Jim Cramer on Market Conditions: Insights for Bitcoin and Asset Investors

In the fast-evolving world of finance and investment, market sentiment can shift rapidly, influencing the decisions of investors across various asset classes. Recently, Jim Cramer, a well-known financial commentator and host of CNBC’s "Mad Money," shared his insights regarding current market conditions, particularly concerning Bitcoin and other assets. According to Cramer, the market is not yet "oversold enough to get that powerful bounce," suggesting that investors should approach the markets with caution. This statement has garnered significant attention in the cryptocurrency community, especially among Bitcoin enthusiasts.

Understanding Jim Cramer’s Perspective

Jim Cramer is renowned for his market analysis and predictions, often stirring discussions among investors. His recent remarks imply that while there may be volatility in the market, the conditions are not favorable for a substantial recovery just yet. Cramer’s assertion indicates that he believes the market has not yet reached a level of overselling that would typically signal a rebound. This perspective can serve as a guiding principle for investors considering their next moves in the cryptocurrency space, particularly Bitcoin.

Implications for Bitcoin and Other Assets

Cramer’s comments can have a profound impact on market psychology. When a prominent figure in finance highlights that the market isn’t oversold, it may deter investors from jumping back into positions prematurely. For Bitcoin, which has been known for its price volatility, this could mean a continued period of uncertainty before a potential upward trend. Investors should be prepared for fluctuating prices and consider their risk tolerance carefully.

The Current State of Bitcoin

Bitcoin, the leading cryptocurrency, has often been viewed as a barometer for the overall health of the cryptocurrency market. As of now, it remains a focal point for many investors. The dynamics surrounding Bitcoin are influenced by various factors, including regulatory developments, market sentiment, and macroeconomic conditions. Cramer’s insights come at a time when many are scrutinizing Bitcoin’s performance and its potential trajectory.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Investors in Bitcoin should stay informed about market trends and expert opinions. The cryptocurrency market is known for its rapid shifts, and understanding the underlying factors can help investors make informed decisions. Cramer’s comments serve as a reminder that while optimism is a vital part of investing, it is equally important to recognize the signs of market conditions that might suggest caution.

Strategies for Investors

In light of Cramer’s remarks, investors might consider several strategies:

- Diversification: As always, diversification remains a key strategy. By spreading investments across various assets, investors can mitigate risk and reduce the impact of volatility in any single asset.

- Research and Analysis: Staying updated on market trends, expert opinions, and economic indicators can provide valuable insights into timing entry and exit points in the market.

- Long-Term Perspective: For many investors, particularly in the cryptocurrency space, adopting a long-term perspective can be beneficial. While short-term fluctuations can be daunting, focusing on long-term growth potential may yield better results.

- Risk Management: Understanding one’s risk tolerance and implementing risk management strategies is crucial, especially in a market as unpredictable as cryptocurrencies. Setting stop-loss orders and having an exit strategy can help safeguard investments.

- Emotional Discipline: The emotional aspect of investing cannot be overlooked. Cramer’s statement serves as a reminder to avoid making impulsive decisions based on fear or greed. Maintaining discipline can lead to more rational investment choices.

Conclusion

Jim Cramer’s recent comments regarding market conditions highlight an important aspect of investing: the need for careful analysis and strategic planning. While his assertion that the market isn’t oversold enough for a significant bounce might create a cautious atmosphere, it also opens up discussions about the future of Bitcoin and other assets. Investors must weigh Cramer’s insights against their investment strategies and market research.

As the cryptocurrency landscape continues to evolve, staying informed and adaptable will be essential for success. Whether you are a seasoned investor or new to the cryptocurrency market, understanding the implications of expert opinions like Cramer’s can aid in navigating the complexities of investment decisions. As always, it is wise to approach investing with a clear strategy and an awareness of market conditions.

BREAKING:

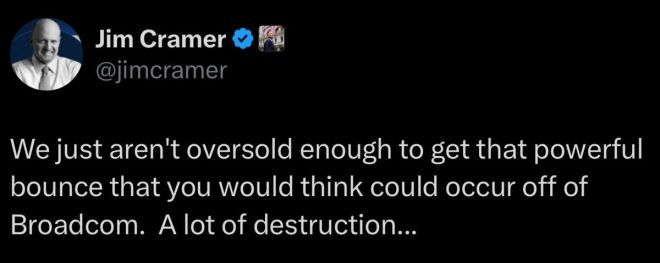

Jim Cramer says: “We just aren’t oversold enough to get that powerful bounce”

BULLISH FOR #BITCOIN AND ALL ASSETS! pic.twitter.com/LBmk7jH9cJ

— Crypto Rover (@rovercrc) March 7, 2025

BREAKING:

There’s a buzz in the market right now, and it’s all thanks to Jim Cramer. He recently stated, “We just aren’t oversold enough to get that powerful bounce.” This statement has sent ripples through the financial community, especially among crypto enthusiasts and investors. So, what does this mean for the market, particularly for Bitcoin and other assets? Let’s dive into the details!

