The Bitcoin Scarcity Phenomenon: Exploring the Implications for Wealth and Investment

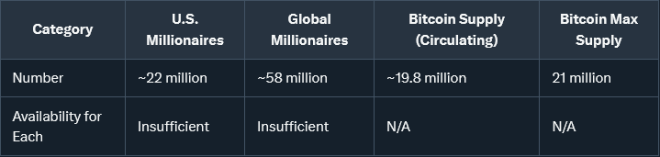

In a recent tweet by Crypto India, it was highlighted that there are not enough Bitcoin available for every millionaire. This statement underscores a significant aspect of Bitcoin’s nature: its scarcity. As the cryptocurrency market continues to evolve, understanding Bitcoin’s limited supply and its implications for wealth distribution and investment strategies becomes increasingly important.

The Scarcity of Bitcoin

Bitcoin, the first and most well-known cryptocurrency, has a capped supply of 21 million coins. This finite limit creates a sense of scarcity, much like precious metals such as gold. As of now, there are approximately 19 million Bitcoin that have been mined, leaving only about 2 million left to be mined over the next century. This scarcity is a crucial factor driving Bitcoin’s value proposition as a digital asset and a store of wealth.

The Millionaire Class and Bitcoin Ownership

A significant point made in the tweet is that there are not enough Bitcoin for every millionaire. According to various estimates, there are over 56 million millionaires globally. With only 21 million Bitcoin available, this means that if every millionaire wanted to own an equal share, they would each receive only a fraction of a Bitcoin. This scenario raises interesting questions about wealth distribution and the accessibility of Bitcoin as an investment.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Investment Strategies

The fact that Bitcoin is not readily available for every millionaire can lead to several implications for investors and those looking to diversify their portfolios:

1. Increased Demand and Value Appreciation

As the number of Bitcoin holders increases, and as more institutional investors enter the market, the demand for Bitcoin is likely to rise. This increased demand, combined with its limited supply, can lead to significant price appreciation over time. For investors, this could mean that holding Bitcoin could become an essential part of their investment strategy.

2. The Role of Bitcoin in Wealth Preservation

Given its scarcity, Bitcoin is often compared to gold as a store of value. Investors seeking to preserve their wealth may look to Bitcoin as an alternative, especially in times of economic uncertainty. The finite supply of Bitcoin may make it an attractive option for those looking to hedge against inflation and currency devaluation.

3. Diversification and Risk Management

For investors, the limited availability of Bitcoin presents both opportunities and challenges. While Bitcoin can be a valuable addition to an investment portfolio, it is essential to consider the associated risks. The cryptocurrency market is known for its volatility, and potential investors should approach Bitcoin with a clear strategy for risk management.

The Future of Bitcoin and Wealth Distribution

As the cryptocurrency market matures, the implications of Bitcoin’s scarcity will continue to evolve. The growing interest from institutional investors, alongside the increasing number of retail investors, suggests that Bitcoin will play a significant role in the financial landscape of the future.

1. Accessibility and Inclusion

One of the challenges posed by Bitcoin’s scarcity is the issue of accessibility. While it may be challenging for every millionaire to own a whole Bitcoin, fractional ownership allows more individuals to invest in Bitcoin without needing to purchase an entire coin. This accessibility could democratize wealth creation through cryptocurrency, enabling a broader segment of the population to benefit from Bitcoin’s potential.

2. Potential for New Financial Products

The limited supply of Bitcoin may also lead to the development of new financial products and investment vehicles. Companies and financial institutions could create derivatives, ETFs, and other investment products that allow individuals to gain exposure to Bitcoin without requiring direct ownership. This innovation could further widen participation in the Bitcoin market.

Conclusion

The assertion that there are not enough Bitcoin for every millionaire is a powerful reminder of the cryptocurrency’s scarcity and its implications for wealth distribution and investment strategies. As Bitcoin continues to gain traction as a digital asset, understanding its limited supply will be crucial for both individual investors and institutional players.

For those looking to invest in Bitcoin, the key will be to navigate the challenges of scarcity while positioning themselves to benefit from the long-term potential of this groundbreaking technology. Whether viewed as a store of value, a hedge against inflation, or a speculative investment, Bitcoin’s limited supply is likely to shape its role in the global financial system for years to come.

In summary, the limited availability of Bitcoin not only highlights its value but also raises important questions about wealth distribution and investment strategies in an evolving digital landscape. As more individuals and institutions embrace Bitcoin, the dynamics of cryptocurrency investment will continue to change, making it an exciting area to watch for both seasoned investors and newcomers alike.

JUST IN: There are not enough #Bitcoin for every millionaire. pic.twitter.com/xIetmhqqjY

— Crypto India (@CryptooIndia) March 5, 2025

JUST IN: There are not enough Bitcoin for every millionaire.

