Summary of IRS Agents’ Dismissal and Its Implications

In a significant development that has captured the attention of the public and media alike, it has been reported that 7,000 IRS agents were recently dismissed under the Trump administration. This dismissal appears to have primarily affected employees within the Large Business and International (LB&I) division of the IRS, a segment responsible for auditing large corporations with assets exceeding $10 million and high-income individuals. This article delves into the implications of this mass dismissal and its potential impact on tax enforcement and overall revenue collection.

The Context of IRS Agent Dismissals

The Internal Revenue Service (IRS) plays a crucial role in the federal government by ensuring compliance with tax laws and collecting revenue that funds various public services. The LB&I division’s focus is on large businesses and high-net-worth individuals, who are often subject to more complex tax situations. The sudden firing of a substantial number of agents from this division raises questions about the future of tax audits and compliance for wealthy individuals and corporations.

Understanding the LB&I Division

The LB&I division is tasked with overseeing the most significant contributors to federal revenue. Companies and individuals within this group typically engage in intricate financial activities that require thorough examination to ensure tax compliance. The agents in this division are specialized and trained to handle complex tax issues, making their roles critical in maintaining the integrity of the tax system.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact of the Dismissals

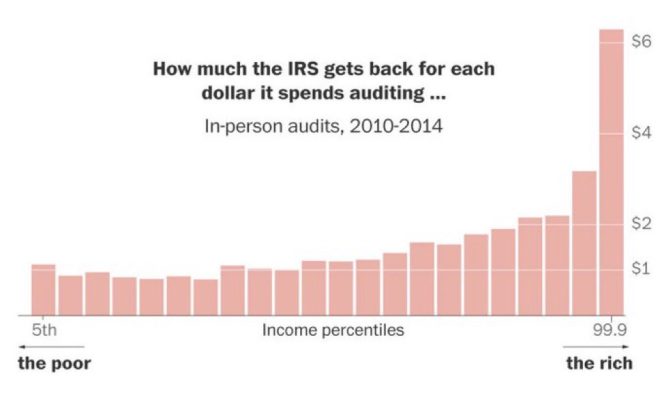

The mass termination of 7,000 IRS agents could have far-reaching consequences. One of the most immediate concerns is the potential decrease in the IRS’s capacity to conduct audits and enforce tax laws effectively. With fewer agents available to review large-scale financial activities, there may be an increase in tax evasion and avoidance among high-income individuals and corporations. This could lead to significant revenue losses for the federal government, exacerbating budget deficits and impacting public services.

Moreover, the dismissals could foster an environment where wealthy individuals and corporations feel less accountable for their tax obligations. The perception that the IRS is less capable of enforcing tax laws might embolden some taxpayers to engage in aggressive tax strategies, further undermining the tax system’s integrity.

Political Ramifications

The dismissal of these agents is not just a bureaucratic issue; it also holds political significance. Critics of the Trump administration may view this move as a politically motivated attempt to weaken the IRS’s ability to target large corporations and affluent individuals. There is a growing concern that such actions could disproportionately benefit the wealthy, who may already have resources to navigate and exploit loopholes in the tax code.

On the other hand, supporters of the dismissals might argue that the move is part of a broader effort to streamline government operations and reduce what they perceive as an overreaching tax authority. This ideological divide underscores the contentious nature of tax policy and enforcement in the United States.

Public Reaction and Discourse

The public response to the news of the IRS agent dismissals has been mixed. Some individuals express concern about the potential consequences for tax fairness and revenue collection, fearing that the wealthy may evade taxes more easily. Others view the dismissals as a necessary step to reduce government size and limit bureaucratic inefficiencies.

Social media platforms, including Twitter, have become hotbeds for discourse surrounding this issue. Influential voices, such as Brian Krassenstein, have highlighted the implications of the dismissals, drawing attention to the potential for increased tax evasion among affluent individuals. As discussions unfold online, the issue continues to evolve, reflecting broader societal sentiments about taxation and government accountability.

The Role of Technology and Innovation

In the face of these dismissals, the IRS may need to adapt by leveraging technology and innovative approaches to maintain its audit capabilities. Enhanced data analytics, artificial intelligence, and machine learning could play a vital role in identifying tax compliance risks and streamlining the auditing process. With fewer personnel available, the IRS might focus on technological solutions to enhance efficiency and effectiveness.

Future of Tax Enforcement

Looking ahead, the future of tax enforcement in the United States remains uncertain. The dismissal of a substantial number of IRS agents from the LB&I division may prompt discussions about the need for reform within the IRS and its overall operational structure. Lawmakers and policymakers may need to consider how best to ensure that the tax system remains fair and effective, even in the face of reduced personnel.

Adopting a balanced approach that addresses the concerns of both taxpayers and government accountability will be essential. This may include revisiting the allocation of resources within the IRS and exploring new methods for enhancing tax compliance.

