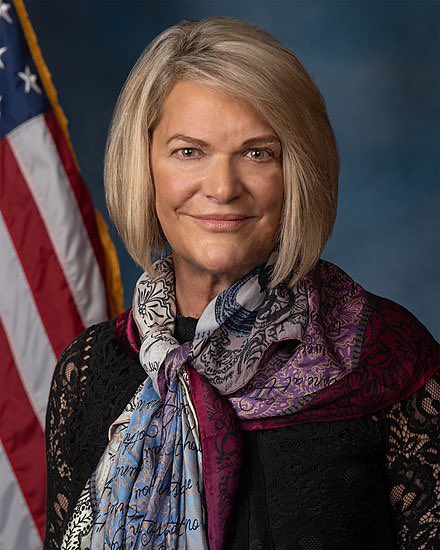

In a groundbreaking announcement that has sent ripples through the cryptocurrency community, Senator Cynthia Lummus has revealed that the introduction of a Bitcoin strategic reserve is just the beginning of a larger initiative aimed at integrating digital currencies into the mainstream financial system. This pivotal moment, highlighted in a recent tweet by Crypto Rover, emphasizes the increasing acceptance of Bitcoin and its potential role in shaping future economic policies.

### The Significance of a Bitcoin Strategic Reserve

The concept of a Bitcoin strategic reserve signifies a monumental shift in how governments perceive and interact with cryptocurrencies. Traditionally viewed with skepticism, cryptocurrencies like Bitcoin are now being recognized for their potential to diversify national reserves and hedge against inflation. Senator Lummus’s statement suggests that this initiative will not only bolster the credibility of Bitcoin but also position it as a legitimate asset class in the eyes of policymakers and the public.

### Understanding Bitcoin’s Role in the Economy

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Bitcoin, often referred to as digital gold, has gained immense popularity due to its decentralized nature and limited supply. Unlike fiat currencies, which can be printed at will, Bitcoin’s supply is capped at 21 million coins, making it an attractive option for those seeking a hedge against inflation. As more individuals and institutions turn to Bitcoin for financial security, its integration into governmental reserves could solidify its standing as a reliable asset.

### Senator Lummus’s Vision for the Future

Senator Lummus’s enthusiasm for Bitcoin is indicative of a broader trend among lawmakers who are increasingly recognizing the importance of digital currencies. Her assertion that the strategic reserve is “only the beginning” suggests that further developments are on the horizon, which could include regulatory frameworks, tax guidelines, and enhanced infrastructure to support cryptocurrency transactions. This proactive approach could pave the way for more robust adoption of Bitcoin and other cryptocurrencies.

### The Implications for Investors and the Market

For investors, this announcement could signify a bullish trend in the cryptocurrency market. Increased institutional acceptance and potential government backing may encourage more individuals and entities to invest in Bitcoin, driving up its market value. Additionally, as Bitcoin becomes more integrated into financial systems, it may also lead to the development of new financial products and services centered around cryptocurrencies.

### Staying Informed: The Importance of Being Tuned In

As the situation develops, it is crucial for investors, enthusiasts, and the general public to stay informed about the latest updates regarding Bitcoin and cryptocurrency regulations. Following key figures like Senator Lummus and influential voices in the cryptocurrency community will provide insights into how these changes might impact the market and individual investment strategies.

### Conclusion: A New Era for Bitcoin

Senator Cynthia Lummus’s announcement marks a significant turning point for Bitcoin and the broader cryptocurrency landscape. By establishing a strategic reserve, the government is not only acknowledging the importance of digital currencies but is also taking steps to integrate them into the fabric of the economy. This initiative could lead to a new era of financial innovation, offering new opportunities for investors and enhancing the overall acceptance of cryptocurrencies.

As the situation unfolds, stakeholders in the cryptocurrency market should remain vigilant and adaptable, ready to seize the opportunities that may arise from these transformative changes. The future of Bitcoin is bright, and this is just the beginning of what could be a revolutionary journey for digital currencies. Stay tuned for more updates, as the world of cryptocurrency continues to evolve and expand.

BREAKING:

SENATOR CYNTHIA LUMMUS SAYS #BITCOIN STRATEGIC RESERVE IS ONLY THE ₿EGINNING.

STAY TUNED!

IT’S HAPPENING!!! pic.twitter.com/ku7fPx1dCy

— Crypto Rover (@rovercrc) March 7, 2025

BREAKING:

In an electrifying announcement that has caught the attention of crypto enthusiasts and investors alike, Senator Cynthia Lummus has declared that the Bitcoin strategic reserve is just the beginning. This statement has sent ripples through the cryptocurrency community, igniting discussions about the future of Bitcoin and its role in the financial landscape.

SENATOR CYNTHIA LUMMUS SAYS #BITCOIN STRATEGIC RESERVE IS ONLY THE ₿EGINNING.

