New York Introduces Bill to Criminalize Crypto Fraud and Rug Pulls

In a significant legislative move, New York has introduced a groundbreaking bill aimed at combating cryptocurrency fraud and "rug pulls," an increasingly common scam in the digital asset space. This initiative is designed to bolster investor protection and establish a regulatory framework that addresses the unique challenges posed by the rapidly evolving cryptocurrency market.

Understanding Cryptocurrency Fraud and Rug Pulls

Cryptocurrency fraud encompasses a wide array of deceptive practices, including Ponzi schemes, fake initial coin offerings (ICOs), and phishing scams. Among these, "rug pulls" have emerged as a particularly notorious form of fraud. In a rug pull, developers abandon a project after attracting significant investment, leaving investors with worthless tokens and no recourse for recovery.

The Need for Legislative Action

The rise of cryptocurrency has been meteoric, attracting millions of investors seeking opportunities for wealth creation. However, this growth has also led to a surge in fraudulent activities, leaving many individuals vulnerable to scams. The New York bill responds to growing concerns about the lack of regulation in the crypto space and the urgent need for protective measures for investors.

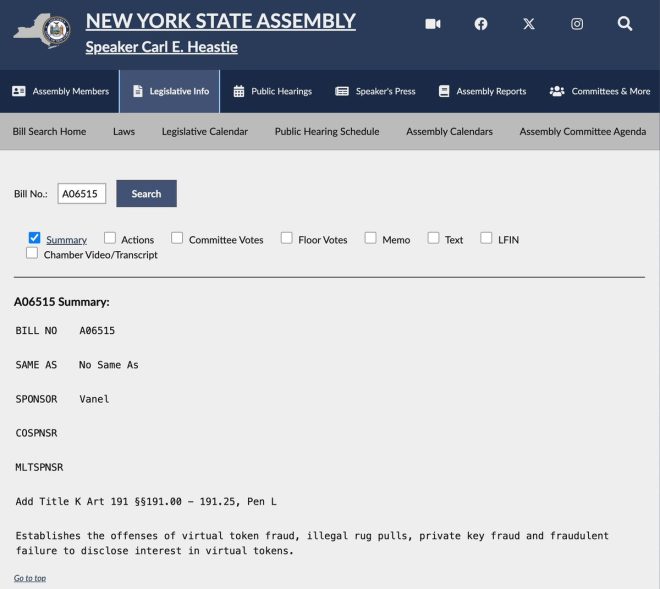

Key Provisions of the Bill

While the specific details of the bill remain under discussion, it is expected to include several key provisions aimed at enhancing investor protection:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Criminalization of Fraudulent Activities: The bill will categorize specific forms of cryptocurrency fraud as criminal offenses, imposing penalties on individuals and entities found guilty of engaging in such activities.

- Regulatory Oversight: The legislation seeks to establish a framework for regulatory oversight of cryptocurrency projects, ensuring that developers are held accountable for their actions and that investors are provided with transparent information.

- Investor Education Initiatives: In addition to punitive measures, the bill emphasizes the importance of educating investors about the risks associated with cryptocurrency investments. This includes promoting awareness of common scams and providing resources to help individuals make informed decisions.

The Impact on the Cryptocurrency Landscape

The introduction of this bill marks a significant shift in how cryptocurrency is regulated in the United States. New York has long been at the forefront of financial regulation, and this move signals a commitment to safeguarding investors in the digital asset market.

By criminalizing fraudulent activities and establishing regulatory oversight, the state aims to create a safer environment for investors. This could also lead to increased confidence among institutional investors, who have been hesitant to enter the crypto market due to concerns about fraud and lack of regulation.

Potential Challenges and Criticisms

While the bill has garnered support from many quarters, it is not without its critics. Some argue that overly stringent regulations could stifle innovation and deter new projects from emerging in the state. Balancing investor protection with the need for a vibrant, innovative cryptocurrency ecosystem will be a critical challenge for lawmakers.

Additionally, there are concerns about the feasibility of enforcing the proposed regulations. Given the decentralized nature of cryptocurrencies, tracking fraudulent activities and holding perpetrators accountable can be complex. Lawmakers will need to work closely with law enforcement and regulatory agencies to develop effective enforcement mechanisms.

The Broader Implications for Cryptocurrency Regulation

The New York bill could serve as a model for other states and countries looking to address the challenges posed by cryptocurrency fraud. As more jurisdictions consider similar legislation, the landscape of cryptocurrency regulation may undergo a significant transformation.

In the long term, the introduction of comprehensive regulations could lead to a more stable and mature cryptocurrency market. This, in turn, could foster greater adoption of digital assets by both retail and institutional investors, ultimately contributing to the growth of the industry.

Conclusion

The introduction of a bill criminalizing cryptocurrency fraud and rug pulls in New York represents a crucial step toward enhancing investor protection in the digital asset space. By establishing a regulatory framework and imposing penalties for fraudulent activities, lawmakers aim to create a safer environment for investors and promote confidence in the cryptocurrency market.

As the legislation progresses, it will be essential for stakeholders, including investors, developers, and regulators, to engage in constructive dialogue to ensure that the final outcome balances protective measures with the need for innovation. The future of cryptocurrency regulation may be shaped by this pivotal moment, setting a precedent for how jurisdictions around the world address the challenges posed by digital assets.

With the ongoing evolution of the cryptocurrency landscape, staying informed about regulatory developments is crucial for all participants in this dynamic market. The New York bill may herald a new era of accountability and transparency in the world of cryptocurrencies, paving the way for a more secure investment environment.

