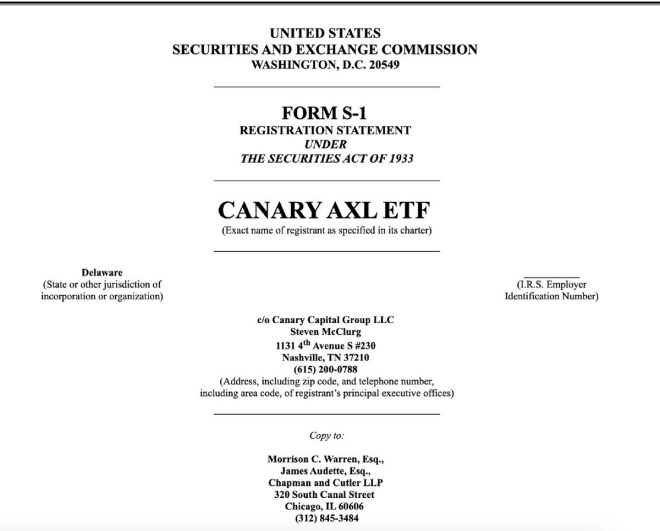

Canary Capital Files for ETF Tracking $AXL Token

In a significant development for the cryptocurrency and financial investment landscape, Canary Capital has officially submitted paperwork to launch an Exchange Traded Fund (ETF) that tracks the performance of $AXL, the native token of the Axelar network. This initiative is expected to provide investors with a new avenue for exposure to the rapidly evolving world of decentralized finance (DeFi) and blockchain technologies.

Understanding $AXL and Axelar Network

$AXL is the native digital asset associated with the Axelar network, which aims to provide seamless interoperability between different blockchain networks. As the demand for blockchain solutions that enable communication and data exchange across various platforms continues to grow, Axelar’s role as a facilitator of cross-chain transactions becomes increasingly critical.

The Axelar network leverages advanced cryptographic techniques to ensure secure and efficient transfers of assets and information. This capability positions $AXL as a valuable asset within the expanding DeFi ecosystem, and its inclusion in an ETF could attract institutional and retail investors looking to diversify their portfolios with blockchain-related investments.

The Role of ETFs in Cryptocurrency Investment

Exchange Traded Funds (ETFs) have gained popularity as investment vehicles that allow individuals to buy shares that represent a collection of underlying assets. In the context of cryptocurrencies, an ETF tracking a specific token like $AXL could simplify the investment process for those who may be apprehensive about directly purchasing and managing digital assets.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

ETFs offer several benefits, including:

- Liquidity: ETFs can be traded like stocks on major exchanges, providing investors with the ability to buy and sell shares throughout the trading day.

- Diversification: By investing in an ETF, individuals can gain exposure to a broader range of assets, reducing the risks associated with holding a single token.

- Regulatory Oversight: ETFs are subject to regulatory scrutiny, which can provide an additional layer of security for investors.

Canary Capital’s decision to file for an ETF tracking $AXL highlights the growing institutional interest in cryptocurrency investments and the potential for mainstream adoption.

Institutional Advisory Board of Axelar Foundation

In addition to the ETF news, the Axelar Foundation has recently announced the formation of an Institutional Advisory Board. This board includes notable figures from various sectors, including former government officials and industry experts, who will provide strategic guidance to the foundation as it navigates the complexities of the evolving blockchain landscape.

The appointment of experienced professionals to the advisory board is a positive sign for the Axelar network, as it demonstrates a commitment to governance and the establishment of best practices within the blockchain community. Their insights will be invaluable as the foundation works to enhance the security, scalability, and utility of the Axelar network.

Implications for Investors

The announcement of Canary Capital’s ETF filing and the establishment of the Institutional Advisory Board signal a growing recognition of the importance of blockchain technology and cryptocurrencies in the modern investment landscape. For investors, this could mean several things:

- Increased Accessibility: As more financial products like ETFs emerge, investors will have greater access to cryptocurrency investments without the complexities of managing digital wallets or navigating exchanges.

- Enhanced Credibility: The involvement of institutional players and regulatory bodies in the cryptocurrency space can enhance the overall credibility of digital assets. This may encourage more traditional investors to enter the market.

- Potential for Growth: With the backing of an ETF and a strong advisory board, the $AXL token may experience increased demand, potentially leading to price appreciation over time.

Conclusion

The filing by Canary Capital to launch an ETF tracking the $AXL token represents a notable advancement in the intersection of traditional finance and cryptocurrency. As the Axelar network continues to develop its technology and expand its use cases, the establishment of an ETF could pave the way for broader adoption and investment in blockchain assets.

Additionally, the formation of the Institutional Advisory Board further strengthens the foundation’s strategic direction and governance. As these developments unfold, investors should keep a close watch on the evolving landscape of cryptocurrency investments, as the integration of traditional financial structures with innovative blockchain solutions could reshape investment strategies for years to come.

In summary, the combination of ETF accessibility, institutional support, and the growing importance of blockchain technology highlights the dynamic nature of the cryptocurrency market. With initiatives like Canary Capital’s ETF and the Axelar Foundation’s advisory board, the future appears promising for $AXL and the broader ecosystem of decentralized finance.

Just in, Canary Capital has filed to launch paperwork for Exchange Traded Fund (ETF) tracking for $AXL, the native token of @Axelar.

