Gold Price Surge and Physical Demand: A Deep Dive

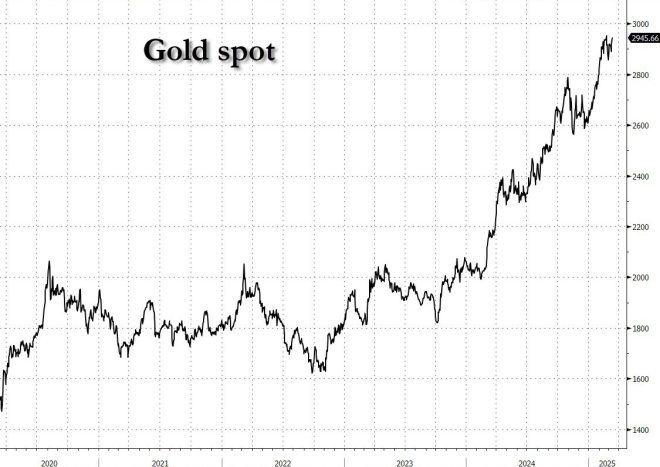

In recent financial news, gold has reached a significant milestone, breaking through the $2,945 mark, coming alarmingly close to its all-time high. This surge in price is not just a numerical increase; it signifies a growing interest and demand for gold in a tumultuous economic landscape. The ongoing trend is further highlighted by the relentless physical delivery of gold to COMEX (Commodity Exchange Inc.) vaults, marking a notable shift in market dynamics.

The Current Market Scenario

As of March 13, 2025, the price of gold has seen an unprecedented rise, with many analysts and investors closely monitoring its trajectory. This increase in value reflects a broader sentiment in the market, where uncertainty and volatility prompt investors to seek safe-haven assets. Gold, historically known for its stability, is once again taking center stage as a preferred investment during uncertain times.

Record Physical Deliveries

One of the most compelling aspects of the current gold market is the physical delivery of gold to COMEX vaults. Over the past three months, there has been a consistent influx of physical gold, amounting to a record total of 40.15 million ounces, or approximately 1,250 metric tons. This surge is notable not only for its volume but also for the implications it carries for the gold market and the economy at large.

The increased physical delivery suggests a robust demand for tangible assets, as investors move away from paper gold – such as futures contracts – to actual physical gold. This trend is indicative of a market that is becoming more cautious, with investors prioritizing the security of physical assets amidst economic uncertainty.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Factors Driving Gold Prices

Several factors are contributing to the current surge in gold prices. Firstly, geopolitical tensions and economic instability have led to increased demand for safe-haven assets. Investors often turn to gold during times of uncertainty, which explains the recent influx in demand.

Secondly, inflationary pressures are also playing a significant role. As central banks around the world implement expansive monetary policies, concerns about inflation have grown. Gold is traditionally viewed as a hedge against inflation, leading to increased purchases as investors seek to protect their wealth.

Moreover, fluctuations in currency values, particularly the U.S. dollar, can impact gold prices. A weaker dollar typically leads to higher gold prices, as it becomes cheaper for holders of other currencies to purchase gold.

The Implications of Increased Demand

The record delivery of physical gold to COMEX vaults has several implications for the market. Firstly, it may indicate a potential shortage of physical gold in the market. As demand continues to outstrip supply, prices could continue to rise, potentially breaking through previous all-time highs.

Additionally, the shift towards physical gold could lead to increased premiums on gold bullion and coins. As more investors seek out physical gold, the market may see a rise in prices not just for the gold itself but also for the associated costs of acquiring it.

Investor Sentiment and Future Outlook

Investor sentiment surrounding gold remains bullish, with many analysts predicting further increases in gold prices. The combination of ongoing economic challenges, inflation concerns, and geopolitical tensions suggests that gold will continue to be a focal point for investors seeking security.

Furthermore, as the physical delivery of gold continues to set records, it could lead to a more significant shift in how investors approach gold as an asset class. The growing preference for physical gold may encourage more individuals and institutions to diversify their portfolios with tangible assets.

Conclusion

The current surge in gold prices, alongside record physical deliveries to COMEX vaults, paints a picture of a market reacting to broader economic conditions. As gold approaches its all-time high, the implications of this trend are significant for both investors and the overall economy. The combination of geopolitical tensions, inflationary pressures, and a shift towards physical assets suggests that gold will remain a critical component of investment strategies in the foreseeable future.

In summary, the increasing price of gold and the concurrent rise in physical deliveries underscore a pivotal moment in the market. Investors are increasingly recognizing the value of gold as a safe-haven asset, leading to a robust demand that could shape the market dynamics in the coming months. As we continue to monitor these developments, it becomes clear that the gold market is entering a new phase, one characterized by heightened demand and significant opportunities for investors seeking stability in uncertain times.

