Bitcoin Market Dynamics: A Major Longs Wipeout

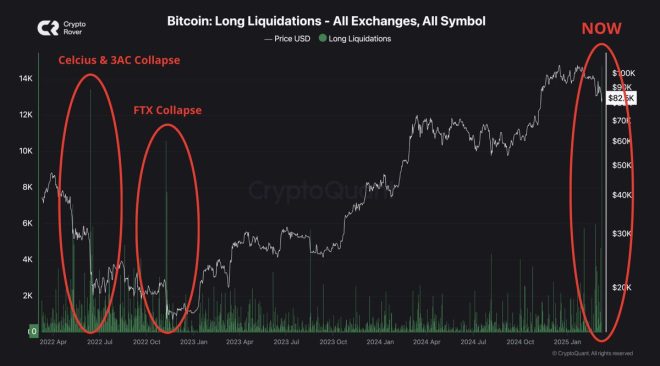

In recent news, the cryptocurrency landscape experienced a seismic shift as reported by Crypto Rover on March 10, 2025. The tweet highlighted a significant wipeout of Bitcoin long positions, marking the most substantial downturn since the infamous Celsius and FTX crashes. This incident has sent ripples through the crypto community, prompting discussions about market volatility, investor sentiment, and the broader implications for Bitcoin and other cryptocurrencies.

Understanding the Context of Bitcoin Longs

Bitcoin longs refer to positions taken by traders who speculate that the price of Bitcoin will rise. When the market behaves unfavorably, as it recently did, these long positions can lead to significant financial losses. The wipeout mentioned in the tweet indicates that a considerable number of these positions were liquidated, resulting in substantial losses for investors.

The Impact of Major Events on Bitcoin Prices

The cryptocurrency market is notoriously volatile, often influenced by external events, regulatory news, and market sentiment. The Celsius and FTX crashes, which occurred in 2022, were pivotal moments that shook investor confidence and contributed to a prolonged bear market. The recent wipeout of long positions raises questions about the current state of investor confidence and the potential for further downturns.

Analyzing the Role of Influential Figures

The tweet refers to "TRUMP REKT US," suggesting that former President Donald Trump’s influence may have played a role in the recent market downturn. While the connection between political figures and cryptocurrency prices can be speculative, it is undeniable that public figures can sway market sentiment, especially in the decentralized world of cryptocurrencies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions and Future Predictions

Following the announcement of the significant wipeout, market reactions have been mixed. Some investors view this as a buying opportunity, while others remain cautious, fearing further declines. Analysts predict that the market may experience additional volatility as traders reassess their positions and strategies in light of the recent events.

The Importance of Risk Management

The recent wipeout serves as a stark reminder of the importance of risk management in trading. Investors who engage in leveraged trading, such as taking long positions in Bitcoin, must remain vigilant and prepared for sudden market shifts. Implementing stop-loss orders and diversifying investment portfolios are essential strategies to mitigate potential losses.

The Future of Bitcoin and Cryptocurrency

As the dust settles from this significant wipeout, many are left wondering what the future holds for Bitcoin and the broader cryptocurrency market. While some analysts remain optimistic about Bitcoin’s long-term potential, others caution that volatility may persist as the market adapts to ongoing economic and political changes.

In conclusion, the recent Bitcoin long positions wipeout highlights the inherent risks associated with cryptocurrency trading. As the market continues to evolve, investors must remain informed and adaptable to navigate the complexities of this dynamic landscape.

BREAKING:

BIGGEST BITCOIN LONGS WIPEOUT SINCE THE CELSIUS AND FTX CRYPTO CRASH.

TRUMP REKT US. pic.twitter.com/L1z7ZoyPrl

— Crypto Rover (@rovercrc) March 10, 2025

BREAKING:

In the ever-volatile world of cryptocurrency, something monumental has just occurred. The market has been rocked by the BIGGEST BITCOIN LONGS WIPEOUT SINCE THE CELSIUS AND FTX CRYPTO CRASH. If you’ve been following crypto news, you know how significant these phrases are. In a landscape already fraught with unpredictability, this latest development has sent shockwaves through the community.

