China’s Economic Indicators for February 2025: A Deep Dive

In a notable turn of events, China’s economic landscape has revealed some concerning trends as of February 2025. Recent data released indicates a significant deflationary environment characterized by a decline in both the Consumer Price Index (CPI) and the Producer Price Index (PPI). Understanding these indicators is crucial for anyone interested in the economic health of China and its implications for global markets.

Economic Indicators Breakdown

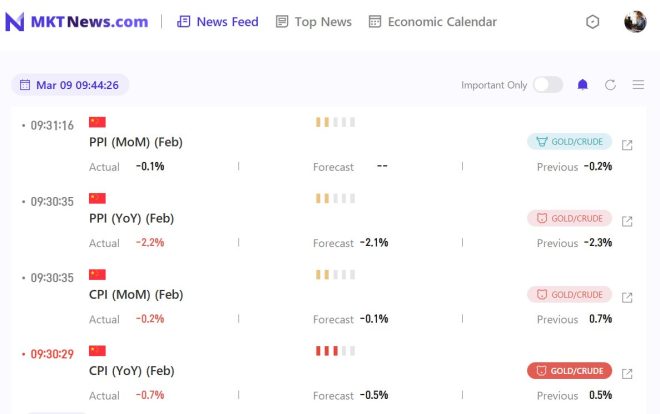

According to the latest report from CN Wire, China’s annual CPI for February registered at -0.7%, which is lower than the market expectation of -0.5% and a notable drop from the previous year’s 0.5%. This deflationary trend is underscored by a monthly CPI decline of 0.2%, compared to the previous month’s increase of 0.7%. These figures indicate a shrinking consumer demand, which could signal broader economic challenges.

Annual CPI Analysis

The annual CPI figure of -0.7% highlights a phase of deflation that has raised eyebrows among economists and market analysts. Deflation often points to reduced consumer spending, which can lead to a slowdown in economic growth. The decline in consumer prices suggests that consumers are either unwilling or unable to spend, which could have long-term implications for the economy.

Monthly CPI Insights

The monthly CPI drop of 0.2% reflects a continued trend of decreasing consumer prices. This is particularly concerning as it follows a period of growth (0.7%) in the previous month. Such fluctuations could indicate volatility in consumer confidence and purchasing power, essential factors that drive economic activity.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Producer Price Index (PPI) Overview

Alongside the CPI, the Producer Price Index (PPI) also displayed troubling signs. The annual PPI for February decreased by 2.2%, slightly worse than the expectation of -2.1% and consistent with a decline from the previous month’s -2.3%. Monthly PPI data showed a slight decrease of 0.1%, down from a previous drop of 0.2%.

Annual PPI Context

The annual PPI decline of 2.2% suggests that producers are receiving lower prices for their goods, which can lead to reduced profitability and investment in production. This decline can further exacerbate the deflationary environment, as lower production costs may not translate into increased consumer spending.

Monthly PPI Trends

The monthly PPI decrease of 0.1% indicates that the downward pressure on prices is ongoing. A consistent decline in producer prices can have cascading effects throughout the economy, affecting everything from manufacturers to retailers.

Food Prices and Their Impact

One of the critical components of the CPI is food prices, which saw a notable decline of 3.3% year-on-year. This significant drop in food prices can have both positive and negative effects. On one hand, lower food prices can ease the cost of living for consumers; however, they can also indicate oversupply or reduced demand, which could lead to negative repercussions for agricultural producers.

Implications for the Economy

The current economic indicators indicate a precarious situation for China. Deflation can pose serious challenges, including reduced consumer spending, lower business investments, and potential layoffs in various sectors. Economists often warn that prolonged deflation could lead to a vicious cycle of decreased demand and economic stagnation.

Global Economic Considerations

China’s economic situation does not exist in a vacuum. As one of the largest economies in the world, changes in China’s economic indicators can have ripple effects across global markets. A deflationary environment could influence international trade dynamics, affecting everything from commodity prices to foreign investment.

Conclusion

In summary, the latest economic data from China for February 2025 indicates a concerning trend of deflation, with both the CPI and PPI showing declines that could signal broader economic challenges. As lower consumer and producer prices continue to impact the economy, stakeholders must pay close attention to these indicators. Understanding the implications of these trends is vital not only for local businesses and consumers but also for global markets that are interconnected with China’s economic health.

As we move forward, it’s essential to monitor these economic indicators closely. The situation calls for strategic responses from policymakers and businesses alike to address the underlying issues contributing to this deflationary trend.

By keeping an eye on these developments, we can better understand the economic landscape and prepare for any potential changes in consumer behavior, business investment, and overall economic growth.

