Circle Mints $250 Million USDC on Solana: A Game-Changer for the Crypto Market

In a significant development for the cryptocurrency space, Circle has recently minted an impressive $250 million worth of USD Coin (USDC) on the Solana blockchain. This move, announced by Cointelegraph on March 6, 2025, signifies a growing trend of integrating stablecoins with high-performance blockchain networks. The minting of USDC on Solana not only showcases Circle’s commitment to expanding its stablecoin’s reach but also highlights Solana’s capabilities as a rapid and efficient platform for digital transactions.

Understanding USDC and Its Importance in the Crypto Ecosystem

USDC is a stablecoin pegged to the US dollar, making it a popular choice for traders and investors looking for a stable alternative to the volatile nature of cryptocurrencies. As a fully-backed digital dollar, USDC offers users the advantages of cryptocurrency—such as speed, transparency, and security—while minimizing the risks associated with price fluctuations.

With its backing by reputable financial institutions and compliance with regulatory standards, USDC has gained significant traction in the crypto market, positioning itself as one of the leading stablecoins alongside Tether (USDT).

Why Solana? The Advantages of Using the Solana Blockchain

Solana has emerged as a leading blockchain solution due to its unique architecture and high throughput capabilities. Here are some reasons why Circle’s decision to mint USDC on Solana is noteworthy:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- High Transaction Speed: Solana boasts a transaction speed of up to 65,000 transactions per second (TPS), making it one of the fastest blockchains in existence. This speed is crucial for users looking to execute trades quickly and efficiently.

- Low Transaction Costs: The cost of transactions on the Solana network is significantly lower than on many other blockchains. This affordability allows users to transact without incurring high fees, which is especially important for those conducting frequent trades.

- Growing Ecosystem: The Solana ecosystem has rapidly expanded, attracting numerous decentralized applications (dApps), decentralized finance (DeFi) projects, and non-fungible token (NFT) marketplaces. By minting USDC on Solana, Circle taps into this vibrant ecosystem, enhancing the utility of USDC for users engaging with various DeFi platforms.

- Scalability: Solana’s unique consensus mechanism, known as Proof of History (PoH), allows the network to scale effectively without sacrificing speed or performance. This scalability is particularly beneficial for projects like USDC, which require a robust infrastructure to support increased demand and usage.

The Impact of Circle’s Minting on the Crypto Market

Circle’s decision to mint $250 million in USDC on Solana is expected to have several implications for the cryptocurrency market:

- Increased Liquidity: By introducing additional USDC into the Solana ecosystem, liquidity is expected to increase, facilitating smoother transactions and trades on various platforms. This influx of liquidity can help stabilize the market and enhance trading efficiency.

- Enhanced DeFi Activity: As USDC becomes more accessible on Solana, the decentralized finance sector is likely to see increased activity. Users can leverage USDC for lending, borrowing, and trading on various DeFi platforms, leading to greater overall engagement within the ecosystem.

- Strengthening Solana’s Position: The minting of USDC on Solana further solidifies the blockchain’s position as a leading platform for stablecoins and DeFi applications. This endorsement from Circle could attract more projects and users to Solana, fostering greater innovation and growth within the ecosystem.

- Market Confidence: The move by Circle illustrates confidence in both the Solana blockchain and the broader cryptocurrency market. As more institutional players enter the space, the legitimacy of cryptocurrencies is reinforced, encouraging further investment and adoption.

Conclusion: What Lies Ahead for USDC and Solana

The minting of $250 million in USDC on Solana marks a pivotal moment for both Circle and the Solana blockchain. As the demand for stablecoins continues to rise, USDC’s expansion into the Solana ecosystem is likely to enhance its utility and adoption among users. The combination of Solana’s speed, affordability, and scalability makes it an attractive option for stablecoin deployment, paving the way for innovative financial solutions in the crypto space.

As we look to the future, it will be interesting to observe how this strategic move influences the overall landscape of cryptocurrencies. The synergy between USDC and Solana may lead to new opportunities in DeFi, increased market liquidity, and stronger institutional interest in cryptocurrencies. Circle’s ongoing commitment to expanding USDC’s reach and utility will undoubtedly play a crucial role in shaping the future of digital finance.

In summary, Circle’s recent minting of $250 million USDC on Solana represents a significant leap forward in the integration of stablecoins into high-performance blockchain networks, setting the stage for a new era of financial innovation and accessibility in the cryptocurrency market.

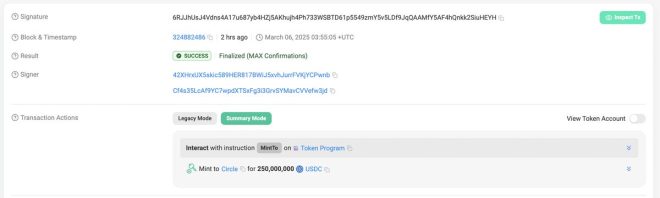

JUST IN: Circle has minted another $250 million $USDC on Solana. pic.twitter.com/KVoHps5e3C

— Cointelegraph (@Cointelegraph) March 6, 2025

JUST IN: Circle has minted another $250 million $USDC on Solana.

