Major Cryptocurrency Acquisition: 17,855 ETH Purchased for $36.8 Million

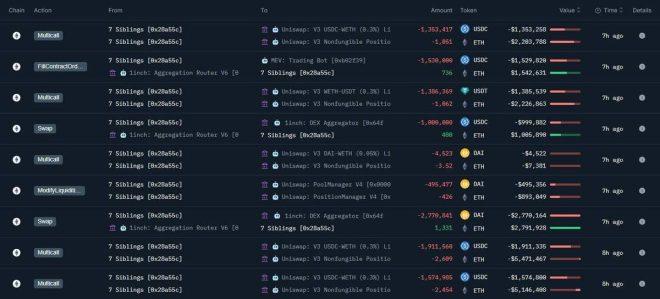

In a significant development within the cryptocurrency market, an entity has made headlines by acquiring a staggering 17,855 Ether (ETH) for a total of $36.8 million. This purchase has led to the entity amassing a total of 1,169,065 ETH, which is currently valued at approximately $2.5 billion. Such a substantial investment not only underscores the growing interest in Ethereum but also highlights the potential for significant gains within the cryptocurrency space.

Understanding Ethereum (ETH)

Ethereum is the second-largest cryptocurrency by market capitalization, following Bitcoin. It was developed to enable smart contracts and decentralized applications (dApps) to be built and run without any downtime, fraud, control, or interference from third parties. The Ethereum network operates on a blockchain, which is a distributed ledger technology that provides security and transparency for transactions.

Since its launch in 2015, Ethereum has evolved significantly. The introduction of Ethereum 2.0 aims to improve scalability, security, and sustainability, transitioning from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. This transformation is designed to reduce energy consumption and improve transaction throughput, making Ethereum a more attractive platform for developers and investors alike.

The Significance of the Recent Acquisition

The acquisition of 17,855 ETH for $36.8 million signifies a bullish sentiment towards Ethereum. This transaction reflects the confidence that investors have in the long-term potential of the cryptocurrency. Holding over a million ETH positions the entity as a significant player in the Ethereum ecosystem, with the potential to influence market trends.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

With the current value of the entire holding at $2.5 billion, this entity’s investment strategy may be aimed at capitalizing on anticipated future price increases. Such large-scale acquisitions can often lead to heightened market activity, as other investors may view this as a signal to buy or sell their own holdings.

Market Implications of Large Transactions

Large transactions like this one can have several implications for the cryptocurrency market:

- Increased Volatility: Significant purchases can lead to price fluctuations. As demand increases, the price of ETH may rise, attracting more investors. Conversely, if the entity decides to sell portions of its holding, it could lead to a decline in prices.

- Market Sentiment: The acquisition can influence overall market sentiment. Positive sentiment often leads to increased trading activity, as investors react to large movements in the market.

- Institutional Interest: The purchase indicates growing institutional interest in cryptocurrencies. As more entities invest large sums into digital assets, it may provide further legitimacy to the cryptocurrency market and attract additional institutional capital.

- Liquidity Considerations: With a substantial holding, the entity may face liquidity challenges if it decides to liquidate a significant portion of its assets. This could affect market dynamics and lead to further volatility.

The Future of Ethereum

As Ethereum continues to evolve, the recent acquisition highlights the cryptocurrency’s potential to grow in value. Several factors contribute to Ethereum’s long-term prospects:

1. DeFi and dApps Growth

Decentralized Finance (DeFi) and dApps built on the Ethereum network are experiencing explosive growth. As more users engage with these platforms, the demand for ETH increases, potentially driving up its value.

2. NFT Market Expansion

The Non-Fungible Token (NFT) market, which is predominantly based on the Ethereum blockchain, continues to attract attention from artists, creators, and collectors. As the NFT space expands, so does the utilization of ETH, further driving its demand.

3. Ethereum 2.0 Transition

The transition to Ethereum 2.0 is set to enhance the network’s scalability and efficiency. As the upgrade progresses, the improvements in transaction speeds and reduced gas fees could attract more users and developers to the platform, contributing to increased demand for ETH.

4. Global Adoption of Cryptocurrencies

The ongoing global acceptance of cryptocurrencies by governments and financial institutions plays a crucial role in the future of Ethereum. As regulations become clearer and more businesses adopt cryptocurrency for transactions, Ethereum’s position as a leading blockchain could solidify further.

Conclusion

The recent purchase of 17,855 ETH for $36.8 million by a significant entity marks an important moment in the cryptocurrency landscape. With the entity now holding over a million ETH, it has positioned itself as a formidable force in the market. As Ethereum continues to evolve, the implications of this acquisition could resonate throughout the cryptocurrency ecosystem.

Investors and enthusiasts should closely monitor developments surrounding Ethereum, as the combination of institutional interest, DeFi growth, NFT expansion, and the Ethereum 2.0 transition could shape the future of the cryptocurrency market. As always, potential investors should conduct thorough research and consider the inherent risks before diving into the volatile world of cryptocurrencies.