BIGGEST BITCOIN LONGS WIPEOUT SINCE THE CELSIUS AND FTX CRYPTO CRASH

The term “wipeout” isn’t taken lightly in the crypto space. It refers to a situation where traders who bet on rising prices face substantial losses, often leading to liquidations of their positions. In this recent case, it seems traders who went long on Bitcoin have faced some of the most significant liquidations since the infamous collapses involving Celsius and FTX. You can read more about those events here.

Understanding the Impact of the Wipeout

So, what does this wipeout mean for the average trader and the crypto market at large? Let’s break it down. When long positions are liquidated, it often leads to a domino effect, triggering further sell-offs and driving prices down even more. This can create a vicious cycle that leaves traders scrambling to recover losses. The phrase “TRUMP REKT US” highlights a sentiment that many in the crypto community feel: external factors, including political events or public figures’ remarks, can significantly influence market sentiment and trading behaviors. You can see more about market reactions to political events here.

What Caused the Wipeout?

While many factors could contribute to such a massive liquidation event, recent market movements and news cycles often play crucial roles. The cryptocurrency market is known for its sensitivity to news, whether it’s regulatory changes, significant trades by large players, or, as in this case, political commentary. With the ongoing discussions surrounding cryptocurrency regulation and the role of institutions, traders must stay vigilant. The interplay between public sentiment and market movements is a dance that requires constant attention.

Who Are the Affected Parties?

In this wipeout, the individuals most affected are retail traders who had leveraged positions. Leveraged trading can amplify gains but also magnifies losses. Many traders may have entered the market during bullish trends, only to see their positions liquidated when the market turns. With Bitcoin’s price fluctuating wildly, it’s easy to see why many would find themselves on the wrong side of a trade. For an in-depth look at how leverage works in crypto trading, check out this great resource here.

Historical Context: Celsius and FTX

The mention of Celsius and FTX is not merely a coincidence; these events are pivotal in understanding the current market environment. The Celsius collapse was a stark reminder of the risks involved in crypto lending platforms, while the FTX debacle highlighted the vulnerabilities in centralized exchanges. Both events resulted in massive losses for investors and a significant loss of trust in the crypto market. If you want to dive deeper into these events, you can read about Celsius here and FTX here.

Market Reactions Following the Wipeout

Following the wipeout, market reactions can be pretty dramatic. Traders often react with panic selling, which can exacerbate the situation. It’s crucial to understand that this response is typically driven by emotion rather than rational trading strategies. Many seasoned traders adopt a different approach during these downturns, focusing on long-term strategies instead of short-term panic reactions. The key takeaway here is that understanding market psychology can be just as important as understanding technical analysis.

What Should Traders Do Next?

For traders who are still in the game, it’s essential to reassess your strategies. Are you using proper risk management techniques? Are you aware of the market trends and potential external factors that could impact your trades? Engaging with the community through forums and social media can provide insights into what others are doing during turbulent times. Staying informed and connected is crucial for making sound decisions in this unpredictable market.

Future Outlook for Bitcoin

Looking ahead, the future of Bitcoin remains uncertain but filled with potential. While the market has its share of volatility, many analysts believe that Bitcoin will recover and continue to show growth over the long term. Institutional adoption, regulatory clarity, and technological advancements will play significant roles in shaping Bitcoin’s future. Keeping an eye on these developments will help traders make informed decisions. For more insights into Bitcoin’s future, check out this analysis here.

Learning from the Past

Every market wipeout offers lessons, and this one is no different. Traders should take this opportunity to reflect on their strategies, risk management practices, and emotional responses to market movements. Understanding what went wrong can help prevent future missteps. A strong foundation in market principles and continuous learning can help traders navigate the complexities of crypto trading more effectively.

Community Support and Resources

In times of market distress, community support can be invaluable. Engaging with other traders, whether through social media, forums, or local meetups, can provide not only emotional support but also practical advice. Many online platforms and resources can help traders stay informed and connected. Websites like Reddit’s CryptoCurrency subreddit or CoinDesk offer spaces for discussion and learning.

Conclusion: Navigating the Crypto Landscape

As we navigate the aftermath of this wipeout, it’s clear that the crypto landscape remains as dynamic as ever. Whether you’re a seasoned trader or just starting, staying informed and adaptable is crucial. The world of cryptocurrency is filled with opportunities, but it also comes with its share of risks. With the right strategies and a strong community, traders can weather the storms and thrive in this exciting market.

“`