Major Liquidation in the Crypto Market: A $1 Billion Event

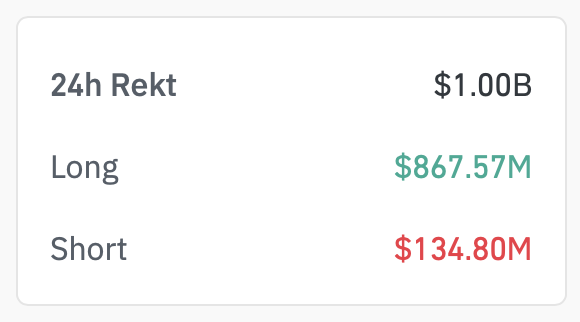

In a shocking turn of events within the cryptocurrency market, over $1 billion has been liquidated across various derivatives platforms. This unprecedented liquidation has affected approximately 286,129 traders, marking a critical moment in the volatile landscape of cryptocurrency trading. The dramatic shift not only highlights the unpredictable nature of crypto markets but also serves as a wake-up call for traders and investors alike.

Understanding Liquidation in Crypto Trading

Liquidation occurs when a trader’s position is forcibly closed by the exchange due to insufficient margin to maintain the trade. This can happen during periods of high volatility, where the price of an asset moves sharply and unexpectedly. In the context of derivatives trading, liquidation can lead to significant financial losses, particularly when leverage is involved. Traders often use leverage to amplify their potential returns, but it also increases the risk of liquidation when the market moves against them.

The Impact of $1 Billion Liquidation

The reported liquidation of $1 billion is not just a number; it represents a substantial upheaval within the cryptocurrency ecosystem. This event has implications for both retail and institutional traders. For retail traders, the loss can be devastating, especially for those who may not fully understand the risks associated with leveraged trading. For institutional players, the liquidation may trigger a reassessment of risk management strategies and trading practices.

Key Takeaways from the Liquidation Event

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Market Volatility: The crypto market is notorious for its volatility, and this event underscores the importance of risk management. Traders should be aware of their exposure and the leverage they are using.

- Educational Resources: The liquidation highlights the need for comprehensive educational resources for traders to help them navigate the complexities of derivatives trading.

- Psychological Impact: Such significant losses can have a psychological effect on traders, leading to fear and hesitation in future trades. It’s essential for traders to maintain a level-headed approach, even in the face of market turmoil.

The Role of Derivatives in Crypto Trading

Derivatives have become increasingly popular in the cryptocurrency space, allowing traders to speculate on the price movements of various digital assets without necessarily owning them. However, with this popularity comes increased risk. The use of derivatives can amplify both gains and losses, making it a high-stakes game for traders.

Types of Derivatives in Crypto

- Futures Contracts: Agreements to buy or sell an asset at a predetermined price at a specified time in the future.

- Options: Contracts that give the buyer the right, but not the obligation, to buy or sell an asset at a specified price before a certain date.

- Perpetual Swaps: A type of futures contract that does not have an expiration date, allowing traders to hold positions indefinitely.

The Ripple Effect on the Market

The liquidation event is expected to have a ripple effect throughout the cryptocurrency market. As traders liquidate their positions, it could lead to further price declines, creating a feedback loop that exacerbates the situation. This phenomenon is often referred to as a "cascade" liquidation, where forced selling leads to additional selling pressure.

Market Correction or Trend Reversal?

While some analysts view this liquidation as a potential market correction, others see it as a sign of deeper issues within the market. The high level of liquidations suggests that many traders were over-leveraged, which could indicate a broader trend of speculation and risk-taking that may not be sustainable in the long run.

What Traders Should Do Next

For those affected by the recent liquidation, it’s crucial to take a step back and reassess trading strategies. Here are a few steps traders can consider:

- Review Risk Management Practices: Ensure that you have appropriate risk management strategies in place, including stop-loss orders and position sizing.

- Educate Yourself: Invest time in learning about the mechanics of derivatives trading, market trends, and technical analysis.

- Diversify Your Portfolio: Avoid putting all your resources into a single asset or trading strategy. Diversification can mitigate risk.

- Stay Informed: Keep up with market news and trends. Understanding the broader economic context can help you make more informed trading decisions.

Conclusion

The recent $1 billion liquidation in the cryptocurrency market serves as a stark reminder of the inherent risks associated with trading derivatives. As the market continues to evolve, both new and experienced traders must prioritize education and risk management to navigate the complexities of the crypto landscape successfully.

Whether you are a seasoned trader or just starting, understanding the dynamics of the market and practicing prudent risk management can help you weather the storms that come with trading in this volatile environment. As the crypto economy continues to grow, staying informed and prepared is essential for long-term success.

JUST IN: $1 billion liquidated from the crypto economy across derivatives platforms! 286,129 traders were liquidated. pic.twitter.com/T8Jf2shBgX

— Bitcoin.com News (@BTCTN) March 4, 2025

JUST IN: $1 billion liquidated from the crypto economy across derivatives platforms! 286,129 traders were liquidated.

