Exposé on Corporate Accountability: The Case of Pierre Poilievre

In a striking revelation that has garnered international attention, a prominent financial newspaper has conducted an extensive exposé on the accounting practices of a company linked to Pierre Poilievre, the Canadian politician poised to become Prime Minister. While Canadian media has been criticized for not scrutinizing Poilievre adequately, this exposé has raised significant questions about transparency and corporate governance.

The Context of the Exposé

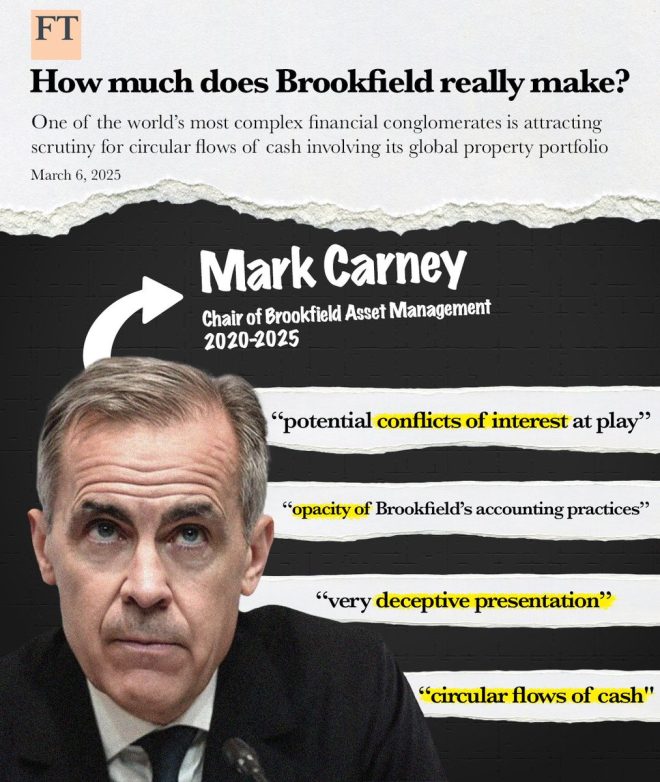

The exposé highlights what the newspaper refers to as a "very deceptive presentation" of the company’s financial accounting. This significant claim suggests that the company’s practices may not align with regulatory standards or ethical business behavior. The implications of such findings are profound, particularly when considering Poilievre’s imminent rise to the Prime Minister’s office.

Financial integrity is a cornerstone of a stable economy, and any signs of misconduct can lead to a loss of investor confidence and ethical standards. The exposé’s findings have reportedly led to a staggering decline in the company’s stock, which has plummeted nearly $20 billion. Such a dramatic drop not only affects shareholders but also raises questions about the potential wider economic impact on the Canadian economy.

The Impacts of Corporate Malfeasance

The repercussions of corporate malfeasance are far-reaching. Investors rely on accurate financial reporting to make informed decisions, and when these reports are misleading, it can lead to devastating financial losses. In this case, the nearly $20 billion crash in stock value serves as a stark reminder of the potential fallout from deceptive accounting practices.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, this situation brings to light the broader implications for corporate governance in Canada. With Poilievre on the brink of assuming a leading role in the government, how he navigates this controversy will likely influence public perception and trust in his leadership. The ability to address corporate accountability within his administration could become a pivotal issue.

The Role of Media in Political Scrutiny

While the exposé by a prestigious financial newspaper has brought attention to the issue, it raises concerns about the role of Canadian media in holding public figures accountable. Critics argue that there has been a lack of rigorous investigative journalism focusing on Poilievre and his business connections. The disparity between international scrutiny and domestic coverage suggests a potential gap in the media’s responsibility to inform the public about the integrity of those in power.

This situation highlights the importance of a robust media landscape that prioritizes transparency and accountability. Investigative journalism plays a crucial role in democracy by providing checks and balances on those who hold power. The failure to adequately scrutinize politicians can lead to a lack of public trust and a weakened democratic process.

Implications for the Canadian Economy

As the news of the exposé spreads, concerns about the potential implications for the Canadian economy grow. A significant drop in stock value can lead to a ripple effect, impacting not just the company in question but also related industries, investor confidence, and market stability.

If Poilievre assumes the role of Prime Minister without addressing these serious concerns, it could lead to increased skepticism regarding his leadership and policies. Economic stability is often tied to public trust in government officials, and any perception of impropriety can have lasting effects on both the market and the electorate.

The Need for Transparency in Leadership

The situation underscores the critical need for transparency and integrity in leadership. As Poilievre prepares to take on the responsibilities of Prime Minister, the expectations for ethical governance will be high. Voters are increasingly aware of corporate accountability issues, and they expect their leaders to prioritize integrity in both business and politics.

To navigate this controversy successfully, Poilievre may need to take proactive steps to address the allegations presented in the exposé. This could involve advocating for stronger regulations on corporate transparency and holding businesses accountable for unethical practices. By doing so, he could restore public faith in his leadership and set a positive example for corporate governance in Canada.

Conclusion

The exposé regarding Pierre Poilievre’s connection to questionable accounting practices raises significant questions about corporate accountability and political scrutiny in Canada. As he approaches his potential role as Prime Minister, the implications of this situation cannot be overstated. The nearly $20 billion loss in stock value serves as a stark reminder of the consequences of corporate malfeasance, impacting not only shareholders but also the broader Canadian economy.

