Overview of Recent Crypto Market Liquidations

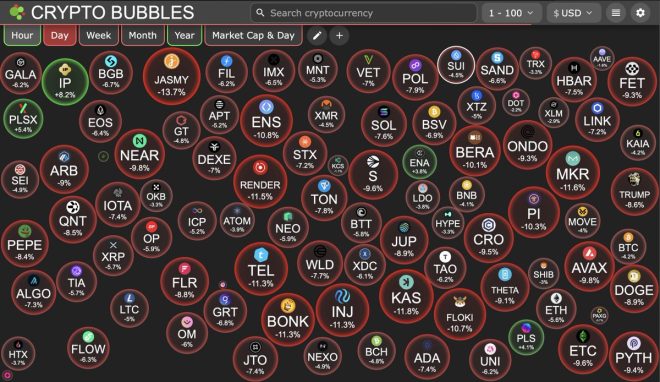

In a shocking turn of events for the cryptocurrency market, a staggering $619 million was liquidated within the span of just 24 hours. This significant liquidation wave has raised concerns among investors and market analysts, indicating potential instability in the crypto landscape. The event was highlighted on Twitter by Crypto Rover, a notable figure in the crypto community, who speculated that the market dynamics might have been more favorable before the Trump era.

Understanding Liquidations in Crypto

Liquidations occur when a trader’s position is forcibly closed due to a significant drop in the asset’s price, often triggered by margin calls. In the volatile world of cryptocurrencies, where prices can fluctuate dramatically, liquidations can lead to cascading effects, exacerbating market downturns. When leveraged positions face liquidation, it can lead to a rapid decrease in prices, further triggering additional liquidations and creating a vicious cycle of selling pressure.

The Impact of Liquidations on Market Sentiment

The recent liquidation of $619 million has undoubtedly impacted market sentiment. Such significant sell-offs can create fear and uncertainty among investors, leading to a lack of confidence in the market. Traders who witness large-scale liquidations may become more risk-averse, opting to exit their positions to avoid potential losses. This shift in sentiment can result in a bearish outlook, leading to further declines in asset prices.

Factors Contributing to Market Volatility

Several factors contribute to the heightened volatility in the cryptocurrency market, including:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Regulatory Concerns: Ongoing discussions surrounding regulatory frameworks for cryptocurrencies can create uncertainty, leading to quick market reactions. Investors often respond to news regarding regulations, which can influence price movements.

- Market Speculation: The crypto market is heavily driven by speculative trading. Investors often buy and sell based on market trends and news, leading to rapid price fluctuations.

- Macro-Economic Influences: Broader economic factors, such as inflation rates, interest rates, and geopolitical events, can also impact investor sentiment in the crypto market.

- Technological Developments: Innovations within the blockchain and cryptocurrency space can significantly affect market dynamics. Positive advancements may lead to increased investor interest, while negative news can have the opposite effect.

The Role of Social Media in Shaping Market Perception

Social media platforms like Twitter play a pivotal role in shaping market perception and investor sentiment. Influencers and analysts often share insights, predictions, and market updates, which can lead to rapid shifts in trading behavior. For instance, Crypto Rover’s tweet regarding the $619 million liquidation has likely caught the attention of many investors, prompting them to reassess their positions.

Historical Context: The Trump Era and Its Effects

The mention of the Trump administration in relation to the current crypto market dynamics brings an interesting historical angle. During Trump’s presidency, there were various debates regarding regulation and the future of cryptocurrencies. Some investors believe that the regulatory environment during this period created uncertainty, which may have impacted market growth.

While it’s challenging to pinpoint a direct correlation between political events and market performance, the sentiment surrounding governance and regulation can certainly influence investor confidence. The crypto market has seen its fair share of ups and downs, and external factors, including political decisions, play a crucial role in shaping its trajectory.

Preparing for Future Market Movements

Given the current market situation, it’s essential for investors to remain vigilant and prepare for potential future movements. Here are some strategies to consider:

- Diversification: Spreading investments across different assets can mitigate risk. Rather than concentrating funds in a single cryptocurrency, consider a diversified portfolio that includes various digital assets.

- Staying Informed: Keeping abreast of market news, trends, and developments is crucial. Following credible sources and influencers can provide valuable insights into market movements.

- Risk Management: Establishing clear risk management strategies, including setting stop-loss orders, can help protect investments in a volatile market.

- Long-Term Perspective: While short-term fluctuations can be alarming, maintaining a long-term investment perspective may yield more favorable outcomes. Historically, the crypto market has shown resilience and recovery potential.

Conclusion: Navigating the Crypto Landscape

The recent liquidation of $619 million in the crypto market serves as a reminder of the inherent volatility and risks associated with digital assets. As investors navigate this unpredictable landscape, understanding the factors contributing to market movements, the role of social media, and the historical context of governance can provide valuable insights.

Investors should prioritize informed decision-making, diversify their portfolios, and employ effective risk management strategies to weather the storm of market volatility. While the current sentiment may lean toward caution, the crypto market has a history of resilience and recovery, offering opportunities for those willing to engage with it thoughtfully.