In the ever-evolving landscape of cryptocurrency, significant events can unfold in the blink of an eye. Recently, the crypto world was rocked when a staggering $1 billion was liquidated across various derivatives platforms. This shocking news, reported by [Bitcoin.com News](https://twitter.com/BTCTN/status/1896743941221109869?ref_src=twsrc%5Etfw), has left many traders and investors on edge, with a whopping 286,129 traders affected. Let’s dive deeper into what this means for the crypto market, why it happened, and what traders should be aware of moving forward.

Understanding Liquidation in the Crypto Market

Liquidation is a term that every crypto trader should familiarize themselves with. Essentially, it refers to the process where a trader’s position is forcibly closed by a trading platform when their margin falls below the required level. This can happen for several reasons, including market volatility, poor risk management, or a sudden drop in the price of an asset. When liquidations occur, they can lead to massive sell-offs, further exacerbating price drops and creating a ripple effect throughout the market.

In this case, the $1 billion liquidation indicates that many traders were caught off guard by sudden price movements, which is not uncommon in the highly volatile crypto market. This event serves as a stark reminder of the importance of understanding risk management strategies and staying updated with market trends.

The Impact of the $1 Billion Liquidation

The immediate impact of this massive liquidation is felt across the board. When such a large amount is liquidated, it can lead to a cascading effect, causing prices to plummet even further. For instance, a significant number of forced sell-offs can lead to a decrease in demand, driving prices down even more and creating a cycle that can be difficult to break.

Additionally, this kind of event can shake investor confidence. Traders who witness such liquidations may become hesitant to enter the market, fearing that they too could be wiped out if they take a leveraged position. On the flip side, it can also create opportunities for seasoned traders to capitalize on lower prices, buying in at a discount.

Why Did This Liquidation Happen?

Several factors can contribute to such a massive liquidation event. Market volatility is often at the top of the list, and the crypto market is notoriously volatile. Prices can swing dramatically in a short period, and traders who don’t manage their leverage properly may find themselves on the wrong side of a trade.

Another factor could be external influences such as regulatory news, technological advancements, or major announcements from influential figures in the crypto space. For example, announcements regarding government regulations or changes in policy can lead to significant market reactions that catch traders off guard.

Moreover, psychological factors can play a role. In a market driven by sentiment, fear and greed can lead to irrational trading decisions, resulting in liquidations. Traders may over-leverage their positions in hopes of maximizing gains, only to face devastating losses when the market turns against them.

What Should Traders Take Away From This Event?

For traders, this event serves as a crucial learning opportunity. Here are some key takeaways:

1. Risk Management is Key

One of the most vital aspects of trading is understanding and implementing risk management strategies. Setting stop-loss orders, diversifying your portfolio, and never investing more than you can afford to lose are essential practices.

2. Stay Informed

Keeping an eye on market trends, news, and potential catalysts can help traders navigate the volatile crypto landscape. Following trusted sources, such as [Bitcoin.com](https://bitcoin.com), can provide valuable insights and updates that can aid in decision-making.

3. Emotional Control

Emotion-driven trading can lead to poor decisions. It’s important to maintain a level head and stick to your trading plan, even in turbulent times. This can help mitigate the risk of emotional reactions leading to liquidations.

4. Education is Essential

Continuous learning about market mechanics, trading strategies, and the overall cryptocurrency ecosystem is crucial. Engaging with educational resources, communities, and market analysis can significantly improve your trading skills.

A Look Ahead: The Future of Crypto After Massive Liquidations

So, what does the future hold for the cryptocurrency market following such a significant liquidation event? History shows that the crypto market has always had its ups and downs. While a $1 billion liquidation may seem catastrophic, it can also pave the way for a market correction that leads to healthier price movements in the long run.

As traders regroup and reassess their strategies, we may see a more cautious approach to trading, with an emphasis on risk management and strategic planning. Moreover, seasoned traders might begin to capitalize on the lower prices post-liquidation, creating a dynamic environment where new opportunities arise.

The resilience of the crypto market is noteworthy; it has recovered from major downturns in the past. While some may view this liquidation as a sign of doom, others see it as an opportunity for growth and learning.

Conclusion: Navigating the Crypto Landscape

In the wake of the recent $1 billion liquidation, the cryptocurrency market is undoubtedly feeling the tremors. However, this event serves as a reminder of the importance of understanding the complexities of trading and the necessity of education in this fast-paced environment.

For anyone involved in the crypto space—whether you’re a seasoned trader or a newcomer—staying informed, managing your risks, and controlling your emotions are critical. The market may be volatile, but with the right strategies in place, traders can navigate these turbulent waters and potentially emerge stronger on the other side.

Stay tuned to reliable sources like [Bitcoin.com News](https://bitcoin.com/news) for updates and insights as the situation develops. The crypto journey is far from over, and learning from events like these can lead to greater success in the future.