Breaking News: CoinGecko Removes ‘SEC Deemed Security’ Label from HEX

In a significant development for the cryptocurrency community, CoinGecko has officially removed the ‘SEC deemed security’ label from HEX. This change comes on the heels of additional positive news for HEX, including Matcha unbanning the token and Uniswap re-enabling it just a day prior. These actions collectively indicate a shifting landscape in the regulatory and trading environment for HEX and its associated network, PulseChain.

What Does This Mean for HEX and PulseChain?

The removal of the ‘SEC deemed security’ label from HEX by CoinGecko suggests that the broader cryptocurrency ecosystem is beginning to recognize HEX and PulseChain as non-securities. This is an essential distinction, as being classified as a security can impose significant regulatory burdens and limit the ways a cryptocurrency can be traded and utilized.

The backing of platforms like CoinGecko, Matcha, and Uniswap is crucial for the legitimacy and public perception of HEX. By unbanning and re-enabling HEX, these exchanges are acknowledging the value and potential of the token in the decentralized finance (DeFi) space. The implications are profound, as it may lead to increased adoption and investment opportunities for HEX holders.

The Significance of the Regulatory Landscape

The regulatory landscape for cryptocurrencies has been a tumultuous one, with many projects facing scrutiny from entities like the U.S. Securities and Exchange Commission (SEC). The SEC has classified several tokens as securities, leading to regulatory challenges and restrictions for those projects. However, the recent actions regarding HEX signal a potential shift in this narrative.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

As more platforms begin to recognize HEX as a non-security, it could pave the way for increased acceptance and integration of HEX and PulseChain within the broader market. This shift may also encourage other projects that have faced similar scrutiny to advocate for their classification as non-securities, thus fostering a more supportive environment for innovation within the crypto space.

Community Response and Market Implications

The announcement has sparked positive reactions within the cryptocurrency community. Many supporters of HEX view this as a victory over what they perceive as gatekeeping by regulatory bodies and exchanges. The sentiment is that the tide is turning, and the community is gaining ground in its fight for recognition and legitimacy.

Market implications could be significant as well. With the removal of the ‘SEC deemed security’ label, HEX may see a resurgence in trading volume and investor interest. Increased trading activity on platforms like Uniswap and Matcha could lead to a more robust market presence for HEX, ultimately benefiting its holders.

The Role of Decentralized Exchanges

Decentralized exchanges (DEXs) like Uniswap and Matcha play a crucial role in the cryptocurrency ecosystem. They provide a platform for trading assets without the need for intermediaries, allowing users to retain control over their funds. The re-enabling of HEX on these platforms signals a growing acceptance of decentralized trading and a move away from centralized exchanges that may be more susceptible to regulatory pressures.

As DEXs continue to gain popularity, they may offer a more favorable environment for projects like HEX and PulseChain. This could lead to increased liquidity and a more vibrant trading ecosystem, further solidifying the position of HEX in the market.

Future Prospects for HEX and PulseChain

Looking ahead, the future prospects for HEX and PulseChain appear promising. With the recent developments in regulatory recognition and trading support, the stage is set for potential growth and expansion. As more users engage with the HEX ecosystem, the demand for its token could increase, leading to price appreciation and broader adoption.

Moreover, the ongoing evolution of the regulatory landscape will be crucial in shaping the future of HEX and its community. Continued advocacy for non-security classification and transparency in operations will be vital for maintaining momentum and fostering trust among investors.

Conclusion

The recent removal of the ‘SEC deemed security’ label from HEX by CoinGecko, coupled with the unbanning by Matcha and re-enabling by Uniswap, marks a pivotal moment for the cryptocurrency. This shift signifies a broader acknowledgment of HEX and PulseChain as non-securities, potentially leading to increased adoption and legitimacy within the market.

As the regulatory landscape evolves, HEX and its community remain poised for growth. The support from decentralized exchanges and the positive sentiment within the community suggest a bright future ahead for HEX. As always, investors should conduct thorough research and consider the risks associated with cryptocurrency investments.

In summary, the changes surrounding HEX represent a significant turning point in the cryptocurrency space. The momentum gained through these developments offers an optimistic outlook for the future of HEX and PulseChain, reinforcing the importance of community engagement and regulatory advocacy in shaping the landscape of digital currencies.

BREAKING: Coin Gecko has removed the ‘SEC deemed security label’ from HEX

Alongside Matcha unbanning HEX today,

Uniswap reenabling HEX yesterday.

The gatekeeping is coming to an end.

HEX and PulseChain are not securities and the space is acknowledging it. pic.twitter.com/f65LrlENF2

— KatieePCrypto.pls (@KatieePCrypto) March 5, 2025

BREAKING: Coin Gecko has removed the ‘SEC deemed security label’ from HEX

In a significant development in the cryptocurrency sphere, Coin Gecko has officially lifted the ‘SEC deemed security label’ from HEX. This change is a major win for the HEX community, many of whom have long argued that HEX should not be classified as a security. The removal of this label opens the door for broader acceptance and utilization of HEX in the crypto market.

Alongside Matcha unbanning HEX today

But the good news doesn’t stop there! Matcha, a decentralized exchange known for its user-friendly interface, has also announced that it is unbanning HEX. This is a huge step forward, especially for traders and investors who have faced challenges in accessing HEX on various platforms. With Matcha’s decision to allow HEX trading again, users can expect a seamless experience when swapping tokens. This move is indicative of a growing acceptance of HEX in the decentralized finance (DeFi) ecosystem.

