Bitcoin Price Surge: A $7,000 Jump in Just Two Hours

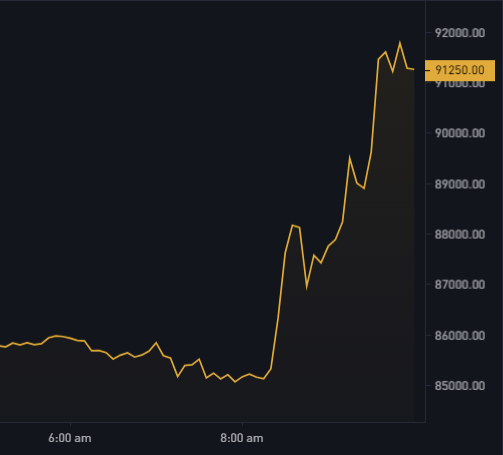

On March 2, 2025, the cryptocurrency market witnessed an astonishing surge in Bitcoin’s value, which skyrocketed by $7,000 within a mere two-hour window. This unprecedented jump has sparked curiosity and speculation among traders, investors, and analysts alike. The tweet from Simply Bitcoin, a prominent source of crypto news, highlighted this significant price movement, raising questions about who the buyers are and what factors contributed to this remarkable volatility.

Understanding Bitcoin’s Surge

Bitcoin, the leading cryptocurrency by market capitalization, has always been known for its price volatility. However, a $7,000 increase in such a short timeframe is indicative of strong market forces at play. Such rapid fluctuations can be attributed to various factors, including increased institutional investment, favorable regulatory developments, or heightened excitement in the crypto community. These elements can create a perfect storm for price surges, leading to dramatic increases in value.

Market Reactions and Speculations

As the news of Bitcoin’s significant price jump spread, traders and analysts began to speculate on the underlying causes. One possibility is that a large institutional investor or a group of investors made a substantial purchase, pushing the price upward. Institutional interest in Bitcoin has been on the rise, as more hedge funds and companies look to diversify their portfolios by including cryptocurrencies. This trend has been a driving force behind previous price rallies.

Additionally, favorable regulatory news or the announcement of new technological advancements in the Bitcoin network could also have contributed to this surge. The crypto market is sensitive to news and developments, and positive signals can lead to increased buying pressure, resulting in rapid price increases.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Social Media in Cryptocurrency Trading

Social media plays a crucial role in the cryptocurrency market, often acting as a catalyst for price movements. The tweet from Simply Bitcoin quickly gained traction, leading to widespread discussions across various platforms. Influencers, traders, and enthusiasts shared their insights, further fueling interest in Bitcoin. The viral nature of social media allows news to spread rapidly, impacting market sentiment and encouraging more people to buy or sell based on the latest updates.

The Psychology Behind Bitcoin Investments

The psychology of investors in the cryptocurrency market can lead to herd behavior, where individuals follow the actions of others. When Bitcoin’s price starts to rise, it often triggers FOMO (Fear of Missing Out), leading to increased buying activity. This phenomenon can create a feedback loop, where rising prices attract more buyers, driving the price even higher. Conversely, when prices drop, fear can lead to panic selling, causing abrupt declines.

Future Outlook for Bitcoin

The recent price surge raises important questions about Bitcoin’s future. Will this increase be sustainable, or are we witnessing a temporary spike? Analysts are divided on their predictions, with some expressing optimism about Bitcoin’s long-term trajectory, while others caution about potential market corrections.

For investors, understanding the factors that contribute to Bitcoin’s price movements is crucial. Staying informed about market trends, regulatory changes, and technological developments can help investors make more informed decisions. Additionally, diversifying investment portfolios and employing risk management strategies can mitigate potential losses in the volatile cryptocurrency market.

Conclusion

The remarkable $7,000 surge in Bitcoin’s price within two hours on March 2, 2025, highlights the unpredictable nature of the cryptocurrency market. While the exact reasons behind this rapid increase may remain speculative, it serves as a reminder of the excitement and volatility that define Bitcoin trading. As the market continues to evolve, staying informed about developments and trends will be essential for current and prospective investors.

In summary, Bitcoin’s price movements are influenced by a complex interplay of market dynamics, investor psychology, and external factors. Understanding these elements can help investors navigate the exhilarating yet volatile world of cryptocurrencies. Whether you’re a seasoned trader or a newcomer, keeping a close eye on market trends and sentiments will be crucial in the fast-paced landscape of digital currencies.

JUST IN: #Bitcoin up $7,000 in 2 hours.

Who’s buying? pic.twitter.com/ryaSaODoW2

— Simply Bitcoin (@SimplyBitcoinTV) March 2, 2025

JUST IN: #Bitcoin up $7,000 in 2 hours.