When it comes to the ever-evolving world of cryptocurrencies, news travels fast, and today is no exception. Circle, a prominent player in the stablecoin arena, has just announced that they have minted another $250 million worth of $USDC on the Solana blockchain. This development is significant not just for Circle, but for the entire crypto ecosystem. So, let’s dive deeper into what this means and why it matters.

Understanding $USDC and Its Role in the Crypto Market

Before we unpack the implications of Circle’s latest minting, let’s take a moment to understand what $USDC actually is. $USDC, or USD Coin, is a stablecoin pegged to the US dollar, meaning it aims to maintain a 1:1 value relative to USD. This stability makes it an attractive option for traders and investors looking to mitigate the volatility typically associated with cryptocurrencies. Circle is one of the key issuers of $USDC, providing transparency and security for users.

Stablecoins like $USDC serve several essential functions in the crypto market. They facilitate trading by providing a stable medium of exchange, allowing users to move in and out of more volatile assets with ease. Additionally, stablecoins are often used for remittances, payments, and even decentralized finance (DeFi) applications.

Circle’s Strategic Move with $250 Million Minting

So, what does it mean when Circle mints another $250 million in $USDC? Essentially, this is Circle’s way of responding to increasing demand for stablecoins in the market. The minting process involves creating new tokens and backing them with reserves, typically held in USD or other highly liquid assets. By minting more $USDC, Circle is enabling more transactions and providing liquidity for users who want to engage in the crypto economy.

This specific minting on the Solana blockchain is particularly noteworthy. Solana has gained traction for its high-speed transactions and low fees, making it an appealing choice for developers and users alike. By integrating $USDC into the Solana ecosystem, Circle is positioning itself to leverage Solana’s growing popularity.

The Significance of Solana in the Crypto Landscape

Solana has quickly become one of the go-to platforms for developers looking to build decentralized applications (dApps) and smart contracts. One of the standout features of Solana is its ability to handle thousands of transactions per second, making it a top choice for projects that require speed and efficiency. The addition of $USDC to this blockchain enhances its utility, allowing users to transact seamlessly while benefiting from the speed and cost-effectiveness that Solana offers.

This minting also highlights a broader trend in the crypto space: the increasing collaboration between stablecoins and layer-1 blockchains. As more stablecoins are adopted on various platforms, it opens up new avenues for liquidity and fosters a more integrated crypto ecosystem.

Implications for Investors and Traders

For investors and traders, this news is crucial. The minting of $250 million in $USDC means more liquidity in the market, which can facilitate smoother trading experiences. When more $USDC is available, it allows traders to enter and exit positions without the need to convert back and forth between fiat and cryptocurrencies. This can be especially valuable during times of high volatility when market conditions are unpredictable.

Moreover, having $USDC on Solana means that users can enjoy faster transaction speeds and lower fees, which is a critical factor when trading. Traders often look for platforms that allow them to execute trades quickly and cost-effectively, and Solana’s attributes combined with the stability of $USDC create an attractive proposition.

The Future of Circle and $USDC

As Circle continues to mint more $USDC, it will be interesting to see how the stablecoin landscape evolves. With the increasing acceptance of cryptocurrencies in traditional finance, stablecoins like $USDC are likely to play a pivotal role in bridging the gap between digital assets and fiat currencies.

Circle’s recent minting on Solana is just one of the many steps the company is taking to solidify its position in the market. As demand for stablecoins grows, Circle’s ability to adapt and innovate will be essential.

Community Response and Market Reactions

Like any news in the fast-paced crypto world, the response from the community has been mixed. Some users are excited about the increased liquidity and potential for growth, while others remain cautious. It’s important to remember that while stablecoins aim to maintain a steady value, the broader crypto market can be unpredictable.

This minting announcement has sparked discussions about the future of stablecoins and their role in the DeFi ecosystem. Many users are optimistic about the integration of $USDC on Solana, as it opens up new possibilities for decentralized finance applications.

Conclusion: What’s Next for $USDC and Solana?

The news of Circle minting another $250 million in $USDC on Solana is a significant development with far-reaching implications. It showcases the growing importance of stablecoins in the crypto market and highlights Solana’s burgeoning role as a leading blockchain platform.

As the crypto landscape continues to evolve, staying informed about these developments is crucial for anyone looking to understand the future of digital currencies. Whether you’re a seasoned trader or just starting, keeping an eye on innovations in the stablecoin space will be essential for making informed decisions.

So, what do you think about Circle’s latest move? Are you excited about the future of $USDC on Solana? The conversation is just beginning, and it’s one worth following closely!