Bitcoin Price Analysis: Key Support Levels and Predictions

In the ever-evolving world of cryptocurrency, Bitcoin remains a focal point for investors and traders alike. Recently, a significant update from CryptoQuant has attracted attention by indicating that Bitcoin’s price could face critical support challenges in the near future. Here’s a comprehensive summary of the current situation, key price levels, and what they mean for the cryptocurrency market.

Current Bitcoin Price Overview

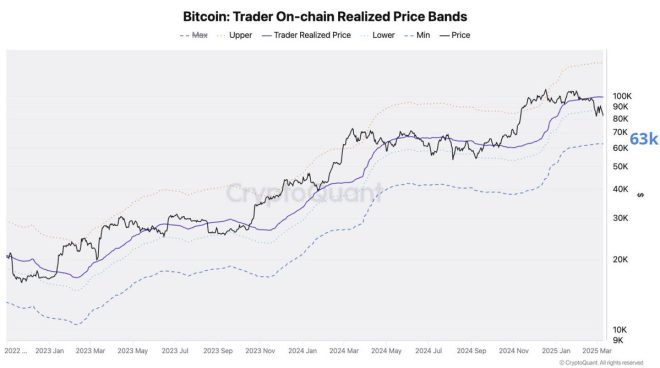

As of the latest reports, Bitcoin is trading within a crucial range, specifically between $75,000 and $78,000. This range is particularly important as it serves as a support level just below the Realized Price lower band. The Realized Price is a metric that reflects the average price at which all bitcoins were last moved, acting as a crucial benchmark for assessing market health.

Importance of the Support Level

According to the insights shared by Coin Bureau via Twitter, if Bitcoin fails to maintain this support level between $75,000 and $78,000, it could potentially drop to a more concerning level of $63,000. This target aligns with the Realized Price minimum band, which is often viewed as a critical support level during periods of deeper market corrections.

What Happens If Bitcoin Breaks Support?

The implications of a breakdown below the $75,000 to $78,000 support range can be significant. A fall to $63,000 would not only indicate a bearish trend but could also trigger panic among investors, leading to further selling pressure. This scenario could create a cascading effect, where more investors opt to exit their positions, further driving down the price.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Historical Context and Market Sentiment

Historically, Bitcoin has shown resilience and the ability to recover from significant dips. However, market sentiment plays a crucial role in price movements. If fear and uncertainty dominate the market, investors may hesitate to buy the dip, prolonging any bearish trends. Conversely, if Bitcoin can hold the support level and show signs of recovery, it could restore confidence among investors, leading to a potential rally upwards.

Potential Recovery Scenarios

Should Bitcoin manage to maintain its position above the crucial support levels, analysts predict a possible price rally that could target previous highs. The psychological barrier of $80,000 is a significant milestone that many investors have their sights set on. Positive news and developments within the cryptocurrency space, such as regulatory clarity or technological advancements, could serve as catalysts for a price increase.

The Role of Market Indicators

Investors should keep an eye on various market indicators that can provide insights into Bitcoin’s price trajectory. Metrics such as trading volume, market sentiment indicators, and on-chain data can help gauge whether the current support levels will hold. Additionally, traders often use technical analysis tools to identify patterns and potential reversal points.

The Broader Crypto Market Impact

Bitcoin’s performance often sets the tone for the broader cryptocurrency market. A significant drop in Bitcoin’s price can lead to declines across altcoins, as investors tend to sell off their holdings to minimize losses. Conversely, a strong performance by Bitcoin can lead to an upward trend in altcoins, creating a bullish environment across the market.

Conclusion: What Lies Ahead for Bitcoin?

In conclusion, Bitcoin is currently at a critical juncture, with support levels ranging from $75,000 to $78,000 being pivotal for its future price trajectory. Failure to maintain this support could lead to a decline towards $63,000, creating potential panic within the market. However, if Bitcoin can stabilize and recover, it may pave the way for further gains and a bullish market sentiment.

Investors should remain vigilant and continuously assess market conditions, keeping an eye on the factors that influence Bitcoin’s price. As always, it is crucial to conduct thorough research and consider both technical analysis and market fundamentals when making investment decisions in the volatile cryptocurrency landscape.

Stay updated with the latest news and insights to navigate the exciting world of Bitcoin and cryptocurrency effectively.

JUST IN: According to CryptoQuant, if Bitcoin fails to hold its support between $75K and $78K (just below the Realized Price lower band), its next target could be $63K.

