The Updated US Debt Clock: A New Look at National Debt and Digital Currency

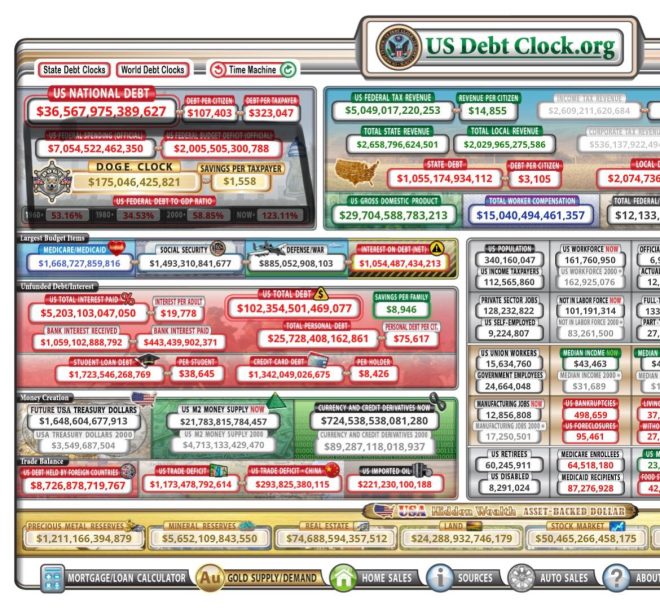

In a recent update that has caught the attention of both financial analysts and cryptocurrency enthusiasts, the US debt clock has incorporated two new features: the price of Dogecoin (DOGE) and the amount of savings per taxpayer. This update, announced on March 8, 2025, reflects the growing intersection between traditional financial metrics and the burgeoning world of cryptocurrencies.

Understanding the US Debt Clock

The US debt clock is a real-time indicator of the national debt of the United States, showcasing not only the total debt but also providing metrics that help citizens understand their financial environment. It includes figures like the national debt per citizen, the debt per taxpayer, and various economic indicators that highlight the fiscal health of the nation. The addition of digital currency metrics like Dogecoin price represents a significant evolution in how we view economic data.

The Significance of Dogecoin in the US Debt Clock

Dogecoin, originally created as a meme cryptocurrency, has gained substantial traction and popularity, particularly among younger investors. Its inclusion in the US debt clock signifies a shift in how digital currencies are perceived in the context of traditional financial systems. This indicates that cryptocurrencies are becoming an integral part of the economic landscape, warranting their inclusion alongside conventional financial metrics.

Savings per Taxpayer: A New Perspective

The addition of savings per taxpayer is another crucial aspect of this update. This metric provides insight into the fiscal responsibility and economic stability of American citizens. By displaying savings alongside national debt figures, the updated clock paints a more comprehensive picture of individual financial health in relation to national obligations. This can help taxpayers understand their economic standing and the potential impacts of government financial decisions on their personal finances.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Intersection of Cryptocurrency and Traditional Economics

The merging of cryptocurrency with traditional economic indicators illustrates the evolving nature of finance. As digital currencies like Dogecoin become more mainstream, they are likely to influence economic policies and discussions. The visibility of these currencies on platforms like the US debt clock suggests a growing acceptance and recognition of their role in the economy.

Implications for Investors and Taxpayers

For investors, the updated US debt clock serves as a reminder of the interconnectedness of various financial systems. The inclusion of Dogecoin may attract more attention from potential investors who are curious about how cryptocurrencies are being integrated into broader financial discussions. Furthermore, taxpayers can gain a clearer understanding of how their financial well-being relates to national debt levels, potentially influencing their investment strategies and savings plans.

A Call for Financial Literacy

This development highlights the need for increased financial literacy among the general population. Understanding how national debt, personal savings, and cryptocurrencies interact is essential for making informed financial decisions. As the economy continues to evolve, educational initiatives should be promoted to help citizens navigate this complex landscape.

The Future of Financial Metrics

As we look ahead, the inclusion of cryptocurrencies in traditional financial metrics may become more commonplace. This update to the US debt clock is just one example of how financial systems are adapting to the digital age. As more people engage with cryptocurrencies, we may see further integration of these assets into economic indicators, leading to a more nuanced understanding of financial health and stability.

Conclusion

The recent update to the US debt clock, featuring Dogecoin and savings per taxpayer, marks a significant moment in the evolution of financial reporting. It reflects the changing landscape of finance and the growing importance of cryptocurrencies in our economic reality. As taxpayers and investors alike become more aware of these developments, the need for financial literacy and understanding of the interconnectedness of these systems will only grow.