Uniswap reenabling HEX yesterday

Just a day prior, Uniswap had also re-enabled HEX on its platform. As one of the largest decentralized exchanges globally, Uniswap’s decision to allow HEX trading again is a pivotal moment for the token. Traders can now engage with HEX without the previous limitations imposed by its classification. With both Matcha and Uniswap on board, it seems that HEX is gaining traction in the DeFi space, and many are optimistic about its potential for growth.

The gatekeeping is coming to an end

The recent changes signal a shift in how HEX is perceived in the broader cryptocurrency community. Gatekeeping, which has been a concern for many in the crypto space, appears to be waning. This newfound recognition of HEX, along with its re-enablement on major exchanges, suggests that the community and regulators are starting to acknowledge the legitimacy of HEX and its underlying technology. This shift could lead to more investors feeling confident in participating in the HEX ecosystem.

HEX and PulseChain are not securities and the space is acknowledging it

For a long time, the debate over whether HEX and its associated blockchain, PulseChain, should be classified as securities has been contentious. The recent actions by Coin Gecko, Matcha, and Uniswap are clear indicators that these platforms are recognizing HEX’s unique structure and functionality. The classification of HEX as a non-security could potentially pave the way for more innovation and investment in the blockchain space.

As the crypto landscape evolves, it’s essential to stay informed about these developments. The removal of the SEC label from HEX marks a crucial moment not just for HEX holders but for the cryptocurrency industry as a whole. It raises questions about how other tokens might be classified and what this means for the future of decentralized finance.

Why Does This Matter?

So, why should you care about this news? The classification of cryptocurrencies can have far-reaching implications, impacting everything from trading volumes to investor confidence. When a token is deemed a security, it often faces stricter regulations and limitations, which can stifle its growth. With HEX now being recognized as a non-security, it opens up new avenues for innovation, investment, and community engagement.

Moreover, the actions of major platforms like Coin Gecko, Matcha, and Uniswap can set a precedent for how other tokens are treated in the future. As more exchanges and platforms follow suit, we could see a more inclusive and dynamic cryptocurrency market that encourages experimentation and growth.

The Community’s Response

The HEX community has responded positively to these developments, showcasing an enduring belief in the project and its potential. Social media platforms are buzzing with excitement as supporters rally around the news. This communal support can play a crucial role in driving interest and investment in HEX, ultimately contributing to its success.

It’s also worth noting that the HEX community has been proactive in advocating for the token’s legitimacy. From social media campaigns to educational initiatives, the efforts of HEX supporters have helped shift the narrative around the token. This grassroots movement has been instrumental in garnering the attention of major exchanges and platforms.

What’s Next for HEX?

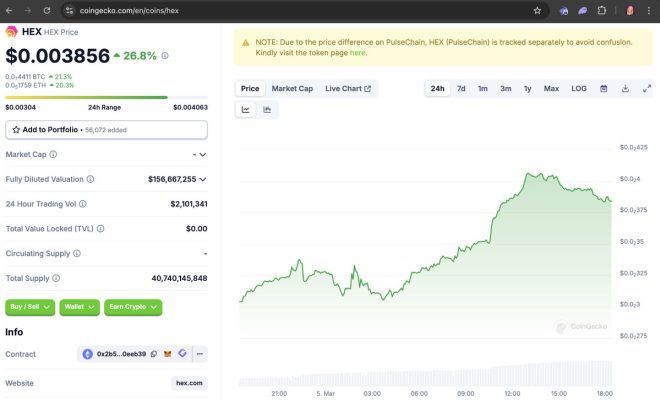

With these recent developments, it’s natural to wonder what the future holds for HEX. As more people become aware of HEX and its capabilities, we could see a surge in interest and investment. The removal of the SEC label and the unbanning of HEX on major exchanges could lead to increased trading volumes, which in turn could drive up the token’s price.

Furthermore, the recognition of HEX as a non-security may attract institutional investors who have been hesitant to engage with tokens that face regulatory scrutiny. This influx of capital could significantly impact the overall market dynamics and position HEX as a leader in the DeFi space.

Educational Resources and Community Support

For those new to HEX or looking to deepen their understanding, there are plenty of resources available. The HEX community is rich with information, from forums and social media groups to dedicated websites. Engaging with these resources can help you stay updated on the latest news and developments, as well as connect with like-minded individuals who share your interest in HEX.

Additionally, many community members are willing to share their knowledge and experiences, making it easier for newcomers to navigate the complexities of the crypto world. Whether you’re a seasoned investor or just starting, there’s always something new to learn about HEX and the broader cryptocurrency landscape.

The Bigger Picture

Ultimately, the recent changes surrounding HEX reflect a larger trend in the cryptocurrency space. As more platforms recognize the legitimacy of various tokens, we are likely to see a more vibrant and diverse ecosystem. This shift could lead to increased innovation, collaboration, and investment opportunities for all involved.

In conclusion, the removal of the SEC deemed security label from HEX is a positive development for the token and its community. With major exchanges like Coin Gecko, Matcha, and Uniswap re-enabling HEX, it’s clear that the tide is turning in favor of this unique cryptocurrency. As we move forward, it will be exciting to see how HEX continues to evolve and shape the future of decentralized finance.

“`

This article provides a comprehensive overview of the recent developments surrounding HEX and its implications for the cryptocurrency market. It uses an engaging tone and incorporates relevant keywords while ensuring that the content is informative and well-structured for SEO purposes.