Breaking News: Anticipated Rate Cut and Its Impact on Bitcoin

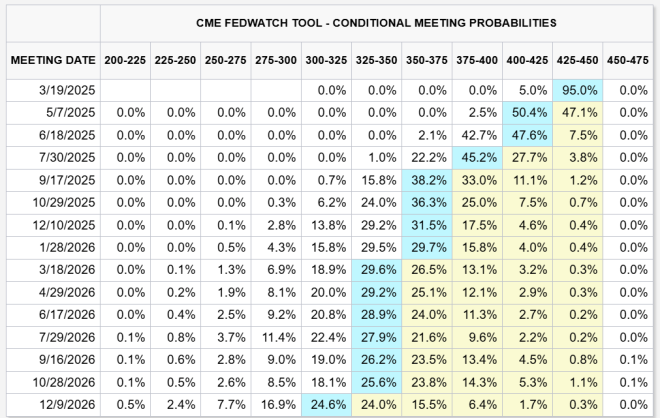

In a significant development for the financial markets, analysts are predicting that the next interest rate cut by the Federal Reserve will occur on May 7th. This forecast has sparked considerable excitement, particularly among cryptocurrency enthusiasts, as it is seen as a bullish signal for Bitcoin. The news has been widely circulated, including a tweet from prominent crypto influencer Crypto Rover, which highlights the potential implications of this anticipated rate cut for Bitcoin and the broader market.

Understanding Interest Rates and Their Influence on the Market

Interest rates set by central banks, such as the Federal Reserve in the United States, are crucial in shaping economic activity. When rates are lowered, borrowing costs decrease, which can stimulate spending and investment. This often leads to increased liquidity in the market, benefiting various asset classes, including stocks and cryptocurrencies.

The Significance of the May 7th Rate Cut Prediction

The prediction that the next rate cut will occur on May 7th is particularly noteworthy for several reasons:

- Market Sentiment: The anticipation of a rate cut generally creates a positive sentiment in the market. Investors tend to react favorably to the prospect of lower interest rates, as it suggests a more accommodating monetary policy that can foster growth.

- Bullish Outlook for Bitcoin: Bitcoin, as a decentralized digital asset, often serves as a hedge against inflation and economic instability. When interest rates are low, the opportunity cost of holding non-yielding assets like Bitcoin decreases, making it more attractive to investors. This has historically led to price increases for Bitcoin during periods of monetary easing.

- Increased Institutional Interest: As traditional financial institutions become more involved in the cryptocurrency space, the correlation between Bitcoin and interest rates is becoming more evident. A rate cut could entice more institutional investors to allocate funds into Bitcoin, further driving demand and price appreciation.

The Role of Bitcoin in a Low-Interest-Rate Environment

Bitcoin has gained popularity as a "digital gold" in recent years, particularly during times of economic uncertainty. In a low-interest-rate environment, several factors contribute to Bitcoin’s appeal:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Inflation Hedge: With central banks lowering rates, concerns about inflation rise. Bitcoin, with its capped supply of 21 million coins, is seen as a store of value that can preserve purchasing power in the face of currency devaluation.

- Diversification: Investors are increasingly looking for alternative assets to diversify their portfolios. Bitcoin offers a unique investment opportunity that is distinct from traditional equities and bonds.

- Global Adoption: As more individuals and businesses adopt Bitcoin for transactions and investment, its utility and demand continue to grow. The anticipation of a rate cut could accelerate this trend, as more people seek to capitalize on potential price increases.

The Broader Economic Context

It’s essential to consider the broader economic context surrounding the predicted rate cut. Several factors are influencing the Federal Reserve’s decision-making process:

- Inflation Rates: Inflation has been a significant concern for policymakers. As inflation rates fluctuate, the Fed must balance the need to support economic growth while keeping inflation in check.

- Economic Growth: The overall health of the economy plays a critical role in determining interest rates. If economic indicators suggest slowing growth, the Fed may opt to lower rates to stimulate activity.

- Geopolitical Factors: Global events, such as trade tensions and geopolitical unrest, can influence economic conditions and, in turn, monetary policy decisions.

The Market Reaction to Rate Cut Predictions

Market participants are often quick to react to predictions regarding interest rate changes. Following the announcement of the expected rate cut on May 7th, we may witness:

- Price Movements in Bitcoin: Historically, Bitcoin has experienced price surges in anticipation of rate cuts. Traders and investors may begin to position themselves for potential gains, leading to increased buying activity.

- Volatility in Traditional Markets: While Bitcoin may benefit from the rate cut, traditional markets could experience volatility as investors reassess their strategies in light of changing economic conditions.

- Increased Media Attention: As the date approaches, media coverage of Bitcoin and the predicted rate cut will likely intensify, drawing more attention from retail investors and the general public.

Preparing for the Potential Impact of the Rate Cut

Investors should consider several strategies as they prepare for the potential impact of the anticipated rate cut:

- Stay Informed: Keeping up with economic news and developments related to interest rates and monetary policy will help investors make informed decisions regarding their portfolios.

