Breaking News: BlackRock to File for Solana and XRP ETFs

In a significant development for the cryptocurrency market, ETFStore President has announced that BlackRock, one of the world’s largest investment management firms, is set to file for Exchange-Traded Funds (ETFs) for both Solana and XRP. This news has sent ripples through the crypto community, as the involvement of a financial giant like BlackRock is seen as a validation of these digital assets and could potentially lead to increased institutional investment in the space.

The Impact of BlackRock’s Decision

The filing of ETFs for Solana and XRP by BlackRock marks a pivotal moment in the evolution of cryptocurrency as a mainstream investment vehicle. ETFs allow investors to buy shares that represent a collection of assets, in this case, cryptocurrencies. This setup offers several advantages, including ease of trading, diversification, and regulatory oversight, which can provide a layer of security for investors.

Why Solana and XRP?

Both Solana and XRP have emerged as prominent players in the cryptocurrency landscape. Solana is renowned for its high-speed transaction capabilities and low fees, making it a favorite for decentralized applications and NFTs. XRP, on the other hand, is well-known for its focus on enabling fast and cost-effective international money transfers. The decision to target these two cryptocurrencies suggests that BlackRock recognizes their potential for growth and utility in the financial ecosystem.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Significance of ETFs in the Cryptocurrency Market

The introduction of ETFs in the cryptocurrency market is a game-changer for several reasons:

- Mainstream Acceptance: With the backing of major financial institutions like BlackRock, cryptocurrencies gain legitimacy. This can encourage more traditional investors to dip their toes into the crypto waters.

- Increased Liquidity: ETFs can enhance liquidity by making it easier for investors to buy and sell shares. This increased trading volume can stabilize prices and reduce volatility in the market.

- Regulatory Framework: ETFs are subject to regulatory oversight, which can instill confidence in potential investors. This regulatory clarity can also help mitigate some of the risks associated with investing in cryptocurrencies.

- Portfolio Diversification: An ETF that includes Solana and XRP allows investors to diversify their portfolios without having to buy these cryptocurrencies directly. This can attract those who are hesitant about managing digital assets.

What This Means for Investors

For investors, the news of BlackRock’s planned ETF filings is a signal to pay attention to Solana and XRP. As more institutional investors enter the market, the demand for these assets could increase, potentially driving up their prices.

Potential Risks and Considerations

While the introduction of ETFs is largely seen as a positive development, investors should remain cautious. The cryptocurrency market is notoriously volatile, and the prices of Solana and XRP can fluctuate dramatically. Additionally, regulatory changes can impact the market landscape, so investors should stay informed about the evolving regulatory environment.

The Future of Cryptocurrency ETFs

As BlackRock moves forward with its ETF filings, the broader implications for the cryptocurrency market are still unfolding. The success of these ETFs could pave the way for more traditional financial institutions to explore similar offerings.

Market Trends to Watch

Investors and analysts alike will be closely monitoring how the market reacts to BlackRock’s announcement. Key trends to watch include:

- Price Movements: The immediate impact on the prices of Solana and XRP following the ETF announcement.

- Regulatory Developments: Any changes in regulatory frameworks that could influence the approval process for these ETFs.

- Institutional Adoption: The level of interest from other institutional investors in cryptocurrency ETFs.

Conclusion

In summary, the announcement from ETFStore President regarding BlackRock’s plans to file for Solana and XRP ETFs is a landmark event in the cryptocurrency space. It underscores the growing acceptance of digital assets by mainstream financial institutions and sets the stage for potentially significant changes in the investment landscape.

Investors should remain vigilant as this situation evolves, keeping an eye on market trends, regulatory developments, and the performance of Solana and XRP. The future looks promising for these cryptocurrencies, especially with the backing of a powerhouse like BlackRock, which could lead to increased adoption and perhaps a new era of cryptocurrency investment.

For more information and updates on cryptocurrency ETFs, stay tuned and follow the latest developments in this exciting market.

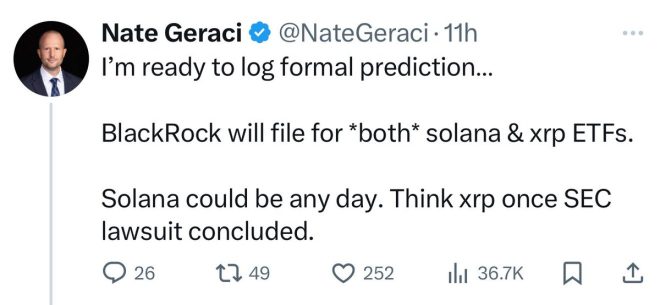

BREAKING: ETFStore President says: “BlackRock will file for both Solana and #XRP ETFs.” pic.twitter.com/lwkqEQGLq2

— JackTheRippler © (@RippleXrpie) March 14, 2025

BREAKING: ETFStore President says: “BlackRock will file for both Solana and #XRP ETFs.” pic.twitter.com/lwkqEQGLq2

— JackTheRippler © (@RippleXrpie) March 14, 2025

Understanding the ETF Landscape

The world of Exchange-Traded Funds (ETFs) has been buzzing with excitement lately, especially with major players like BlackRock stepping into the crypto arena. For those who might not be familiar, ETFs are investment funds traded on stock exchanges, much like stocks. They hold assets like stocks, commodities, or bonds and generally operate with an arbitrage mechanism designed to keep trading close to its net asset value, though they can occasionally deviate significantly.

