electronics, might also feel the effects. Higher gold prices could lead to increased costs for manufacturers, which could, in turn, affect prices for consumers. It’s a complex web of interconnections, and keeping an eye on these trends can help investors navigate the landscape.

The Psychological Impact of Gold Prices

There’s also a psychological aspect to consider. Gold has long been considered a “safe” investment, and reaching the $3,000 mark may reinforce this perception. Investors often look for signals to guide their decisions, and a milestone like this can create a positive feedback loop, encouraging more people to invest in gold.

Furthermore, when gold prices rise, it can foster a sense of urgency among potential investors. Those who may have hesitated to buy gold might feel compelled to jump in now, fearing they’ll miss out on further gains. This can create a surge in demand, which could contribute to even higher prices.

What to Watch For Moving Forward

As gold continues to trade at historic highs, it’s essential to stay informed about the factors influencing its price. Economic indicators, geopolitical developments, and market trends will all play critical roles in determining the future of gold prices. Investors should keep a close eye on these factors and consider how they might impact their investment strategies.

Additionally, it’s vital to remember that markets can be unpredictable. While the current trend is positive for gold investors, fluctuations are always a possibility. Diversification remains a key strategy for minimizing risk, and investors should be prepared for potential changes in the market.

The Broader Economic Implications

The fact that gold has reached $3,000 also raises questions about the broader economic implications. For one, it could signal a shift in global economic power dynamics. As countries grapple with inflation and currency devaluation, gold might become an increasingly important asset for nations as well.

Moreover, central banks may reassess their gold reserves and purchasing strategies. The World Gold Council has noted that many central banks have been increasing their gold reserves, and this trend could accelerate as countries look to stabilize their economies. The implications of this could be far-reaching, influencing everything from international trade to currency values.

Conclusion: A New Era for Gold

Gold trading at $3,000 for the first time ever is not just a number; it’s a reflection of our world’s economic state. This milestone highlights the importance of gold as a safe haven and raises questions about future market trends. As we move forward, it will be fascinating to see how this impacts investors, industries, and economies globally. Whether you’re a seasoned investor or someone just dipping your toes into the gold market, it’s crucial to stay informed and adapt to the ever-changing landscape. The allure of gold isn’t going anywhere, and its role in our economy will continue to evolve.

“`

This HTML-formatted article is designed to be engaging and informative, while also being optimized for search engines with relevant keywords and source links embedded in the text.