BREAKING:

$619 MILLION LIQUIDATED FROM CRYPTO MARKET IN LAST 24 HOURS.

Maybe crypto was better before Trump… pic.twitter.com/uTSoYAK6gR

— Crypto Rover (@rovercrc) March 10, 2025

BREAKING:

The cryptocurrency market has been rocked recently with a staggering $619 MILLION LIQUIDATED FROM CRYPTO MARKET IN LAST 24 HOURS. This massive liquidation is sending shockwaves through the digital asset space, leading many to question the stability and future of cryptocurrencies. So, what’s behind this sudden downturn, and what does it mean for investors and the market as a whole?

Understanding Liquidation in Crypto

Before diving deeper, let’s break down what liquidation means in the world of cryptocurrencies. When we talk about liquidation, we’re referring to the forced selling of assets, usually triggered by margin calls. Traders who use leverage borrow funds to amplify their positions, and if the market moves against them, exchanges automatically sell their assets to cover losses. This can lead to a domino effect, causing even more price drops and further liquidations.

The Current State of the Crypto Market

The current market sentiment is quite bearish. With $619 MILLION LIQUIDATED FROM CRYPTO MARKET IN LAST 24 HOURS, many are feeling the pressure. The liquidity crunch has left traders scrambling, and as fear sets in, we can expect more volatility. Market dynamics are changing rapidly, and it’s essential to stay updated on the latest developments. You can find more about market trends on sites like CoinDesk and CoinTelegraph.

What Caused the Liquidation?

Several factors have contributed to this massive liquidation event. One major reason could be the overall economic climate. With ongoing inflation concerns and changes in monetary policy, traditional markets are feeling the strain, and crypto is no exception. Additionally, regulatory uncertainties surrounding cryptocurrencies have also contributed to a shaky market environment. The recent comments made by politicians, including former President Trump, about the crypto market have added to the tension. Speculation surrounding his influence on the market has led to debates among traders—many are wondering if maybe crypto was better before Trump.

The Impact of Social Sentiment

Social media plays a significant role in shaping market sentiment. Tweets, articles, and news reports can sway traders’ emotions, leading to panic selling or irrational buying. In this case, the tweet from @rovercrc highlighting the liquidation has sparked conversations about the future of crypto. The phrase maybe crypto was better before Trump has even become a talking point among investors, reflecting a blend of nostalgia and frustration.

What Should Investors Do Now?

If you’re invested in cryptocurrencies, you might be feeling anxious about the current situation. Here are some steps to consider:

- Stay Informed: Keeping up with news and market analysis is crucial. Websites like Investing.com provide real-time updates and expert opinions.

- Manage Risk: If you’re trading with leverage, consider reducing your exposure. It’s vital to protect your capital during turbulent times.

- Diversify: Don’t put all your eggs in one basket. Consider diversifying your investments to mitigate risks.

Long-Term Perspective

While the short-term outlook may seem grim, it’s essential to maintain a long-term perspective. The crypto market is notoriously volatile, but history has shown that it can bounce back from significant downturns. Many successful investors adopt a buy-and-hold strategy, focusing on the potential growth of the market over time. Projects with solid fundamentals are likely to endure these turbulent times and emerge stronger.

Regulatory Landscape and Its Impacts

Regulatory scrutiny is another factor affecting the crypto market. Governments worldwide are increasingly looking to regulate cryptocurrencies, which can lead to uncertainty among investors. While some regulations can provide a safer environment for investors, they can also stifle innovation and growth in the space. Keeping an eye on regulatory developments is essential, as they can significantly impact market dynamics. You can check updates on regulations from sources like Finance Magnates.

The Role of Institutional Investors

Institutional investors have been playing a more significant role in the crypto market, and their actions can greatly affect price movements. When large funds liquidate positions, it can lead to a ripple effect, as seen in the $619 MILLION LIQUIDATED FROM CRYPTO MARKET IN LAST 24 HOURS. Conversely, when institutions show interest in crypto, it can lead to bullish trends. Understanding the actions of institutional players can provide insights into market direction.

Future Outlook for Crypto

Despite the current challenges, the future of cryptocurrency remains bright for many enthusiasts. The technology behind crypto, including blockchain, is still being explored and developed. Innovations continue to emerge, and new use cases for cryptocurrencies are being discovered. As the market matures, we can expect more stability and perhaps a more robust regulatory framework that benefits both investors and developers.

Final Thoughts

The recent news about the liquidation of $619 MILLION FROM THE CRYPTO MARKET IN LAST 24 HOURS serves as a stark reminder of the volatility inherent in this space. While the phrase maybe crypto was better before Trump reflects some traders’ sentiments, it’s essential to approach the market with a clear mind and a solid strategy. By staying informed, managing risks, and keeping a long-term perspective, investors can navigate these tumultuous waters and potentially come out ahead.

As always, make sure to do your research and consult trusted sources before making any investment decisions. The crypto world is ever-evolving, and staying ahead of the curve is crucial in this fast-paced environment.