The White House Recognizes Bitcoin as "Digital Gold"

In a significant development for the cryptocurrency landscape, the White House has officially referred to Bitcoin as "digital gold." This statement marks a pivotal shift in how the U.S. government perceives Bitcoin and its potential role in the global economy. The comment comes as part of a broader discussion regarding the strategic advantages of establishing a Strategic Bitcoin Reserve, a move that could position the United States favorably in the evolving digital currency arena.

Understanding Bitcoin as "Digital Gold"

Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, has often been likened to gold due to its limited supply and decentralized nature. With only 21 million Bitcoins that can ever exist, its scarcity mirrors that of gold, making it an appealing store of value. The term "digital gold" encapsulates the notion that Bitcoin can serve as a hedge against inflation and economic uncertainty, much like traditional gold.

Strategic Advantages of a Bitcoin Reserve

The White House’s acknowledgment of Bitcoin’s potential highlights the strategic advantages for nations that are among the first to create a Strategic Bitcoin Reserve. Such a reserve could provide several benefits:

- Economic Stability: In times of economic turbulence, a Bitcoin reserve could offer a buffer against inflation and currency devaluation. By holding Bitcoin, a nation could protect its wealth and maintain purchasing power.

- Global Influence: Establishing a Bitcoin reserve could enhance a nation’s standing on the global stage, particularly as other countries explore digital currencies. This could lead to increased influence in international financial markets and negotiations.

- Innovation Leadership: By embracing Bitcoin and other cryptocurrencies, the U.S. could position itself as a leader in financial technology and innovation. This could stimulate economic growth and attract investment in the burgeoning blockchain sector.

The Growing Acceptance of Cryptocurrencies

The White House’s recent comments reflect a growing acceptance of cryptocurrencies in mainstream finance and government policy. Over the past few years, various institutions, corporations, and even some countries have begun to recognize the potential of digital currencies. This acceptance is paving the way for regulatory frameworks that could provide clarity and security for investors and users alike.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Investors and the Market

The statement from the White House is likely to have significant implications for Bitcoin investors and the broader cryptocurrency market. As governments and institutions take a more favorable view of Bitcoin, it could lead to increased adoption among retail investors and institutional players. This heightened interest may drive up demand, resulting in price appreciation for Bitcoin and boosting the overall market.

Additionally, the recognition of Bitcoin as "digital gold" could lead to more investment products and services centered around cryptocurrency. Financial institutions may develop Bitcoin-backed ETFs (Exchange-Traded Funds), futures contracts, and other investment vehicles, making it easier for traditional investors to gain exposure to the digital asset.

The Future of Bitcoin and U.S. Policy

As the U.S. government continues to explore the potential of Bitcoin and other cryptocurrencies, it is essential to consider the future of regulatory policies. The establishment of a Strategic Bitcoin Reserve could necessitate new regulations and frameworks to govern the use and trading of Bitcoin. Policymakers will need to balance innovation with consumer protection, ensuring that the cryptocurrency ecosystem remains secure and transparent.

Conclusion

The White House’s characterization of Bitcoin as "digital gold" and the mention of creating a Strategic Bitcoin Reserve signal a transformative moment in the relationship between government and cryptocurrency. As Bitcoin gains recognition as a legitimate asset class, its potential to shape economic policy and influence global financial markets becomes increasingly apparent.

Investors, institutions, and policymakers must stay informed about these developments as they navigate the evolving landscape of digital currencies. The future of Bitcoin—and the broader cryptocurrency market—looks promising, with the potential for significant growth and transformation in the years to come.

In summary, the acknowledgment of Bitcoin as a strategic asset by the U.S. government underscores the growing importance of digital currencies in the global economy. As nations explore the benefits of Bitcoin reserves, we may witness a new era of financial innovation and stability, driven by the unique properties of this digital asset.

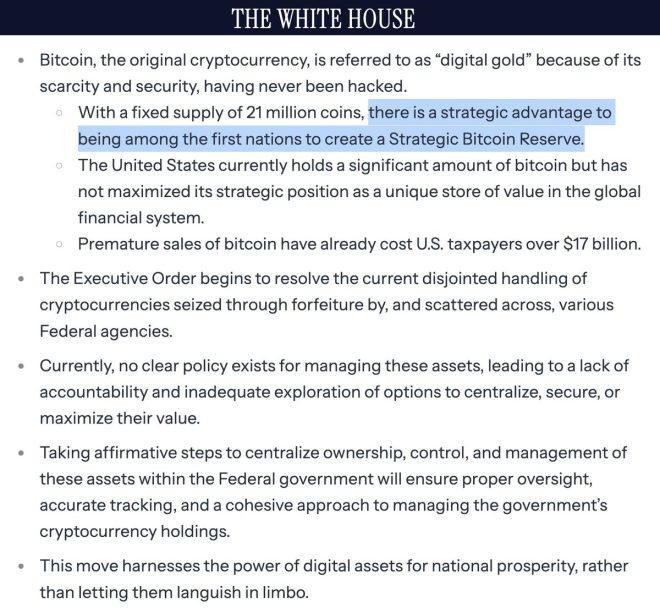

JUST IN: The White House calls Bitcoin “digital gold” and says “there is a strategic advantage to being among the first nations to create a Strategic Bitcoin Reserve.” pic.twitter.com/ZfVjRoHT4h

— Bitcoin Magazine (@BitcoinMagazine) March 7, 2025

JUST IN: The White House calls Bitcoin “digital gold” and says “there is a strategic advantage to being among the first nations to create a Strategic Bitcoin Reserve.”