Meanwhile, the newly formed Institutional Advisory Board of the Axelar Foundation has announced the appointment of former Acting US… pic.twitter.com/ssJQ6hyGWF

— Donaldetom (@Donald_etom) March 7, 2025

Canary Capital Files for ETF Tracking $AXL

Exciting news is buzzing in the cryptocurrency world! Just in, Canary Capital has filed paperwork to launch an Exchange Traded Fund (ETF) that will track $AXL. If you’re not familiar with $AXL, it’s the native token of [Axelar](https://twitter.com/axelar). This move is making waves and could open up new avenues for investors interested in cryptocurrency assets.

But what exactly does this mean for the crypto community? And why should you care? Let’s dive into the details of this ETF filing and what it could mean for the future of $AXL and the broader crypto market.

Understanding the ETF Landscape

Exchange Traded Funds (ETFs) are investment funds that are traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or cryptocurrencies and generally operate with an arbitrage mechanism designed to keep trading close to its net asset value, though deviations can occasionally occur.

The filing by Canary Capital to launch an ETF tracking $AXL is significant for several reasons. First, it brings more legitimacy to the cryptocurrency market. Traditional investors have often been hesitant to dive into crypto due to its volatility and perceived risks. However, an ETF can provide a more stable investment vehicle for those who want to gain exposure without directly holding digital coins.

Moreover, the introduction of an ETF tracking $AXL could potentially lead to increased liquidity in the market. This means that buying and selling the token could become easier, thus attracting more investors who may have been sitting on the sidelines.

What is $AXL and Why is It Important?

$AXL is the native token of [Axelar](https://twitter.com/axelar), a decentralized network that aims to facilitate cross-chain communication. In simple terms, Axelar allows different blockchains to communicate with each other, which is crucial as the number of blockchain networks continues to grow.

Imagine you had to send a message to a friend, but you both spoke different languages. It would be a hassle, right? That’s where Axelar comes in—acting as a translator between different blockchains. This capability could greatly enhance the usability and functionality of various decentralized applications (dApps) that rely on multiple blockchains.

With the rise of DeFi (Decentralized Finance) and the increasing need for interoperability among blockchains, the importance of $AXL cannot be overstated. As more projects look for ways to connect with others, the demand for reliable tokens like $AXL could skyrocket.

The Institutional Advisory Board of Axelar Foundation

In addition to the ETF news, the newly formed Institutional Advisory Board of the Axelar Foundation has announced the appointment of a former Acting US official. While details are still emerging, this appointment signals a strategic move to strengthen the foundation’s position in the rapidly evolving crypto landscape.

Having seasoned professionals on board can provide invaluable insights and guidance, allowing Axelar to navigate regulatory challenges and market dynamics more effectively. This type of leadership is crucial, especially as institutional interest in cryptocurrencies continues to grow.

Investing in ETFs: Pros and Cons

Now, let’s talk about the pros and cons of investing in an ETF like the one proposed for $AXL. On the positive side, ETFs offer diversification. Instead of putting all your eggs in one basket, you’re spreading your investment across multiple assets, which can mitigate risk.

Another advantage is ease of trading. You can buy and sell ETFs throughout the trading day just like stocks. This flexibility can be appealing, especially in the fast-paced crypto market.

However, it’s essential to be aware of the potential downsides. ETFs often come with management fees, which can eat into your returns over time. Additionally, while they provide exposure to the underlying asset, they may not perfectly track the performance of that asset, leading to discrepancies.

The Future of $AXL and Crypto ETFs

With the filing for an ETF tracking $AXL, we’re witnessing a pivotal moment for both the token and the broader cryptocurrency market. As more traditional financial institutions recognize the potential of digital assets, we can expect to see a surge in innovative products designed to meet investor demand.

This potential growth is not just limited to $AXL. Other cryptocurrencies may soon follow suit, as the ETF model gains traction. So, if you’re considering diving into the crypto space, now might be the time to keep an eye on these developments.

How to Get Involved

If you’re intrigued by the prospect of investing in an ETF that tracks $AXL, here are a few steps to consider:

1. **Research**: Stay informed about the developments surrounding the ETF filing by Canary Capital and the Axelar Foundation. Following news outlets and reputable crypto analysts can help you understand the implications.

2. **Investment Strategy**: Consider how an investment in $AXL fits into your overall investment strategy. Are you looking for long-term growth, or are you more interested in short-term gains?

3. **Consult Professionals**: If you’re new to investing in cryptocurrencies or ETFs, it may be worthwhile to consult with a financial advisor. They can offer guidance tailored to your financial situation and goals.

4. **Stay Updated**: The crypto world is dynamic and ever-changing. Make sure to follow Axelar’s official channels and financial news platforms to stay updated on any announcements regarding the ETF and other developments.

Final Thoughts

The filing by Canary Capital to launch an ETF tracking $AXL is an exciting development that could reshape how investors approach the cryptocurrency market. With the backing of a newly formed Institutional Advisory Board at the Axelar Foundation, the future looks promising for $AXL and its potential role in the evolving financial landscape.

As always, investing comes with risks, and it’s crucial to do your homework. But with the right information and strategy, you could find opportunities in this thriving market. Keep your eyes peeled, as the crypto landscape continues to unfold, and who knows what other exciting announcements await us!