Summary of the Bybit Hacker Incident: 499,395 ETH Laundering

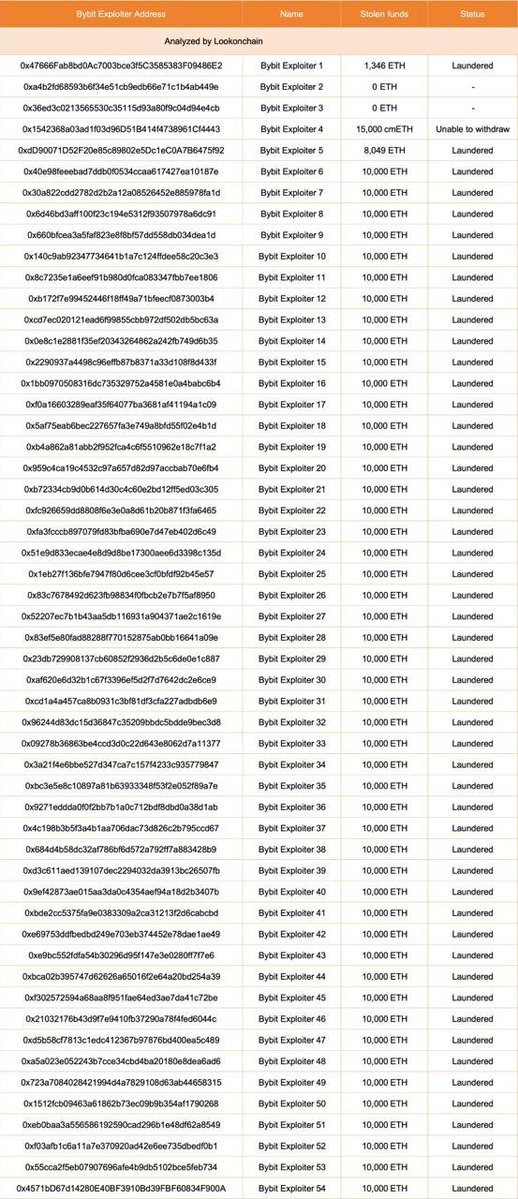

Recently, the cryptocurrency community was rocked by the news that the hacker responsible for the theft of an astonishing 499,395 ETH from Bybit has successfully laundered all of the stolen funds. This information was revealed in a tweet by Mario Nawfal’s Roundtable, which cited a source named LookOnChain. The incident raises significant concerns regarding security in the cryptocurrency exchange space and highlights the ongoing challenges of tracking illicit activities in decentralized finance.

Understanding the Bybit Hack

Bybit, a well-known cryptocurrency exchange, has been a significant player in the digital asset market. However, the platform fell victim to a major hacking incident, with the hacker stealing approximately 499,395 ETH. This staggering amount of Ethereum, valued at several hundred million dollars, underscores the vulnerability of even established platforms in the crypto landscape.

Cryptocurrency hacks are not new, but the sheer scale of this incident has sent shockwaves throughout the community. Hackers often exploit vulnerabilities in exchange security protocols to gain unauthorized access to funds, and the Bybit incident is a stark reminder of the risks associated with trading and holding assets on centralized exchanges.

The Laundering Process

Following the theft, the hacker took swift action to launder the stolen ETH. Laundering cryptocurrency typically involves a series of complex transactions designed to obscure the origin of the funds. This can include moving assets through various wallets, utilizing mixing services, or converting cryptocurrencies into stablecoins and other assets.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The speed at which the hacker laundered the stolen funds has raised alarms among security experts and law enforcement agencies. Effective laundering not only complicates recovery efforts but also enables criminals to benefit from their illicit activities without fear of immediate repercussions.

Implications for the Cryptocurrency Market

The successful laundering of 499,395 ETH has far-reaching implications for the cryptocurrency market. First and foremost, it highlights the ongoing security issues that plague cryptocurrency exchanges. As more users flock to digital assets, the potential for hacks and thefts increases, raising questions about the safety of user funds.

