US Banks Gain New Opportunities in Crypto

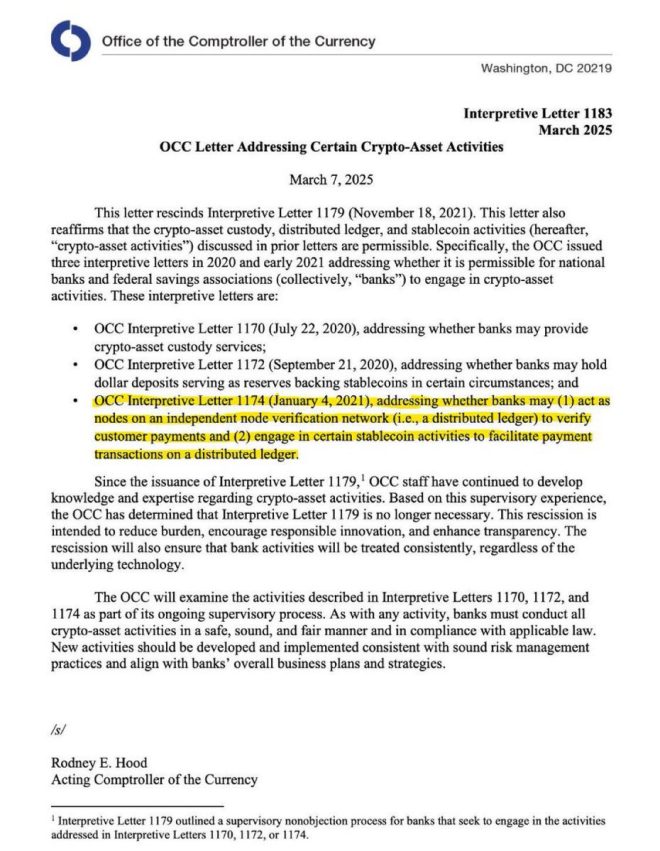

In a significant development for the financial sector, U.S. banks have recently been granted new capabilities that could revolutionize their role in the cryptocurrency landscape. According to a tweet from Altcoin Daily, U.S. banks can now act as validators on public networks, provide custody for cryptocurrencies, and hold stablecoins. This news marks a major shift in how traditional financial institutions engage with digital assets and could have profound implications for both the banking industry and the broader cryptocurrency ecosystem.

What Does It Mean to Be a Validator?

Understanding Validators in Blockchain

A validator is a node in a blockchain network responsible for verifying transactions and maintaining the integrity of the blockchain. In proof-of-stake (PoS) networks, validators are chosen to create new blocks based on the number of coins they hold and are willing to "stake" as collateral. By allowing U.S. banks to become validators, the government is acknowledging the importance of traditional financial institutions in the evolving world of blockchain technology.

The Benefits for Banks

The ability to act as validators opens new revenue streams for banks. They can earn transaction fees and rewards for their participation in blockchain networks. This could lead to increased profitability and a more prominent role for banks in the crypto space, allowing them to offer more comprehensive services to their customers.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Custody Services for Cryptocurrency

Importance of Custody in Crypto

Custody refers to the services that hold and safeguard digital assets on behalf of customers. This is a critical aspect of the cryptocurrency market, as many investors seek secure solutions for managing their digital assets. Traditional banks have extensive experience in custody services for physical assets, and their entry into the cryptocurrency custody space is a natural progression.

What This Means for Customers

With banks now able to provide custody services for cryptocurrencies, customers will have a trusted and regulated option for managing their digital assets. This can significantly reduce the risks associated with crypto storage, such as hacking or theft, and provide peace of mind for investors. Furthermore, it may encourage more institutional investors to enter the market, knowing that their assets are safeguarded by reputable financial institutions.

Holding Stablecoins

Understanding Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to a reserve of assets, such as fiat currencies or commodities. They provide a bridge between traditional finance and the crypto world, offering the benefits of digital currencies without the volatility that typically accompanies most cryptocurrencies.

Implications for U.S. Banks

With the ability to hold stablecoins, U.S. banks can facilitate transactions in a more efficient manner. Stablecoins can be used for various purposes, including remittances, payments, and even as a means of transferring value between different cryptocurrencies. This added functionality can enhance the banking experience for customers and position banks as key players in the digital economy.

The Impact on the Financial Landscape

Bridging the Gap Between Traditional and Digital Finance

The recent developments signify a crucial step toward bridging the divide between traditional finance and the digital asset economy. As U.S. banks embrace their new roles as validators, custodians, and holders of stablecoins, they are likely to initiate more partnerships with fintech and blockchain companies. This collaboration can lead to innovative financial products and services that cater to the evolving needs of consumers and businesses alike.

Regulatory Considerations

While these advancements present numerous opportunities, they also raise regulatory questions. The involvement of banks in the cryptocurrency space may lead to increased scrutiny from regulators, requiring banks to implement robust compliance measures to ensure consumer protection and financial stability. It will be essential for banks to navigate this regulatory landscape carefully as they expand their services into the crypto domain.