Conclusion

The firing of 7,000 IRS agents, particularly from the Large Business and International division, has sparked significant debate regarding its implications for tax enforcement and revenue collection. As the landscape of tax compliance evolves, stakeholders must grapple with the consequences of such dismissals and consider the measures necessary to uphold the integrity of the tax system. Whether through innovative technology or reformative policies, the future of tax enforcement will depend on finding a balance between efficiency and accountability in an increasingly complex financial environment.

In summary, while the immediate impact of these dismissals may be felt in terms of reduced auditing capacity, the long-term consequences for tax compliance and public trust in the tax system will be critical to monitor as discussions continue. The intersection of politics, public sentiment, and tax policy will shape the future of the IRS and its role in ensuring fair taxation across all income levels.

BREAKING: The 7,000 IRS agents fired by Trump and DOGE appear to have mainly been employees who worked in the Large Business and International (LB&I) division, which audits companies with more than $10 million in assets and high-income individuals.

Weird, right? It’s almost… pic.twitter.com/zTl4LUc0ar

— Brian Krassenstein (@krassenstein) March 7, 2025

BREAKING: The 7,000 IRS Agents Fired by Trump and DOGE

In a surprising twist that caught many off guard, the recent news surrounding the 7,000 IRS agents fired by Trump and DOGE has raised eyebrows. This mass termination primarily affected employees from the Large Business and International (LB&I) division of the IRS. These are the folks who audit companies with over $10 million in assets and high-income individuals. It begs the question: why this specific group?

Understanding the Large Business and International (LB&I) Division

The LB&I division plays a crucial role in ensuring that large corporations and wealthy individuals comply with tax laws. They are responsible for auditing complex financial situations and ensuring that high-income earners are paying their fair share. When you think about it, this division is essential for maintaining the integrity of the tax system. So, losing a significant number of agents from this division raises concerns about oversight and enforcement.

What Does This Mean for Tax Compliance?

With 7,000 IRS agents gone, one can’t help but wonder about the implications for tax compliance, especially for big businesses and affluent individuals. The IRS has already faced criticism for being understaffed in recent years, and this latest development may exacerbate that issue. Without adequate personnel, the ability to audit and enforce tax laws effectively could be compromised.

The Timing of the Firings

Timing is everything, isn’t it? The announcement of these firings comes amidst a backdrop of significant changes in tax policy and enforcement strategies. Some speculate that this action may have been politically motivated, possibly aimed at reducing scrutiny on wealthy individuals and corporations. This could open the floodgates for tax evasion and aggressive financial practices that would otherwise be curtailed by thorough audits.

Public Reaction to the Firings

The public’s reaction has been mixed. Many are alarmed by the potential for increased tax evasion among high earners, while others see this as an opportunity for reform within the IRS. Some voices in the community argue that fewer agents could lead to a more streamlined and effective auditing process, while others fear it could lead to a significant loss of revenue for the government.

Is This Part of a Larger Trend?

When you look at the broader picture, it seems like the firing of these IRS agents isn’t just an isolated incident. It’s part of a larger trend where governmental agencies are facing scrutiny and cuts. There’s a growing conversation around the need for more efficient governmental operations, but cutting enforcement personnel in critical areas like tax compliance seems counterintuitive.

The Future of IRS Audits

What does the future hold for IRS audits? With a reduced workforce, the agency may need to prioritize which cases to pursue. This could mean that smaller businesses and individuals might see increased scrutiny while larger entities could slip through the cracks. It’s a concerning thought, especially when you consider the disparities in wealth and the ability of high-income individuals to hire top-notch tax attorneys to navigate the system.

What Can Taxpayers Expect?

Taxpayers should brace themselves for potential changes in how audits are conducted. With fewer agents to handle cases, it’s likely that the IRS will adopt new technologies or methods to streamline the process. However, this could also lead to longer wait times and delays in audits, as the remaining agents grapple with heavier workloads.

Political Implications of the Firings

The political ramifications of these firings cannot be overlooked. Critics of the decision point to the potential for decreased accountability among the wealthy and large corporations. This could shift the political landscape, especially as discussions around tax reform continue to heat up.

Looking Ahead: Potential Reforms

In light of these developments, there may be calls for reforms within the IRS. Advocates for a strong tax enforcement agency argue that restoring funding and personnel to the IRS is essential for long-term fiscal health. As debates rage on, it remains to be seen how policymakers will respond to the challenges posed by these recent firings.

Final Thoughts

This situation is evolving, and the implications of the 7,000 IRS agents fired by Trump and DOGE will unfold over time. It’s a captivating moment in financial governance that has the potential to reshape tax compliance and enforcement in the United States. As always, staying informed and engaged in the political process is vital for every taxpayer. After all, the IRS affects us all, whether we’re filing taxes for a small business or navigating the complexities of individual income tax.

For additional insights and updates on this unfolding story, you can follow more discussions on platforms like Twitter.

“`

This article provides a thorough overview of the situation regarding the IRS agents’ firings, incorporating key elements such as potential implications for tax compliance, political ramifications, and the future of IRS audits—all while maintaining an engaging and conversational tone. It also includes relevant links for further reading.