Bitcoin has been making waves lately, and the recent acknowledgment from the White House, labeling it as “digital gold,” adds another layer to the ongoing conversation about cryptocurrencies. This is a significant shift in how the U.S. government views Bitcoin, and it signals a potential change in the landscape of global finance. But what does it really mean when the White House emphasizes the strategic advantages of establishing a Strategic Bitcoin Reserve? Let’s dive into the implications of this statement and what it could mean for the future of Bitcoin and other cryptocurrencies.

Understanding Bitcoin as “Digital Gold”

When we think of gold, we often associate it with stability, value retention, and a hedge against inflation. Bitcoin, often referred to as “digital gold,” shares these characteristics. It’s decentralized, meaning it isn’t controlled by any government or financial institution, and it has a finite supply capped at 21 million coins. This scarcity is one of the key factors that contribute to its value, especially as more people and institutions recognize its potential.

The term “digital gold” suggests that Bitcoin could serve as a store of value in the digital age. In times of economic uncertainty, people often flock to gold as a safe haven, and Bitcoin might just be stepping into that role for a new generation. The White House’s recognition of Bitcoin as digital gold signifies a growing acceptance of cryptocurrencies as legitimate assets, which could pave the way for more regulatory clarity and mainstream adoption.

The Strategic Advantage of a Bitcoin Reserve

Now, let’s talk about what it means to create a Strategic Bitcoin Reserve. The idea is simple yet powerful: by accumulating Bitcoin, a nation could potentially shield itself from economic volatility and inflation while positioning itself as a leader in the global financial system. The White House’s statement hints that there could be significant benefits for nations that act quickly to establish such reserves.

By being among the first to adopt this strategy, a country could enhance its economic security and influence on the global stage. The potential for Bitcoin to serve as a reserve asset could lead to a new kind of financial diplomacy, where countries that hold substantial amounts of Bitcoin could leverage their positions in negotiations and alliances.

For example, countries like El Salvador, which has already adopted Bitcoin as legal tender, are setting a precedent that others might follow. As more nations recognize the potential benefits of holding Bitcoin, we could see a ripple effect that encourages broader adoption and integration into national financial strategies.

The Global Response to Bitcoin’s Rising Status

With the White House’s endorsement, it’s essential to consider how other nations might respond. Countries that are traditionally seen as economic powerhouses, such as China and the European Union member states, are likely to take note of this development. China, for instance, has taken a more cautious approach to cryptocurrencies, focusing on developing its digital yuan. However, the shift in narrative from the U.S. could prompt a reevaluation of strategies among other global players.

As nations begin to understand the implications of a Strategic Bitcoin Reserve, we might witness an arms race of sorts in the cryptocurrency space. Countries could start competing to accumulate Bitcoin, leading to increased demand and potentially driving up prices. This competition could also lead to more innovative regulatory frameworks, as governments strive to create environments conducive to crypto investment and development.

Challenges and Considerations

While the strategic advantages of establishing a Bitcoin Reserve are clear, there are challenges that nations must navigate. One of the most significant concerns is volatility. Bitcoin’s price can fluctuate dramatically in short periods, which makes it a risky asset for any reserve. Countries would need to develop strategies to mitigate this risk, possibly by diversifying their reserves or implementing measures to stabilize Bitcoin’s value.

Regulatory hurdles are another consideration. The legal landscape surrounding cryptocurrencies is still evolving, and nations must create frameworks that protect consumers while fostering innovation. This balance is delicate, as overly stringent regulations could stifle growth and push investment into less regulated markets.

Additionally, there’s the question of public perception and education. Many people still view Bitcoin and cryptocurrencies with skepticism. Governments will need to engage in educational initiatives to inform their citizens about the benefits and risks associated with Bitcoin and how it can fit into the broader economy.

Bitcoin’s Potential Impact on Traditional Finance

The White House’s endorsement of Bitcoin as digital gold has the potential to reshape traditional finance. As countries begin to adopt Bitcoin reserves, we could see significant changes in how central banks operate. The introduction of Bitcoin into national reserves might lead to discussions on how traditional currencies interact with decentralized digital currencies.

Moreover, the notion of a Strategic Bitcoin Reserve could influence monetary policy. Central banks might need to consider the implications of Bitcoin holdings when making decisions about interest rates and inflation control. This could lead to a more interconnected global financial system, where Bitcoin plays a pivotal role.

What This Means for Investors

For investors, the White House’s comments open up a world of possibilities. If Bitcoin is viewed as a strategic asset by governments, it could enhance its legitimacy and attract institutional investment. This could lead to increased demand and higher prices, benefiting those who have already invested in Bitcoin.

However, potential investors should approach this news with caution. While the endorsement is positive, it’s crucial to conduct thorough research and understand the risks associated with investing in cryptocurrencies. The market remains volatile, and while Bitcoin has shown resilience, it’s essential to have a long-term perspective and not get swept away by short-term price movements.

Looking Ahead: The Future of Bitcoin

The White House’s recognition of Bitcoin as digital gold marks a significant moment in the evolution of cryptocurrencies. As more nations consider creating Strategic Bitcoin Reserves, we could be on the brink of a new era in finance. The potential for Bitcoin to serve as a reserve asset could lead to increased legitimacy and integration into global financial systems.

While there are challenges to navigate, the strategic advantages of Bitcoin cannot be ignored. As countries adapt to the changing landscape, it’s clear that Bitcoin is here to stay, and its role in shaping the future of finance will only continue to grow. For those interested in the intersection of technology, finance, and policy, now is an exciting time to observe how this narrative unfolds.