This level aligns with the Realized Price minimum band, marking key support during deeper corrections. pic.twitter.com/Oe2rqeuuzo— Coin Bureau (@coinbureau) March 12, 2025

JUST IN: According to CryptoQuant, if Bitcoin fails to hold its support between $75K and $78K (just below the Realized Price lower band), its next target could be $63K.

Bitcoin, the king of cryptocurrencies, has been on a wild ride lately. If you’re keeping an eye on the market, you might have heard the recent alert from CryptoQuant. They’ve pointed out that if Bitcoin doesn’t manage to hold its support level between $75,000 and $78,000, we could be looking at a potential drop to around $63,000. This isn’t just some random speculation; it’s based on solid data and analysis.

This level aligns with the Realized Price minimum band, marking key support during deeper corrections.

Now, what does this mean for us? The Realized Price is an important metric used to analyze the price at which all Bitcoins were last moved. When Bitcoin is trading below this price, it often indicates that many investors are sitting on losses, which can lead to panic selling and further price drops. The $63,000 level is particularly critical as it aligns with the Realized Price minimum band, a crucial support area during deeper corrections. If Bitcoin falls below this level, we might see even more significant selling pressure.

Understanding Bitcoin’s Support Levels

Support levels are like safety nets for Bitcoin. They are price points where the cryptocurrency tends to bounce back after a decline. The current support zone between $75K and $78K has been relatively strong, but if it breaks, it could signal a shift in market sentiment. Traders and investors often use these support levels to make decisions about buying or selling. If you’re in the market, it’s wise to keep an eye on these levels.

Why Is the $63K Target Significant?

The potential drop to $63K isn’t just a random number; it has significant implications. For one, it represents a psychological barrier. Many investors view round numbers as critical points for buying and selling. If Bitcoin falls to $63K, it could trigger a wave of selling as traders look to cut their losses or react to market fear. This level also coincides with historical price action, where Bitcoin has previously found support during corrections.

Analyzing Market Sentiment

Market sentiment plays a huge role in Bitcoin’s price movements. When traders feel optimistic, prices tend to rise. Conversely, fear can lead to rapid declines. Right now, there’s a mix of bullish and bearish sentiment in the market. Analysts are divided on whether Bitcoin will hold its current support or whether we’ll see a drop to $63K. It’s essential to stay updated with the latest news and trends, as market sentiment can shift quickly.

What Are the Risks?

Investing in Bitcoin comes with inherent risks, and understanding these risks is crucial. If Bitcoin fails to hold its support and drops to $63K, it could lead to panic selling among investors. Additionally, external factors such as regulatory changes, macroeconomic conditions, and technological developments can all impact Bitcoin’s price. Keeping informed about these factors can help you make better investment decisions.

Strategies for Navigating Bitcoin’s Volatility

The volatility of Bitcoin can be both a curse and a blessing. For traders, it offers opportunities for profit, but for long-term investors, it can be nerve-wracking. Here are some strategies to help you navigate this volatile landscape:

- Dollar-Cost Averaging: This approach involves investing a fixed amount regularly, regardless of price. It helps mitigate the impact of market fluctuations.

- Set Stop-Loss Orders: To protect your investment, consider setting stop-loss orders to limit potential losses if the price drops below a certain level.

- Stay Informed: Follow reliable sources like CryptoQuant and other market analysts to keep up with trends and price predictions.

- Understand Your Risk Tolerance: Know how much you can afford to lose and invest accordingly. This will help you stay calm during market downturns.

Historical Context of Bitcoin’s Price Movements

To understand where Bitcoin might be headed, it’s helpful to look back at its historical price movements. Bitcoin has experienced multiple bull and bear cycles. Each time it has corrected, it has found new support levels, which are often higher than previous ones. This historical context can provide valuable insights into potential future movements, especially as we analyze current trends.

The Role of Market Indicators

Market indicators such as the Relative Strength Index (RSI), Moving Averages, and trading volume can offer additional insights into Bitcoin’s price trajectory. The RSI, for example, can indicate whether Bitcoin is overbought or oversold, giving traders clues about potential reversals. Similarly, moving averages can help identify trends, while trading volume can indicate the strength of a price movement.

Conclusion: Preparing for Possible Outcomes

Bitcoin’s price action is unpredictable, and while the alert from CryptoQuant has raised eyebrows, it’s essential to approach this information with a balanced perspective. Whether Bitcoin holds its support between $75K and $78K or drops to $63K, preparation is key. By staying informed and employing effective strategies, you can navigate the ever-changing cryptocurrency landscape with greater confidence.

So, what’s your take? Are you bullish or bearish on Bitcoin’s short-term prospects? Whatever your stance, make sure you’re armed with the right information as you make your investment decisions.