Michael Saylor’s Strong Stance on Bitcoin: A Message to David Sacks

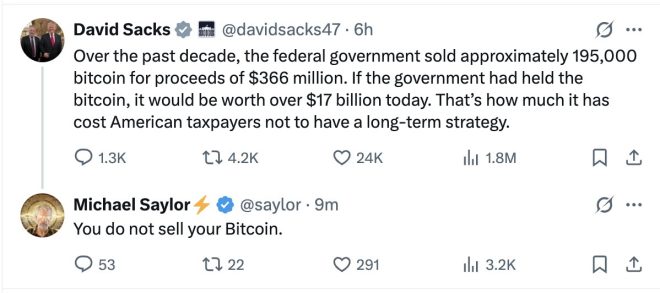

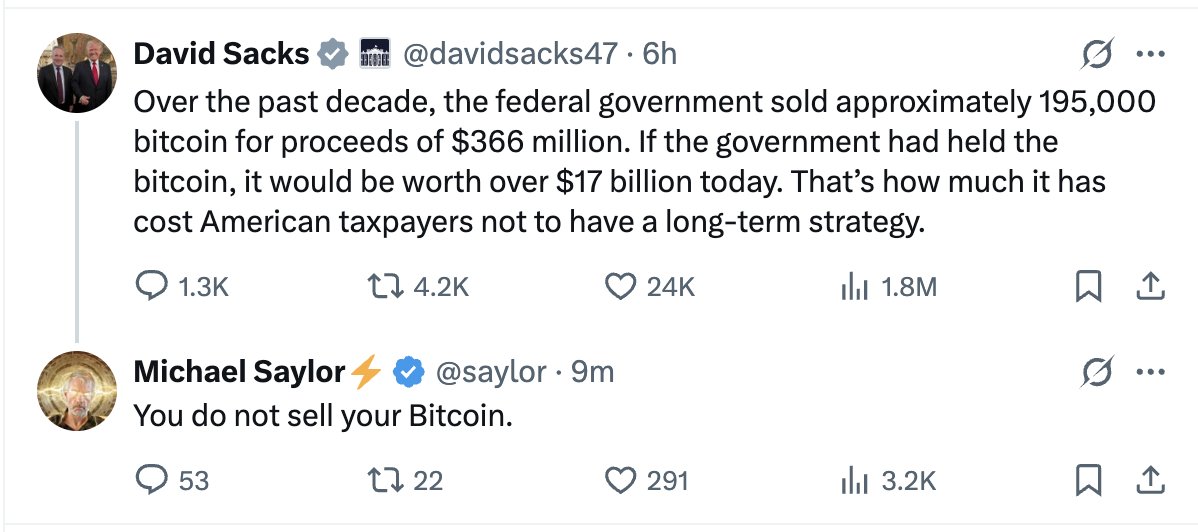

In a recent tweet that has captured the attention of the cryptocurrency community, Michael Saylor, co-founder and executive chairman of MicroStrategy, emphasized a crucial principle regarding Bitcoin investments during a conversation with David Sacks, who has been appointed as President Trump’s Crypto Czar. Saylor’s message was simple yet profound: “You do not sell your Bitcoin.” This statement underscores an important philosophy that many Bitcoin advocates uphold, particularly in the context of the increasing mainstream adoption of cryptocurrencies.

The Context of the Statement

Saylor’s assertion comes at a time when Bitcoin has seen significant fluctuations in value, and discussions around regulation and investment strategies are intensifying. As the newly appointed Crypto Czar, Sacks plays a pivotal role in shaping the future of cryptocurrency in the United States. His decisions will likely influence the regulatory landscape, impacting investors, companies, and the overall market. Saylor’s message, therefore, serves as a reminder to both policymakers and investors about the long-term value proposition of Bitcoin.

The Importance of Holding Bitcoin

Saylor’s philosophy is rooted in the idea that Bitcoin is not just a commodity or a currency; it is a digital store of value akin to gold. The notion of ‘HODLing,’ a term derived from a misspelled word "hold," encapsulates this strategy of retaining Bitcoin despite market volatility. Saylor argues that selling Bitcoin, particularly during downturns, undermines its potential as a hedge against inflation and economic instability.

