Bitcoin Whale Makes $7.5M from Trump’s Executive Order Pump

In a striking development within the cryptocurrency market, a Bitcoin whale has reportedly made a staggering $7.5 million by engaging in both long and short positions related to a recent executive order issued by former President Donald Trump. This news has stirred significant interest among crypto traders and investors, as it highlights the potential for substantial profits during volatile market conditions driven by political events.

Understanding the Context: Bitcoin and Executive Orders

Bitcoin, the leading cryptocurrency, often reacts dramatically to macroeconomic and political news. Executive orders, particularly from influential figures like the President of the United States, can create waves in financial markets, including cryptocurrencies. The recent executive order by Trump prompted a surge in Bitcoin prices, leading to significant trading opportunities for savvy investors.

The whale in question capitalized on this opportunity by strategically positioning themselves to profit from the price movements generated by the executive order’s announcement. Longing during the initial price surge and subsequently shorting as the market corrected, this trader demonstrated a keen understanding of market dynamics and timing.

The Strategy: Longing and Shorting

The strategy employed by the whale involved both longing and shorting Bitcoin. Longing refers to buying Bitcoin with the expectation that its price will rise, allowing the trader to sell at a higher price for a profit. Conversely, shorting involves selling Bitcoin with the anticipation that its price will fall, enabling the trader to buy back at a lower price.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In this instance, the whale’s ability to go long during the initial price pump and then shift to a short position indicates a sophisticated approach to trading. This not only showcases their understanding of technical analysis but also suggests a deeper insight into market sentiment influenced by political events.

Market Reactions: Targeting $70K–$74K

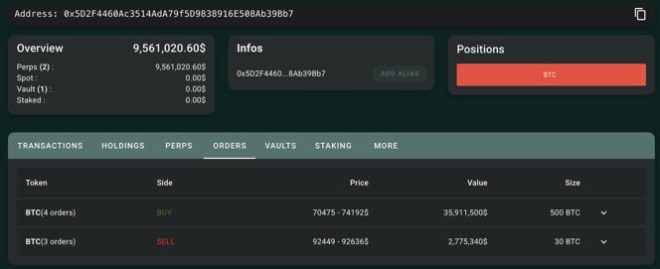

Following the whale’s recent trades, there has been speculation about where Bitcoin’s price might head next. The whale is now reportedly targeting a price range between $70,000 and $74,000. This projection has garnered attention, as it reflects the trader’s confidence in their analysis of market trends and potential price movements.

The $70,000 to $74,000 range is particularly significant for Bitcoin, as it represents a psychological barrier and a key level of resistance that traders are watching closely. If Bitcoin manages to break through this range, it could signal further bullish momentum, while a failure to do so might lead to increased selling pressure.

The Role of Insider Information

There is also speculation surrounding whether the whale had access to insider information regarding the executive order’s implications for the cryptocurrency market. Such insights could provide a substantial advantage in trading, allowing the whale to anticipate market movements more accurately than the average investor.

While insider trading is illegal in traditional financial markets, the decentralized and relatively unregulated nature of cryptocurrencies makes it challenging to enforce similar rules. This has led to a culture of speculation and rumors within the crypto community, where some traders believe that certain individuals may have information that gives them an edge.

The Impact on the Cryptocurrency Market

The actions of high-profile traders, such as this Bitcoin whale, can significantly influence the broader cryptocurrency market. Large trades can lead to increased volatility, attracting more traders and investors looking to capitalize on price movements. This can create a feedback loop, where the actions of a few individuals generate significant market activity.

Moreover, the narrative surrounding the whale’s trades plays into the larger story of Bitcoin as a volatile but potentially lucrative asset class. For many investors, stories of substantial profits can drive interest and investment in cryptocurrencies, further fueling the market’s growth.

Conclusion: What Lies Ahead for Bitcoin?

As the cryptocurrency market evolves, the actions of influential traders like this Bitcoin whale will continue to shape market dynamics. The recent $7.5 million profit made through strategic longing and shorting illustrates the opportunities available in this space, particularly during times of political and economic uncertainty.

Looking ahead, traders will be closely monitoring Bitcoin’s price movements, especially in the context of key resistance levels around $70,000 to $74,000. Whether Bitcoin can break through these levels will likely depend on a combination of market sentiment, broader economic factors, and potential political developments.

In the ever-changing landscape of cryptocurrency trading, the ability to adapt quickly to new information and market conditions remains crucial. For both seasoned traders and newcomers alike, understanding the implications of major events like executive orders and the strategies employed by successful traders can provide valuable insights into navigating this complex market.

As Bitcoin continues to capture the attention of investors worldwide, the actions of whales and other prominent figures in the space will undoubtedly remain a focal point for market analysis and speculation. For those looking to engage in cryptocurrency trading, staying informed and agile in response to market developments will be key to capitalizing on potential opportunities.

