Death- Obituary News

Analyzing Market Movements: Insights from a Twitter Trader’s Experience

In the fast-paced world of trading, market fluctuations can lead to both opportunities and challenges. A recent tweet from a trader known as @DamnGoodTrading provides a glimpse into the emotional landscape of trading, particularly around key economic indicators like the Consumer Price Index (CPI). This analysis explores the trader’s experience and broader implications for market participants, focusing on the themes of volatility, decision-making, and risk management.

Understanding the Context: CPI and Market Reactions

The Consumer Price Index (CPI) is a critical economic indicator that measures the average change over time in the prices paid by consumers for goods and services. Traders closely monitor CPI data as it can significantly impact market sentiment and influence Central Bank decisions regarding interest rates. In the tweet, the trader expressed a strong belief that the CPI would lead to a market sweep, indicating a bullish sentiment. However, the unexpected market behavior led to an unrealized loss, illuminating the unpredictable nature of trading.

Emotional Impact of Trading Decisions

The trader’s use of the phrase "got cooooked" reflects the emotional toll that trading can take. This sentiment resonates with many traders who have experienced the stress of making decisions in volatile markets. The mention of an "unrealized loss" signifies that the trader has not yet closed their position, indicating a hope that the market will turn in their favor. Emotional resilience and decision-making under pressure are crucial skills for any trader, as they navigate the often tumultuous waters of market fluctuations.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Market Volatility

The trader’s reference to "all that chop action" highlights a common experience among traders: the challenges of navigating a choppy market. Choppy markets, characterized by frequent price fluctuations without a clear trend, can be particularly difficult to trade. The trader’s experience serves as a reminder that volatility can create both opportunities and risks. For those in the trading community, understanding how to manage trades during volatile periods is essential for long-term success.

Strategies for Managing Risk

In light of the trader’s experience, it’s pertinent to discuss risk management strategies that can help traders navigate uncertain market conditions. Here are several key strategies:

- Setting Stop-Loss Orders: Implementing stop-loss orders can help limit potential losses by automatically closing a position at a predetermined price point. This strategy can provide traders with a safety net during volatile market conditions.

- Diversification: Spreading investments across different asset classes can reduce risk. By diversifying, traders can mitigate the impact of adverse market movements in a single asset.

- Position Sizing: Proper position sizing is essential for managing risk. Traders should determine the size of their trades based on their risk tolerance and the volatility of the market.

- Emotional Discipline: Maintaining emotional discipline is crucial for successful trading. Traders should strive to make decisions based on data and analysis rather than emotions, especially during times of high volatility.

- Continuous Learning: The trading landscape is constantly evolving. Staying informed about market trends, economic indicators, and trading strategies can help traders adapt and make informed decisions.

The Importance of Community and Shared Experiences

The trading community on platforms like Twitter serves as a valuable resource for sharing experiences, insights, and strategies. The tweet from @DamnGoodTrading highlights how traders often seek validation and support from their peers. Engaging with the trading community can help individuals learn from each other’s successes and failures, fostering a sense of camaraderie in the face of market challenges.

Conclusion: Navigating the Complex World of Trading

The experience shared by @DamnGoodTrading underscores the complexities and emotional challenges of trading in a volatile market. As traders react to economic indicators like the CPI, they must navigate uncertainty and potential losses. By implementing effective risk management strategies and engaging with the trading community, traders can enhance their ability to succeed in the ever-changing financial landscape.

In summary, the insights from this tweet serve as a reminder of the importance of emotional resilience, informed decision-making, and community support in trading. Whether you’re a seasoned trader or just starting, understanding the dynamics of the market and learning from the experiences of others can lead to more informed and successful trading endeavors.

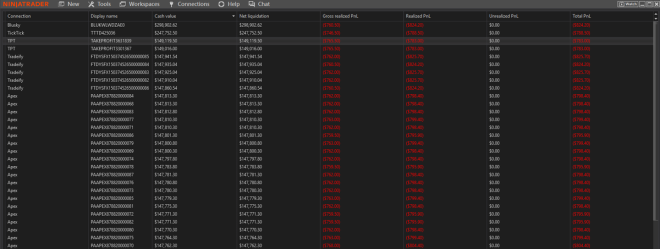

Thought for sure we were sweeping CPI highs EOD but was wrong and got cooooked. Unrealized loss is more than this because of all that chop action rip rip. $NQ $ES pic.twitter.com/uehAeVMgyN

— Damn Good Trading (@DamnGoodTrading) March 12, 2025

Thought for Sure We Were Sweeping CPI Highs EOD but Was Wrong and Got Cooooked

Trading can feel like a rollercoaster ride, especially when you’re convinced that the market is about to move in your favor. This sentiment is beautifully captured in a recent tweet from Damn Good Trading, where they expressed their expectation to sweep CPI highs by the end of the day (EOD) but ended up facing unexpected losses. It’s moments like these that keep traders on their toes, reminding us of the volatile nature of the markets.