Bitcoin: A Hedge Against Inflation

One of the primary reasons Saylor and many other proponents advocate for holding Bitcoin is its deflationary nature. Unlike fiat currencies, which can be printed infinitely by central banks, Bitcoin has a capped supply of 21 million coins. This scarcity is what gives Bitcoin its value, particularly in an era where governments are increasing money supply to combat economic challenges. By holding Bitcoin, investors position themselves against the depreciating value of traditional currencies, making it a strategic asset in uncertain times.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Bitcoin in the Future Financial System

Saylor’s statement reflects a broader sentiment within the crypto community regarding the future role of Bitcoin in the global financial system. As more institutional investors and corporations adopt Bitcoin, its legitimacy as a financial asset continues to grow. This trajectory is supported by various factors, including increased regulatory clarity, technological advancements, and growing acceptance among consumers.

Regulatory Landscape and Its Impact

The conversation between Saylor and Sacks comes at a critical juncture when the regulatory framework surrounding cryptocurrencies is still evolving. With Sacks now at the helm of crypto policy under the Trump administration, the industry is keenly observing how regulations will shape the market. Saylor’s emphasis on holding Bitcoin can also be seen as a call for greater understanding and support from regulators regarding the unique characteristics of digital assets.

The Community’s Response

The Bitcoin community has largely rallied around Saylor’s message, viewing it as a reaffirmation of their collective belief in the long-term success of Bitcoin. Many in the community believe that selling Bitcoin is counterproductive to the vision of a decentralized financial future. Saylor’s influence, especially through MicroStrategy’s significant Bitcoin investments, has positioned him as a leading voice in advocating for the adoption and retention of Bitcoin as a critical asset.

The Future of Bitcoin and Crypto Regulation

As the dialogue between influential figures like Saylor and Sacks continues, it is essential to consider the implications for the future of Bitcoin and cryptocurrency regulation. The outcome of these discussions could significantly impact how cryptocurrencies are perceived and utilized in the broader financial ecosystem. For investors, understanding the landscape and adhering to principles like ‘not selling Bitcoin’ could be crucial in navigating the complexities of the market.

Conclusion

Michael Saylor’s assertion to David Sacks, “You do not sell your Bitcoin,” resonates deeply within the cryptocurrency community, embodying a steadfast belief in the long-term value of Bitcoin as a digital asset. As the regulatory environment continues to evolve and Bitcoin’s adoption spreads, Saylor’s message serves as a guiding principle for both investors and policymakers. The dialogue surrounding Bitcoin, its potential as a hedge against inflation, and the importance of holding onto this digital asset is more relevant now than ever. As we move forward, it will be fascinating to see how these discussions shape the future of cryptocurrency in the United States and beyond.

In summary, Michael Saylor’s firm stance on not selling Bitcoin emphasizes the long-term investment strategy that advocates for retaining this digital asset. As discussions around cryptocurrency regulation intensify, the principles of holding Bitcoin as a valuable asset continue to gain traction, making it a pivotal point of consideration for investors and policymakers alike.

JUST IN: Michael Saylor to President Trump’s Crypto Czar David Sacks: “You do not sell your Bitcoin.” pic.twitter.com/NqiROtxfyp

— Bitcoin Magazine (@BitcoinMagazine) March 6, 2025

JUST IN: Michael Saylor to President Trump’s Crypto Czar David Sacks: “You do not sell your Bitcoin.”

In the ever-evolving world of cryptocurrency, few statements carry as much weight as the one recently made by Michael Saylor. The co-founder and executive chairman of MicroStrategy, a company that has made headlines for its substantial Bitcoin acquisitions, has a strong opinion on the matter of selling Bitcoin. During a conversation with David Sacks, known as President Trump’s Crypto Czar, Saylor emphatically stated, “You do not sell your Bitcoin.” This statement has sparked a lot of discussions in the crypto community and beyond. But what does this really mean for investors and the future of Bitcoin?

The Importance of Holding Bitcoin

When Michael Saylor speaks about Bitcoin, he’s not just expressing a personal preference; he represents a growing sentiment among long-term Bitcoin holders. The philosophy behind “not selling your Bitcoin” is grounded in the belief that Bitcoin is not just a digital currency but a store of value, akin to digital gold. By holding onto Bitcoin, investors are betting on its future appreciation as more people adopt it and as its supply becomes increasingly scarce due to the halving events that occur approximately every four years.