- Diversify Investments: Given the uncertainty surrounding economic conditions, diversifying investments across various asset classes can mitigate risks and enhance potential returns.

- Long-Term Perspective: While short-term price movements may be influenced by market sentiment and speculation, maintaining a long-term investment perspective is crucial for navigating volatility in the cryptocurrency market.

Conclusion

The predicted interest rate cut on May 7th represents a pivotal moment for the financial markets, particularly for Bitcoin and the cryptocurrency space. As investors brace for potential changes in monetary policy, the bullish sentiment surrounding Bitcoin is likely to grow. Understanding the implications of interest rate changes and their impact on asset prices will be essential for navigating the evolving financial landscape. By staying informed and adopting strategic investment approaches, individuals can position themselves to capitalize on the opportunities that may arise from this significant economic development.

BREAKING:

THE MARKET IS PRICING IN THE NEXT RATE CUT TO HAPPEN ON MAY 7th.

THIS IS BULLISH FOR #BITCOIN!!! pic.twitter.com/tCG5rHnKPe

— Crypto Rover (@rovercrc) March 11, 2025

BREAKING:

THE MARKET IS PRICING IN THE NEXT RATE CUT TO HAPPEN ON MAY 7th.

Hey there! If you’re following the financial markets, you probably caught the recent buzz about the anticipated rate cut scheduled for May 7th. It’s a hot topic among traders, economists, and Bitcoin enthusiasts alike. But what does this really mean for you, and why is it generating so much excitement? Let’s dive in!

What’s Happening with the Rate Cut?

The latest news indicates that the market is gearing up for a significant change in monetary policy with a potential rate cut. When interest rates are decreased, borrowing becomes cheaper for consumers and businesses alike. This often leads to increased spending and investment, which can stimulate economic growth. Intriguingly, the chatter surrounding this upcoming rate cut has been more than just financial jargon; it’s sparked a bullish sentiment in various markets, especially in the realm of cryptocurrency.

Why the Buzz Around Bitcoin?

When the announcement of the rate cut hit the news, many analysts quickly pointed out its implications for Bitcoin. Historically, Bitcoin has shown a tendency to thrive in lower interest rate environments. Why? Well, lower rates often drive investors toward alternative assets, and Bitcoin fits that bill perfectly. As traditional investments like bonds yield less, investors may seek higher returns from assets like Bitcoin, pushing its price upwards.

Understanding Market Psychology

The psychology of the market plays a significant role in how assets are traded. When news breaks about a potential rate cut, it can create a ripple effect, leading to increased buying activity as investors anticipate future gains. In this case, the sentiment that “this is bullish for Bitcoin” isn’t just a casual remark; it reflects a collective belief that Bitcoin’s value will appreciate as more individuals and institutions look to hedge against inflation and currency devaluation. The community is buzzing, and rightfully so!

How Rate Cuts Affect the Economy and Bitcoin

To understand the implications fully, let’s break it down. Rate cuts typically stimulate the economy by encouraging spending and investment. However, they can also lead to fears of inflation. As the money supply increases, the value of fiat currencies can diminish, driving people to look for alternatives—like Bitcoin. This digital asset is viewed as a store of value, often referred to as “digital gold.” With the expectation of inflation, more investors may flock to Bitcoin, further driving its price upside.

The Role of Institutional Investors

Another angle to consider is the growing interest from institutional investors. Large-scale purchases by companies and investment funds can significantly influence Bitcoin’s market dynamics. When rate cuts are announced, institutional investors are likely to reassess their portfolios, potentially increasing their exposure to Bitcoin. The entry of institutional money into the crypto space has already shown to stabilize and propel prices, making this aspect even more exciting for everyday investors.

Potential Risks to Consider

While the bullish sentiment surrounding Bitcoin in light of the impending rate cut is strong, it’s crucial to remain cautious. Markets can be unpredictable. If the rate cut doesn’t happen as anticipated, or if the economic conditions worsen, Bitcoin could face significant volatility. Moreover, regulatory concerns and market corrections can also impact the price dramatically. Therefore, while it’s great to be optimistic, always keep an eye on the broader economic landscape.

Staying Informed

As an investor or someone interested in cryptocurrencies, staying informed is essential. Following reliable sources and expert opinions can help you navigate these waters better. Platforms like CoinDesk and The Block regularly provide insights and updates on market trends and regulatory changes. Keeping an eye on these developments can better equip you to make informed decisions.

Conclusion

The anticipation of the upcoming rate cut on May 7th has undoubtedly stirred excitement in the markets, particularly for Bitcoin enthusiasts. This environment presents a unique opportunity, but it also comes with its share of risks. By understanding the underlying economic principles, staying informed, and carefully considering your investment strategies, you can navigate this evolving landscape more effectively. Whether you’re a seasoned trader or a newcomer to Bitcoin, the next few weeks promise to be intriguing.