Gold breaking out to $2945, just shy of all time high… meanwhile the physical scramble continues: every single day for the past 3 months physical gold has been delivered to comex vaults bringing the total to a record 40.15MM oz or 1,250 metric tons pic.twitter.com/RBC1DBiYLa

— zerohedge (@zerohedge) March 13, 2025

Gold Breaking Out to $2945: Just Shy of All-Time High

Gold has always been a hot topic for investors, but it’s recently reached a fever pitch with reports of it breaking out to $2945, just shy of its all-time high. If you’ve been following the market, you’ll know that the physical scramble for gold is real. For three whole months, physical gold has been delivered daily to COMEX vaults, bringing the total to an astounding 40.15 million ounces or 1,250 metric tons. This is significant, and it raises questions about what’s happening in the gold market right now.

Understanding the Current Gold Market Dynamics

So, what’s driving this surge in gold prices? Several factors are at play, including economic uncertainty, inflation fears, and geopolitical tensions. Investors flock to gold as a safe-haven asset during turbulent times. As the economy experiences ups and downs, gold often shines brighter. With gold breaking out to $2945, we see a clear indication that many people are seeking stability, and they’re turning to this precious metal.

The Physical Gold Scramble

Now, let’s talk about that physical gold scramble. The fact that every single day for the past three months there has been a steady stream of physical gold being delivered to COMEX vaults is remarkable. This doesn’t just represent a number; it signifies a fundamental shift in how people view gold. Investors are not just speculating; they are buying physical gold, and they want it in their hands. This trend can signal a lack of confidence in other investment vehicles, prompting people to secure their wealth in something tangible.

What Does 40.15 Million Ounces Mean?

When you hear that 40.15 million ounces of gold have been delivered to COMEX, think about what that really means. To put it into perspective, that’s enough gold to fill numerous Olympic-sized swimming pools! This record total indicates an unprecedented demand for physical gold. It shows that investors are not just betting on gold through futures or ETFs; they want the real thing. This kind of demand can lead to higher prices as supply dwindles.

Gold vs. Other Investments

It’s important to consider how gold stacks up against other investment options. With stocks fluctuating and interest rates being unpredictable, gold remains a stable choice for many. Unlike stocks or bonds, gold doesn’t rely on corporate performance or government policy. It’s a historical hedge against inflation and economic downturns. As we see gold breaking out to $2945, it’s a reminder that, especially in uncertain times, many investors are looking for a safe haven.

The Role of Central Banks

Central banks around the world are also contributing to the gold narrative. Many have been increasing their gold reserves, which further drives up demand. When central banks buy gold, it sends a strong message to the market about the importance of this asset. They’re not just buying gold for the sake of it; they’re doing so to stabilize their currencies and reduce reliance on fiat money. As they accumulate gold, it adds to the overall demand, pushing prices higher.

What’s Next for Gold Prices?

Looking ahead, many analysts are watching closely to see if gold can maintain its momentum. If the current trend continues, we might see gold surpass its all-time high. Factors like inflation rates, geopolitical tensions, and changes in interest rates will all play a role. With the physical scramble continuing and demand showing no signs of slowing down, the next few months could be pivotal for gold prices.

Investing in Physical Gold

If you’re considering investing in gold, you might be wondering how to get started. Investing in physical gold can be a straightforward process. You can purchase gold coins, bars, or even jewelry. It’s crucial to buy from reputable dealers to ensure you get quality products. Additionally, consider storage options for your gold. Many investors choose safe deposit boxes or specialized storage facilities to keep their gold secure.

The Psychological Factor

Another interesting element to consider is the psychological aspect of investing in gold. When prices rise, it can create a fear of missing out (FOMO) among investors. This can lead to more buying, further driving up prices. The current buzz around gold breaking out to $2945 might encourage more people to jump into the market. It’s a classic case of crowd mentality, and it’s something that investors should be aware of as they make their decisions.

Conclusion: Why Gold Matters Now More Than Ever

In a world filled with economic uncertainty and fluctuating markets, gold remains a cornerstone of sound investment strategy. The recent surge in prices, combined with the physical scramble for gold, underscores its significance in today’s market. Whether you’re a seasoned investor or just starting, keeping an eye on gold and understanding its dynamics can provide valuable insights into your investment strategy.

So, as we watch gold breaking out to $2945 and the scramble for physical gold continues, remember that this isn’t just a trend; it’s a reflection of broader economic forces at play. It’s a reminder that, in the realm of investments, sometimes going back to basics with gold can be the smartest move.