When it comes to cryptocurrencies, the landscape is still maturing, and the introduction of crypto ETFs can be a game changer. These funds allow investors to gain exposure to digital assets without having to directly buy and store cryptocurrencies themselves.

BREAKING: ETFStore President says: “BlackRock will file for both Solana and #XRP ETFs.”

This exciting news from the ETFStore President suggests that BlackRock, one of the largest asset management firms in the world, is setting its sights on two major players in the crypto world: Solana and XRP. If this filing goes through, it could mark a significant moment in the history of cryptocurrency investment.

Solana, known for its high throughput and low transaction costs, has gained a lot of traction among developers and investors alike. Meanwhile, XRP, the cryptocurrency associated with Ripple, has been in the spotlight due to ongoing legal battles but has also demonstrated a strong use case in cross-border payments.

The potential for ETFs focusing on these cryptocurrencies could bring in new capital and broaden the investor base for both assets. Imagine retail investors, who might have been hesitant to dive into the complexities of crypto trading, suddenly able to invest in Solana and XRP through their regular brokerage accounts.

The Importance of Solana and XRP in the Crypto Market

Both Solana and XRP represent different aspects of the cryptocurrency ecosystem. Solana is celebrated for its speed and scalability, making it an attractive choice for decentralized applications (dApps) and decentralized finance (DeFi) projects. Its innovative approach to blockchain technology allows it to handle thousands of transactions per second, a feature that could appeal to institutional investors looking for solid technological foundations.

XRP, on the other hand, has positioned itself as a bridge currency for banks and financial institutions, aiming to enable faster and cheaper cross-border transactions. Ripple has established partnerships with numerous banks globally, which speaks volumes about its potential utility.

The combination of these two assets under a BlackRock ETF could be a strategic move to capture a diverse segment of the crypto market. Institutions looking to hedge against traditional financial systems may find these ETFs particularly appealing.

The Impact of BlackRock’s Entry into Crypto ETFs

Now, let’s talk about what it means for the crypto market when a giant like BlackRock decides to enter the fray. BlackRock’s involvement could legitimize cryptocurrencies in the eyes of traditional investors. Their entry might lead to increased regulatory clarity as they have the resources to work closely with regulators. This could potentially pave the way for more institutional adoption of cryptocurrencies.

Moreover, BlackRock’s influence could lead to increased liquidity in the market. With more institutional money flowing in, cryptocurrencies like Solana and XRP could experience significant price appreciation, which is great news for current investors.

Investors often look towards large asset managers for cues about market trends. If BlackRock is bullish on Solana and XRP, it might encourage other institutional investors to follow suit, creating a ripple effect throughout the crypto space.

The Future of Crypto ETFs

As the crypto market continues to evolve, the introduction of more ETFs could expand the range of investment products available. This could include not just individual cryptocurrencies but also themed ETFs that focus on sectors like DeFi, NFTs, and gaming.

With BlackRock potentially leading the charge, we might see a wave of similar filings from other asset management firms. This competition could drive innovation in the ETF space and lead to better products for investors.

However, it’s important to remember that the crypto market is inherently volatile. While ETFs can provide a more stable investment vehicle, they are still subject to the whims of the cryptocurrency market. Educating investors about the risks and benefits of investing in crypto ETFs will be crucial as this space continues to grow.

What Investors Should Consider

If you’re considering investing in Solana or XRP through a potential BlackRock ETF, there are several factors to keep in mind. First, understand the fundamentals of each cryptocurrency. What are their use cases? What technology backs them?

Second, keep an eye on the regulatory landscape. The approval of crypto ETFs has been a hot topic among regulators. While BlackRock is a formidable player, the outcome of their filing will depend on regulatory responses, which can be unpredictable.

Lastly, consider your own investment strategy. Are you looking for long-term growth, or are you a more speculative trader? This will help determine how much of your portfolio, if any, should be allocated to these ETFs once they become available.

Wrapping Up

The news of BlackRock planning to file for ETFs focused on Solana and XRP is undoubtedly exciting. This move could not only legitimize these assets in the eyes of traditional investors but also pave the way for a new era of cryptocurrency investment.

As we await further developments, it’s essential to stay informed about both the opportunities and risks that come with investing in cryptocurrencies. Whether you’re a seasoned investor or someone just dipping your toes into the crypto waters, understanding the implications of these moves will be crucial for making informed decisions.

Stay tuned for more updates as this story unfolds, and consider how these developments might impact your own investment strategy in the ever-evolving world of cryptocurrencies.