This perspective is crucial, especially considering the recent volatility in the cryptocurrency market. Many investors panic and sell during downturns, but Saylor advocates for a more resilient approach. He believes that by holding Bitcoin, investors can weather market fluctuations and ultimately benefit from its long-term growth. This strategy is especially relevant given the increasing institutional interest in Bitcoin, which further legitimizes it as an asset class.

Understanding the Mindset of Bitcoin Investors

The mindset of Bitcoin investors has evolved significantly over the past few years. Initially, many saw Bitcoin as a speculative investment, a way to make quick profits. However, as the market has matured, a growing number of investors are recognizing the long-term potential of Bitcoin. They view it as a hedge against inflation and a means of preserving wealth. This shift in perspective aligns with Saylor’s assertion that one should not sell their Bitcoin.

For those new to the crypto space, it can be tempting to sell during price surges or dips. However, seasoned investors often remind us that Bitcoin’s historical price trajectory has shown resilience over time. For instance, despite experiencing significant corrections, Bitcoin has consistently reached new all-time highs. This is a sign that patience and holding can often yield better results than trying to time the market.

What Does This Mean for the Future of Bitcoin?

So, what does Saylor’s advice mean for the future of Bitcoin? For starters, it reinforces the narrative that Bitcoin is becoming an integral part of the global financial system. As more institutional players enter the market, the demand for Bitcoin is likely to increase, which could drive prices higher. Saylor himself has been a strong advocate for Bitcoin adoption, often speaking about its potential to revolutionize finance.

This message resonates particularly well in the context of economic uncertainty. With inflation rates rising and traditional currencies losing value, more individuals and institutions are looking to Bitcoin as a safe haven. Saylor’s statement serves as a rallying cry for those who believe in Bitcoin’s potential to serve as a digital gold standard.

Challenges and Considerations for Investors

While Saylor’s advice is compelling, it’s essential to acknowledge the challenges that come with investing in Bitcoin. The cryptocurrency market is notoriously volatile, and prices can swing dramatically in short periods. Therefore, anyone considering investing in Bitcoin should do so with a clear understanding of their risk tolerance and investment goals.

Additionally, the regulatory landscape for cryptocurrencies is still developing. Governments around the world are grappling with how to regulate Bitcoin and other digital assets. This uncertainty can create risks for investors, as regulatory changes can impact the market’s dynamics significantly. Saylor’s position on not selling Bitcoin can be seen as a long-term play, but it’s also important for investors to stay informed about regulatory developments that might affect their holdings.

How to Approach Bitcoin Investment

If you’re considering entering the Bitcoin market or expanding your existing holdings, here are some tips to keep in mind:

- Educate Yourself: Understanding the fundamentals of Bitcoin and the technology behind it is crucial. Resources like Investopedia provide excellent insights into Bitcoin’s workings and its market dynamics.

- Start Small: If you’re new to cryptocurrency, consider starting with a small investment. This approach allows you to learn the ropes without exposing yourself to excessive risk.

- Have a Plan: Define your investment strategy. Are you in it for the long haul, or are you looking to make quick gains? Having a plan helps you stay disciplined during market fluctuations.

- Stay Informed: The crypto space is continuously evolving. Keeping up with news and trends will help you make informed decisions. Follow credible sources like CoinDesk for the latest updates.

Joining the Bitcoin Community

Investing in Bitcoin is not just about the financial aspect; it’s also about being part of a community that shares a common vision. Engaging with fellow investors and enthusiasts can provide valuable insights and support. Online forums, social media groups, and meetups can be excellent ways to connect with like-minded individuals.

Furthermore, being part of the community allows you to stay updated on best practices, emerging trends, and potential pitfalls. Remember, you’re not alone in this journey; there are countless others who are navigating the same path.

Final Thoughts on Michael Saylor’s Message

Michael Saylor’s statement to David Sacks encapsulates a growing philosophy within the Bitcoin community: the importance of holding Bitcoin rather than selling it hastily. As more individuals and institutions recognize Bitcoin’s potential as a store of value, this message will likely resonate even more. While the path to Bitcoin adoption may come with challenges, the long-term outlook remains optimistic for those who choose to hold. So, as you navigate your Bitcoin journey, keep Saylor’s advice in mind: “You do not sell your Bitcoin.” This mindset could very well shape your investment success in the years to come.

For more insights and updates on the cryptocurrency market, be sure to check out Bitcoin Magazine and other reputable sources. Happy investing!