Understanding CPI and Its Impact on Trading

When we talk about CPI, or the Consumer Price Index, we’re diving into one of the critical indicators of economic health. CPI measures the average change over time in the prices paid by urban consumers for a basket of goods and services. Traders closely monitor CPI data because it can significantly influence market sentiment and, consequently, trading decisions.

Expectations around CPI can lead to increased volatility in the markets, making it a double-edged sword. As the tweet suggests, many traders thought the market was poised for a breakout as the CPI figures were released. However, the reality was quite different, leading to what some might call a ‘chop action’—a period of indecisive price movements that can cause unrealized losses for traders who are caught on the wrong side.

Unrealized Loss Is More Than This Because of All That Chop Action

Unrealized losses can be a painful aspect of trading, especially when you’ve done your homework and still end up on the losing side. The tweet captures this feeling perfectly. The phrase “chop action” refers to market movements that don’t lead anywhere definitive, often frustrating traders who are looking for clear trends.

The unpredictability of the market means that even seasoned traders can find themselves in a tough spot. If you’ve ever felt the sting of unrealized losses, you’re not alone. It’s essential to remember that these losses are part of the trading journey and can serve as valuable learning experiences.

Rip Rip: The Emotional Rollercoaster of Trading

The term “rip rip” evokes a sense of urgency and excitement in trading lingo. It’s that moment when traders feel the adrenaline rush as prices surge, and they believe they’ve made the right call. But this feeling can quickly turn sour, as the tweet illustrates. The emotional rollercoaster of trading is something that every trader faces.

Whether you’re trading futures, stocks like $NQ, or indices like $ES, the highs and lows can be exhilarating yet exhausting. It’s crucial to manage your emotions, especially during volatile times. Remember, staying level-headed is key to making sound trading decisions.

The Importance of Risk Management in Trading

One of the most critical aspects of trading is risk management. The tweet serves as a reminder that even the best predictions can go awry, leading to substantial losses. Having a solid risk management strategy in place can help mitigate these losses when the market doesn’t behave as anticipated.

Setting stop-loss orders, diversifying your portfolio, and not risking more than you can afford to lose are all vital components of effective risk management. By implementing these strategies, you can safeguard your trading capital against unforeseen market movements, much like the unexpected chop action described in the tweet.

Learning from the Market: A Trader’s Perspective

Every trader has had their share of losses. The key is to learn from these experiences. The tweet from Damn Good Trading reflects a moment of vulnerability, which is essential in trading. Acknowledging mistakes and analyzing what went wrong can provide invaluable insights for future trades.

It’s also beneficial to engage with the trading community. Sharing experiences, whether they’re wins or losses, can help you gain perspective and learn new strategies. Following traders on platforms like Twitter can provide real-time insights and foster a sense of camaraderie among traders navigating similar challenges.

Embrace the Journey: Trading as a Continuous Learning Experience

Trading isn’t just about making quick profits; it’s a continuous journey of learning and growth. The emotional highs and lows, as expressed in the tweet, are part of what makes trading so compelling. Embracing this journey can lead to a more fulfilling trading experience.

Consider keeping a trading journal to document your trades, thoughts, and feelings. This practice can help you identify patterns in your trading behavior and improve your decision-making process over time. By reflecting on both your successes and setbacks, you can develop a more resilient and informed approach to trading.

Building a Community: Connecting with Other Traders

Trading can often feel like a solitary endeavor, but building a community can enhance your experience. Engaging with fellow traders allows you to share insights, strategies, and even your losses—like the one mentioned in the tweet. Platforms like Twitter, Reddit, and various trading forums can be excellent places to connect with others who share your passion for trading.

By joining discussions and following experienced traders, you can gain valuable insights into market trends and trading strategies. Plus, having a support system can help you navigate the emotional challenges that come with trading.

Stay Informed: The Importance of Market Research

Staying informed about market trends and economic indicators like CPI is crucial for any trader. The unexpected nature of the markets, as highlighted in the tweet, underscores the need to stay updated with the latest news and analysis. Subscribe to reputable financial news sources, follow market analysts, and engage with educational content to sharpen your trading skills.

Moreover, understanding how various economic reports impact market sentiment can help you make more informed trading decisions. Knowledge is power in trading, and the more you know, the better equipped you’ll be to navigate the complexities of the market.

Wrapping Up Your Trading Journey

Trading is a challenging yet rewarding endeavor that requires a combination of knowledge, emotional resilience, and community support. The experiences shared in the tweet resonate with many traders, emphasizing the importance of managing expectations and understanding the market’s unpredictable nature.

By developing a solid risk management strategy, engaging with fellow traders, and continuously learning from your experiences, you can turn the challenges of trading into opportunities for growth. Remember, every trader faces ups and downs, and it’s how you respond to these challenges that will ultimately define your success in the market.

“`

This HTML formatted article captures the essence of trading experiences as reflected in the tweet, focusing on the challenges, emotional aspects, and the importance of community and learning in the trading journey.