The role of media in holding public figures accountable is paramount, and the disparity between international and domestic scrutiny highlights a pressing need for improved investigative journalism. As Canadians prepare for a new leadership era, the importance of transparency, integrity, and ethical governance has never been more critical.

For further discussions on corporate accountability and political leadership, stay tuned for updates on this evolving story. The implications for Canadian businesses and the economy are far-reaching, and the public’s response will shape the future of governance in Canada.

While Canadian media do no scrutiny on the man who will be PM in mere days, last week one of the world’s most prestigious financial newspapers did a massive exposé on the “very deceptive presentation” of his company’s accounting.

The company stock has crashed nearly $20 billion… pic.twitter.com/03fZ1f7L9i

— Pierre Poilievre (@PierrePoilievre) March 9, 2025

While Canadian media do no scrutiny on the man who will be PM in mere days, last week one of the world’s most prestigious financial newspapers did a massive exposé on the “very deceptive presentation” of his company’s accounting.

In the fast-paced world of politics and finance, timing is everything. As Canada braces itself for a new Prime Minister, an unexpected storm brews over the financial integrity of the man stepping into the role. It’s not just any scrutiny; it’s an exposé from one of the world’s leading financial newspapers that has raised eyebrows and sent shockwaves through the industry. The article dives deep into what it describes as the “very deceptive presentation” of his company’s accounting practices, sparking a debate that many believe could have lasting repercussions.

The Company Stock Has Crashed Nearly $20 Billion

Let’s break this down. The findings from the exposé have led to a staggering drop in the company’s stock value—nearly $20 billion. That’s not just pocket change; it’s a monumental loss that could reverberate through the economy. Investors, analysts, and the general public are left wondering how this could happen, especially with the impending leadership change in Canada. If you’re interested in the detailed report, you can check it out here.

Understanding the Financial Exposé

What exactly did the exposé uncover? The article highlighted dubious accounting practices that misrepresented the company’s financial health. It pointed to discrepancies in revenue reporting and potential manipulation of earnings, which could mislead stakeholders and investors alike. When a financial institution of such prestige raises concerns, it’s a wake-up call for everyone involved. The implications of these findings extend beyond just the company; they could influence public trust in the new Prime Minister’s ability to lead, especially if he has ties to these questionable practices.

Why Does This Matter Now?

As Canadians prepare for a new leader, the timing of this exposé is crucial. The Prime Minister-elect is not just inheriting the country’s governance but also the public’s trust. If his corporate past is marred by financial discrepancies, it raises questions about his capability to steer Canada towards a prosperous future. Many citizens are concerned about whether he can separate his corporate interests from public service, especially when the stakes are so high. The public deserves transparency and accountability from their leaders, and these revelations challenge that notion.

Public Reaction and Media Scrutiny

Interestingly, the Canadian media has been criticized for not diving deeply into the Prime Minister-elect’s financial history. This lack of scrutiny raises eyebrows among citizens who expect thorough vetting of their leaders. Social media platforms, like Twitter, are buzzing with comments and opinions, reflecting a mixture of outrage and skepticism. People are demanding more accountability and questioning why local media hasn’t taken a stronger stance on such a pivotal issue.

Implications for Investors and Stakeholders

For investors, the exposé is a clarion call. A company’s reputation can drastically affect its stock price, and with nearly $20 billion wiped off its value, stakeholders are understandably anxious. This situation prompts investors to reconsider their positions and reassess the risks associated with the company and its leadership. The financial market thrives on trust, and when that trust is shaken, the repercussions can be felt across various sectors.

Potential Political Fallout

As the new Prime Minister prepares to take office, he faces a dual challenge: managing the nation’s affairs while also addressing these serious financial allegations. The political landscape in Canada could shift dramatically if these issues are not handled transparently. Opposition parties may seize the opportunity to question the integrity of the leadership, potentially impacting legislative agendas and public support. The Prime Minister-elect must act swiftly to restore faith in his leadership while navigating these turbulent waters.

What’s Next for the Prime Minister-elect?

The next steps for the Prime Minister-elect are critical. He must engage with the public openly and honestly about the findings of the exposé. Transparency is key; acknowledging the issues and outlining a plan to address them could mitigate some of the backlash. Moreover, he may need to consider distancing himself from the company’s past practices to reassure the electorate of his commitment to ethical governance.

Lessons Learned from the Financial Crisis

This situation serves as a potent reminder of the importance of corporate governance and ethical accountability. It highlights how quickly things can spiral out of control when financial integrity is compromised. For aspiring leaders, the lesson is clear: transparency, honesty, and ethical behavior are crucial in maintaining public trust. As we navigate the complexities of leadership and governance, let’s not forget the importance of holding our leaders accountable.

Conclusion: A Call for Scrutiny

The exposé on the new Prime Minister-elect’s company accounting practices is more than just a financial story; it’s a significant political issue that requires immediate attention. Canadians deserve to know the truth about the leaders they elect, and the media has a responsibility to investigate and report on these matters diligently. As we move forward, it’s essential to advocate for transparency and accountability in both the corporate and political arenas. Only then can we ensure a government that truly represents the interests of its citizens.

“`

This article provides a comprehensive overview of the situation involving the Prime Minister-elect, the exposé on his company’s accounting practices, and its implications for both the political and financial landscapes. The conversational tone and use of HTML headings help engage the reader while maintaining clarity and structure.