Jim Cramer’s Insights

Jim Cramer, the well-known financial analyst and host of CNBC’s Mad Money, often shares insights that can sway market sentiments. His recent comment indicates that he believes the market is not in a position to experience a significant rebound just yet. This perspective can be particularly relevant for traders and investors who are looking for signs of market recovery or potential investment opportunities.

Understanding Market Sentiment

Market sentiment often dictates the direction of asset prices. When Cramer mentions that we aren’t oversold enough, he’s referring to the general feeling among traders that prices have dropped significantly and are due for a bounce back. In this instance, he suggests that we still have a way to go before we see that bounce. This sentiment can be pivotal for investors who are trying to time their entries into the market.

BULLISH FOR #BITCOIN AND ALL ASSETS!

Despite his cautious outlook on the current oversold status, Cramer’s comments are still bullish for Bitcoin and other assets. The crypto market, known for its volatility, often reacts strongly to sentiment changes. If investors believe that a recovery is on the horizon, even if it’s not immediate, they may start accumulating Bitcoin and other cryptocurrencies, anticipating future gains.

The Current State of Bitcoin

As of now, Bitcoin has been on a rollercoaster ride, experiencing sharp fluctuations in price. Following Cramer’s remarks, many traders are speculating whether this could be a buying opportunity. Bitcoin has a reputation for bouncing back after corrections, and this has led to a wave of optimism among its supporters. According to data from CoinMarketCap, Bitcoin’s price movements often correlate with broader market trends, and Cramer’s statement could influence investor behavior in the coming days.

The Role of Technical Analysis

For those who follow technical analysis, Cramer’s statement might suggest a need to evaluate key indicators. Traders often rely on oversold and overbought signals to make decisions. An oversold condition typically occurs when an asset’s price drops significantly and is deemed undervalued. When Cramer indicates that we aren’t oversold enough, it may imply that traders should look for further price declines before considering a bullish position.

What Investors Should Consider

As an investor, it’s essential to weigh Cramer’s insights carefully. While he articulates a cautious stance on the current market conditions, it’s crucial to remember that the financial landscape can change rapidly. Investors should conduct their own research and consider various factors, including market news, economic indicators, and technical analysis before making investment decisions.

Community Reactions

The crypto community is known for its passionate responses to market news. Following Cramer’s comments, many traders took to social media to express their opinions. Some believe that even though the market may not be oversold, the inherent volatility of cryptocurrencies like Bitcoin presents opportunities for savvy investors. Others echo Cramer’s sentiments, advocating for patience and a wait-and-see approach.

The Future of Bitcoin and Other Assets

Looking ahead, the future of Bitcoin and other assets remains uncertain but intriguing. Cramer’s remarks serve as a reminder that while the market may not be primed for a powerful bounce just yet, it doesn’t mean that opportunities won’t arise. The crypto market is notoriously unpredictable, and many investors thrive on that volatility.

Strategies for Navigating the Market

For those looking to navigate the current market landscape, consider a few strategies:

- Diversification: Spreading your investments across different assets can help mitigate risk.

- Stay Informed: Keeping up with market news and expert opinions, like those from Cramer, can provide valuable insights.

- Technical Analysis: Utilize charts and indicators to guide your trading decisions.

- Long-term Perspective: If you’re investing in Bitcoin or other cryptocurrencies, consider a long-term strategy rather than focusing solely on short-term fluctuations.

Final Thoughts

Jim Cramer’s insights have sparked discussions about the current state of the market and what it means for Bitcoin and other assets. While he suggests that a powerful bounce may not be on the immediate horizon, the inherent volatility of the crypto market means that opportunities can arise at any time. As always, it’s critical to stay informed, make educated decisions, and be prepared for whatever the market throws your way.

As we move forward, keep an eye on market trends and expert opinions to gauge the best times to invest in Bitcoin and other assets. Remember, the market is dynamic, and today’s insights can shape tomorrow’s opportunities!