Additionally, incidents like the Bybit hack can erode trust in centralized exchanges. Users may become wary of depositing their assets on platforms that are susceptible to security breaches. This could lead to a shift towards decentralized finance (DeFi) solutions, where users retain control of their private keys and funds, albeit with their own set of risks.

The Role of Regulatory Bodies

As the cryptocurrency landscape continues to evolve, regulatory bodies are increasingly under pressure to address issues related to security and fraud. The Bybit hack serves as a catalyst for discussions surrounding the need for enhanced regulations and security standards in the crypto space.

Regulators around the world are examining how to create frameworks that protect consumers while fostering innovation. Striking the right balance is crucial; too many regulations may stifle growth, while too few can leave consumers vulnerable to fraud and theft.

Community Response and Future Actions

The reaction from the cryptocurrency community regarding the Bybit hack has been one of concern and calls for action. Many community members are advocating for improved security measures across exchanges, including stronger authentication processes, increased transparency, and the implementation of advanced monitoring systems to detect suspicious activities.

Moreover, the incident has ignited discussions on the importance of user education. Providing users with knowledge about securing their funds, recognizing phishing attempts, and understanding the risks associated with exchanges can empower them to make informed decisions about their investments.

Conclusion

The laundering of 499,395 ETH stolen from Bybit serves as a critical reminder of the vulnerabilities present in the cryptocurrency ecosystem. As the market continues to grow, so too do the tactics employed by hackers and criminals. The need for robust security measures, regulatory oversight, and community awareness is more pressing than ever.

As the cryptocurrency community reflects on this incident, it is essential to draw lessons that can guide future actions. Enhancing security protocols, fostering regulatory frameworks, and educating users are vital steps toward mitigating the risks associated with cryptocurrency trading and storage.

In summary, the Bybit hack and the subsequent laundering of stolen ETH have spotlighted the ongoing challenges facing the crypto market. With proactive measures and collective responsibility, the industry can work toward a safer and more secure environment for all participants.

JUST IN: BYBIT HACKER HAS LAUNDERED ALL OF THE 499,395 STOLEN $ETH

Source: LookOnChain https://t.co/l01L63MuHT pic.twitter.com/w5ZmSJo1Vx

— Mario Nawfal’s Roundtable (@RoundtableSpace) March 4, 2025

JUST IN: BYBIT HACKER HAS LAUNDERED ALL OF THE 499,395 STOLEN $ETH

The cryptocurrency world never sleeps, and with it comes a whirlwind of news, updates, and sometimes, shocking revelations. One of the latest headlines making waves is that the **Bybit hacker has successfully laundered all of the 499,395 stolen $ETH**. This incident raises many eyebrows, and it’s crucial to unpack the implications and details surrounding this event.

Understanding the Bybit Hack

Before diving into the laundering aspect, let’s revisit what transpired during the Bybit hack. Bybit, a major cryptocurrency exchange, faced a significant security breach that led to the loss of a staggering amount of Ethereum (ETH). The hackers executed a well-planned operation that has left many in the crypto community rattled. If you’re new to the world of cryptocurrency, hacking incidents like this highlight the vulnerabilities that still exist in digital finance.

But what makes this particular hack so interesting? It’s the sheer scale of the theft, with the hacker making off with **499,395 ETH**, which is not just a number but a massive sum in the cryptocurrency market. Such significant thefts not only affect the exchange but also shake the trust of investors and traders alike.

The Laundering Process Explained

So, how did the hacker manage to launder this massive amount of stolen ETH? Laundering, in the context of cryptocurrency, typically involves a series of transactions that obscure the origin of the funds. Hackers often use mixers or tumblers that break the connection between the stolen assets and their original source. This makes it extremely challenging for law enforcement to trace the stolen funds.

