Breaking News: €10 Trillion Plan for EU Defence

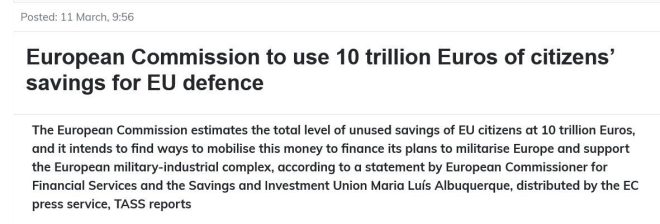

In a shocking announcement, the European Commission has unveiled plans to allocate a staggering €10 trillion from citizens’ savings for the purpose of bolstering EU defence initiatives. This revelation, which has sparked significant concern among the public and financial analysts alike, raises questions about the security of personal savings in European banks and the implications for citizens across Europe.

Understanding the €10 Trillion Defence Initiative

The proposed €10 trillion expenditure is aimed at enhancing the military capabilities and overall defence posture of the European Union. This initiative is a response to increasing global tensions and the perceived need for a unified defence strategy within Europe. However, the announcement has raised alarm bells as it suggests a potential risk to private citizens’ savings.

Implications for Citizens’ Savings

The notion of the European Commission tapping into citizens’ savings has led to widespread unease. Many are interpreting this move as a direct threat to financial security. The call to action from financial commentator Financelot, urging individuals to withdraw their money from European banks, underscores the gravity of the situation. This recommendation reflects a growing concern that the EU may implement measures that could jeopardize personal finances.

The Importance of Financial Security

In an era where financial stability is crucial, citizens are understandably anxious about the implications of such a large-scale initiative. The fear of losing hard-earned savings to governmental policies can lead to a lack of trust in financial institutions. As citizens grapple with this news, it is essential to consider the broader context of financial security within the EU.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Response from Financial Experts

Financial experts are weighing in on the potential consequences of the European Commission’s plans. Many analysts emphasize the importance of safeguarding personal assets and recommend that citizens stay informed about the developments related to this initiative. They advise individuals to consider diversifying their investments and exploring alternative banking options to mitigate risks.

Should You Withdraw Your Money?

Given the alarming news, many are left wondering whether they should follow Financelot’s advice and withdraw their money from European banks. While it is always prudent to have a financial plan in place, experts caution against making hasty decisions. Instead, citizens should conduct thorough research, assess their financial situations, and consult with financial advisors before taking any drastic actions.

The Political Landscape

The political implications of the European Commission’s plans cannot be overlooked. As governments navigate the complexities of defence funding, public sentiment may shift. Citizens are likely to demand transparency and accountability from their leaders, leading to potential political ramifications for those in power.

The Role of the EU in Global Defence

As the EU seeks to strengthen its defence capabilities, it is essential to understand the geopolitical landscape. The decision to allocate such a significant amount of funds towards defence highlights the EU’s commitment to playing a more prominent role on the global stage. However, this commitment must be balanced with the needs and concerns of its citizens.

Conclusion: A Call for Vigilance

The announcement of the €10 trillion defence initiative by the European Commission has raised critical questions about the security of personal savings and the overall financial landscape in Europe. As citizens grapple with this news, it is vital to remain vigilant and informed. While the call to withdraw funds from banks may resonate with many, it is crucial to approach the situation with careful consideration and a well-thought-out financial plan.

In the coming days and weeks, the developments surrounding this initiative will undoubtedly unfold, and citizens must stay engaged in the conversation. Balancing the need for a robust defence strategy with the protection of individual financial security will be a significant challenge for the EU moving forward.

Stay Informed

As this situation evolves, it is essential to keep abreast of the latest news and developments. Engaging with financial experts, participating in discussions, and staying informed about the implications of the EU’s defence plans will empower citizens to make informed decisions about their financial futures. The intersection of politics, finance, and security is more crucial than ever in shaping the future of Europe.

BREAKING: The European Commission plans to take €10 trillion of citizens’ savings for EU defence

*Get your money out of European banks. https://t.co/wfYpqhq0cx pic.twitter.com/a9my820H0M

— Financelot (@FinanceLancelot) March 12, 2025

BREAKING: The European Commission plans to take €10 trillion of citizens’ savings for EU defence

The recent announcement from the European Commission has sent shockwaves across the continent. With a plan to potentially take €10 trillion of citizens’ savings for EU defence, many are left questioning the implications of such a move. This could fundamentally change the relationship between citizens and their governments, and it’s essential to understand what this means for your savings and financial security.