In a world where cryptocurrencies are becoming increasingly mainstream, a startling revelation has emerged: there simply aren’t enough Bitcoin to go around for every millionaire. This eye-opening statement, shared by Crypto India, raises critical questions about the future of Bitcoin and the broader implications for wealth distribution in the digital age.

What Does This Mean for Bitcoin?

First off, let’s break it down. Bitcoin, the original cryptocurrency, has a capped supply of 21 million coins. As of now, millions of individuals around the globe hold millionaire status, with wealth often measured in assets, investments, and yes, cryptocurrencies. The math is simple: if there are more millionaires than available Bitcoins, a significant number of millionaires will be left out in the cold, unable to own even a single Bitcoin.

This reality presents a fascinating paradox. Bitcoin is often touted as a hedge against inflation and a store of value, but with scarcity comes competition. As demand for Bitcoin continues to rise, and as more people see it as a viable investment, the price is likely to soar. It’s like a classic supply-and-demand scenario, where the limited supply of Bitcoin against an ever-increasing demand will drive prices higher.

The Scarcity Factor

Let’s talk about scarcity for a moment. In economics, scarcity refers to the basic problem that arises because resources are limited. Bitcoin’s capped supply is a fundamental feature that drives its value. Unlike fiat currencies that can be printed at will, Bitcoin is finite. According to Investopedia, this limited availability is what makes Bitcoin appealing to many investors. The more people who want to own Bitcoin, the higher the price will go, especially since not every millionaire can own a piece of it.

This scarcity isn’t just an abstract concept; it has real-world implications for wealth distribution. As the rich get richer, the wealth gap continues to widen, and the inability of every millionaire to own a Bitcoin may symbolize a larger issue in our society. If a digital asset like Bitcoin can’t be accessed by all, what does that say about equity in the financial system?

The Impact of Institutional Investment

Another factor that complicates this scenario is institutional investment. More and more institutions are beginning to invest in Bitcoin. In fact, companies like MicroStrategy and Tesla have made headlines for their significant investments in Bitcoin. This influx of institutional capital not only adds legitimacy to Bitcoin but also creates additional demand, further exacerbating the scarcity issue.

As institutions buy up large quantities of Bitcoin, the available supply for individual investors shrinks. This trend has led to a surge in Bitcoin’s price, making it even more challenging for the average investor to acquire a full coin. If you’re a millionaire trying to get into Bitcoin now, you might have to settle for a fraction of a Bitcoin instead of owning one outright.

The Future of Bitcoin Ownership

So, what does this mean for the future of Bitcoin? If the current trends continue, we could be looking at a future where ownership of Bitcoin is increasingly concentrated among the wealthiest individuals and institutions. This could lead to a further stratification of wealth, where only those with significant resources can afford to invest in and hold Bitcoin.

For the average person, this raises several important questions. Should you still invest in Bitcoin? Is it worth it to buy fractions of a Bitcoin? The answer is complex and depends on individual circumstances and investment strategies. However, the notion that there aren’t enough Bitcoins for every millionaire serves as a crucial reminder: time is of the essence in this dynamic market.

Alternative Cryptocurrencies

With the growing scarcity of Bitcoin, many investors are turning to alternative cryptocurrencies, known as altcoins. There are thousands of altcoins available, and some offer innovative features and potential for high returns. Coins like Ethereum, Cardano, and Solana are gaining traction and could provide opportunities for investors who feel priced out of Bitcoin. These alternatives can sometimes provide unique use cases and growth potential, making them worth considering.

However, it’s important to conduct thorough research before diving into altcoins. The volatility of the cryptocurrency market means that while there is potential for high rewards, there is also significant risk. Always approach any investment with caution, and consider diversifying your portfolio to mitigate risks.

Understanding Bitcoin’s Role in the Financial Ecosystem

Bitcoin is more than just an investment; it’s a revolutionary financial technology that has the potential to change the way we think about money. As a decentralized currency, Bitcoin operates outside the control of traditional financial institutions, allowing for peer-to-peer transactions without intermediaries. This is particularly appealing in regions where access to banking services is limited.

As Bitcoin matures, its role in the global financial system will likely evolve. More people are adopting it not just as an investment, but as a means of conducting transactions. This shift could challenge traditional banking systems and lead to a more inclusive financial ecosystem.

Conclusion: The Path Forward

As we navigate this rapidly changing landscape, it’s essential to stay informed about the implications of Bitcoin’s scarcity and the opportunities that lie ahead. Whether you’re a seasoned investor or just starting, understanding the dynamics of supply and demand in the cryptocurrency market can help you make more informed decisions.

In a nutshell, the statement that there aren’t enough Bitcoins for every millionaire serves as a wake-up call for many. It highlights the importance of acting swiftly and strategically in a market that is constantly evolving. As we look to the future, the question remains: how will you position yourself in a world where Bitcoin is becoming increasingly scarce?