In this case, reports from [LookOnChain](https://www.lookonchain.com/) indicate that the hacker has indeed managed to launder all of the stolen ETH successfully. This means that the funds have likely been transferred through various wallets and exchanges, making it nearly impossible to track their movement.

Impact on the Crypto Community

The laundering of such a significant amount of stolen ETH raises alarm bells across the cryptocurrency community. When a hack occurs, it not only affects the direct victims but has a ripple effect on the entire ecosystem. Trust in exchanges, particularly centralized ones like Bybit, takes a hit. Traders might think twice before engaging with platforms that have experienced significant breaches.

Moreover, the incident can lead to increased scrutiny from regulators. Governments and financial authorities worldwide are already grappling with how to manage the burgeoning cryptocurrency market. Events like these could push them to introduce stricter regulations to protect investors and ensure the security of assets.

What This Means for Bybit

As for Bybit, this incident is undoubtedly a significant blow. The exchange will likely need to bolster its security measures and reassure users that their funds are safe. This might involve implementing more advanced security protocols, enhancing user education about safe trading practices, and possibly even compensating affected users.

User trust is paramount in the crypto space, and any damage to that trust can have long-lasting effects. Bybit will need to navigate this situation carefully to regain the confidence of its user base.

The Role of Cryptocurrency Regulations

As we see the laundering of the stolen $ETH, discussions surrounding cryptocurrency regulations gain momentum. Governments are increasingly aware of the potential for fraud and theft in the crypto space. The laundering incident serves as a case study for why regulations might be needed to protect investors and create a safer trading environment.

Many advocates argue that regulations could help in preventing such incidents from occurring in the first place. By requiring exchanges to adhere to strict security protocols and ensuring that they have measures in place to address potential hacks, the overall security of the cryptocurrency ecosystem could be improved.

Staying Safe in the Crypto Space

If you’re actively trading or investing in cryptocurrencies, there are several steps you can take to protect yourself from hacks and thefts. Here are some tips to keep in mind:

1. **Use Hardware Wallets**: Storing your cryptocurrencies in a hardware wallet rather than on exchanges can significantly reduce the risk of theft. Hardware wallets are offline, making them less susceptible to hacks.

2. **Enable Two-Factor Authentication**: Always enable 2FA on your exchange accounts and wallets. This adds an extra layer of security that can help protect your funds.

3. **Stay Informed**: Keep yourself updated on the latest news and trends in the cryptocurrency space. Being aware of potential threats can help you take proactive measures.

4. **Diversify Your Investments**: Don’t put all your eggs in one basket. Diversification can reduce risk and help protect your overall portfolio.

5. **Use Reputable Exchanges**: Stick to well-known and reputable exchanges that have a proven track record of security. Researching user reviews and past incidents can provide insight into their reliability.

The Future of Crypto Security

As the cryptocurrency landscape continues to evolve, so too will the tactics employed by hackers. The laundering of the **499,395 stolen $ETH** is just one example of the ongoing challenges that exchanges and investors face. The future will likely see the introduction of advanced security technologies, such as blockchain analytics, that can help trace stolen assets more effectively.

Moreover, ongoing partnerships between exchanges and law enforcement agencies may yield better outcomes in tracking down stolen funds. The more proactive the industry becomes in tackling these issues, the safer the environment will be for everyone involved.

Conclusion: What’s Next?

The laundering of the stolen $ETH is a wake-up call for everyone in the cryptocurrency ecosystem. It underscores the importance of security, trust, and the need for regulatory frameworks that can protect investors. As we continue to navigate this exciting yet volatile landscape, staying informed and proactive will be key to ensuring a safe trading experience.

The recent events surrounding the Bybit hack and the subsequent laundering of funds highlight the urgency for better security measures and investor protections in the cryptocurrency industry. While the journey ahead may be fraught with challenges, it also presents opportunities for growth and improvement in the way we approach digital finance.