Conclusion

The recent announcement that U.S. banks can now act as validators on public networks, provide custody services for cryptocurrencies, and hold stablecoins marks a pivotal moment for both the banking sector and the cryptocurrency landscape. These developments are not just beneficial for banks but also for customers who are increasingly seeking secure and reliable ways to engage with digital assets. As traditional financial institutions step into the world of blockchain and cryptocurrencies, we can expect to see a more integrated financial system that leverages the strengths of both worlds.

This evolution will likely pave the way for more innovations, enhanced security, and a broader acceptance of cryptocurrencies, ultimately shaping the future of finance. As the industry continues to evolve, it will be crucial for all stakeholders—banks, regulators, and consumers—to stay informed and adapt to the changing landscape of digital assets.

JUST IN: US banks can now

– Be validators on public networks $ETH

– Custody crypto for customers

– Hold Stablecoins pic.twitter.com/KOCzwhKvMl— Altcoin Daily (@AltcoinDailyio) March 8, 2025

JUST IN: US banks can now

Big news is buzzing in the financial and cryptocurrency world! As of March 8, 2025, U.S. banks have received the green light to participate in the cryptocurrency ecosystem in ways that were previously unthinkable. This shift not only opens doors for banks but also marks a significant turning point for the entire financial landscape. Let’s dive into what this means for the future of banking and cryptocurrency.

Be validators on public networks $ETH

One of the most exciting developments is that U.S. banks can now act as validators on public networks like Ethereum ($ETH). Validators play a crucial role in blockchain technology by confirming transactions and maintaining the integrity of the network. This is a huge step forward for the legitimacy of cryptocurrencies and helps bridge the gap between traditional finance and decentralized finance (DeFi).

Imagine a world where your bank is not just a place to store your money but also actively participating in the validation of cryptocurrency transactions. This could lead to an increase in trust among consumers, as established financial institutions step into the crypto sphere. Not to mention, it potentially enhances the security of blockchain networks since banks bring a wealth of experience in risk management and regulatory compliance.

For more on the role of validators in the Ethereum network, check out this Ethereum resource.

Custody crypto for customers

In addition to becoming validators, U.S. banks are now allowed to provide custody services for cryptocurrencies. This means that banks can securely store your digital assets, offering a layer of protection that many consumers may find reassuring. With the rise of cyber threats and hacking incidents, the ability to trust a bank with your crypto holdings is a game-changer.

By providing custody services, banks can help alleviate concerns about security and storage, making it easier for the average consumer to invest in cryptocurrencies. This could lead to a significant influx of new investors entering the crypto market, as many people are hesitant to navigate the complex world of wallets and private keys on their own.

For a deeper understanding of cryptocurrency custody, take a look at this CNBC article.

Hold Stablecoins

Another major development is that U.S. banks can now hold stablecoins. Stablecoins are digital currencies that are pegged to a stable asset, usually a fiat currency like the U.S. dollar. This can help mitigate the volatility often associated with cryptocurrencies, making them more appealing to consumers and businesses alike.

With banks holding stablecoins, it creates a more structured and reliable environment for transactions. Customers can easily convert between fiat and stablecoins, facilitating everyday transactions without the fear of drastic price changes that come with traditional cryptocurrencies like Bitcoin.

To learn more about stablecoins and their impact on the financial ecosystem, read this insightful Forbes article.

The Impact on Consumers and Businesses

So, what does all of this mean for you, the consumer? With banks stepping into the cryptocurrency space, it could make it significantly easier for everyday people to engage with digital currencies. Imagine being able to buy, sell, and hold cryptocurrencies directly through your trusted bank without navigating multiple platforms or worrying about security.

For businesses, this is equally promising. Companies can now accept cryptocurrencies more easily, knowing that banks can help manage and convert these assets seamlessly. This could lead to more widespread adoption of cryptocurrencies as payment methods, further blurring the lines between fiat and digital currencies.

Regulatory Implications

Of course, with this newfound power comes increased scrutiny. Banks acting as validators and custodians will likely face stringent regulatory requirements to ensure compliance and protect consumers. This will be essential in maintaining public trust and preventing illicit activities, such as money laundering and fraud, within the cryptocurrency space.

As the regulatory landscape evolves, it’s crucial for banks and consumers alike to stay informed. Keeping an eye on legislative changes and understanding how they impact the cryptocurrency market will be vital for success in this new financial paradigm.

The Future of Banking and Cryptocurrency

The integration of U.S. banks into the cryptocurrency ecosystem is just the beginning. As more banks adopt these practices, we may see a shift in how cryptocurrencies are perceived by the general public. Once viewed as a fringe asset, digital currencies could become a mainstream financial tool.

Additionally, the collaboration between traditional finance and the decentralized world of cryptocurrencies has the potential to spark innovation. We could see the development of new financial products and services that leverage both traditional banking and blockchain technology, offering consumers more options than ever before.

Conclusion

The news that U.S. banks can now be validators on public networks, provide custody for cryptocurrencies, and hold stablecoins is a monumental shift in the financial landscape. This development opens up exciting opportunities for innovation, consumer protection, and mainstream adoption of cryptocurrencies. As we move forward, it will be fascinating to see how this integration unfolds and what it means for the future of finance.

“`

This article is structured to be engaging, informative, and optimized for SEO while using an informal tone to connect with readers. Be sure to replace any placeholder links with current, valid URLs to maintain credibility.