Trump’s Crypto Portfolio: A Major Loss

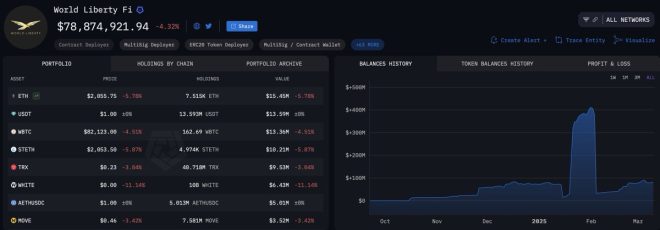

In an unexpected revelation, it has come to light that former President Donald Trump has incurred significant losses in his cryptocurrency investments, amounting to over $110 million. This startling news has sparked discussions in both the financial and political arenas, as many are curious about the implications of such losses for a figure as prominent as Trump.

Understanding the Context of Crypto Investments

Cryptocurrency has become a hot topic over the past few years, attracting both seasoned investors and newcomers. The volatility of these digital assets can lead to dramatic fluctuations in value, making them both a risky and potentially lucrative investment. Trump’s involvement in cryptocurrency adds a layer of intrigue, especially considering his previous statements regarding the digital currency market.

Details of the Loss

According to a recent tweet by Crypto Rover, a well-known figure in the cryptocurrency community, Trump has not liquidated his crypto holdings despite facing a staggering loss. This decision to hold onto his investments despite market downturns aligns with a common strategy among long-term investors who believe in the potential recovery of their assets over time.

The tweet, which has garnered significant attention, emphasizes that Trump is experiencing the same challenges as everyday investors in the crypto space. The phrase "He’s just one of us" suggests a relatable quality to his financial situation, highlighting that even high-profile investors can face the harsh realities of the crypto market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Broader Implications

Trump’s losses in his cryptocurrency investments could have broader implications beyond just his personal finances. As a public figure and former president, his financial decisions can influence public perception and the behavior of other investors. If Trump were to make a public statement regarding his investments, it could sway the opinions of his followers and impact market trends.

The Current State of the Crypto Market

The cryptocurrency market has been characterized by its volatility, with values rising and falling dramatically over short periods. Several factors contribute to these fluctuations, including regulatory news, technological advancements, and shifts in investor sentiment. Trump’s losses come at a time when the market is experiencing increased scrutiny and volatility, which could deter potential investors from entering the space.

The Future of Cryptocurrency Investments

As the crypto landscape continues to evolve, investors, including notable figures like Trump, must navigate the challenges and opportunities presented by this dynamic market. The key takeaway from Trump’s situation is the importance of conducting thorough research and understanding the risks associated with cryptocurrency investments.

Long-term investors often adopt a "buy and hold" strategy, believing that market downturns are temporary and that their assets will appreciate over time. However, this approach requires patience and a strong belief in the underlying technology and market fundamentals.

Conclusion

Trump’s reported loss of over $110 million in his cryptocurrency portfolio serves as a reminder of the inherent risks associated with digital asset investments. As the market matures, both individual and institutional investors will need to adapt their strategies to navigate the complexities of this evolving financial landscape.

The revelation that Trump has not sold any of his crypto holdings may resonate with many investors who are also facing similar challenges. It highlights the universal nature of investment struggles, regardless of one’s financial stature. As the cryptocurrency market continues to develop, it will be interesting to see how Trump’s decisions and public statements influence investor sentiment and market trends in the future.

In summary, the recent news about Trump’s crypto losses underscores the unpredictable nature of the cryptocurrency market and serves as a critical reminder for all investors to remain informed and cautious as they navigate this exciting yet uncertain investment landscape.

BREAKING:

TRUMP LOST OVER $110 MILLION IN HIS CRYPTO PORTFOLIO.

HE HASN’T SOLD ANYTHING!

HE’S JUST ONE OF US. pic.twitter.com/b0YRtN8vFn

— Crypto Rover (@rovercrc) March 10, 2025

BREAKING:

In a jaw-dropping revelation that has sent shockwaves through both the political and cryptocurrency landscapes, it has come to light that Trump lost over $110 million in his crypto portfolio. This news is particularly fascinating, not just because of the staggering amount of money involved but also due to the implications it holds for both the former president and the wider crypto market. As more people dive into the world of digital currencies, Trump’s experience serves as a cautionary tale for investors, big and small.

TRUMP LOST OVER $110 MILLION IN HIS CRYPTO PORTFOLIO.