If you haven’t heard the latest buzz in the cryptocurrency world, it’s time to tune in. Recently, Bitcoin, the frontrunner of all cryptocurrencies, surged an incredible $7,000 in just two hours. This astonishing spike has left many investors and enthusiasts scratching their heads, wondering, “Who’s buying?” The excitement surrounding Bitcoin’s price movement is palpable, and it’s igniting conversations across social media platforms and investment forums alike.

Bitcoin’s price fluctuations aren’t just numbers on a screen; they represent real individuals and institutions making strategic decisions that can shift the market’s landscape in a matter of hours. Let’s dive deeper into what this surge means and who might be behind this sudden influx of buying.

Who’s buying?

You might be asking yourself, who exactly is behind this significant uptick in Bitcoin’s value? A variety of players could be involved, from retail investors to large institutional buyers. Retail investors often react to price changes, buying in when they see a sudden increase, hoping to ride the wave of profitability. On the flip side, institutional investors, such as hedge funds and corporations, might be making significant purchases, believing in Bitcoin’s long-term value or hedging against inflation.

Recent trends indicate that institutional interest in Bitcoin is on the rise. Companies like MicroStrategy and Tesla have made headlines for their substantial Bitcoin purchases, signaling a shift in how corporations view cryptocurrency as a legitimate asset class. If you’re curious about how institutional buying affects market dynamics, you can read more on [CoinDesk](https://www.coindesk.com).

Understanding Bitcoin’s Volatility

Bitcoin’s price volatility can be attributed to a myriad of factors. One of the primary reasons is the relatively low liquidity in the cryptocurrency market compared to traditional financial markets. When a large buy order is placed, it can significantly impact the price due to the limited number of available coins at that moment. This is often referred to as “slippage,” and it can lead to dramatic price swings like the recent jump of $7,000.

Additionally, external factors such as regulatory news, technological advancements, and macroeconomic trends can also influence Bitcoin’s price. For instance, when news breaks about a country adopting Bitcoin as legal tender or a major exchange facing regulatory scrutiny, it can cause a ripple effect in the market. To stay updated, many investors rely on platforms like [CoinTelegraph](https://cointelegraph.com) for the latest news and analysis.

What Does This Mean for Investors?

The recent spike in Bitcoin’s price could signify a few things for investors. For some, it’s an opportunity to buy into a trending asset, hoping to sell later at a higher price. For others, it may raise concerns about market manipulation or the sustainability of such rapid increases.

If you are considering investing in Bitcoin after this surge, it’s essential to do your homework. Understanding market trends, historical price movements, and potential risks involved can help you make informed decisions. Websites like [Investopedia](https://www.investopedia.com) provide valuable resources for those looking to deepen their understanding of cryptocurrency investing.

The Role of Social Media in Cryptocurrency Trading

Social media plays a crucial role in shaping investor sentiment in the cryptocurrency space. Platforms like Twitter, Reddit, and Telegram are often where news breaks and discussions happen in real-time. The excitement surrounding Bitcoin’s $7,000 surge is a perfect example of how quickly information spreads across these platforms, influencing buying and selling decisions.

The viral nature of social media can lead to FOMO (fear of missing out) among investors, prompting them to jump into the market without fully understanding the implications. It’s a double-edged sword that can create both opportunities and risks. Engaging with communities on platforms like [Reddit](https://www.reddit.com/r/Bitcoin/) can provide insights, but it’s crucial to approach such information critically.

Future Outlook for Bitcoin

Looking ahead, what’s next for Bitcoin? Many analysts and crypto enthusiasts remain bullish on its long-term prospects, citing its scarcity (only 21 million Bitcoins will ever exist) and increasing adoption as key factors that could drive prices even higher. However, the market is inherently unpredictable, and potential investors should be prepared for fluctuations.

Emerging trends, such as the integration of Bitcoin into traditional financial systems and increasing regulatory clarity, could play a pivotal role in shaping Bitcoin’s future. If you want to keep an eye on market forecasts and expert opinions, check out resources like [CoinMarketCap](https://coinmarketcap.com) for the latest insights.

Final Thoughts

The recent surge in Bitcoin’s value is a fascinating development that underscores the dynamic nature of the cryptocurrency market. Whether you’re a seasoned investor or just starting, understanding the forces at play can help you navigate this exciting yet volatile landscape. As Bitcoin continues to capture headlines and investor interest, staying informed and engaged will be key to making the most of this digital gold rush.

So, who’s buying? The answer might be a mix of retail investors excited by the potential gains and institutional players seeing the long-term value in Bitcoin. As we continue to watch the market unfold, one thing’s for sure: the conversation around Bitcoin is far from over.