Why would the European Commission propose such a drastic measure? The idea is to bolster EU defence capabilities, especially in light of rising geopolitical tensions and the need for a more unified military strategy. However, the question remains: should citizens foot the bill for these ambitions?

*Get your money out of European banks.

In response to these developments, financial experts are advising individuals to reconsider their savings strategies. The advice to “get your money out of European banks” might sound alarmist, but it reflects a growing concern over the stability of the banking system in light of these proposed changes. With such a significant amount of money at stake, it’s essential to explore your options and protect your hard-earned savings.

So, what can you do? First, consider diversifying your assets. This could mean investing in real estate, precious metals, or even cryptocurrencies. These assets often provide a hedge against inflation and government interference. Additionally, having a portion of your savings in foreign banks could also be a wise move, as it may insulate you from local economic policies.

The Rationale Behind the Proposal

Understanding the rationale behind the European Commission’s proposal is crucial. The EU has been under pressure to enhance its defence capabilities, especially considering the shifting geopolitical landscape. The ongoing conflicts in Eastern Europe and the need to respond to challenges from global powers have created a sense of urgency.

Increased military spending is often justified as a necessity for national security. However, the idea of using citizens’ savings as a funding source raises ethical questions. Shouldn’t governments find other ways to finance their defence needs without directly impacting individual citizens?

The Risks of Centralized Control

Centralized control over citizens’ savings can lead to significant risks. History is replete with examples where governments have mismanaged funds, leading to economic instability. When trust in institutions erodes, people often seek alternative ways to secure their finances. This has been evident in recent trends where citizens are increasingly turning to decentralized finance (DeFi) and cryptocurrencies as safer alternatives.

Moreover, the implications of a government taking control of personal savings can have far-reaching consequences. It could lead to a lack of confidence in the banking system, prompting a rush to withdraw funds. This, in turn, could destabilize the financial sector, creating a vicious cycle of economic decline.

The Role of Public Opinion

Public sentiment plays a critical role in shaping government policy. With many citizens likely to oppose the idea of having their savings commandeered for defence, it’s essential for individuals to voice their concerns. Engaging in discussions, writing to representatives, and participating in public forums can help amplify public opinion against such measures.

Awareness is key. Sharing information about the potential consequences of this proposal can help mobilize citizens to take action. The more informed the public is, the more pressure there will be on the European Commission to reconsider its decision.

Alternatives to Traditional Banking

Given the current climate, exploring alternatives to traditional banking systems is more crucial than ever. Digital wallets, peer-to-peer lending platforms, and investment in assets like gold and silver can provide individuals with more control over their savings.

Cryptocurrencies, while volatile, have gained popularity as a means of safeguarding wealth from governmental overreach. Decentralized finance offers an innovative approach, allowing individuals to manage their finances without relying on traditional banks. This shift could empower citizens and reduce the risks associated with centralized control.

What This Means for the Future

The implications of the European Commission’s plans extend far beyond immediate financial concerns. If this proposal gains traction, it could set a precedent for how governments interact with their citizens’ finances. The balance of power between the state and individual rights is a delicate one, and any shift towards government control can lead to long-term ramifications.

As citizens, it’s essential to remain vigilant and proactive. Keeping abreast of government policies, understanding personal finance, and advocating for change are all vital steps to ensure that individual rights and economic stability are preserved.

Staying Informed and Prepared

In a rapidly changing financial landscape, staying informed is your best defense. Regularly check reputable news sources and financial analysis platforms to understand how proposed changes might affect you. Websites like [Reuters](https://www.reuters.com/) and [Bloomberg](https://www.bloomberg.com/) offer insights into financial policies and economic forecasts.

Additionally, consider following financial experts on social media and engaging in online communities focused on personal finance. This can provide you with diverse perspectives and strategies to safeguard your wealth.

The Need for Transparency

Transparency is vital in any financial system. Citizens have the right to know how their money is being used and to hold their governments accountable. The European Commission’s proposal should be subject to public debate and scrutiny, ensuring that all voices are heard before any drastic measures are taken.

Advocating for transparency can lead to more responsible governance. Citizens should demand clear communication from their leaders about financial policies and the implications for personal savings. This dialogue can foster trust and collaboration between the government and its citizens.

Conclusion: Taking Action

The proposal to take €10 trillion of citizens’ savings for EU defence is a significant development that requires careful consideration and action from individuals across Europe. It’s time to take charge of your financial future.

Explore options to safeguard your savings, diversify your investments, and stay informed about governmental changes. Whether it’s engaging in discussions, advocating for transparency, or considering alternative financial systems, every action counts in protecting your wealth from potential government overreach.

This is a crucial moment in the relationship between citizens and their governments, and how we respond today will shape the future of financial security in Europe.