In summary, this acquisition not only reflects the bullish outlook on Ethereum but also serves as a reminder of the dynamic nature of the cryptocurrency market. The next few months and years will be crucial in determining the trajectory of Ethereum and its role in the broader financial landscape.

BREAKING:

AN ENTITY HAS BOUGHT 17,855 ETH FOR $36.8 MILLION.

IT NOW HOLDS 1,169,065 ETH WORTH $2.5 BILLION. pic.twitter.com/MS3UsLZFJ7

— Ash Crypto (@Ashcryptoreal) March 5, 2025

BREAKING:

In a move that has sent ripples through the cryptocurrency community, a major entity has just purchased a whopping 17,855 ETH for $36.8 million. This significant acquisition highlights the ongoing interest and investment in Ethereum, one of the leading cryptocurrencies in the market today. But what does this mean for the future of Ethereum and the broader crypto landscape?

AN ENTITY HAS BOUGHT 17,855 ETH FOR $36.8 MILLION.

So, who is this mysterious entity that has made such a bold investment? While the identity remains unknown for now, the implications of this purchase are enormous. Acquiring 17,855 ETH signifies a strong belief in Ethereum’s potential and ongoing utility. It’s not just a mere investment; it’s an assertion that Ethereum’s value will continue to grow. The purchase was reported by Ash Crypto, and the numbers are staggering. This entity now holds a total of 1,169,065 ETH worth $2.5 billion. That’s a lot of virtual coins!

IT NOW HOLDS 1,169,065 ETH WORTH $2.5 BILLION.

To put this into perspective, holding over a million ETH is no small feat. This vast accumulation of Ethereum suggests that the entity is positioning itself for a significant return in the coming years. With Ethereum’s recent upgrades, including its transition to a proof-of-stake model and the introduction of Ethereum 2.0, investors are becoming increasingly optimistic about its future. The community is buzzing with excitement about what this entity’s large-scale purchase means for the price trajectory of Ethereum. Could we see Ethereum prices soar as demand increases? Only time will tell, but one thing is clear: this purchase has opened up a lot of conversations.

The Implications of Large Purchases in the Crypto Market

When large entities make massive purchases, it often creates a ripple effect in the market. Many traders and investors watch these movements closely, as they can indicate trends or shifts in market sentiment. A purchase of this magnitude can lead to increased interest from other investors and traders. The question remains: will this spark additional buying, or will it lead to cautious behavior as people wait to see how the market reacts?

The Future of Ethereum: What Lies Ahead?

With Ethereum’s ongoing developments and the expanding ecosystem of decentralized applications (dApps), the future is looking bright for this cryptocurrency. The recent purchase of 17,855 ETH is a testament to the growing belief in Ethereum’s capabilities. As more use cases emerge, including DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens), the demand for ETH could further increase, pushing its price higher.

Understanding Ethereum’s Market Dynamics

Ethereum isn’t just a currency; it’s a platform that enables developers to build decentralized applications. This versatility is a significant factor driving its value. As more developers and businesses recognize the advantages of building on Ethereum, the demand for ETH will likely grow. Additionally, Ethereum has implemented several upgrades aimed at improving scalability and reducing transaction costs, which are crucial for mass adoption. With these improvements, holding large amounts of ETH could prove to be a wise investment as the network continues to evolve.

What Should Investors Consider?

For those looking to invest in Ethereum or any cryptocurrency, it’s essential to conduct thorough research. Understanding market trends, technological advancements, and the broader economic landscape can help you make informed decisions. The recent acquisition of 1,169,065 ETH can be seen as a leading indicator of where the market might be headed. However, investing in cryptocurrencies is inherently risky, and it’s crucial to only invest what you can afford to lose. Diversification is also key; consider spreading your investments across different assets to mitigate risks.

Monitoring Market Reactions

After such a significant purchase, it’s essential to monitor how the market reacts. Will we see an uptick in ETH prices? Are more investors likely to jump on board after witnessing such a transaction? These are questions that need to be observed in the coming weeks. Social media platforms and crypto news outlets will likely provide insights into how the community perceives this move. Keeping an eye on trading volumes and price fluctuations will also give you a clearer picture of the market sentiment.

Engaging with the Crypto Community

Being part of the cryptocurrency community can provide valuable insights and updates. Join forums, follow influential figures on social media, and participate in discussions to stay informed. The crypto world is constantly changing, and engaging with others can help you navigate these shifts more effectively. Remember, the more you know, the better positioned you’ll be to make strategic investment decisions.

Final Thoughts on the Ethereum Purchase

The recent purchase of 17,855 ETH for $36.8 million by an unidentified entity is a pivotal moment in the Ethereum landscape. With this entity now holding a staggering 1,169,065 ETH worth $2.5 billion, it’s a clear signal of confidence in Ethereum’s future. As we watch how the market reacts and how Ethereum continues to develop, one thing is certain: the allure of Ethereum is only growing stronger.

Stay Informed and Ready

As the cryptocurrency market evolves, staying informed is crucial. Follow reputable sources and engage with the community to keep up with the latest trends and insights. Whether you’re a seasoned investor or just starting, understanding the implications of significant purchases like this one can help you navigate the dynamic world of cryptocurrency.