BREAKING:

BITCOIN WHALE MADE $7.5M LONGING & SHORTING THE TRUMP EXECUTIVE ORDER PUMP.

NOW SHORTING AGAIN, TARGETING $70K–$74K…

ANOTHER INSIDER? pic.twitter.com/7edigzPJN1

— Crypto Rover (@rovercrc) March 10, 2025

BREAKING:

In the ever-evolving world of cryptocurrency, news travels fast, and some events shake the market to its core. Recently, the crypto community was abuzz with reports that a Bitcoin whale made a staggering $7.5 million by both longing and shorting during the Trump Executive Order pump. This news has raised eyebrows and sparked questions about insider trading and market manipulation.

BITCOIN WHALE MADE $7.5M LONGING & SHORTING THE TRUMP EXECUTIVE ORDER PUMP.

For those unfamiliar, a “Bitcoin whale” refers to individuals or entities that hold large amounts of Bitcoin, sufficient to influence market prices. The report indicates that this whale capitalized on a surge in Bitcoin prices following a Trump Executive Order, which sent ripples through the market. Longing and shorting are trading strategies where an investor bets on the price going up (longing) or down (shorting). The whale’s ability to play both sides effectively illustrates a sophisticated understanding of market dynamics.

This particular incident raises several questions: How did this whale manage to navigate such a volatile market? Was there prior knowledge about the Executive Order that allowed for such strategic positioning? As the crypto community delves deeper into the implications of this event, many are speculating whether this Bitcoin whale might have had insider information, thus prompting the question: ANOTHER INSIDER?

NOW SHORTING AGAIN, TARGETING $70K–$74K…

Fast forward to now, and it appears this Bitcoin whale is not done making moves. Reports suggest that they are now shorting again, with a target price in the range of $70,000 to $74,000. If you’re tracking Bitcoin’s price movements, you know how quickly things can change. This new strategy indicates a bearish sentiment from the whale, suggesting they anticipate a price correction after the recent pump.

Shorting at these levels could mean that this whale is looking to profit from what they expect to be a downward trend. But what does this mean for the average investor? For many, the market can feel like a rollercoaster, and while experienced traders might play these swings adeptly, newcomers might find it challenging to navigate. It’s crucial for all traders to remain informed and cautious, especially in such a volatile market.

Understanding the Pump and Dump Phenomenon

The Bitcoin market is notorious for its pump and dump schemes, where prices are artificially inflated before being sold off, leaving latecomers with losses. The situation surrounding the Trump Executive Order can be seen through this lens, where the announcement perhaps fueled speculation and trading frenzy.

Understanding these dynamics can help investors make more informed decisions. If you’re looking to invest in Bitcoin or any cryptocurrency, it’s essential to stay updated on market news and be wary of sudden price movements tied to specific events or announcements.

The Role of News in Cryptocurrency Markets

News plays a pivotal role in shaping the crypto market. Events such as regulatory changes, endorsements from influential figures, or major geopolitical decisions can lead to significant price fluctuations. The Trump Executive Order is a prime example, highlighting how political developments can have immediate and lasting effects on Bitcoin’s price.

Investors should not only focus on the price charts but also pay attention to news headlines. Platforms like Reuters and CNBC often provide timely updates on significant events that could impact market sentiment. Being proactive and informed can help investors make better trading decisions.

Market Sentiment and Investor Behavior

The behavior of Bitcoin whales can greatly influence market sentiment. When a significant player makes a move, others often follow, either in fear of missing out or as a result of panic selling. This herd mentality can lead to exaggerated market movements, making it crucial for smaller investors to maintain their composure.

Understanding sentiment analysis and recognizing patterns in investor behavior can be beneficial. Tools like social media sentiment trackers or dedicated crypto analytics platforms can help you gauge the mood of the market. As a trader, being aware of these sentiments can provide context to price movements and help in crafting a more strategic approach to investing.

Best Practices for Engaging with the Crypto Market

If you’re looking to engage with the crypto market, there are several best practices to consider. Firstly, always do your own research. Relying solely on social media influencers or news headlines can lead to poor decision-making. Instead, delve into the fundamentals of the cryptocurrencies you’re interested in.

Additionally, consider diversifying your portfolio. While Bitcoin is often viewed as the gold standard of cryptocurrency, there are thousands of altcoins available that may offer unique opportunities. Diversifying can help mitigate risks associated with market volatility.

Lastly, keep your emotions in check. The cryptocurrency market can be incredibly emotional, with drastic price swings leading to panic selling or euphoric buying. Stick to your trading strategy and remember to take profits when necessary.

Conclusion

In the world of cryptocurrency, the recent moves by a Bitcoin whale during the Trump Executive Order pump have highlighted the complexities and opportunities within the market. As they target new price levels, it prompts a flurry of questions about market dynamics and investor behavior. By staying informed, practicing diligent research, and maintaining a level head, investors can navigate this exciting yet unpredictable landscape.