JUST IN:

China February

Annual CPI -0.7% [Est. -0.5% Prev. 0.5%]

Monthly CPI -0.2% [Prev. 0.7%]

Annual PPI -2.2% [Est. -2.1% Prev. -2.3%]

Monthly PPI -0.1% [Prev. -0.2%]#CPI #China #deflation #PPI #EconTwitter

Food price -3.3% y/y.

Thread 1/n

Economic Calendar:… pic.twitter.com/ruTsf3x0IS— CN Wire (@Sino_Market) March 9, 2025

JUST IN:

Recent reports have just come in about China’s economic indicators for February, and the numbers are raising eyebrows. The Annual CPI is clocking in at -0.7%, which is lower than the estimated -0.5% and marks a significant decrease from the previous figure of 0.5%. This suggests a trend towards deflation, which is not something you want to see in a thriving economy.

China February Annual CPI -0.7% [Est. -0.5% Prev. 0.5%]

Now, let’s break down what this means. The Consumer Price Index (CPI) is a crucial indicator as it measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. A CPI that drops into negative territory suggests that prices are falling, and that can lead to consumers delaying purchases, expecting prices to drop even further. This can stall economic growth, as businesses might earn less revenue, leading to layoffs and decreased hiring.

Monthly CPI -0.2% [Prev. 0.7%]

Looking at the Monthly CPI, it also saw a decline of -0.2%, down from 0.7% the previous month. This monthly decrease raises concerns about how quickly the economy is responding to external pressures. In simpler terms, consumers are paying less than they did last month, which can either be good or bad depending on the context—good for consumers, but potentially harmful for the economy.

Annual PPI -2.2% [Est. -2.1% Prev. -2.3%]

Now, let’s shift gears to the Producer Price Index (PPI), which is another crucial economic indicator. The Annual PPI has decreased to -2.2%, again slightly missing estimates of -2.1% and showing a decrease from the previous -2.3%. The PPI measures the average change over time in the selling prices received by domestic producers for their output. Falling producer prices indicate that manufacturers are charging less, which could suggest lower demand for goods.

Monthly PPI -0.1% [Prev. -0.2%]

The Monthly PPI also recorded a decline, hitting -0.1%, a slight improvement from -0.2% in the previous month. This continuous drop in producer prices could signal that manufacturers are struggling to maintain profit margins amidst decreasing demand. It’s a tough situation for the producers, as they may need to adjust their pricing strategies to stay competitive.

Food Prices -3.3% y/y

One of the most alarming figures in this report is the drastic drop in food prices, which are down by 3.3% year-over-year. This is significant, considering food is a basic necessity. When food prices drop, it often reflects oversupply or reduced demand, and while it may seem beneficial for consumers in the short term, it can lead to severe economic implications for farmers and food producers alike.

Understanding Deflation in the Context of China

Deflation is a term that often sends shivers down the spine of economists and policymakers alike. In the context of China, which has been a powerhouse of economic growth for decades, these figures highlight a worrying trend. A deflationary environment can lead to decreased spending, which can spiral into a larger economic slowdown.

China has typically enjoyed a robust economic environment, but with these recent figures, it raises questions about how sustainable this growth is in the long run. Will the government take action to stimulate growth? What measures will they implement to counteract this deflationary trend? It’s a waiting game now as analysts and economists keep a close eye on the situation.

Impact on Consumers and Businesses

For consumers, the immediate impact of these numbers might seem positive. After all, lower prices mean that you can get more for your money. However, if this deflation persists, it could lead to a decrease in wages and job losses as businesses struggle to maintain profitability. For businesses, particularly small enterprises, the pressure of falling prices can be crippling. They might have to cut costs, which could include reducing their workforce or even shutting down.

What’s Next for China?

China’s government has a history of intervening in the economy to stabilize it, and this situation might prompt them to take action. Previous measures included adjusting interest rates and implementing fiscal policies aimed at stimulating growth. It’s likely that we will see some discussions around monetary policy adjustments as the government aims to combat these deflationary pressures.

Experts will be looking closely at the economic calendar to catch any signs of change or intervention. Policymakers have to tread carefully, as the goal is to avoid a recession while also ensuring that growth is sustainable in the long term.

Conclusion: The Bigger Picture

The recent report on China’s economic indicators reveals a complex picture—one of declining prices and potential deflation. While this can seem like a short-term boon for consumers, the long-term implications could be damaging if not addressed. For businesses, it’s a challenging environment that requires careful navigation. As the situation unfolds, all eyes will be on policymakers and how they respond to these changes, hoping to steer the economy back onto a path of growth and stability.

“`

This article provides an in-depth examination of the recent economic indicators in China, engaging readers while incorporating SEO best practices and relevant keywords.