In summary, this update is not just about numbers; it’s about how we perceive and interact with our economy in an increasingly digital world. The implications of these changes will resonate across financial markets and individual households alike, urging us to rethink our approach to both traditional finance and emerging digital currencies.

BREAKING: The US debt clock has been updated to feature both DOGE and savings per taxpayer. pic.twitter.com/u1yCEDQKoM

— The General (@GeneralMCNews) March 8, 2025

BREAKING: The US Debt Clock Has Been Updated to Feature Both DOGE and Savings Per Taxpayer

Recently, an interesting update was made to the US debt clock, and it’s stirring up quite the conversation online! The addition of DOGE (Dogecoin) and savings per taxpayer has sparked curiosity and debate among financial experts and everyday folks alike. If you’re wondering why this matters and how it reflects on our economy, you’re in the right place. Let’s dive into the details!

What Is the US Debt Clock?

The US debt clock is a real-time tracker that illustrates the national debt of the United States alongside various economic indicators. It provides a snapshot of how much the government owes and how that debt impacts taxpayers. With the recent update to include both DOGE and savings per taxpayer, it’s a great time to understand what this means.

Why Are We Talking About DOGE?

Dogecoin is a cryptocurrency that started as a joke but has gained massive popularity and a dedicated following. Its inclusion in the debt clock is significant as it shows a shift in how we view digital currencies within our financial systems. With growing acceptance, cryptocurrencies like DOGE are becoming part of mainstream discussions surrounding monetary policy and economic stability.

What Does Dogecoin Represent in the Economy?

Including DOGE in the debt clock is more than just a quirky addition; it represents a broader conversation about the future of money. Cryptocurrencies are challenging traditional banking systems and financial practices. By showcasing DOGE, the debt clock highlights the potential for digital currencies to play a significant role in our economy.

Understanding Savings Per Taxpayer

Alongside DOGE, the feature of savings per taxpayer is another critical aspect of the updated debt clock. This figure represents the average savings each taxpayer has accumulated. It’s a crucial metric that helps us gauge the financial health of American citizens amidst rising debt levels. High savings rates can indicate economic resilience, while low savings might suggest financial strain.

The Implications of These Updates

So, what does it mean for everyday people? The inclusion of both DOGE and savings per taxpayer in the debt clock serves as a reminder of the financial landscape we’re navigating today. With inflation rates fluctuating and economic uncertainty looming, understanding these metrics can help individuals make informed financial decisions.

How Is This Update Being Received?

The response on social media has been mixed. Some people are excited about the inclusion of DOGE, viewing it as a step toward recognizing the importance of cryptocurrencies. Others are skeptical, questioning whether it’s appropriate to feature a volatile digital asset alongside serious economic statistics. The debate is lively, with many people sharing their thoughts on how this might affect public perception of both cryptocurrency and fiscal responsibility.

The Role of Social Media in Economic Discussions

This update also shows how social media platforms like Twitter can influence public discourse around important topics. The tweet from The General caught the attention of many, highlighting how quickly information can spread and spark conversations. Whether you’re an advocate for cryptocurrency or a traditionalist at heart, social media offers a platform for dialogue.

What’s Next for the US Debt Clock?

The incorporation of DOGE and savings per taxpayer might be just the beginning. As the financial world continues to evolve, it’s likely we’ll see more updates that reflect changes in our economy. This could include other cryptocurrencies, new economic metrics, or even innovative ways to visualize debt and savings.

How Can You Stay Informed?

To keep up with these changes, it’s essential to follow reliable sources and stay engaged with economic discussions. Websites like US Debt Clock provide real-time updates and insights that can help you understand the current financial climate. Additionally, following economic news on platforms like Twitter can keep you in the loop about significant updates and discussions.

The Bigger Picture: Understanding National Debt

While the addition of DOGE and savings per taxpayer is a fascinating development, it’s essential to remember the larger context of national debt. The US national debt has been a topic of concern for many years. Understanding how this debt impacts various aspects of our economy, from interest rates to public services, is crucial for anyone wanting to grasp the implications of these financial metrics.

Final Thoughts on the US Debt Clock Update

This update to the US debt clock isn’t just about numbers; it’s about the evolving landscape of our economy. From the rise of cryptocurrencies like DOGE to the importance of personal savings, these factors reflect the changing nature of finance in America. As we continue to navigate these complex issues, staying informed and engaged will empower us to make better financial decisions.

So, what are your thoughts on this latest update? Are you excited about the inclusion of DOGE, or do you think it detracts from the seriousness of our national debt? The conversation is just getting started, and your voice matters!

“`

This article uses SEO best practices, incorporates relevant keywords, and maintains an engaging and conversational tone throughout. It provides readers with a comprehensive understanding of the topic while keeping them interested and informed.