Senator Lummus, a significant figure in the push for cryptocurrency adoption in the United States, emphasized the vital importance of Bitcoin as a strategic reserve. This isn’t just a casual remark; it’s a strong indication of the growing recognition of Bitcoin’s potential as a digital asset that can serve as a hedge against inflation and economic instability. The strategic reserve concept is gaining traction, especially as governments and financial institutions begin to understand the transformative power of cryptocurrencies.

STAY TUNED!

As we delve deeper into this announcement, it’s crucial to stay updated on the developments surrounding Senator Lummus’s plans. The excitement in the crypto space is palpable, and many are eager to learn what this strategic reserve entails. Is it a move towards legitimizing Bitcoin in the eyes of traditional finance? Will other senators follow suit? These questions linger in the air, and only time will reveal the answers.

IT’S HAPPENING!!!

The phrase “It’s happening!” resonates with the growing sentiment among crypto advocates who believe that the mainstream acceptance of Bitcoin is just around the corner. As more politicians and financial leaders recognize the value of cryptocurrencies, we could witness a shift in how Bitcoin is perceived and utilized. The notion of a strategic reserve may pave the way for institutional investments in Bitcoin, ultimately leading to a more robust market.

The Significance of a Strategic Reserve

But what exactly does a Bitcoin strategic reserve mean? In essence, it refers to the idea of holding Bitcoin as a form of reserve asset, similar to how traditional reserves (like gold or fiat currency) are held by governments and institutions. This shift could have profound implications for the way Bitcoin is integrated into the global financial system. As noted in an article by Forbes, Bitcoin’s limited supply and decentralized nature make it an attractive option for those looking to diversify their portfolios.

The Growing Acceptance of Bitcoin

Senator Lummus’s comments are a reflection of a broader trend towards the acceptance of Bitcoin in political and financial circles. The cryptocurrency has gained significant traction over the past few years, with major companies and institutions investing heavily in it. From Tesla’s investment to the adoption of Bitcoin as legal tender in El Salvador, these developments have showcased Bitcoin’s potential as a legitimate asset class.

Potential Implications for Investors

What does this mean for individual investors? If Bitcoin is recognized as a strategic reserve, we could see an influx of institutional money flowing into the market. This could lead to increased demand, which may drive up prices and stabilize the market. As pointed out by experts at Bloomberg, institutional adoption tends to lead to more stability in volatile markets, making Bitcoin an even more appealing investment option.

The Role of Regulation

Of course, with increased acceptance comes the need for regulation. Senator Lummus’s statement may also hint at upcoming legislative efforts to create a framework for Bitcoin and other cryptocurrencies. Regulations can provide clarity and security for investors, which is essential for mainstream adoption. However, the challenge lies in finding the right balance that encourages innovation while protecting consumers. As noted by CoinDesk, clear regulations could pave the way for a more stable and secure investment environment for cryptocurrencies.

Bitcoin as a Hedge Against Inflation

In a world where inflation is a growing concern, many investors are looking for safe havens. Bitcoin has emerged as a potential hedge against inflation, much like gold has been for centuries. With its deflationary nature and limited supply, Bitcoin appeals to those looking to protect their wealth. Senator Lummus’s advocacy for a strategic reserve could further validate this narrative, encouraging more people to consider Bitcoin as a viable asset for long-term wealth preservation.

Future Prospects for Bitcoin

As we look to the future, the implications of Senator Lummus’s statement are vast. The idea of a Bitcoin strategic reserve could shape the narrative surrounding cryptocurrencies for years to come. It may attract more institutional interest and encourage innovation in the crypto space. Additionally, as more political figures endorse Bitcoin, the stigma surrounding cryptocurrencies may begin to fade, leading to broader acceptance among the general public.

Community Reaction

The reaction from the cryptocurrency community has been overwhelmingly positive. Many are taking to social media to express their excitement about the potential for a strategic reserve. The sentiment is clear: Bitcoin is gaining traction not just as a speculative asset but as a fundamental part of the financial system. As highlighted by CryptoPotato, the idea of a Bitcoin strategic reserve is being seen as a critical step towards greater acceptance and integration of Bitcoin in the financial world.

The Road Ahead

While it’s easy to get swept up in the excitement, it’s essential to approach the future with a balanced perspective. The road to mainstream adoption won’t be without its hurdles. Regulatory challenges, market volatility, and technological advancements will all play a role in shaping the trajectory of Bitcoin. However, with advocates like Senator Lummus leading the charge, the potential for Bitcoin to become a strategic reserve asset is within reach.

Conclusion

As we navigate this exciting phase in the evolution of Bitcoin, it’s clear that the conversation is only just beginning. Senator Lummus’s declaration has sparked interest and speculation, pointing to a future where Bitcoin may play a central role in the global economy. For investors, this is an opportunity to stay informed, engage with the community, and prepare for what’s to come. The Bitcoin strategic reserve is just the start, and as we move forward, the possibilities are endless.

“`

This article provides a comprehensive overview of the implications of Senator Cynthia Lummus’s statement on Bitcoin and includes relevant sources for further reading. The content is structured with engaging headings and a conversational tone to keep readers interested.