It’s hard to fathom the idea of losing such a hefty sum in investments, especially for someone like Trump, who has been known for his wealth and business acumen. Yet, the report detailing this loss indicates that the former president hasn’t sold any of his assets. That’s right! He hasn’t sold anything! This situation raises a myriad of questions about the volatility of the cryptocurrency market and the emotional toll it can take on investors, regardless of their financial background.

The crypto landscape has been notoriously unpredictable. Prices can skyrocket and plummet within hours, leading to significant losses for even the most seasoned investors. For someone like Trump, who has often touted his business prowess, this loss may mark a humbling experience. It underscores the reality that even the most affluent and experienced investors can find themselves at the mercy of market fluctuations.

HE HASN’T SOLD ANYTHING!

Now, you might wonder why Trump hasn’t cut his losses and sold his crypto assets. It’s a common strategy among investors to sell off failing assets to prevent further losses, but Trump seems to be taking a different approach. By holding onto his investments, he’s choosing to weather the storm, perhaps hoping for a market rebound. This tactic can be risky, especially in an environment as volatile as the cryptocurrency market.

Many investors are faced with a dilemma: should they hold on for a potential recovery, or sell off their assets to cut their losses? Trump’s decision to hold on might resonate with many everyday investors who find themselves in similar situations. It’s a reflection of a broader sentiment in the crypto community, where many feel a strong emotional attachment to their investments, often leading them to stick it out during tough times.

HE’S JUST ONE OF US.

This phrase strikes a chord. When you think about it, Trump’s situation makes him relatable to everyday investors. He is, after all, just one of us when it comes to navigating the ups and downs of the crypto market. This connection can humanize him in the eyes of many, especially those who have also faced financial setbacks.

Investing in cryptocurrencies has become increasingly popular, with millions of people flocking to platforms like Bitcoin, Ethereum, and even lesser-known altcoins. However, the crypto market is rife with risks, and losses are part of the game. By sharing his experience, Trump may inadvertently encourage more discussion about the realities of investing, pushing others to evaluate their strategies and emotional responses to market changes.

The Broader Implications of Trump’s Crypto Loss

So, what does Trump’s crypto loss mean for the broader market? For one, it serves as a stark reminder that no one is immune to the risks associated with investing in digital currencies. As more individuals and institutions enter the crypto space, this type of news can impact market sentiment. If people see a high-profile investor like Trump facing significant losses, it might lead to increased caution among potential investors.

Moreover, Trump’s experience could impact regulatory discussions surrounding cryptocurrencies. As governments and financial institutions scrutinize the crypto market more closely, stories like this can fuel debates around investor protection and market stability. The fact that someone with Trump’s background is experiencing such losses might compel regulators to take more proactive measures to safeguard investors.

The Emotional Side of Investing

Investing isn’t just about numbers; it’s also about emotions. The highs of a successful investment can be exhilarating, while the lows can be devastating. Trump’s situation illustrates the emotional rollercoaster that many investors endure. Holding onto a failing investment can be tough, and it often leads to feelings of regret or anxiety.

Many investors find solace in sharing their experiences within communities, whether online or in person. This shared experience can help individuals feel less isolated when facing losses. It’s essential to remember that everyone can face setbacks in their investment journey, regardless of their financial standing.

What Can Investors Learn from Trump’s Experience?

Trump’s crypto losses can offer several key takeaways for investors:

- Diversification is Crucial: Relying heavily on one asset class can be risky. Diversifying your investments can help mitigate losses.

- Emotional Resilience Matters: Learning to manage emotions during market fluctuations can lead to better decision-making.

- Do Your Homework: Understanding the market and the assets you invest in can help you make informed decisions.

- Know When to Cut Your Losses: Sometimes selling off assets can be the best move, even if it feels tough.

Investing in cryptocurrency can be a wild ride, but it’s essential to approach it with a level head and a solid strategy. Trump’s experience reminds us all that even those who seem untouchable can face financial challenges. It’s a reality that resonates with many, driving home the importance of prudent investing and emotional intelligence.

Final Thoughts

As we reflect on Trump’s significant crypto loss, it’s vital to remember that the world of investing is fraught with uncertainty. Whether you’re a seasoned pro or a newcomer, the lessons learned from high-profile investors can inform our strategies. While it’s easy to get caught up in the thrill of potential gains, it’s crucial to balance that excitement with caution and strategic thinking.

So, as we continue to navigate this ever-evolving landscape, let’s take this opportunity to learn, grow, and share our experiences. After all, in the world of investing, we’re all in this together.