BREAKING:

NEW YORK HAS INTRODUCED A BILL CRIMINALISING CRYPTO FRAUD AND “RUG PULLS,” WITH AN AIM TO PROTECT INVESTORS. pic.twitter.com/0OMvOQYoik

— Ash Crypto (@Ashcryptoreal) March 6, 2025

BREAKING:

NEW YORK HAS INTRODUCED A BILL CRIMINALISING CRYPTO FRAUD AND “RUG PULLS,” WITH AN AIM TO PROTECT INVESTORS.

If you’ve been keeping an eye on the world of cryptocurrencies, you might have noticed the buzz around New York’s latest legislative move. The state has introduced a bill aimed at tackling crypto fraud, specifically targeting what’s known in the community as “rug pulls.” This development is crucial for investors and enthusiasts alike, as it seeks to create a safer environment for everyone involved in the crypto space.

But what exactly does this mean? Let’s break it down.

Understanding Crypto Fraud and Rug Pulls

To get a grip on why this bill is a big deal, we need to understand what crypto fraud and rug pulls are. Crypto fraud refers to any deceptive practice in the cryptocurrency market, which can range from Ponzi schemes to phishing attacks and fake ICOs (Initial Coin Offerings).

On the other hand, rug pulls are a specific type of scam where developers abandon a project and take investors’ funds with them. Imagine investing in a shiny new cryptocurrency that promises the moon, only for the developers to vanish with your money once they’ve built up enough interest. It’s a nightmare, and unfortunately, it’s happened too often.

The new legislation aims to address these issues head-on, providing a framework to penalize those who engage in these fraudulent activities.

Why Is This Legislation Important?

The introduction of this bill marks a significant step toward investor protection in the volatile world of cryptocurrencies. With the increasing popularity of digital currencies, the risks associated with them have also grown. Recent reports from the [Federal Trade Commission](https://www.ftc.gov/news-events/media-resources/protecting-your-identity/crypto-scams) indicate that consumers lost over $1 billion to cryptocurrency fraud in 2021 alone. This staggering figure shows just how urgent the need for regulation has become.

By criminalizing crypto fraud and rug pulls, New York aims to deter would-be scammers from targeting unsuspecting investors. It’s about creating a safer environment where people can invest without the constant fear of losing their hard-earned money to deceitful practices.

What Does the Bill Propose?

The specifics of the bill outline a range of penalties for those found guilty of engaging in crypto fraud or executing rug pulls. While the details are still being finalized, lawmakers have indicated that the legislation will include:

1. **Severe Penalties**: Offenders could face hefty fines and potential prison time, sending a strong message that fraud in the crypto space will not be tolerated.

2. **Increased Transparency**: The bill could require crypto projects to disclose more information about their operations, making it harder for bad actors to hide in the shadows.

3. **Consumer Education**: Alongside punitive measures, the legislation aims to educate investors about the risks involved in cryptocurrency investments, empowering them to make informed decisions.

By implementing these measures, New York is taking a proactive approach to safeguarding its residents and fostering a more trustworthy crypto ecosystem.

How Will This Impact Investors?

For everyday investors, this legislation brings a sense of reassurance. Knowing that there are laws in place to protect them can encourage more individuals to enter the cryptocurrency market. It’s like having a safety net; while investing in crypto will always carry risks, having legal protections can help mitigate some of the anxieties associated with it.

Moreover, with increased transparency and accountability from crypto projects, investors will have better tools at their disposal to assess the legitimacy of a project before diving in. This can lead to a more educated investing public and, hopefully, a decrease in the number of scams that plague the industry.

The Bigger Picture: Nationwide Implications

While New York is making strides with this bill, it raises the question: will other states follow suit? The cryptocurrency landscape is constantly evolving, and regulatory measures vary significantly from one state to another. New York has often been at the forefront of financial regulation, so if this bill proves effective, it could inspire similar legislation across the country.

As other states observe the impacts of New York’s new law, we might see a domino effect, prompting more comprehensive regulations to address the multitude of issues within the crypto market. This could lead to a more unified approach to cryptocurrency regulation in the U.S., ultimately benefiting investors nationwide.

Challenges Ahead

However, it’s not all smooth sailing. Implementing and enforcing this legislation will come with its challenges. The rapidly changing nature of technology, combined with the global aspect of cryptocurrencies, makes regulation a complex issue. Fraud and scams can sometimes outpace regulatory efforts, and bad actors are always looking for loopholes.

Furthermore, over-regulation could stifle innovation in the crypto space. Striking the right balance between protecting investors and fostering a thriving industry will be crucial. It’s a delicate dance that lawmakers will need to navigate carefully.

The Role of the Crypto Community

The crypto community itself plays a significant role in this narrative. Educating oneself and others about the risks and realities of investing in cryptocurrencies can go a long way in preventing scams. Additionally, community-driven initiatives to report fraudulent activities can help authorities identify and prosecute scammers more effectively.

As the New York bill unfolds, it’s essential for investors, developers, and enthusiasts to stay informed and engaged. By working together, the crypto community can create a safer environment for everyone involved.

Conclusion: A Step Toward a Safer Crypto Landscape

In a world where cryptocurrency continues to gain traction, the introduction of this bill in New York is a pivotal moment. It reflects a growing recognition of the need for regulation in the crypto space, aiming to protect investors from fraud and deceptive practices.

As we watch how this legislation develops, it’s clear that the conversation around crypto regulation is just beginning. With ongoing advancements in technology and the ever-evolving nature of digital currencies, staying informed and proactive is key. As investors, being aware of these developments can empower us to navigate the crypto landscape more confidently, making informed decisions that align with our financial goals.

Keep an eye on this space; it’s bound to get even more interesting as laws and regulations continue to shape the future of cryptocurrencies.